Filed Pursuant to Rule 424(b)(5)

Registration No. 333-203733

This preliminary prospectus supplement relates to an effective

registration statement under the Securities Act of 1933, as amended, but is not complete and may be changed. This preliminary prospectus supplement is not an offer to sell these securities, and we are not soliciting an offer to buy these securities,

in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED MARCH 16, 2017

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus dated April 30, 2015)

5,000,000 Shares

Common Shares

We are offering 5,000,000 common shares, no par value, as described in this prospectus supplement and the accompanying prospectus.

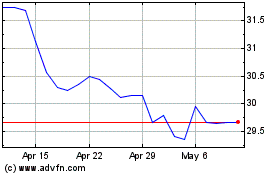

Our common shares are listed on the New York Stock Exchange under the symbol “RYN.” On March 15, 2017, the reported closing price of our common

shares on the New York Stock Exchange was $28.86 per share.

We have granted the underwriters a 30-day option to purchase up to an additional

750,000 common shares on the same terms and conditions as set forth above if the underwriters sell more than 5,000,000 common shares in this offering.

In order to maintain our qualification as a real estate investment trust, we must abide by certain provisions in the Internal Revenue Code of 1986, as

amended, including rules restricting concentration of ownership. For more information, see “Additional Material U.S. Federal Income Tax Considerations” in this prospectus supplement and “Certain Federal Income Tax Consequences”

in the accompanying prospectus.

Investing in our common shares involves risks. Before buying any shares, you should carefully consider the

risk factors described in the section titled “

Risk Factors

” beginning on page S-7 of this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

|

$

|

|

|

|

$

|

|

|

Underwriting discounts and commissions (1)

|

|

|

$

|

|

|

|

$

|

|

|

Proceeds, before expenses, to us

|

|

|

$

|

|

|

|

$

|

|

|

(1)

|

We have agreed to reimburse the underwriters for certain expenses. See “Underwriters.”

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The common shares will be ready for

delivery on or about March , 2017.

|

|

|

|

|

MORGAN STANLEY

|

|

RAYMOND JAMES

|

The date of this prospectus supplement is March , 2017

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement and the information incorporated by reference herein, which, among

other things, describes the specific terms of this offering and adds to and updates the information contained in the accompanying prospectus. The second part is the accompanying prospectus and the information incorporated by reference therein,

which, among other things, provides more general information about the Company and its business, some of which may not apply to this offering. If any information varies between this prospectus supplement and the information incorporated by reference

herein and the accompanying prospectus and the information incorporated by reference therein, you should rely on the information in this prospectus supplement and the information incorporated by reference herein.

Additional information about us is incorporated in this prospectus supplement and the accompanying prospectus by reference to certain of our

filings with the Securities and Exchange Commission (the “SEC”). You are urged to read carefully this prospectus supplement and the accompanying prospectus and the information incorporated by reference into this prospectus supplement and

the accompanying prospectus, including the risk factors and other cautionary statements described under the heading “Risk Factors” elsewhere in this prospectus supplement and in our Annual Report on Form 10-K for the year ended

December 31, 2016, before deciding whether to invest in our common shares. See “Where You Can Find More Information” and “Incorporation by Reference” in this prospectus supplement.

References in this prospectus supplement to the terms “we,” “us,” “our,” “Rayonier,” the

“Company” or other similar terms mean Rayonier Inc. and its subsidiaries, unless we state otherwise or the context indicates otherwise.

FORWARD-LOOKING STATEMENTS

Some of the information included in this prospectus supplement, the accompanying prospectus and in the documents incorporated by reference

into this prospectus supplement and the accompanying prospectus regarding anticipated financial outcomes, including Rayonier’s earnings guidance, if any, Rayonier’s ability to complete this offering, the gross proceeds and uses of those

proceeds, business and market conditions, outlook, expected dividend rate, Rayonier’s business strategies, including expected harvest schedules, timberland acquisitions, Rayonier’s targets for incremental Adjusted EBITDA and Cash Available

for Distribution (“CAD”) from timberland acquisitions, sales of non-strategic timberlands, the anticipated benefits of Rayonier’s business strategies, and other similar statements relating to Rayonier’s future events,

developments or financial or operational performance or results, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These

forward-looking statements are identified by the use of words such as “may,” “will,” “should,” “expect,” “estimate,” “believe,” “intend,” “project,”

“anticipate,” “target” and other similar language. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. While management believes that these forward-looking

statements are reasonable when made, forward-looking statements are not guarantees of future performance or events and undue reliance should not be placed on these statements. These statements are based on beliefs and assumptions of management,

which in turn are based on currently available information. In particular, Rayonier’s targets for incremental Adjusted EBITDA and CAD from timberland acquisitions are based on a range of assumptions, including the price realized and cost

associated with harvesting acquired timber, the harvest yield of the timberlands acquired and estimates of merchantable timber inventories, growth rates and end-product yields. These assumptions could prove inaccurate.

The forward-looking statements also involve significant business, economic, regulatory and competitive uncertainties, many of which are

outside of our control. In addition, the following important factors, together with those identified in the sections titled “Risk Factors” in this prospectus supplement, the accompanying

S-i

prospectus and any documents we incorporate by reference in this prospectus supplement or the accompanying prospectus, among others, could cause actual results or events to differ materially from

those expressed in forward-looking statements that may have been made in this document:

|

|

•

|

|

the cyclical and competitive nature of the industries in which we operate;

|

|

|

•

|

|

fluctuations in demand for, or supply of, our forest products and real estate offerings;

|

|

|

•

|

|

entry of new competitors into our markets;

|

|

|

•

|

|

changes in global economic conditions and world events;

|

|

|

•

|

|

fluctuations in demand for our products in Asia, and especially China;

|

|

|

•

|

|

various lawsuits relating to matters arising out of our previously announced internal review and restatement of our consolidated financial statements;

|

|

|

•

|

|

the uncertainties of potential impacts of climate-related initiatives;

|

|

|

•

|

|

the cost and availability of third party logging and trucking services;

|

|

|

•

|

|

the geographic concentration of a significant portion of our timberland;

|

|

|

•

|

|

our ability to identify, finance and complete timberland acquisitions, including the Acquisitions (as defined below);

|

|

|

•

|

|

changes in environmental laws and regulations regarding timber harvesting, delineation of wetlands, and endangered species, that may restrict or adversely impact our ability to conduct our business, or increase the cost

of doing so;

|

|

|

•

|

|

adverse weather conditions, natural disasters and other catastrophic events such as hurricanes, wind storms and wildfires, which can adversely affect the availability of our timberlands;

|

|

|

•

|

|

interest rate and currency movements;

|

|

|

•

|

|

our capacity to incur additional debt;

|

|

|

•

|

|

changes in tariffs, taxes or treaties relating to the import and export of our products or those of our competitors;

|

|

|

•

|

|

changes in key management and personnel;

|

|

|

•

|

|

our ability to meet all necessary legal requirements to continue to qualify as a real estate investment trust (“REIT”) and changes in tax laws that could adversely affect beneficial tax treatment;

|

|

|

•

|

|

the cyclical nature of the real estate business generally;

|

|

|

•

|

|

a delayed or weak recovery in the housing market;

|

|

|

•

|

|

the lengthy, uncertain and costly process associated with the ownership, entitlement and development of real estate, especially in Florida, which also may be affected by changes in law, policy and political factors

beyond our control;

|

|

|

•

|

|

unexpected delays in the entry into or closing of real estate transactions;

|

|

|

•

|

|

changes in environmental laws and regulations that may restrict or adversely impact our ability to sell or develop properties;

|

|

|

•

|

|

the timing of construction and availability of public infrastructure; and

|

|

|

•

|

|

the availability of financing for real estate development and mortgage loans.

|

The above

description of risks and uncertainties is not all-inclusive but is designed to highlight what we believe are important factors to consider. For additional factors that could impact future results, please see “Risk Factors” herein and

similar discussions in our other SEC filings, including, without limitation, our Annual Report on Form 10-K for the year ended December 31, 2016 and subsequent reports we file with the SEC.

S-ii

Forward-looking statements are only as of the date they are made, and the Company undertakes no

duty to update its forward-looking statements except as required by law. You are advised, however, to review any further disclosures we make on related subjects in our subsequent reports filed with the SEC.

You may rely on the information contained in or incorporated by

reference into this prospectus supplement, the accompanying prospectus and any free writing prospectus we may authorize to be delivered to you. Neither we nor the underwriters have authorized anyone to provide information different from that

contained in this prospectus supplement or the accompanying prospectus. Neither we nor the underwriters take any responsibility for, or provide any assurance as to the reliability of, any other information that others may give you. This prospectus

supplement, the accompanying prospectus and any such free writing prospectus may be used only for the purposes for which they have been published. Neither the delivery of this prospectus supplement nor the sale of common shares means that

information contained in this prospectus supplement or the accompanying prospectus is correct after the date of this prospectus supplement. This prospectus supplement is not an offer to sell or the solicitation of an offer to buy these common shares

in any circumstances under which the offer or solicitation is unlawful.

S-iii

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information contained elsewhere in or incorporated by reference into this prospectus supplement and the

accompanying prospectus. It does not contain all of the information that you should consider before making an investment decision. You should carefully read this prospectus supplement, the accompanying prospectus and the information incorporated by

reference into this prospectus supplement and the accompanying prospectus in their entirety, including especially the “Risk Factors” section, as well as the documents that we have referred you to under “Where You Can Find More

Information” below, before making an investment decision.

The Company

We are a leading timberland REIT with assets located in some of the most productive softwood timber growing regions in the U.S. and New

Zealand. The focus of our business is to invest in timberlands and to actively manage them to provide current income and attractive long-term returns to our shareholders. As of December 31, 2016, we owned, leased or managed approximately

2.7 million acres of timberlands located in the U.S. South (1.85 million acres), U.S. Pacific Northwest (378,000 acres) and New Zealand (433,000 gross acres, or 299,000 net plantable acres). In addition, we engage in

the trading of logs from New Zealand and Australia to Pacific Rim markets, primarily to support our New Zealand export operations. We have an added focus to maximize the value of our land portfolio by pursuing higher and better use (“HBU”)

land sales opportunities.

On June 27, 2014, Rayonier completed the tax-free spin-off of its Performance Fibers manufacturing

business from its timberland and real estate operations, thereby becoming a “pure-play” timberland REIT. As a REIT, we are generally not required to pay U.S. federal income taxes on our earnings from timber harvest operations and other

REIT-qualifying activities contingent upon meeting applicable distribution, income, asset, shareholder and other tests.

Our U.S. timber

operations are primarily conducted by our wholly-owned REIT subsidiaries. Our New Zealand timber operations are conducted by Matariki Forestry Group, a majority-owned joint venture subsidiary (the “New Zealand JV”). Our non-REIT qualifying

operations, which are subject to corporate-level tax, are held by various taxable REIT subsidiaries. These operations include our log trading business and certain real estate activities, such as the sale and entitlement of development HBU

properties.

Our common shares are publicly traded on the New York Stock Exchange (“NYSE”) under the symbol “RYN.” We

are a North Carolina corporation with executive offices located at 225 Water Street, Suite 1400, Jacksonville, Florida 32202. Our telephone number is (904) 357-9100. Our website address is www.rayonier.com. The information contained

on our website is not part of this prospectus supplement unless it is otherwise filed with the SEC. Computershare is the transfer agent and registrar of our common shares.

Recent Developments

Proposed

Acquisitions

In March 2017, we entered into three transactions with separate sellers, pursuant to which we agreed to purchase

approximately 95,100 acres of industrial timberlands located in Florida, Georgia, and South Carolina for an aggregate purchase price of approximately $217 million, or $2,280 per acre (the “Acquisitions”), in each case, subject to customary

closing conditions. The Acquisitions are expected to close in the second quarter of 2017. We expect to finance the Acquisitions, in part, with the net proceeds of this offering. The Acquisitions are comprised of highly productive timberlands located

in some of the strongest timber markets in the U.S. South (based on average composite stumpage price by region), primarily along the I-95 coastal corridor near Savannah, Georgia. The timberlands are complementary to our existing holdings and

increase our ownership in

S-1

the U.S. South Coastal Atlantic markets by approximately 15%. Approximately 89% of the acreage is held in fee simple interest, while the remaining 11% is held in timber leases. The Acquisitions

are comprised of approximately 73% planted/plantable lands supporting predominantly loblolly plantations with an average site index of 78 and an average plantation age of approximately 14 years. The Acquisitions contain merchantable timber inventory

of approximately 4.3 million tons (45 tons per gross acre) and are expected to improve our sustainable yield by approximately 450,000 tons annually (or 4.7 tons per acre per year on the acquired lands). As a result of the Acquisitions, we are

targeting an annual increase in Adjusted EBITDA and CAD of approximately $13 million and $10 million, respectively, over the medium-term.

For a description of, and further discussion on, “merchantable timber inventory” and “sustainable yield,” see

“Item 1—Business—Discussion of Timber Inventory and Sustainable Yield” in our Annual Report on Form

10-K

for the year ended December 31, 2016, which is incorporated by reference

into this prospectus supplement. For definitions of Adjusted EBITDA and CAD, and a reconciliation of each measure to the most comparable GAAP (as defined below) measure for our historical periods, see “—Summary Historical Consolidated

Financial Data—Non-GAAP Financial Measures.” We have not provided a reconciliation of these forward-looking non-GAAP financial measures to the most comparable GAAP measures because Adjusted EBITDA and CAD exclude the impact of certain

items, as described in further detail below, and management cannot estimate the impact these items will have on Adjusted EBITDA or CAD on a forward-looking basis without unreasonable effort. We believe that the probable significance of providing

these forward-looking non-GAAP financial measures without a reconciliation to net income and cash provided by operating activities, as applicable, is that investors and analysts will have certain information that we believe is useful and meaningful

regarding the Acquisitions, but will not have that information on a GAAP basis. As a result, investors and analysts may be unable to accurately compare the expected impact of the Acquisitions to our historical results or the results or expected

results of other companies who may have treated such matters differently. Management believes that, given the inherent uncertainty of forward-looking statements, investors and analysts will be able to understand and appropriately take into account

the limitations in the information we have provided. Investors are cautioned that we cannot predict the occurrence, timing or amount of all non-GAAP items that we exclude from Adjusted EBITDA or CAD. Accordingly, the actual effect of these items,

when determined, could potentially be significant to the calculation of Adjusted EBITDA or CAD over the medium-term.

Further, these

medium-term targets for Adjusted EBITDA and CAD are based on assumptions and are subject to significant uncertainties, many of which are outside of our control. While management believes these targets and the underlying assumptions are reasonable,

they are not guarantees of future performance. Actual results will vary, and those variations may be material. Please see “Forward-Looking Statements” in this prospectus supplement for a discussion of some of the factors that may cause

variations. Nothing herein is a representation by any person that these targets will be achieved, and we undertake no duty to update these targets.

Settlement Agreement

On March 13, 2017, we announced that we had reached an agreement in principle to settle the securities class action litigation pending against

us in the United States District Court for the Middle District of Florida (the “District Court”), entitled

In re Rayonier Inc. Securities Litigation

, Case No. 3:14-cv-01395-TJC-JBT. The settlement will resolve the claims currently

asserted against all defendants in the action, including the Company and three former executive officers. The terms agreed upon by the parties contemplate a settlement payment to the class of $73 million, all of which will be funded by our

directors’ and officers’ liability insurance carriers. We expect to incur approximately $740,000 of costs in the first half of 2017 for reimbursement of certain pre-litigation legal expenses in connection with the settlement. The proposed

settlement is subject to completion of formal documentation and approval by the District Court following notice to all class members.

S-2

THE OFFERING

|

|

|

|

|

Issuer

|

|

Rayonier Inc., a North Carolina corporation.

|

|

|

|

|

Common shares offered by us

|

|

5,000,000 shares, plus up to an additional 750,000 shares if the underwriters exercise their option to purchase additional shares in full.

|

|

|

|

|

Common shares to be outstanding after this offering

|

|

128,009,175 shares (or 128,759,175 shares if the underwriters exercise their option to purchase additional shares in full).

|

|

|

|

|

Use of proceeds

|

|

The net proceeds from this offering, after deducting estimated underwriting discounts and commissions and estimated offering expenses, are

expected to be approximately $137.8 million (or $158.6 million if the underwriters exercise their option to purchase additional shares in full), in each case assuming a public offering price of $28.86 per common share, which is equal to the last

reported sale price of our common shares on March 15, 2017. A $1.00 increase (decrease) in the assumed offering price per common share would increase (decrease) the estimated net proceeds from this offering by approximately $4.8 million

(or $5.5 million if the underwriters exercise their option to purchase additional shares in full), after deducting underwriting discounts and commissions and estimated offering expenses.

We intend to use the net proceeds from this offering to finance a portion of the

Acquisitions and the remainder, if any, for general corporate purposes. This offering is not contingent on the completion of the Acquisitions. See “Use of Proceeds.”

|

|

|

|

|

Option to purchase additional shares

|

|

To the extent that the underwriters sell more than 5,000,000 common shares, the underwriters will have a 30-day option to purchase up to an additional 750,000 common shares from us at the initial price to public less

the underwriting discount.

|

|

|

|

|

NYSE symbol

|

|

“RYN”

|

|

|

|

|

Risk Factors

|

|

You should carefully read and consider the information set forth in “Risk Factors” beginning on page S-7 of this prospectus supplement, including the risk factors set forth in our Annual Report on Form 10-K for the

year ended December 31, 2016, incorporated by reference into this prospectus supplement before deciding whether to invest in our common shares.

|

The total number of common shares to be outstanding following this offering is based on 123,009,175 common

shares outstanding as of March 15, 2017 and does not include any securities convertible into or exercisable for common shares (including common shares issuable pursuant to awards outstanding under, or common shares available for issuance under,

our existing shareholder-approved incentive plans).

Unless we specifically state otherwise, the information contained in this prospectus

supplement is based upon the assumption that the underwriters will not exercise the option to purchase additional shares.

S-3

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following tables set forth our summary historical consolidated financial data as of and for the periods and the dates indicated. Our

summary historical consolidated financial data as of December 31, 2016 and 2015 and for the years ended December 31, 2016, 2015 and 2014 have been derived from, and should be read together with, and are qualified in their entirety by

reference to, our audited consolidated financial statements and related notes thereto incorporated by reference into this prospectus supplement and the accompanying prospectus.

The summary historical consolidated financial data presented below does not contain all of the information you should consider before deciding

whether or not to invest in our common shares, and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and

related notes, each of which are incorporated by reference into this prospectus supplement. See “Where You Can Find More Information” and “Incorporation by Reference.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

|

|

(in thousands)

|

|

|

Income Statement Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

(a)

|

|

$

|

788,278

|

|

|

$

|

544,874

|

|

|

$

|

603,521

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

|

524,707

|

|

|

|

441,099

|

|

|

|

483,860

|

|

|

Selling and general expenses

|

|

|

42,785

|

|

|

|

45,750

|

|

|

|

47,883

|

|

|

Other operating income, net

|

|

|

(34,991

|

)

|

|

|

(19,759

|

)

|

|

|

(26,511

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

532,501

|

|

|

|

467,090

|

|

|

|

505,232

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

(a)

|

|

|

255,777

|

|

|

|

77,784

|

|

|

|

98,289

|

|

|

Interest expense

|

|

|

(32,245

|

)

|

|

|

(31,699

|

)

|

|

|

(44,248

|

)

|

|

Interest and miscellaneous expense, net

|

|

|

(698

|

)

|

|

|

(3,003

|

)

|

|

|

(9,199

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations before income taxes

|

|

|

222,834

|

|

|

|

43,082

|

|

|

|

44,842

|

|

|

Income tax (expense) benefit

|

|

|

(5,064

|

)

|

|

|

859

|

|

|

|

9,601

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

|

217,770

|

|

|

|

43,941

|

|

|

|

54,443

|

|

|

Discontinued Operations, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from discontinued operations, net of income tax expense

|

|

|

—

|

|

|

|

—

|

|

|

|

43,403

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

|

217,770

|

|

|

|

43,941

|

|

|

|

97,846

|

|

|

Net income (loss) attributable to noncontrolling interest

|

|

|

5,798

|

|

|

|

(2,224

|

)

|

|

|

(1,491

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Rayonier Inc.

|

|

|

211,972

|

|

|

|

46,165

|

|

|

|

99,337

|

|

|

Other comprehensive income (loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment, net of income tax expense

|

|

|

6,322

|

|

|

|

(32,451

|

)

|

|

|

(15,847

|

)

|

|

Cash flow hedges, net of income tax (expense) benefit

|

|

|

22,822

|

|

|

|

(9,961

|

)

|

|

|

(1,855

|

)

|

|

Actuarial change and amortization of pension and postretirement plan liabilities, net of income

tax effect

|

|

|

5,533

|

|

|

|

2,933

|

|

|

|

54,046

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34,677

|

|

|

|

(39,479

|

)

|

|

|

36,344

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

The 2016 results included sales and operating income of $207.3 million and $143.9 million, respectively, related to Large Dispositions. The 2014 results included sales and operating income of $22 million

and $21.4 million, respectively, related to Large Dispositions. Large Dispositions are defined as transactions involving the sale of timberland that exceed $20 million in size and do not have any identified HBU premium relative to

timberland value.

|

S-4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

|

|

(in thousands)

|

|

|

Comprehensive Income

|

|

|

252,447

|

|

|

|

4,462

|

|

|

|

134,190

|

|

|

Comprehensive income (loss) attributable to noncontrolling interest

|

|

|

9,555

|

|

|

|

(13,027

|

)

|

|

|

(6,462

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive Income Attributable to Rayonier Inc.

|

|

$

|

242,892

|

|

|

$

|

17,489

|

|

|

$

|

140,652

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash provided by (used for):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating activities

|

|

$

|

203,801

|

|

|

$

|

177,164

|

|

|

$

|

320,416

|

|

|

Investing activities

|

|

|

(283,155

|

)

|

|

|

(166,309

|

)

|

|

|

(196,676

|

)

|

|

Financing activities

|

|

|

114,423

|

|

|

|

(116,463

|

)

|

|

|

(161,449

|

)

|

|

Ratio of earnings to fixed charges

|

|

|

7.82x

|

|

|

|

2.35x

|

|

|

|

2.01x

|

|

|

|

|

|

|

|

Balance Sheet Data (at end of period):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

85,909

|

|

|

$

|

51,777

|

|

|

|

|

|

|

Restricted deposits

|

|

|

71,708

|

|

|

|

23,525

|

|

|

|

|

|

|

Total assets

|

|

|

2,685,760

|

|

|

|

2,315,938

|

|

|

|

|

|

|

Long-term debt, net of deferred financing costs

|

|

|

1,030,205

|

|

|

|

830,554

|

|

|

|

|

|

|

Total debt, net of deferred financing costs

|

|

|

1,061,881

|

|

|

|

830,554

|

|

|

|

|

|

|

Total shareholders’ equity

|

|

|

1,496,752

|

|

|

|

1,361,740

|

|

|

|

|

|

Non-GAAP Financial Measures

We include or incorporate by reference into this prospectus supplement certain financial measures, including Adjusted EBITDA and Cash Available

for Distribution (“CAD”), which are not defined by generally accepted accounting principles (“GAAP”) and should not be considered as alternatives to net income, cash provided by operating activities, or any other financial

performance measure derived in accordance with GAAP. Management considers Adjusted EBITDA and CAD to be important in order to estimate the enterprise and shareholder values of the Company as a whole and of its core segments, and for allocating

capital resources. In addition, analysts, investors and creditors use these measures when analyzing our operating performance, financial condition and cash generating ability. Management uses Adjusted EBITDA as a performance measure and CAD as a

liquidity measure. Adjusted EBITDA and CAD as defined may not be comparable to similarly titled measures reported by other companies.

Adjusted EBITDA is a non-GAAP financial measure and is defined as earnings before interest, taxes, depreciation, depletion, amortization, the

non-cash cost of land and real estate sold, costs related to shareholder litigation, gain on foreign currency derivatives, costs related to the spin-off of the Performance Fibers business, internal review and restatement costs, Large Dispositions

and discontinued operations.

The following table presents our Adjusted EBITDA and reconciles our net income to our Adjusted EBITDA for

the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

|

|

(in millions)

|

|

|

Net income

|

|

$

|

217.8

|

|

|

$

|

43.9

|

|

|

$

|

97.8

|

|

|

Interest, net, continuing operations

|

|

|

33.0

|

|

|

|

34.7

|

|

|

|

49.7

|

|

|

Income tax expense (benefit), continuing operations

|

|

|

5.0

|

|

|

|

(0.9

|

)

|

|

|

(9.6

|

)

|

|

Depreciation, depletion and amortization

|

|

|

115.1

|

|

|

|

113.7

|

|

|

|

120.0

|

|

|

Non-cash cost of land and improved development

|

|

|

11.7

|

|

|

|

12.5

|

|

|

|

13.2

|

|

|

Costs related to shareholder

litigation

(a)

|

|

|

2.2

|

|

|

|

4.1

|

|

|

|

—

|

|

S-5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

|

|

(in millions)

|

|

|

Gain on foreign currency

derivatives

(b)

|

|

$

|

(1.2

|

)

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Large Dispositions

|

|

|

(143.9

|

)

|

|

|

—

|

|

|

|

(21.4

|

)

|

|

Cost related to spin-off of Performance Fibers

|

|

|

—

|

|

|

|

—

|

|

|

|

3.8

|

|

|

Internal review and restatement costs

|

|

|

—

|

|

|

|

—

|

|

|

|

3.4

|

|

|

Net income from discontinued operations

|

|

|

—

|

|

|

|

—

|

|

|

|

(43.4

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

|

$

|

239.7

|

|

|

$

|

208.0

|

|

|

$

|

213.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

Costs related to shareholder litigation include expenses incurred as a result of the securities litigation and the shareholder derivative demands. See Note 10 of the notes to our consolidated financial statements

in our Annual Report on Form 10-K for the year ended December 31, 2016, which is incorporated by reference into this prospectus supplement. In addition, these costs include the costs associated with the Company’s response to a

subpoena it received from the SEC in November 2014. In July 2016, the Division of Enforcement of the SEC notified the Company that it had concluded its investigation into the Company.

|

|

(b)

|

Gain on foreign currency derivatives is the gain resulting from the foreign exchange derivatives the Company used to mitigate the risk of fluctuations in foreign exchange rates while awaiting the capital contribution to

the New Zealand JV.

|

CAD is a non-GAAP measure of cash generated during a period that is available for dividend

distribution, repurchase of the Company’s common shares, debt reduction and strategic acquisitions. We define CAD as cash provided by operating activities adjusted for capital spending (excluding timberland acquisitions), Large Dispositions,

cash provided by discontinued operations and working capital and other balance sheet changes. In compliance with SEC requirements for non-GAAP measures, we reduce CAD by mandatory debt repayments which results in the measure entitled “Adjusted

CAD.” Adjusted CAD generated in any period is not necessarily indicative of the amounts that may be generated in future periods.

The

following table presents CAD and Adjusted CAD and reconciles each measure to cash provided by operating activities for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

|

|

(in millions)

|

|

|

Cash provided by operating activities

|

|

$

|

203.8

|

|

|

$

|

177.2

|

|

|

$

|

320.4

|

|

|

Capital expenditures from continuing

operations

(a)

|

|

|

(58.7

|

)

|

|

|

(57.3

|

)

|

|

|

(63.7

|

)

|

|

Large Dispositions

|

|

|

—

|

|

|

|

—

|

|

|

|

(21.4

|

)

|

|

Cash flow from discontinued operations

|

|

|

—

|

|

|

|

—

|

|

|

|

(102.4

|

)

|

|

Working capital and other balance sheet changes

|

|

|

(0.8

|

)

|

|

|

(2.5

|

)

|

|

|

(39.5

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAD

|

|

$

|

144.3

|

|

|

$

|

117.4

|

|

|

$

|

93.4

|

|

|

Mandatory debt repayments

|

|

|

(31.5

|

)

|

|

|

(131.0

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted CAD

|

|

$

|

112.8

|

|

|

$

|

(13.6

|

)

|

|

$

|

93.4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash used for investing activities

|

|

$

|

(283.2

|

)

|

|

$

|

(166.3

|

)

|

|

$

|

(196.7

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash provided by (used for) financing activities

|

|

$

|

114.4

|

|

|

$

|

(116.5

|

)

|

|

$

|

(161.4

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of timberlands

|

|

$

|

(366.4

|

)

|

|

$

|

(98.4

|

)

|

|

$

|

(130.9

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

Capital expenditures exclude timberland acquisitions.

|

S-6

R

ISK FACTORS

An investment in our common shares involves various risks. You should carefully consider the risks and uncertainties described below and

the other information included or incorporated by reference into this prospectus supplement and the accompanying prospectus, including the risk factors set forth in our Annual Report on

Form 10-K

for the

year ended December 31, 2016, before deciding to invest in our common shares. Any of the risk factors described therein or set forth below could significantly and adversely affect our business, prospects, financial condition and results of

operations. As a result, the trading price of our common shares could decline and you could lose a part or all of your investment.

Risk Related to

the Proposed Acquisitions

This offering is not contingent upon the completion of the Acquisitions. If one or more of the

Acquisitions are not completed, we will have broad discretion to use the net proceeds of this offering for general corporate purposes.

This offering is not contingent upon the completion of the Acquisitions. Accordingly, your purchase of common shares in this offering may be an

investment in us on a stand-alone basis without the anticipated benefits of the Acquisitions. We will have broad discretion to use the net proceeds of this offering for general corporate purposes if one or more of the Acquisitions do not occur.

There are a number of risks and uncertainties relating to the Acquisitions. For example, one or more of the Acquisitions may not be completed,

or may not be completed in the time frame, on the terms or in the manner currently anticipated, as a result of a number of factors, including, among other things, the failure of one or more of the conditions to closing. There can be no assurance

that the conditions to closing of the Acquisitions will be satisfied or waived or that other events will not intervene to delay or result in the failure to close one or more of the Acquisitions. Any delay in closing or a failure to close could have

a negative impact on our business and the trading prices of our securities, including our common shares. Likewise, one or more of the Acquisitions may be completed on terms that differ, perhaps substantially, from those currently anticipated and

investors will not be entitled to require us to repurchase, redeem or repay any of the common shares sold as a result of any such differences.

Risks

Related to our Common Shares

The price of our common shares may be volatile, which may make it difficult for you to resell the

common shares when you want or at prices you find attractive.

The market price of our common shares could be subject to

significant fluctuations and may decline below the offering price. This may make it difficult for you to resell the common shares when you want or at prices you find attractive. Among the factors that could affect the price of our common shares are:

|

|

•

|

|

our operating and financial performance and prospects;

|

|

|

•

|

|

variations in the rate of growth of our financial indicators, such as earnings per share, net income and revenues;

|

|

|

•

|

|

changes in revenue or earnings estimates;

|

|

|

•

|

|

publication of research reports by analysts;

|

|

|

•

|

|

speculation in the press or investment community;

|

|

|

•

|

|

strategic actions by us or our competitors, such as acquisitions or restructurings;

|

|

|

•

|

|

sales of our common shares by shareholders;

|

|

|

•

|

|

actions by institutional investors;

|

S-7

|

|

•

|

|

fluctuations in commodity prices;

|

|

|

•

|

|

general market conditions; and

|

|

|

•

|

|

U.S. and international economic, legal and regulatory factors unrelated to our performance.

|

Recently, stock markets have experienced extreme volatility that has at times been unrelated or disproportionate to the operating

performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common shares, regardless of our operating performance.

Loss of our REIT status would adversely affect our cash flow and stock price.

We intend to continue to operate in accordance with REIT requirements pursuant to the Internal Revenue Code of 1986, as amended (the

“Code”), and related U.S. Treasury regulations and administrative guidance. Qualification as a REIT involves the application of highly technical and complex provisions of the Code, which are subject to change, perhaps retroactively, and

which are not within our control. We cannot assure that we will remain qualified as a REIT or that new legislation, U.S. Treasury regulations, administrative interpretations or court decisions will not significantly affect our ability to remain

qualified as a REIT or the U.S. federal income tax consequences of such qualification.

We continually monitor and test our compliance

with all REIT requirements. In particular, we regularly test our compliance with the REIT “asset tests,” which require generally that, at the close of each calendar quarter, (1) at least 75% of the market value of our total assets

must consist of REIT-qualifying interests in real property (such as timberlands), including leaseholds and options to acquire real property and leaseholds, as well as cash and cash items and certain other specified assets, (2) no more than 25%

of the market value of our total assets may consist of other assets that are not qualifying assets for purposes of the 75% test in clause (1) above and (3) for calendar years prior to 2018, no more than 25% of the market value of our total

assets may consist of the securities of one or more “taxable REIT subsidiaries.”

If in any taxable year we fail to qualify as a

REIT, we will not be allowed a deduction for dividends paid to shareholders in computing our taxable income and we will be subject to U.S. federal income tax on our REIT taxable income. In addition, we will be disqualified from qualification as a

REIT for the four taxable years following the year during which the qualification was lost, unless we are entitled to relief under certain provisions of the Code. As a result, our net income and the cash available for distribution to our

shareholders could be reduced for up to five years or longer, which could have a material adverse effect on our financial condition.

If

we fail to remain qualified as a REIT, we may need to borrow funds or liquidate some investments or assets to pay any resulting additional tax liability. Accordingly, cash available for distribution to our shareholders would be reduced.

Our cash dividends are not guaranteed and may fluctuate.

Generally, REITs are required to distribute 90% of their ordinary taxable income, but not their net capital gains income. Accordingly, we do

not generally believe that we are required to distribute material amounts of cash since substantially all of our taxable income is generally treated as capital gains income. However, a REIT must pay corporate level tax on its undistributed taxable

income and capital gains.

Our Board of Directors, in its sole discretion, determines the amount of quarterly dividends to be paid to our

shareholders based on consideration of a number of factors. These factors include, but are not limited to, our results of operations, cash flow and capital requirements, economic conditions, tax considerations, borrowing

S-8

capacity and other factors, including debt covenant restrictions that may impose limitations on cash payments, future acquisitions and divestitures, harvest levels, changes in the price and

demand for our products and general market demand for timberlands, including those timberland properties that have higher and better uses. Consequently, our dividend levels may fluctuate.

Lack of shareholder ownership and transfer restrictions in our articles of incorporation may affect our ability to qualify as a REIT.

In order to qualify as a REIT, an entity cannot have five or fewer individuals who own, directly or indirectly after applying

attribution of ownership rules, 50% or more of the value of its outstanding shares during the last six months in each calendar year. Although it is not required by law or the REIT provisions of the Code, almost all REITs have adopted ownership and

transfer restrictions in their articles of incorporation or organizational documents which seek to assure compliance with that rule. While we are not in violation of the ownership rules, we do not have, nor do we have any current plans to adopt,

share ownership and transfer restrictions. As such, the possibility exists that five or fewer individuals could acquire 50% or more of the value of our outstanding shares, which could result in our disqualification as a REIT.

We may issue preferred stock with rights senior to our common shares.

Our articles of incorporation authorize the issuance of preferred shares without shareholder approval. The shares may have dividend, voting,

liquidation and other rights and preferences that are senior to the rights of our common shares. In addition, such preferred shares may be convertible into common shares. Conversion of preferred shares into our common shares may dilute the value of

our common shares, which may adversely affect the value of your common shares.

Additional issuances of equity securities would

dilute the ownership of our existing shareholders and could reduce our earnings per share.

We may issue additional equity

securities in the future in connection with capital raises, acquisitions, strategic transactions or for other purposes. To the extent we issue substantial additional equity securities, the ownership of our existing shareholders would be diluted and

our earnings per share could be reduced.

S-9

USE OF PROCEEDS

We expect to receive net proceeds of approximately $137.8 million from this offering (or $158.6 million if the underwriters exercise

their option to purchase additional shares in full), after deducting underwriting discounts and commissions and estimated offering expenses. We intend to use the net proceeds from this offering to finance a portion of the Acquisitions and the

remainder, if any, for general corporate purposes. This offering is not contingent on the Acquisitions. We will have broad discretion to use the net proceeds of this offering if the completion of the Acquisitions does not occur. See “Risk

Factors—Risk Related to the Proposed Acquisitions—This offering is not contingent upon the completion of the Acquisitions. If one or more of the Acquisitions are not completed, we will have broad discretion to use the net proceeds of this

offering for general corporate purposes.”

The estimated net proceeds from this offering have been calculated by assuming a public

offering price of $28.86 per common share, which is equal to the last reported sale price of our common shares on March 15, 2017. A $1.00 increase (decrease) in the assumed offering price per common share would increase (decrease) the estimated

net proceeds from this offering by approximately $4.8 million (or $5.5 million if the underwriters exercise their option to purchase additional shares in full), after deducting underwriting discounts and commissions and estimated offering

expenses.

S-10

CAPITALIZATION

The following table sets forth our cash and capitalization as of December 31, 2016:

|

|

•

|

|

on an actual basis; and

|

|

|

•

|

|

on an as adjusted basis to give effect to (i) the issuance of 5,000,000 common shares in this offering and the use of the net proceeds therefrom as described under “Use of Proceeds” and (ii) the

consummation of the Acquisitions as described under “Prospectus Supplement Summary—Recent Developments.”

|

You

should read the information in this table in conjunction with “Risk Factors—Risk Related to the Proposed Acquisitions—This offering is not contingent upon the completion of the Acquisitions. If one or more of the Acquisitions are not

completed, we will have broad discretion to use the net proceeds of this offering for general corporate purposes,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited

consolidated financial statements and related notes, each of which are included in our Annual Report on Form 10-K for the year ended December 31, 2016 incorporated by reference into this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2016

|

|

|

|

|

Actual

|

|

|

As

Adjusted

(1)

|

|

|

|

|

(Dollars in thousands)

|

|

|

Cash and cash equivalents

|

|

$

|

85,909

|

|

|

$

|

77,909

|

|

|

|

|

|

|

|

|

|

|

|

|

Total debt:

|

|

|

|

|

|

|

|

|

|

Term credit agreement

|

|

|

350,000

|

|

|

|

350,000

|

|

|

Incremental term loan agreement

|

|

|

300,000

|

|

|

|

300,000

|

|

|

Revolving credit facility

(2)

|

|

|

25,000

|

|

|

|

25,000

|

|

|

3.75% senior notes due 2022

|

|

|

325,000

|

|

|

|

325,000

|

|

|

4.35% mortgage notes due 2017

(3)

|

|

|

31,676

|

|

|

|

31,676

|

|

|

Solid waste bonds due 2020

(4)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

New Zealand JV noncontrolling interest shareholder loan

(5)

|

|

|

18,796

|

|

|

|

18,796

|

|

|

Less: deferred financing costs

|

|

|

(3,591

|

)

|

|

|

(3,591

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total debt

|

|

$

|

1,061,881

|

|

|

$

|

1,061,881

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common shares; 480,000,000 shares authorized, 122,904,368 shares issued and outstanding at

December 31, 2016, 127,904,368 shares issued and outstanding as adjusted

|

|

|

709,867

|

|

|

|

847,667

|

|

|

Retained earnings

|

|

|

700,887

|

|

|

|

700,887

|

|

|

Accumulated other comprehensive income

|

|

|

856

|

|

|

|

856

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Rayonier Inc. shareholders’ equity

|

|

|

1,411,610

|

|

|

|

1,549,410

|

|

|

|

|

|

|

|

|

|

|

|

|

Noncontrolling interest

|

|

|

85,142

|

|

|

|

85,142

|

|

|

Total shareholders’ equity

|

|

|

1,496,752

|

|

|

|

1,634,552

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

2,558,633

|

|

|

$

|

2,696,433

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

This assumes the Acquisitions are completed on currently anticipated terms. If the Acquisitions are not completed, cash and cash equivalents would increase by $137.8 million. See “Risk Factors—Risk

Related to the Proposed Acquisitions—This offering is not contingent upon the completion of the Acquisitions. If one or more of the Acquisitions are not completed, we will have broad discretion to use the net proceeds of this offering for

general corporate purposes.”

|

|

(2)

|

As of December 31, 2016, the Company had $169.6 million of available borrowings under this facility, net of $5.4 million to secure its outstanding letters of credit.

|

|

(3)

|

These notes were recorded at a premium of $0.2 million as of December 31, 2016. Upon maturity, the liability will be $31.5 million.

|

S-11

|

(4)

|

The solid waste bonds bear interest at a variable interest rate of 2.0% at December 31, 2016. The solid waste bonds are the obligation of Rayonier Inc. and Rayonier TRS Holdings Inc. (“Rayonier TRS”). As

part of Rayonier Inc.’s conversion into a real estate investment trust, Rayonier TRS assumed the obligations of Rayonier Inc. under the solid waste bonds, but Rayonier Inc. continues to be the primary obligor of such bonds.

|

|

(5)

|

The shareholder loan is an interest-free loan from the noncontrolling New Zealand JV partner in the amount of $19 million. Although Rayonier Inc. is not liable for this loan, the shareholder loan instrument

contains features with characteristics of both debt and equity and is therefore required to be classified as debt and consolidated.

|

S-12

PRICE RANGE OF COMMON SHARES AND DIVIDEND POLICY

Our common shares are listed on NYSE. The following table sets forth the highest and lowest intra-day sales prices per share of our common

shares and the cash dividends paid per share for the periods indicated.

On June 27, 2014, we spun off our Performance Fibers

business to our shareholders as a newly formed publicly traded company named Rayonier Advanced Materials. On June 27, 2014, the shareholders of record received one share of Rayonier Advanced Materials common stock for every three common shares

of Rayonier held as of the close of business on the record date of June 18, 2014. The high end of the second quarter 2014 range as well as the first quarter 2014 range in the following table reflects share prices adjusted for the spin-off.

Dividends for the first and second quarter 2014 have also been adjusted for the spin-off.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High

|

|

|

Low

|

|

|

Dividends

|

|

|

2017:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter (through March 15, 2017)

|

|

$

|

29.86

|

|

|

$

|

26.54

|

|

|

|

—

|

|

|

2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter

|

|

$

|

28.47

|

|

|

$

|

25.24

|

|

|

$

|

0.25

|

|

|

Third Quarter

|

|

|

28.16

|

|

|

|

25.50

|

|

|

|

0.25

|

|

|

Second Quarter

|

|

|

26.37

|

|

|

|

24.01

|

|

|

|

0.25

|

|

|

First Quarter

|

|

|

24.80

|

|

|

|

17.85

|

|

|

|

0.25

|

|

|

2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter

|

|

$

|

24.83

|

|

|

$

|

21.83

|

|

|

$

|

0.25

|

|

|

Third Quarter

|

|

|

26.49

|

|

|

|

21.84

|

|

|

|

0.25

|

|

|

Second Quarter

|

|

|

27.03

|

|

|

|

24.70

|

|

|

|

0.25

|

|

|

First Quarter

|

|

|

29.88

|

|

|

|

26.19

|

|

|

|

0.25

|

|

As of March 15, 2017, we had approximately 6,347 holders of record of our common shares.

Our Board of Directors, in its sole discretion, determines the amount of quarterly dividends to be paid to our shareholders based on

consideration of a number of factors. These factors include, but are not limited to, our results of operations, cash flow and capital requirements, economic conditions, tax considerations, borrowing capacity and other factors, including debt

covenant restrictions that may impose limitations on cash payments, future acquisitions and divestitures, harvest levels, changes in the price and demand for our products and general market demand for timberlands, including those timberland

properties that have higher and better uses. Consequently, our dividend levels may fluctuate.

S-13

ADDITIONAL MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following is a summary of additional material U.S. federal tax considerations with respect to the ownership of our common

shares. This summary includes a description of the changes to the Code made by the Protecting Americans from Tax Hikes Act of 2015 (the “PATH Act”). This summary supplements and, where applicable, supersedes the discussion under

“Certain Federal Income Tax Consequences” in the accompanying prospectus, and should be read together with such discussion.

Taxation of

Rayonier

If we acquire any asset from a C corporation, or a corporation generally subject to full corporate-level tax, in a merger or

other transaction in which we acquire a basis in the asset that is determined by reference either to the C corporation’s basis in the asset or to another asset, we will pay tax at the highest regular corporate rate applicable if we recognize

gain on the sale or disposition of the asset during the 5-year period after we acquire the asset.

Taxable REIT Subsidiaries

As discussed in the accompanying prospectus under “Certain Federal Income Tax Consequences—Taxation of Rayonier—Taxable REIT

Subsidiaries,” a REIT may jointly elect with a subsidiary corporation, whether or not wholly-owned, to treat the subsidiary corporation as a taxable REIT subsidiary (“TRS”). Overall, no more than 25% of the value of a REIT’s

assets may consist of stock or securities of one or more TRSs. For taxable years beginning after December 31, 2017, that percentage is reduced to 20%.

Gross Income Tests

As discussed in the

accompanying prospectus under “Certain Federal Income Tax Consequences—Taxation of Rayonier—Income Test,” we must satisfy two gross income tests annually to maintain our qualification as a REIT. Although a debt instrument issued

by a “publicly offered REIT” (i.e., a REIT that is required to file annual and periodic reports with the SEC under the Securities and Exchange Act of 1934 (the “Exchange Act”)) is treated as a “real estate asset” for

purposes of the asset tests, the gain from the sale of such debt instruments is not treated as qualifying income for the 75% gross income test unless the debt instrument is secured by real property or an interest in real property.

Additionally, as discussed in the accompanying prospectus under “Certain Federal Income Tax Consequences—Taxation of

Rayonier—Income Test,” certain hedging income is excluded from gross income for purposes of the 75% and 95% income tests. Effective for taxable years beginning after December 31, 2015, if we have entered into a qualifying hedging

transaction (an “Original Hedge”), and a portion of the hedged indebtedness is extinguished or the related property is disposed of and in connection with such extinguishment or disposition we enter into a new clearly identified hedging

transaction that would counteract the Original hedging transaction (a “Counteracting Hedge”), income from the Original Hedge and income from the Counteracting Hedge (including gain from the disposition of the Original Hedge and the

Counteracting Hedge) will not be treated as gross income for purposes of the 95% and 75% gross income tests.

The accompanying prospectus

also explains that income derived from mortgages on real property will be qualifying income for purposes of the 75% gross income test. For taxable years beginning after December 31, 2015, in the case of mortgage loans secured by both real

property and personal property, if the fair market value of such personal property does not exceed 15% of the total fair market value of all such property securing the loan, then the personal property securing the loan will be treated as real

property for purposes of determining whether the mortgage loan is a qualifying asset for the 75% asset test and the related interest income qualifies for purposes of the 75% gross income test.

S-14

The PATH Act expands the safe harbor referenced in the accompanying prospectus under

“Certain Federal Income Tax Consequences—Taxation of Rayonier—Income Test” that would protect the sale of timberlands from a 100% prohibited transaction tax. Effective for taxable years beginning after December 31, 2015, a

REIT may also satisfy this safe harbor if, among other requirements:

|

|

•

|

|

the aggregate adjusted tax bases of all property sold by the REIT (other than foreclosure property or sales to which section 1033 of the Code applies) during the year did not exceed 20% of the aggregate tax bases

of all property of the REIT at the beginning of the year and the average annual percentage of properties sold by the REIT compared to all the REIT’s properties (measured by adjusted tax bases) in the current and two prior years did not exceed

10%; or

|

|

|

•

|

|

the aggregate fair market value of all such property sold by the REIT during the year did not exceed 20% of the aggregate fair market value of all property of the REIT at the beginning of the year and the average annual

percentage of properties sold by the REIT compared to all the REIT’s properties (measured by fair market value) in the current and two prior years did not exceed 10%.

|

Asset Tests

As discussed in the

accompanying prospectus under “Certain Federal Income Tax Consequences— Taxation of Rayonier—Asset Tests,” in order to maintain our qualification as a REIT, we also must satisfy several asset tests at the end of each quarter of

each taxable year. Under the first test described in the accompanying prospectus, at least 75% of the value of our total assets must consist of the items listed in the accompanying prospectus. In addition to those items, qualifying assets for

purposes of the 75% asset test include (i) personal property leased in connection with real property to the extent that rents attributable to such personal property are treated as “rents from real property” and (ii) debt

instruments issued by “publicly offered REITs.”

In addition, the fourth test described in the accompanying prospectus in such

subsection is replaced in its entirety by the following:

Fourth, not more than 25% (20% for taxable years beginning after

December 31, 2017) of the value of our total assets may be represented by the securities of one or more TRSs.

Finally, an additional

test provides that not more than 25% of the value of our total assets may be represented by debt instruments issued by “publicly offered REITs” to the extent not secured by real property or interests in real property.

Distribution Requirements

The

accompanying prospectus discusses our distribution requirements under the caption “Certain Federal Income Tax Consequences—Taxation of Rayonier—Annual Distribution Requirements.” In between the third paragraph and fourth

paragraphs of this discussion, the following paragraph is added:

In order for distributions to be counted towards our distribution

requirement, and to provide us with a tax deduction, such distributions must not have been “preferential dividends.” A distribution is not a preferential dividend if it is pro rata among all outstanding shares within a particular class,

and is in accordance with the preferences among the different classes of shares as set forth in our organizational documents. However, the PATH Act provides that for distributions in taxable years beginning after 2014, the preferential dividend

rules do not apply to publicly offered REITs. Consequently, so long as we continue to be a “publicly offered REIT,” the preferential dividend rule does not apply to us beginning with our 2015 taxable year.