Diageo Boosts Marketing Spend to Lift Flat Guinness Markets

March 16 2017 - 11:58AM

Dow Jones News

By Saabira Chaudhuri

LONDON--Although drinkers around the world will toast St.

Patrick on Friday with about 14 million pints of Guinness--enough

to fill 32 Olympic-size swimming pools--the big day masks a tough

global picture for the Irish stout and its owner, Diageo PLC

(DGE.LN).

In the six months through December, the first half of

Diageo's fiscal 2017, Guinness sales revenue was flat as volumes

fell 3%.

Beer volumes have slackened as consumers flock to cocktails and

wine in developed countries, while big markets like India retain

a strong preference for whiskey over beer. Beer volume growth

globally dropped to just 0.94% last year from 4.4% in 2007,

according to industry tracker GlobalData PLC.

Now, Diageo is increasing marketing investment in major

Guinness markets, said John O'Keefe, the drinks giant's Africa

president, in a Thursday conference call with investors.

"Guinness is the cornerstone of Diageo's Africa business," he

said.

Mr. O'Keefe said he expects Diageo's beer sales there to

improve in the second half but warned that a 43% in excise duty on

bottled beer in Kenya that took effect in December 2015 would

continue to hold back Guinness sales there.

Diageo has been working to cut costs in Nigeria, where it is

battling input inflation on imports as well as local inflation, Mr.

O'Keefe said. The company has cut staff at its breweries,

improved its bottling efficiency by 10% and is reaching out to more

suppliers in a bid to get the most competitive prices, he

said.

Nigeria has been one of Guinness's biggest markets for years,

but sales have dwindled there recently. A chronic shortage of

foreign currency, combined with high demand for dollars, has caused

the naira to lose as much as 45% of its value on the black market,

making it one of the world's fastest-falling currencies.

Diageo in October pedaled back from plans to raise its stake in

Guinness Nigeria, which houses brands such as Guinness, Harp and

Malt. Raising its stake as planned to 70% from 54.3% would have

given Diageo more control over its business in Africa's most

populous nation.

Diageo's biggest beer markets now include Nigeria, Ghana,

Cameroon, Ethiopia, East Africa, Ireland and Indonesia, with beer

making up more than 60% of Diageo's sales in those markets. By

contrast, in the U.S., Britain, Canada and South Korea, beer

makes up 5% to 20% of net sales.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

March 16, 2017 11:43 ET (15:43 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

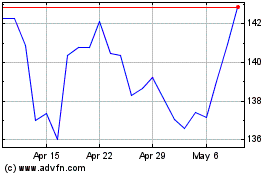

Diageo (NYSE:DEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

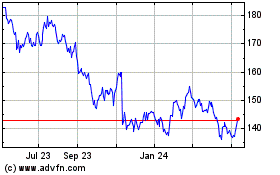

Diageo (NYSE:DEO)

Historical Stock Chart

From Apr 2023 to Apr 2024