Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

| Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12 |

|

|

|

|

|

| NRG ENERGY, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

(1) |

|

Title of each class of securities to which transaction applies:

|

| |

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

| |

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

| |

|

(5) |

|

Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing. |

| |

|

(1) |

|

Amount Previously Paid:

|

| |

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

| |

|

(3) |

|

Filing Party:

|

| |

|

(4) |

|

Date Filed:

|

Table of Contents

Table of Contents

2017 Annual Meeting of Stockholders and Proxy Statement

March 16, 2017

Fellow

Stockholders:

We

are pleased to invite you to attend NRG Energy, Inc.'s Annual Meeting of Stockholders, which will be held at 9 a.m., Eastern Time, on Thursday, April 27, 2017, at the Hyatt

Regency Princeton, 102 Carnegie Center, Princeton, New Jersey 08540. Details regarding admission to the meeting and the business to be conducted are more fully described in the accompanying

Notice of Annual Meeting of Stockholders and Proxy Statement.

Your

vote is important. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. Information about voting methods is set forth in the accompanying Notice of

Annual Meeting of Stockholders and Proxy Statement.

On

behalf of everyone at NRG, I thank you for your ongoing interest and investment in NRG Energy, Inc. We are committed to acting in your best interests. If you have any questions with respect

to voting, please call our proxy solicitor, MacKenzie Partners, Inc., at (800) 322-2885 (toll free).

Sincerely,

LAWRENCE S. COBEN

Chairman of the Board

THIS

PROXY STATEMENT AND PROXY CARD ARE

BEING DISTRIBUTED ON OR ABOUT MARCH 16, 2017.

Table of Contents

NRG Energy, Inc.

804 Carnegie Center, Princeton, New Jersey 08540

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

When: Thursday, April 27, 2017, 9:00 a.m. Eastern Time

Where: Hyatt Regency Princeton, 102 Carnegie Center, Princeton, New Jersey 08540

We are pleased to invite you to join our Board of Directors and senior leadership at the NRG Energy, Inc. 2017 Annual Meeting of Stockholders.

- 1.

- To

elect thirteen directors.

- 2.

- To

adopt the NRG Energy, Inc. Amended and Restated Long-Term Incentive Plan.

- 3.

- To

adopt the NRG Energy, Inc. Amended and Restated Employee Stock Purchase Plan.

- 4.

- To

approve, on a non-binding advisory basis, NRG's executive compensation.

- 5.

- To

approve, on a non-binding advisory basis, the frequency of the non-binding advisory vote on executive compensation.

- 6.

- To

ratify the appointment of KPMG LLP as NRG's independent registered public accounting firm for the 2017 fiscal year.

- 7.

- To

vote on a stockholder proposal regarding disclosure of political expenditures, if properly presented at the meeting.

- 8.

- To

transact such other business as may properly come before the Annual Meeting and any adjournment or postponement.

You

are entitled to vote if you were a stockholder of record at the close of business on March 13, 2017.

Even

if you plan to attend the Annual Meeting in person, please vote right away using one of the following advance voting methods. Make sure to have your proxy card or voting

instruction form in hand and follow the instructions.

Via the Internet:

You may vote at www.proxyvote.com, from anywhere in the world, 24 hours a day, 7 days a week, up

until 11:59 p.m. Eastern Time on April 26, 2017.

By phone:

If you live in the United States, you may vote 24 hours a day, 7 days a week, up until 11:59 p.m. Eastern Time on April 26, 2017,

by calling (800) 690-6903 from a touch-tone phone.

By mail:

If you received a paper copy of the materials, you may mark, sign, date and mail your proxy card or voting instruction card in the enclosed, postage-paid

address envelope, so that it is received by the Company prior to April 27, 2017, the Annual Meeting date.

In person:

You can vote by a ballot that will be provided to you at the Annual Meeting. However, if you are a beneficial owner of shares held in street name (through a

bank, broker or other nominee), you must bring a legal proxy from your bank, broker or other nominee to vote in person.

By

Order of the Board of Directors

BRIAN

E. CURCI,

Corporate Secretary

Table of Contents

2017 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

Table of Contents

Proxy Statement Highlights

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should

consider, and you should read the entire Proxy Statement before voting. For more complete information regarding the Company's 2016 performance, please review the Company's Annual Report on

Form 10-K for the year ended December 31, 2016.

Roadmap of Voting Matters

|

Stockholders

are being asked to vote on the following matters at the 2017 Annual Meeting of Stockholders:

|

|

|

PROPOSAL |

|

BOARD

RECOMMENDATION |

|

|

|

Proposal 1. Election of Directors (page 17) |

|

|

The Board of Directors (the Board) and the Governance and Nominating Committee believe that the 13 director nominees possess the necessary

qualifications, attributes, skills and experiences to provide advice and counsel to the Company's management and effectively oversee the business and the long-term interests of our stockholders. |

|

FOR

each Director nominee |

|

|

|

|

Proposal 2. Adoption of the NRG Energy, Inc. Amended and Restated Long-Term Incentive Plan (LTIP) (page 25)

|

|

|

The Compensation Committee and the Board believe that it is in the best interests of the Company and its stockholders to

increase the number of shares available for issuance under the LTIP, extend the term of the LTIP until February 22, 2027, add plan features to provide additional shareholder protections, and to make other minor technical changes to the LTIP.

Stockholders are being asked to adopt the LTIP which, as amended, incorporates these changes. |

|

FOR |

|

|

|

|

Proposal 3. Adoption of the NRG Energy, Inc. Amended and Restated Employee Stock Purchase Plan (ESPP) (page 34)

|

|

|

The Compensation Committee and the Board believe that it is in the best interests of the Company and its stockholders to

increase the number of shares authorized for issuance and available for purchase under the ESPP, to extend the term of the ESPP until December 31, 2026 and to make other minor changes to the ESPP. Stockholders are being asked to adopt the ESPP

which, as amended, incorporates these changes. |

|

FOR |

|

|

|

|

Proposal 4. Approval, on a non-binding advisory basis, of NRG's executive compensation (the Say on Pay Proposal)

(page 37) |

|

|

The Company seeks a non-binding advisory vote to approve the compensation of its named executive officers as described in the

Compensation Discussion and Analysis beginning on page 49 and the compensation tables and narrative discussion. The Board values stockholders' opinions, and the Compensation Committee will take into account the outcome of the advisory vote when

considering future executive compensation decisions. |

|

FOR |

|

|

|

|

Proposal 5. Approval, on a non-binding advisory basis, of the frequency of the vote to approve NRG's executive compensation

(the Say on Frequency Proposal) (page 38) |

|

|

The Company seeks a non-binding advisory vote on how often the Company should include a vote to approve the Company's executive

compensation, the Say on Pay Proposal, in its proxy materials for future annual stockholder meetings. Stockholders may vote to have the Say on Pay Proposal included every one year, two years or three years or abstain from the vote. |

|

ONE

YEAR |

|

|

|

|

|

|

|

|

|

| Proxy

Statement

Highlights |

|

1 |

Table of Contents

|

|

|

PROPOSAL |

|

BOARD

RECOMMENDATION |

|

|

|

Proposal 6. Ratification of the appointment of KPMG LLP as NRG's independent registered public accounting firm for the 2017 fiscal

year (the Ratification of KPMG LLP's Appointment Proposal) (page 39) |

|

|

The Audit Committee and the Board believe that the retention of KPMG LLP as the Company's independent registered public

accounting firm for the 2017 fiscal year is in the best interests of the Company and its stockholders. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee's selection of KPMG LLP. |

|

FOR |

|

|

|

|

Proposal 7. Stockholder Proposal, if properly presented (page 40) |

|

|

Political Expenditures Disclosure |

|

AGAINST |

|

|

|

|

Corporate Governance Highlights

|

We

are committed to maintaining the highest standards of corporate governance, which promote the long-term interests of our stockholders, strengthen Board and management accountability and help build

public trust in the Company. The Governance of the Company section beginning on page 6 describes our corporate governance framework, which includes the following highlights:

|

|

|

|

|

|

|

• Annual election of directors |

|

• Regular executive sessions of independent directors |

|

|

|

|

• Majority voting for directors |

|

• Risk oversight by full Board and committees |

|

|

|

|

• 13 director nominees of which 11 are independent |

|

• Commitment to sustainability |

|

|

|

|

• Adopted proxy access for stockholders to nominate directors |

|

• Anti-hedging and anti-pledging policies |

|

|

|

|

• Independent Audit, Compensation, and Governance Committees |

|

|

|

|

|

|

|

|

|

|

|

2 |

|

Proxy

Statement

Highlights | |

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMITTEE MEMBERSHIPS1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME, PRIMARY OCCUPATION |

|

|

|

|

AGE |

|

|

|

|

DIRECTOR SINCE |

|

|

|

|

INDEPENDENT |

|

|

|

|

OTHER PUBLIC

COMPANY

BOARDS |

|

|

|

A |

|

|

|

B |

|

|

|

C |

|

|

|

G&N |

|

|

|

F |

|

|

|

N |

|

|

|

NSC |

Lawrence S. Coben (Chairman of the Board) |

|

|

|

|

58 |

|

|

|

|

2003 |

|

|

|

|

YES |

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

★ |

|

|

|

|

Chairman and Chief Executive Officer, Tremisis Energy Corporation LLC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E. Spencer Abraham |

|

|

|

|

64 |

|

|

|

|

2012 |

|

|

|

|

YES |

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

· |

|

|

|

· |

|

|

|

|

|

|

|

· |

|

|

|

· |

Chairman and Chief Executive Officer, The Abraham Group |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kirbyjon H. Caldwell |

|

|

|

|

63 |

|

|

|

|

2009 |

|

|

|

|

YES |

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

· |

|

|

|

· |

|

|

|

|

|

|

|

· |

|

|

|

|

Senior Pastor, Windsor Village United Methodist Church |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Terry G. Dallas |

|

|

|

|

66 |

|

|

|

|

2012 |

|

|

|

|

YES |

|

|

|

|

0 |

|

|

|

· |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

· |

|

|

|

· |

|

|

|

· |

Former Executive Vice President and Chief Financial Officer, Unocal Corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mauricio Gutierrez |

|

|

|

|

46 |

|

|

|

|

2016 |

|

|

|

|

NO |

|

|

|

|

1 |

|

|

|

|

|

|

|

· |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

· |

|

|

|

|

President and Chief Executive Officer, NRG Energy, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

William E. Hantke |

|

|

|

|

69 |

|

|

|

|

2006 |

|

|

|

|

YES |

|

|

|

|

1 |

|

|

|

★ |

|

|

|

|

|

|

|

· |

|

|

|

|

|

|

|

|

|

|

|

· |

|

|

|

|

Former Executive Vice President and Chief Financial Officer, Premcor, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paul W. Hobby |

|

|

|

|

56 |

|

|

|

|

2006 |

|

|

|

|

NO |

|

|

|

|

0 |

|

|

|

|

|

|

|

· |

|

|

|

|

|

|

|

|

|

|

|

· |

|

|

|

· |

|

|

|

★ |

Managing Partner, Genesis Park, L.P. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anne C. Schaumburg |

|

|

|

|

67 |

|

|

|

|

2005 |

|

|

|

|

YES |

|

|

|

|

1 |

|

|

|

|

|

|

|

· |

|

|

|

|

|

|

|

|

|

|

|

· |

|

|

|

· |

|

|

|

|

Former Managing Director of Credit Suisse First Boston |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Evan J. Silverstein |

|

|

|

|

62 |

|

|

|

|

2012 |

|

|

|

|

YES |

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

· |

|

|

|

★ |

|

|

|

· |

|

|

|

|

Former General Partner and Portfolio Manager at SILCAP LLC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barry T. Smitherman |

|

|

|

|

59 |

|

|

|

|

2017 |

|

|

|

|

YES |

|

|

|

|

0 |

|

|

|

· |

|

|

|

· |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

· |

|

|

|

· |

Energy Industry Consultant and Adjunct Professor of Energy Law at The University of Texas School of Law |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas H. Weidemeyer |

|

|

|

|

69 |

|

|

|

|

2003 |

|

|

|

|

YES |

|

|

|

|

2 |

|

|

|

· |

|

|

|

|

|

|

|

|

|

|

|

★ |

|

|

|

|

|

|

|

· |

|

|

|

|

Former Director, Senior Vice President and Chief Operating Officer of United Parcel Service, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. John Wilder |

|

|

|

|

58 |

|

|

|

|

2017 |

|

|

|

|

YES |

|

|

|

|

1 |

|

|

|

|

|

|

|

★ |

|

|

|

|

|

|

|

|

|

|

|

· |

|

|

|

· |

|

|

|

|

Executive Chairman of Bluescape Energy Partners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Walter R. Young |

|

|

|

|

72 |

|

|

|

|

2003 |

|

|

|

|

YES |

|

|

|

|

0 |

|

|

|

· |

|

|

|

|

|

|

|

★ |

|

|

|

|

|

|

|

|

|

|

|

· |

|

|

|

|

Former Chairman, Chief Executive Officer and President of Champion Enterprises, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

★ Chair · Member |

|

G&N = |

|

Governance and Nominating Committee |

|

|

|

A = |

|

Audit Committee |

|

F = |

|

Finance and Risk Management Committee |

|

|

|

B = |

|

Business Review Committee |

|

N = |

|

Nuclear Oversight Committee |

|

|

|

C = |

|

Compensation Committee |

|

NSC = |

|

Nuclear Oversight Subcommittee |

|

|

|

|

|

| Proxy

Statement

Highlights |

|

3 |

Table of Contents

Please

see the Questions and Answers section beginning on page 73 for important information about the proxy materials, voting and the 2018 Annual Meeting of Stockholders.

Additional questions may be directed to our proxy solicitor, MacKenzie Partners, Inc., at (800) 322-2885 or proxy@mackenziepartners.com.

Learn More About Our Company

|

You

can learn more about the Company, view our governance materials and much more by visiting our website, www.nrg.com.

Please

also visit our 2017 Annual Meeting website at www.proxyvote.com to easily access the Company's proxy materials or vote through the Internet.

|

|

|

|

|

4 |

|

Proxy

Statement

Highlights | |

Table of Contents

We are providing these proxy materials to you in connection with the solicitation of proxies by the Board of NRG Energy, Inc. for the 2017 Annual Meeting of Stockholders

(Annual Meeting) and for any adjournment or postponement of the Annual Meeting. The Annual Meeting will be held on Thursday, April 27, 2017, at 9 a.m. Eastern Time at the Hyatt Regency

Princeton, 102 Carnegie Center, Princeton, NJ 08540. In this Proxy Statement, "we," "us," "our," "NRG" and the "Company" refer to NRG Energy, Inc.

You

are receiving this Proxy Statement because you own shares of our common stock, par value $0.01 per share, that entitle you to vote at the Annual Meeting. By use of a proxy, you can vote whether or

not you attend the Annual Meeting. This Proxy Statement describes the matters on which we would like you to vote and provides information on those matters.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

of Stockholders to be held on Thursday, April 27, 2017

Each

of the Notice of Annual Meeting, this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 is available at www.proxyvote.com. If you would like to receive, without charge, a paper copy of our

Annual Report on Form 10-K, including the financial statements and the financial statement schedules, please send

your request to Investor Relations, 804 Carnegie Center, Princeton, New Jersey 08540.

|

|

|

|

|

| Proxy

Statement |

|

5 |

Table of Contents

Governance of the Company

Corporate Governance Guidelines and Charters

|

The

Board has adopted Corporate Governance Guidelines (Guidelines) that, along with the Amended and Restated Certificate of Incorporation, the Fourth Amended and Restated Bylaws

(Bylaws) and the charters of the committees of the Board (Committees), provide the framework for the governance of the Company. The Board's Governance and Nominating Committee is responsible for

periodically reviewing the Guidelines and recommending any proposed changes to the Board for approval. The Guidelines are available on the Governance section of the Company's investor relations

website at http://investors.nrg.com, along with the charters of all the Committees and the Code of Conduct. The Guidelines, the charters of all of the

Committees and the Code of Conduct are also available in print to any stockholder who requests them.

Under

the Guidelines, a majority of the Board must be composed of independent directors. The Board determines the independence of our directors by applying the independence

principles and standards established by the New York Stock Exchange (NYSE). These provide that a director is independent only if the Board affirmatively determines that such director does not have a

direct or indirect material relationship with the Company, which may include commercial, industrial, consulting, legal, accounting, charitable, familial and other business, professional and personal

relationships.

The

Board conducts a review of the independence of the Company's directors on an annual basis. In its most recent review, the Board considered, among other

things:

- •

- Any employment relationships between the Company and its directors (other than Mauricio Gutierrez) or their immediate family members;

- •

- Any affiliations of the Company's directors or their immediate family members with the Company's

independent

registered public accounting firm, compensation consultants, legal counsel and other consultants and advisors;

- •

- Any transactions that would require disclosure as a related person transaction or that qualify for review under our related person transactions

policy;

- •

- Any transactions made in the ordinary course of business with a company in which a director serves on the board or as a member of the executive

management team; and

- •

- Any transactions involving payments made by the Company to educational institutions.

In

addition, because the Company provides retail electricity services through certain of its subsidiaries, the Board also considered instances where certain of our directors are directors of

businesses that received electricity services from the Company.

The

Board has determined that all of the Company's directors are independent under the Guidelines and the NYSE listing standards, with the exception of Mauricio Gutierrez, our President and Chief

Executive Officer, and Paul Hobby, whose sister-in-law is a partner at the Company's independent registered public accounting firm. Mr. Hobby's sister-in-law is not involved in any Company

matters. Mr. Hobby's sister-in-law intends to retire in September 2017, and at such time we expect that Mr. Hobby will become an independent director.

Each

of the Audit, Compensation, and Governance and Nominating Committees is made up solely of independent directors. In accordance with the Guidelines and NYSE listing standards, all members of the

Audit and Compensation Committees meet additional independence standards applicable to audit and compensation committee members, respectively.

|

|

|

|

|

6 |

|

Governance

of

the

Company | |

Table of Contents

Board Structure and Leadership

|

|

|

|

|

|

|

|

• Chairman of the Board: Lawrence S. Coben |

|

• Separate Chairman and Chief Executive Officer (CEO) |

|

|

|

|

• Number of directors: 13 |

|

• Regular executive sessions of independent directors |

|

|

|

|

• Number of regular meetings in 2016: 5 |

|

• Majority voting for directors |

|

|

|

|

• Number of special meetings in 2016: 5 |

|

• Each committee led by an independent director |

|

|

|

|

• Annual election of directors |

|

• Active engagement by all directors |

|

|

|

|

All

directors stand for election annually. Each director will hold office until his or her successor has been elected and qualified or until the director's earlier death, resignation or removal.

As

of the 2016 Annual Meeting of Stockholders, there were 13 members of the Board. During the 2016 fiscal year, no director attended less than 75% of the total of the Board meetings and the meetings

of the Committees on which he or she served.

On

February 13, 2017, in connection with the Cooperation Agreements as further described on page 17, Mr. Howard Cosgrove resigned as chairman of the Board and as a director and

Mr. Edward R. Muller resigned as vice chairman of the Board and as a director. The Board elected Mr. Lawrence S. Coben as chairman of the Board to replace Mr. Cosgrove. The Board

elected Mr. Barry T. Smitherman and Mr. C. John Wilder to the vacant seats created by the resignations of Messrs. Cosgrove and Muller. On February 23, 2017,

the Board reconstituted the composition of its standing committees as a result of the recent changes in the composition of the full Board and to take into account the number of committees on which

each Board member serves.

The

Guidelines provide that non-executive directors meet in executive session regularly following Board meetings. The Company's Non-Executive Chairman, Mr. Coben, presides at these sessions.

Also, pursuant to the Company's Bylaws, Mr. Coben has been designated as an "alternate member" of all Committees to replace any absent or disqualified members of a Committee.

Directors

are encouraged to attend the annual meetings of stockholders. All of the directors attended the 2016 Annual Meeting of Stockholders.

Our

CEO, Mr. Gutierrez, and Chairman, Mr. Coben, work closely together in complementary roles. Mr. Gutierrez focuses on the day-to-day developments of the Company and establishes

the Company's strategic plan. Mr. Coben leads the Board's responsibilities to review, approve and monitor fundamental financial and business strategies and major corporate actions, assess major

risks facing the Company and management, oversee succession planning, most notably at the CEO level, and preside over the Board and its Committees as they perform their broad and varied oversight

functions. The Board believes that these complementary roles provide the appropriate governance structure for the Company at this time.

Since

December 2003, NRG's governance structure has been led by a separate CEO and Chairman of the Board. Irrespective of the Company's current practice, the Board believes that an effective board

leadership structure is highly dependent on the experience, skills and personal interaction between persons in leadership roles. As stated in the Guidelines, the Board believes that it is in the best

interest of the Company for the Board to make a determination regarding whether or not to separate the roles of Chairman and CEO based upon the present circumstances.

The

Board has taken a proactive approach in applying leading governance practices, which is evidenced by the Board's recommendation, and our stockholders' subsequent approval, of the

majority voting standard for the election of directors at the 2009 Annual Meeting of Stockholders, the declassification of our Board at the 2012 Annual Meeting of Stockholders and the adoption of

proxy access following the 2016 Annual Meeting of Stockholders. Furthermore, as described in the Guidelines, the Board follows a series of governance practices that it believes foster effective Board

oversight and accountability to the Company's stockholders. These practices include:

- •

- Executive and director stock ownership guidelines to align interests with our stockholders;

- •

- Ongoing succession planning for the CEO and other senior management;

- •

- Annual performance evaluations of the Board and each of its standing Committees, as well as periodic peer review for individual directors;

- •

- Director orientation and continuing education program, including Company site visits and information sessions with Company management; and

- •

- Access to and engagement of outside advisors and consultants to assist the Board and the Committees in the performance of their duties, as

appropriate.

Following

our 2016 Annual Meeting of Stockholders at which a non-binding proxy access stockholder proposal received the affirmative vote of majority of shares present, we engaged

with the stockholder who submitted the proposal. Our Board determined that the best course of action for the Company and our stockholders was to

|

|

|

|

|

| Governance

of

the

Company |

|

7 |

amend our bylaws to include proxy access. In December 2016, our Board adopted amendments to our Bylaws to implement proxy access. Under the proxy access

provisions in our Bylaws, a stockholder (or group of up to 20 stockholders) continuously owning at least 3% of our outstanding common stock for a period of at least three years prior to the date of

the nomination may nominate and include in our proxy materials for the following annual meeting director nominees constituting up to 20% of the Board. To do so, the stockholder must submit the

information required by Article II, Section 15 of our Bylaws to the Company's Corporate Secretary as described further under "Director Nominees for Inclusion in the Proxy Materials for

the 2018 Annual Meeting of Stockholders (Proxy Access)."

While

the Company's management is responsible for the day-to-day management of the risks that the Company faces, the Board, as a whole and through its Committees, has responsibility for overall risk

oversight of the Company. A fundamental aspect of risk oversight includes not only understanding the material risks to the business and what steps management is taking or should be taking to manage

those risks, but also understanding and determining the appropriate risk appetite for the Company. The Board's role in reviewing and approving matters such as the Company's annual business plan,

budget and long-term plan, strategic initiatives, individual development projects, acquisitions and divestitures, and capital allocation plan, represents the primary means by which the Board defines

for management what constitutes an appropriate level of risk for the Company.

RISK OVERSIGHT HIGHLIGHTS

|

- •

- The Board has responsibility for overall risk oversight

of the Company.

- •

- Board Committees, especially the Finance and Risk Management Committee, play an important

role.

- •

- Risk oversight includes understanding the material

risks to the business and what steps management is taking or should be taking to manage those risks, as well as understanding and determining the appropriate risk appetite for the

Company.

- •

- To define the Company's risk appetite, the Board reviews and approves the annual business plan, budget and long-term

plan, strategic initiatives, individual development projects, acquisitions and divestitures, and capital allocation plan.

The

Board performs its risk oversight function in several ways. The Board monitors, reviews and reacts to strategic and corporate risks through reports by management, including the Enterprise Risk

Management team, which is further described below, and through the Committees of the Board. This oversight function is conducted primarily through the Finance and Risk Management Committee. The

Finance and Risk Management Committee was formed

in

2014 and is responsible for company-wide enterprise risk management. The Finance and Risk Management Committee provides risk oversight with respect to the Company's trading of fuel, transportation,

energy and related products and services, regulatory compliance, and its management of the risks associated with such activities. The Company's Financial Risk Management Committee, a committee

comprised of senior management and key personnel in and around the finance, commercial operations and risk functions, reports to the Finance and Risk Management Committee on a regular basis.

The

table below summarizes the significant role the various Board Committees play in carrying out the risk oversight function.

|

|

|

|

COMMITTEE |

|

RISK OVERSIGHT FOCUS AREA |

|

Audit Committee |

|

Discusses our policies with respect to risk assessment and risk management. |

|

|

Focuses on financial risks, including reviewing the effectiveness of our internal controls, conducting a detailed review of the financial portions of our Securities and Exchange Commission (SEC) reports, approving the independent auditor and the

annual audit plan, and receiving periodic reports from the Company's independent auditor, our internal auditor and our corporate compliance officer. |

|

|

|

|

| Compensation Committee |

|

Oversees risks related to our compensation policies and practices, with input from management and the Compensation Committee's independent outside compensation consultant, Pay Governance LLC (Pay Governance).

|

|

|

|

|

|

Finance and Risk Management Committee |

|

Oversees risks related to our capital structure, liquidity, financings and other capital markets transactions as well as risks related to our trading of fuel, transportation, energy and related products and services, and regulatory compliance.

|

|

|

|

|

| Nuclear Oversight Committee and Subcommittee |

|

Oversees risks related to our ownership and operation, directly or indirectly, of interests in nuclear power plant facilities. |

|

|

|

|

The

Chairs of each of the Committees regularly report to the Board on all matters reviewed by their respective Committees, thereby providing the Board with the opportunity to identify and discuss any

risk-related issues or request additional information from management or the Committees that may assist the Board in its risk oversight role. To this end, risk-related issues presented to the

Committees and the Nuclear Oversight Subcommittee are routinely presented to the full Board to ensure proper oversight.

|

|

|

|

|

8 |

|

Governance

of

the

Company | |

As

described above, the Compensation Committee is responsible for overseeing risks related to our compensation policies and practices. The Company's Enterprise Risk Management team is responsible for

assisting the Compensation Committee with its oversight and analysis of these risks. To assist the Compensation Committee with determining whether the Company's compensation policies and practices

subject the Company to unnecessary risk or could potentially motivate employees to take excessive risk, the Company's Enterprise Risk Management team conducted a review of these policies and practices

and reported to the Compensation Committee its findings as follows:

- •

- base salaries are a sufficient component of total compensation to discourage risk taking;

- •

- earnings goals under the Company's Second Amended and Restated Annual Incentive Plan for Designated Corporate Officers (AIP) are based upon its

audited financial statements and the Company believes that the goals are attainable without the need to take inappropriate risks or make material changes to the Company's business or strategy;

- •

- named executive officers who receive payment under the AIP and the LTIP may be required to reimburse the Company for all or a portion of the

payment (commonly referred to as a clawback) if the Company has to prepare an accounting restatement because it is in material noncompliance with any financial reporting requirements or in the case of

fraud, embezzlement or other serious misconduct, which discourages risk taking;

- •

- Market Stock Unit (MSU) or Relative Performance Stock Unit (RPSU) awards under the LTIP are typically based upon total stockholder return over

three-year periods, which mitigates short-term risk taking;

- •

- because incentive compensation has a large equity component, value is best realized through long-term appreciation of stockholder value,

especially when coupled with the stock ownership guidelines, which expose the Company's named executive officers to loss of the value of the retained equity if stock appreciation is jeopardized; and

- •

- the use of incentive compensation components that are paid or vest over an extended period also mitigates against unnecessary or excessive risk

taking.

Furthermore,

the Enterprise Risk Management team has continued to evaluate and review new or amended compensation policies or practices and has reported its findings to the Compensation Committee,

which are consistent with the principles identified above.

As

a result of the review, management and the Compensation Committee have concluded that the Company's compensation policies and practices are not reasonably likely to have a material adverse effect

on the Company.

Director Nominee Selection Process

|

The

Governance and Nominating Committee is responsible for identifying individuals that the Committee believes are qualified to become Board members in accordance with criteria set

forth in the Guidelines. These criteria include an individual's business experience and skills, independence, judgment, integrity, and ability to commit sufficient time and attention to the activities

of the Board. The Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all Board members. While the Company does not have a formal

diversity policy, the Guidelines, since their adoption in 2004, provide that the Committee will consider diversity criteria in the context of the perceived needs of the Board as a whole and seek to

achieve a diversity of backgrounds and perspectives on the Board.

The

Governance and Nominating Committee's process for identifying and evaluating director nominees also includes consultation with all directors, solicitation of proposed nominees from all directors,

the engagement of one or more

professional search firms, if deemed appropriate, interviews with prospective nominees by the Committee (and other directors, if deemed appropriate) and recommendations regarding qualified candidates

to the full Board.

As

further described under "Stockholder Recommendations for Director Candidates" on page 79, the Governance and Nominating Committee also considers director candidates recommended by

stockholders.

The

Board has the following five standing Committees: Audit, Compensation, Governance and Nominating, Finance and Risk Management and Nuclear Oversight, which includes the Nuclear

Oversight Subcommittee. In addition, in February 2017, the Board created the Business Review Committee, which is an ad hoc committee of the Board. The membership and the functions of each Committee

are described below.

- •

- Members: William

E. Hantke (Chair), Terry G. Dallas, Barry T. Smitherman, Thomas H. Weidemeyer and Walter R. Young

- •

- Number of meetings in

2016: 4

- •

- Audit Committee Financial

Experts: William E. Hantke, Terry G. Dallas and Walter R. Young

- •

- Primary

Responsibilities: appoints, retains, oversees, evaluates, and compensates the independent auditors; reviews the annual audited

and quarterly consolidated financial statements; and reviews major issues regarding accounting principles and financial statement presentations.

- •

- Independence: 5

of 5 members

|

|

|

|

|

| Governance

of

the

Company |

|

9 |

The

Audit Committee represents and provides assistance to the Board with respect to matters involving the accounting, auditing, financial reporting, internal controls, and legal compliance functions

of the Company and its subsidiaries, including assisting the Board in its oversight of the integrity of the Company's financial statements, compliance with legal and regulatory requirements, the

qualifications, independence, and performance of the Company's independent auditors, the performance of the Company's internal audit function, and effectiveness of the Company's financial risk

management. Among other things, the Audit Committee:

- •

- appoints, retains, oversees, evaluates, and compensates the independent auditors;

- •

- reviews the annual audited and quarterly consolidated financial statements;

- •

- reviews major issues regarding accounting principles and financial statement presentations;

- •

- reviews earnings press releases and earnings guidance provided to analysts and rating agencies;

- •

- reviews with the independent auditors the scope of the annual audit, and approves all audit and permitted nonaudit services provided by the

independent auditors;

- •

- considers the adequacy and effectiveness of the Company's internal control and reporting system;

- •

- discusses policies with respect to risk assessment and risk management, including the Company's major financial risk exposures and the

effectiveness of the Company's system for monitoring compliance with laws and regulations, and reviews the Company's tax policies and findings of regulatory agencies and independent auditors;

- •

- reports regularly to the Board regarding its activities and prepares and publishes required annual Committee reports;

- •

- establishes procedures for the receipt, retention, and treatment of complaints and concerns regarding accounting, internal accounting controls,

or auditing matters;

- •

- oversees the internal audit and corporate compliance functions;

- •

- reviews the Company's political contributions and expenditures and its related policy, as well as its membership in business and trade

associations that engage in lobbying activities or make political expenditures; and

- •

- annually evaluates the performance of the Audit Committee and the adequacy of its charter.

- •

- Members: Walter

R. Young (Chair), E. Spencer Abraham, Kirbyjon H. Caldwell and William E. Hantke

- •

- Number of meetings in

2016: 5

- •

- Primary

Responsibilities: oversees the Company's

overall compensation structure, policies, and programs

- •

- Independence: 4

of 4 members

Among

other things, the Compensation Committee:

- •

- reviews and recommends to the Board annual and long-term goals and objectives relevant to the compensation of the President and CEO, evaluates

the performance of the President and CEO in light of those goals and objectives, and either as a committee with the Chairman of the Board or together with the other independent directors, determines

and approves the President and CEO's compensation;

- •

- reports to the Board on the review of annual and long-term goals and objectives relevant to the compensation of the Chief Financial Officer,

the Executive Vice Presidents and any other officer designated

by the Board, the evaluation of those officers' performance in light of those goals and objectives, the determination and approval of compensation levels based on such evaluations and the review and

approval of employment arrangements, severance arrangements and benefits plans;

- •

- reviews and recommends to the Board the compensation, incentive compensation and equity-based plans that are subject to Board approval;

- •

- reviews and approves stock incentive awards for executive officers other than the President and CEO;

- •

- makes recommendations regarding, and monitors compliance by officers and directors with, the Company's stock ownership guidelines;

- •

- reviews the compensation of directors for service on the Board and its committees;

- •

- oversees the evaluation of management and annually reviews the Company's senior management succession plans;

- •

- reviews and approves employment agreements and severance arrangements, benefit plans not otherwise subject to Board approval, and corporate

goals and objectives for officers other than the President and CEO;

- •

- reviews and discusses with management the Compensation Discussion and Analysis (CD&A) to be included in the Company's Proxy Statement or annual

report on Form 10-K, and based on such review and discussions, recommends to the Board that the CD&A be included in the Company's Proxy Statement or annual report on Form 10-K, as

applicable;

|

|

|

|

|

10 |

|

Governance

of

the

Company | |

- •

- evaluates any conflicts of interest and the independence of any outside advisors engaged by the Compensation Committee;

- •

- reviews and oversees the Company's overall compensation strategy, structure, policies, programs, risk profile and any stockholder advisory

votes on the Company's compensation practices and assesses whether the compensation structure establishes appropriate incentives for management and employees; and

- •

- annually evaluates the performance of the Compensation Committee and the adequacy of its charter.

The

Compensation Committee may delegate to one or more subcommittees such power and authority as the Compensation Committee deems appropriate. No subcommittee shall consist of fewer than two members,

and the Compensation Committee may not delegate to a subcommittee any power or authority that is required by any law, regulation or listing standard to be exercised by the Compensation Committee as a

whole.

Pay

Governance, the Compensation Committee's independent compensation consultant for fiscal year 2016, assisted with executive pay decisions and worked with the Compensation Committee to formulate the

design of the executive compensation program for 2016.

GOVERNANCE AND NOMINATING COMMITTEE

|

- •

- Members: Thomas

H. Weidemeyer (Chair), E. Spencer Abraham, Kirbyjon H. Caldwell and Evan J. Silverstein

- •

- Number of meetings in

2016: 4

- •

- Primary

Responsibilities: recommends director candidates to the Board for election at the Annual Meeting of Stockholders, and

periodically reviews the Guidelines and recommends changes to the Board

- •

- Independence: 4

of 4 members

Among

other things, the Governance and Nominating Committee:

- •

- identifies and reviews the qualifications of potential nominees to the Board consistent with criteria approved by the Board, and assesses the

contributions and independence of incumbent directors in determining whether to recommend them for re-election;

- •

- establishes and reviews procedures for the consideration of Board candidates recommended by the Company's stockholders;

- •

- makes recommendations to the Board concerning the structure, composition, and functioning of the Board and its committees;

- •

- reviews and assesses the channels through which the Board receives information, and the quality and timeliness of information received;

- •

- reviews and recommends to the Board retirement and other tenure policies for directors;

- •

- reviews and approves Company policies applicable to the Board, the directors and officers subject to Section 16 of the Securities

Exchange Act of 1934, as amended (the Exchange Act);

- •

- reviews and reports to the Board regarding potential conflicts of interests of directors;

- •

- recommends to the Board director candidates for the annual meeting of stockholders, and candidates to be elected by the Board as necessary to

fill vacancies and newly created directorships;

- •

- oversees the evaluation of the Board and its committees;

- •

- monitors directorships in other public companies held by directors and senior officers of the Company;

- •

- annually evaluates the performance of the Governance and Nominating Committee and the appropriateness of its charter;

- •

- oversees the orientation process for new director programs for the continuing education of directors; and

- •

- coordinates annual self-evaluations for the Board, each director, and each of the Audit Committee, Compensation Committee, Governance and

Nominating Committee, Finance and Risk Management Committee and Nuclear Oversight Committee and Subcommittee to assess their effectiveness and review their respective charters.

FINANCE AND RISK MANAGEMENT COMMITTEE

|

- •

- Members: Evan J.

Silverstein (Chair), Terry G. Dallas,

Paul W. Hobby, Anne C. Schaumburg and C. John Wilder

- •

- Number of meetings in

2016: 7

- •

- Primary

Responsibilities: assists the Board in fulfilling

its responsibilities with respect to the oversight of trading, power marketing and risk management issues at the Company, and reviews and approves certain financial development

transactions

- •

- Independence: 4

of 5 members

The

Finance and Risk Management Committee consists of at least three directors, a majority of which are independent as defined under the listing standards of the NYSE and as affirmatively determined

by the Board. No member of the Finance and Risk Management Committee may be removed except by majority vote of the independent directors of the Board then in office.

|

|

|

|

|

| Governance

of

the

Company |

|

11 |

Among

other things, the Finance and Risk Management Committee:

- •

- reviews, reports and makes recommendations to the Board on management recommendations or proposals regarding the Company's and its

subsidiaries' (a) capital structure, (b) liquidity, (c) need for credit or debt or equity financing, (d) amounts, timing and sources of capital market transactions, and

(e) financial hedging and derivative activities;

- •

- reviews and approves, or authorizes officers to approve, the pricing and other terms and conditions of transactions relating to debt or equity

financings, financial hedging and derivatives activities, and other similar financial activities, in each case which have been reviewed and approved by the Board;

- •

- reviews and approves, or authorizes officers to approve, repurchases, early redemption or other similar actions with respect to the Company's

securities;

- •

- reviews and approves, or authorizes officers to approve, the pricing and other terms and conditions of financing transactions related to

mergers, acquisitions, tender offers, and reorganizations which have been reviewed and approved by the Board;

- •

- reviews and approves, or authorizes officers to approve, the pricing and other terms and conditions of securities offerings which have been

reviewed and approved by the Board;

- •

- approves determinations of the fair market value of assets and investments of the Company for purposes of the Company's note indentures, senior

secured credit agreement or other similar financing documents where fair market value is required to be determined by the Board or by a Committee of the Board;

- •

- reviews with management, on a periodic basis, contributions to employee benefit retirement plans of the Company, investment performance,

funding, asset allocation policies and other similar performance measures of the employee benefit retirement plans of the Company;

- •

- oversees the Company's trading of fuel, transportation, energy and related products and services, and its management of risks associated with

such activities;

- •

- reviews, advises and consults with management and the Audit Committee regarding the Company's risk management policies, practices and

procedures;

- •

- approves as appropriate, the Company's power marketing and trading transactions, limits, policies, practices and procedures, and counterparty

credit limit and policies, and approves exceptions to policies, as necessary;

- •

- annually evaluates the performance of the Finance and Risk Management Committee and the appropriateness of the Finance and Risk Management

Committee's charter;

- •

- reviews and approves transactions exceeding the CEO's individual authority limits under the Company's risk management policies; and

- •

- performs such other responsibilities as may be delegated to it by the Board from time to time that are consistent with its purpose.

NUCLEAR OVERSIGHT COMMITTEE AND SUBCOMMITTEE

|

- •

- Committee

Members: Lawrence S. Coben (Chair) and

all other Board members

- •

- Sub Committee

Members: Paul W. Hobby (Chair), E. Spencer Abraham, Terry G. Dallas and Barry T.

Smitherman

- •

- Number of Committee meetings in

2016: 1

- •

- Number of Subcommittee meetings in

2016: 2

- •

- Primary

Responsibilities: assists the Board in fulfilling

its responsibilities with respect to the oversight of the Company's ownership and operation, directly or indirectly, of its interests in nuclear power plant

facilities

- •

- Committee

Independence: 11 of 13 members

- •

- Subcommittee

Independence: 3 of 4 members

The

Nuclear Oversight Committee consists of all of the members of the Board, all of whom are citizens of the United States and meet the requirements of applicable law to serve on the Committee, a

majority of which are independent as defined under the listing standards of the NYSE and as affirmatively determined by the Board. The Nuclear Oversight Committee formed the Nuclear Oversight

Subcommittee to review and report to the Board and the Nuclear Oversight Committee on matters not expressly reserved for review by the Board. In this capacity, the Nuclear Oversight Subcommittee

regularly meets with Company management regarding the Company's nuclear operating facilities and the Chair of the Subcommittee subsequently reports to the Board and the Nuclear Oversight Committee on

such matters during regularly scheduled Board meetings.

|

|

|

|

|

12 |

|

Governance

of

the

Company | |

BUSINESS REVIEW COMMITTEE

|

- •

- Members: C.

John Wilder (Chair), Mauricio Gutierrez, Paul W. Hobby, Anne C. Schaumburg and Barry T. Smitherman

- •

- Primary

Responsibilities: reviews and makes recommendations to the Board regarding the Company's strategic

initiatives

- •

- Independence: 3

of 5 members

The

Business Review Committee was formed in February 2017 to review and make recommendations to the Board with respect to operational and cost excellence initiatives; potential portfolio and/or asset

de-consolidations, dispositions and optimization; capital structure and allocation; and broader strategic initiatives.

Anti-Hedging and Anti-Pledging Policies

|

The

Company prohibits executive officers, directors and employees from directly or indirectly engaging in any kind of hedging transaction that could reduce or limit their economic

risk with respect to their holdings, ownership or interest in the Company's securities, including prepaid variable forward contracts, equity swaps, collars, puts, calls

and options. The Company also prohibits executive officers, directors and employees from directly or indirectly engaging in any transaction in which the

Company's securities are being pledged.

Communication with Directors

|

Stockholders

and other interested parties may communicate with the Board by writing to the Corporate Secretary, NRG Energy, Inc., 804 Carnegie Center, Princeton, New Jersey

08540. Communications intended for a specific director or directors should be addressed to their attention to the Corporate Secretary at the address provided above. Communications received from

stockholders are forwarded directly to Board members as part of the materials mailed in advance of the next scheduled Board meeting following receipt of the communications. The Board has authorized

the Corporate Secretary, in his or her discretion, to forward communications on a more expedited basis if circumstances warrant or to exclude a communication if it is illegal, unduly hostile or

threatening, or similarly inappropriate. Advertisements, solicitations for periodical or other subscriptions, and other similar communications generally will not be forwarded to the directors.

|

|

|

|

|

| Governance

of

the

Company |

|

13 |

Table of Contents

The total annual compensation received by our directors for their service as Board members and chairs of the committees of the Board, if applicable,

is described in the chart below.

|

|

|

COMPENSATION ELEMENT |

|

COMPENSATION AMOUNT |

Annual Retainer |

|

$100,000 |

|

|

|

|

Annual Equity Retainer |

|

$125,000 |

|

|

|

|

Chairperson Retainer |

|

$160,000 |

|

|

|

|

Vice Chairperson Retainer1 |

|

$40,000 |

|

|

|

|

Audit Committee Chair Retainer |

|

$35,000 |

|

|

|

|

Other Committee Chair Retainer |

|

$20,000 |

|

|

|

|

Employee Directors |

|

No fees |

|

|

|

|

|

|

|

1 |

|

On February 13, 2017, the Board approved amendment to the Bylaws to eliminate the position of vice chairman of the Board. |

A non-employee director who is newly appointed to the Board, other than in connection with an annual meeting of stockholders, will receive the Annual Equity Retainer and a pro rata portion of the

Annual Retainer upon appointment.

Directors

receive approximately 45% of their total annual compensation in the form of cash and the remaining 55% in the form of vested Deferred Stock Units (DSUs). Each DSU is equivalent in value to

one share of NRG's common stock and represents the right to receive one such share of common stock payable at the time elected by the director, or in the event the director does not make an election

with respect to payment, when the director ceases to be a member of the Board. In connection with the grants of the DSUs, each non-employee director also receives dividend equivalent rights (DERs)

which become exercisable proportionately with the DSUs to which they relate. Similar to its competitive assessment on behalf of the named executive officer compensation, Pay Governance performed a

review of director compensation. Results of the review were shared with the Compensation Committee who made a recommendation to the full Board for final approval. The Compensation Committee and Board

did not make any changes to director compensation in light of the Company's Total Shareholder Return (TSR) performance.

|

|

|

|

|

14 |

|

Director

Compensation | |

Table of Contents

Director Compensation

Fiscal Year Ended December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

FEES EARNED OR PAID IN CASH |

|

|

STOCK AWARDS1 |

|

|

TOTAL |

|

E. Spencer Abraham |

|

$ |

100,000 |

|

$ |

129,484 |

|

$ |

229,484 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Kirbyjon H. Caldwell |

|

$ |

100,000 |

|

$ |

130,339 |

|

$ |

230,339 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lawrence S. Coben |

|

$ |

100,000 |

|

$ |

130,503 |

|

$ |

230,503 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Terry G. Dallas |

|

$ |

100,000 |

|

$ |

131,586 |

|

$ |

231,586 |

|

|

|

|

|

|

|

|

|

|

|

|

|

William E. Hantke |

|

$ |

117,500 |

|

$ |

145,286 |

|

$ |

262,786 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Paul W. Hobby |

|

$ |

110,000 |

|

$ |

135,002 |

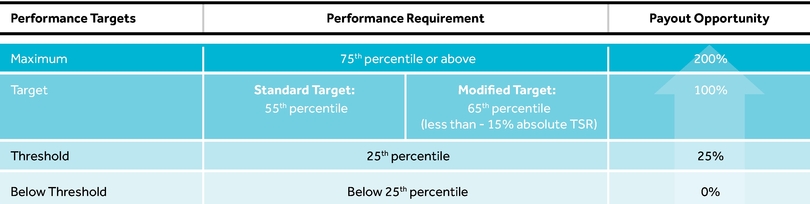

|