Oracle's Cloud Business Drives Revenue Growth

March 15 2017 - 5:03PM

Dow Jones News

By Jay Greene

Though late to cloud computing, Oracle Corp.'s growth in

web-based, on-demand applications and other services is offsetting

declines in revenue from the company's legacy software-licensing

operations.

Oracle on Wednesday reported fiscal third-quarter gains in its

businesses of selling access to applications, known as software as

a service, and selling access to tools to manage apps as well as

analyze data, called platform as a service. Combined, Oracle's

sales in those markets rose 73% to $1.01 billion.

Meanwhile, revenue from new software licenses fell 15% to $1.41

billion in the quarter, which ended Feb. 28.

Revenue from cloud computing and new software licenses are a

fraction of Oracle's massive software-license updates and

product-support business. The company's total cloud and on-premise

software operations generated $7.37 billion in sales in the

quarter, a 4% jump from a year earlier.

Oracle, which is based in Redwood City, Calif., said last summer

it would aggressively build its infrastructure-as-a-service

business. That is a market Amazon.com Inc. pioneered and dominates,

though Microsoft Corp. and Alphabet Inc. are growing into

legitimate rivals. Oracle's revenue in that segment grew 17% to

$178 million.

By comparison, net sales in Amazon Web Services, which is

comprised largely of its infrastructure-as-a-service business, grew

47% to $3.5 billion in its most recent quarter.

Oracle is investing in the massive data centers required to

handle customers' computing operations in the cloud. In the latest

quarter, Oracle spent $1.68 billion on capital expenditures, up

from $1.61 billion a year earlier. That, in part, led to operating

margins of 32%, compared with 34% a year ago.

Oracle reported a profit of $2.24 billion, or 53 cents a share,

up from $2.14 billion, or 50 cents a share, a year earlier. Oracle

said adjusted per-share earnings, which commonly exclude

stock-based compensation and other items, were 69 cents.

Quarterly revenue grew 2.1% to $9.21 billion. Excluding the

impact of a strong U.S. dollar, revenue would have grown 3%.

According to estimates gathered by Thomson Reuters, analysts

expected Oracle to earn 62 cents a share on an adjusted basis, on

sales of $9.26 billion.

Shares rose 2.5% to $43.94 in recent after-hours trading.

Anne Steele contributed to this article

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

March 15, 2017 16:48 ET (20:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

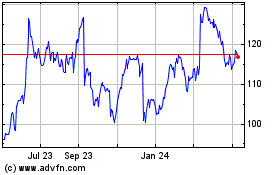

Oracle (NYSE:ORCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

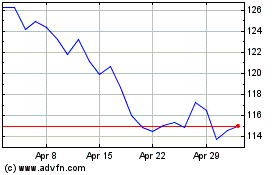

Oracle (NYSE:ORCL)

Historical Stock Chart

From Apr 2023 to Apr 2024