CAUTIONARY

STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

Information in and incorporated by reference

into this prospectus contains “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 and the safe harbor provided by Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Statements

that are not purely historical may be forward-looking. You can identify some forward-looking statements by the use of

words such as “believe,” “anticipate,” “expect,” “intend,” “goal,”

“plan” and similar expressions. Forward looking statements involve inherent risks and uncertainties regarding

events, conditions and financial trends that may affect our future plans of operation, business strategy, results of operations,

and financial position.

A number of important factors could cause actual

results to differ materially from those included within or contemplated by such forward-looking statements, including, but not

limited to risks relating to our limited experience manufacturing hardware devices, the uncertainty of growth in market acceptance

for our technology, our history of losses since inception, our ability to remain competitive in response to new technologies, the

costs to defend, as well as risks of losing, patents and intellectual property rights, our customer concentration and dependence

on a limited number of customers, a reliance on our future customers’ ability to develop and sell products that incorporate

our technology, the uncertainty of demand for our technology in certain markets, the length of a product development and release

cycle, our ability to manage growth effectively, our dependence on key members of our management and development team and our need

and ability to obtain adequate capital to fund future operations. For a discussion of these and other factors that could cause

actual results to differ from those contemplated in the forward-looking statements, please see the discussion under “Risk

Factors” contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and in our subsequent filings

with the SEC.

Forward-looking

statements speak only as of the date made. Because actual results or outcomes could differ materially from those expressed in

any forward-looking statements made by us or on our behalf, you should not place undue reliance on any such forward-looking statements.

We do not undertake any responsibility to update or revise any of these factors or to announce publicly any revisions to forward-looking

statements, whether as a result of new information, future events or otherwise.

PROSPECTUS

SUMMARY

The following is only a summary

and therefore does not contain all of the information you should consider before investing in our common stock. We urge you to

read this entire prospectus, including the matters discussed under “Risk Factors” in and incorporated by reference

into this prospectus and the more detailed consolidated financial statements, notes to the consolidated financial statements and

other information incorporated by reference from our other filings with the SEC.

Our

Company

We

develop and license user interface and touch technology. We also manufacture and sell hardware sensor solutions as modules incorporating

our touch technology. Our patented family of optical touch and gesture solutions is offered under the zForce brand.

As of December 31, 2016, we had forty-one

technology license agreements with global Original Equipment Manufacturers (“OEMs”) and Tier 1 suppliers. During the

year ended December 31, 2016, we had sixteen customers using our touch technology in products that were being shipped to customers

and end-users. In addition, we provide engineering consulting services to our customers on a flat rate or hourly rate basis.

In

2016, we augmented our licensing business and started to manufacture sensor modules that incorporate our technology. We sell these

standardized embedded sensors to OEMs and Tier 1 suppliers for use in their products. We also sell Neonode branded products, such

as AirBar, through distributors and directly to consumers. AirBar is a consumer hardware device that connects through a USB port

to enable touch functionality for non-touch notebooks.

In the fourth quarter of 2016, we stopped entering

into new license agreements. We anticipate continuing to earn license fees from our existing license customers. We plan to transition

current customers with license agreements to purchase agreements selling our sensor modules. This conversion process is expected

to take several years.

Neonode

Inc., formerly known as SBE, Inc., was incorporated in the State of Delaware on September 4, 1997. SBE, Inc.’s name was

changed to Neonode Inc. upon the completion of a merger in August 2007 between SBE, Inc. and the parent company of Neonode AB,

a company founded in February 2004 and incorporated in Sweden. As a result of the merger, the business and operations of Neonode

AB became the primary business and operations of Neonode Inc. Our headquarters is located at Storgatan 23C, 114 55 Stockholm,

Sweden and our phone number is +46 (0) 8 667 17 17. We also maintain an office in the United States at 2880 Zanker Road, Suite

362, San Jose, CA 95134. Our website address is www.neonode.com. Information on our website is not incorporated by reference into

this prospectus and does not constitute part of this prospectus.

The

Offering

We may use this prospectus to offer shares

of our common stock, par value $0.001 per share, in one or more offerings with an aggregate offering price up to $20,000,000. This

prospectus provides a general description of the common stock that we may offer. The particular terms of an offering, including

the specific prices of the shares and the plan of distribution for that offering, will be described in one or more supplements

to this prospectus. The prospectus supplements also may describe risks associated with an investment in our common stock in addition

to those described in the “Risk Factors” section of this prospectus or incorporated by reference herein.

We

may sell the shares of common stock directly or through underwriters, dealers, or agents. We and our underwriters, dealers, or

agents reserve the right to accept or reject all or part of any proposed purchase of shares. If we do offer common stock through

underwriters or agents, we will include in the applicable prospectus supplement the names of those underwriters or agents, applicable

fees, discounts, and commissions to be paid to them, details regarding over-allotment options, if any and the net proceeds to

us.

RISK

FACTORS

An

investment in our common stock involves risks. Prior to making a decision about investing in our common stock, you should consider

carefully the risks together with all of the other information contained or incorporated by reference in this prospectus, including

any risks described in the section entitled “Risk Factors” contained in any supplements to this prospectus and in

our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and in our subsequent filings with the SEC.

USE

OF PROCEEDS

We

will retain broad discretion over the use of the net proceeds from the sale of the shares of common stock offered hereby. Except

as otherwise provided in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the shares covered

by this prospectus for working capital and general corporate purposes. We may also use a portion of the net proceeds to acquire

or invest in complementary businesses, technologies, product candidates, or other intellectual property, although we have no present

commitments or agreements to do so.

DESCRIPTION

OF COMMON STOCK

We

are currently authorized to issue 70,000,000 shares of common stock, par value $0.001 per share. As of March 8, 2017, there were

48,844,503 shares of our common stock issued and outstanding.

Common

Stock

Voting

Rights

. Holders of our common stock possess exclusive voting rights in us, except to the extent that shares of preferred stock

issued in the future may have voting rights. Each holder of shares of our common stock is entitled to one vote for each share

held of record on all matters submitted to a vote of our stockholders.

Dividend

Rights

. Holders of our common stock are entitled to receive dividends when, as and if declared by our Board of Directors out

of funds legally available therefor, subject to any preferential dividend rights that may attach to preferred stock that we may

issue in the future. The current policy of the Board of Directors, however, is to retain earnings, if any.

Liquidation

Rights

. In the event we are liquidated or dissolved, each holder of our common stock would be entitled to receive, after payment

of all our debts and liabilities, a pro rata portion of all of our assets available for distribution to holders of our common

stock. If we have issued any preferred stock, the holders thereof may have a priority in liquidation or dissolution over the holders

of our common stock.

Other

Characteristics

. Holders of our common stock do not have preemptive rights with respect to any additional shares of common

stock that we may issue in the future. There are no redemption or sinking fund provisions applicable to the shares of our common

stock. Cumulative voting in the election of directors is not permitted. The transfer agent for shares of our common stock is American

Stock Transfer & Trust Company, LLC.

Anti-Takeover

Effects of Provisions of our Certificate of Incorporation, our Bylaws, and Delaware Law.

Some

provisions of our Certificate of Incorporation, our Bylaws, and Delaware law contain provisions that could make the following

transactions more difficult: acquisition of us by means of a tender offer; acquisition of us by means of a proxy contest or otherwise;

or removal of our incumbent officers and directors. It is possible that these provisions could make it more difficult to accomplish

or could deter transactions that stockholders may otherwise consider to be in their best interest or in our best interests, including

transactions that might result in a premium over the market price of our shares.

These

provisions, summarized below, are expected to discourage coercive takeover practices and inadequate takeover bids. These provisions

are also designed to encourage persons seeking to acquire control of us to first negotiate with our Board of Directors. We believe

that the benefits of increased protection of our potential ability to negotiate with the proponent of an unfriendly or unsolicited

proposal to acquire or restructure us outweigh the disadvantages of discouraging these proposals because negotiation of these

proposals could result in an improvement of their terms.

Undesignated

Preferred Stock

. The ability to authorize undesignated preferred stock makes it possible for our Board of Directors to issue

preferred stock with voting or other rights or preferences that could impede the success of any attempt to change control of us.

These and other provisions may have the effect of deferring hostile takeovers or delaying changes in control or management of

our company.

Requirements

for Advance Notification of Stockholder Nominations and Proposals

. Our Bylaws establish advance notice procedures with respect

to stockholder proposals and the nomination of candidates for election as directors, other than nominations made by or at the

direction of our Board of Directors or a committee of our Board of Directors.

Elimination

of Stockholder Action by Written Consent

. Our Certificate of Incorporation eliminates the right of stockholders to act by

written consent without a meeting.

Delaware

Anti-Takeover Statute

. We are subject to Section 203 of the Delaware General Corporation Law which prohibits persons deemed

“interested stockholders” from engaging in a “business combination” with a Delaware corporation for three

years following the date these persons become interested stockholders. Generally, an “interested stockholder” is a

person who, together with affiliates and associates, owns, or within three years prior to the determination of interested stockholder

status did own, 15% or more of a corporation’s voting stock. Generally, a “business combination” includes a

merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. The existence

of this provision may have an anti-takeover effect with respect to transactions not approved in advance by our Board of Directors.

PLAN

OF DISTRIBUTION

We

may sell the offered shares of common stock in any of the ways described below or in any combination or in any way set forth in

an applicable prospectus supplement from time to time:

|

|

●

|

to or through underwriters, brokers, or dealers;

|

|

|

●

|

through one or more agents;

|

|

|

●

|

directly to purchasers or to a single purchaser;

|

|

|

●

|

through

a block trade in which the broker or dealer engaged to handle the block trade will attempt

to sell the shares as agent, but may position and resell a portion of the block as principal

to facilitate the transaction; or

|

|

|

●

|

through a combination of any of these methods of sale.

|

The

distribution of the shares of common stock may be effected from time to time in one or more transactions:

|

|

●

|

at a fixed price or prices, which may be changed from

time to time;

|

|

|

●

|

at market prices prevailing at the time of sale;

|

|

|

●

|

at prices related to such prevailing market prices;

or

|

Each

prospectus supplement will describe the method of distribution of the common stock and any applicable restrictions.

The

prospectus supplement will describe the terms of the offering of the shares of common stock, including the following:

|

|

●

|

the

name or names of any underwriters, dealers, or agents and the amounts of shares underwritten

or purchased by each of them;

|

|

|

●

|

the

public offering price of the shares and the proceeds to us and any discounts, commissions

or concessions allowed or re-allowed or paid to dealers; and

|

|

|

●

|

any exchanges on which the shares may be listed.

|

Underwriters

may offer and sell the offered shares of common stock from time to time in one or more transactions, including negotiated transactions,

at a fixed public offering price, or at varying prices determined at the time of sale. The obligations of the underwriters to

purchase the shares will be subject to the conditions set forth in an underwriting agreement between us and the underwriters.

If underwriters are used in the sale of any shares, the shares will be acquired by the underwriters for their own account and

may be resold from time to time in one or more transactions described above. The shares may be either offered to the public through

underwriting syndicates represented by managing underwriters, or directly by underwriters. Generally, the underwriters’

obligations to purchase the shares will be subject to certain conditions precedent. The underwriters will be obligated to purchase

all of the shares if they purchase any of the shares. We may use underwriters with whom we have a material relationship. We will

describe in the prospectus supplement or a free writing prospectus, naming the underwriter, the nature of any such relationship.

Any

offering price and any discounts or concessions allowed or re-allowed or paid to dealers may be changed from time to time.

We

may from time to time engage a firm to act as our agent for one or more offerings of the shares of common stock. We sometimes

refer to this agent as our “offering agent.” If we reach agreement with an offering agent with respect to a specific

offering, including the number of shares and any minimum price below which sales may not be made, then the offering agent will

try to sell such shares on the agreed terms. The offering agent could make sales in privately negotiated transactions or using

any other method permitted by law, including sales deemed to be an “at the market” offering as defined in Rule 415

promulgated under the Securities Act, including sales made directly on the NASDAQ Capital Market, or sales made to or through

a market maker other than on an exchange. The offering agent will be deemed to be an “underwriter” within the meaning

of the Securities Act with respect to any sales effected through an “at the market” offering.

Agents,

underwriters and other third parties described above may be entitled to indemnification by us against certain civil liabilities,

including liabilities under the Securities Act, or to contribution from us with respect to payments that the agents, underwriters,

or other third parties may be required to make in respect of these civil liabilities. Agents, underwriters, and such other third

parties may be customers of, engage in transactions with or perform services for us in the ordinary course of business.

Certain

underwriters may use the prospectus and any accompanying prospectus supplement for offers and sales related to market-making transactions

in the shares of common stock. These underwriters may act as principal or agent in these transactions, and the sales will be made

at prices related to prevailing market prices at the time of sale.

Certain

persons participating in an offering may engage in overallotment, stabilizing transactions, short covering transactions and penalty

bids in accordance with rules and regulations under the Exchange Act. Overallotment involves sales in excess of the offering size,

which create a short position. Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing

bids do not exceed a specified maximum. Short covering transactions involve purchases of shares in the open market after the distribution

is completed to cover short positions. Penalty bids permit the underwriters to reclaim a selling concession from a dealer when

the shares originally sold by the dealer are purchased in a short covering transaction to cover short positions. Those activities

may cause the price of the shares to be higher than it would otherwise be. If commenced, the underwriters may discontinue any

of the activities at any time.

To

the extent permitted by and in accordance with Regulation M under the Exchange Act, any underwriters who are qualified market

makers on the NASDAQ Capital Market may engage in passive market making transactions in the shares of common stock on the NASDAQ

Capital Market during the business day prior to the pricing of an offering, before the commencement of offers or sales. Passive

market makers must comply with applicable volume and price limitations and must be identified as passive market makers. In general,

a passive market maker must display its bid at a price not in excess of the highest independent bid for such security; if all

independent bids are lowered below the passive market maker's bid, however, the passive market maker's bid must then be lowered

when certain purchase limits are exceeded.

We

also may sell any of the shares of common stock through agents designated by us from time to time. We will name any agent involved

in the offer or sale of the shares and will list commissions payable by us to these agents in the applicable prospectus supplement.

These agents will be acting on a best efforts basis to solicit purchases for the period of their appointment, unless stated otherwise

in the applicable prospectus supplements.

In

compliance with guidelines of the Financial Industry Regulatory Authority (“FINRA”), the maximum consideration or

discount to be received by any FINRA member or independent broker dealer may not exceed 8% of the aggregate amount of the shares

of common stock offered pursuant to this prospectus and any applicable prospectus supplement.

EXPERTS

The

consolidated financial statements incorporated in this prospectus by reference from our Annual Report on Form 10-K for the year

ended December 31, 2016, and the effectiveness of our internal control over financial reporting, have been audited by KMJ Corbin

& Company LLP, an independent registered public accounting firm as stated in their reports, which are incorporated herein

by reference, and have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in

accounting and auditing.

LEGAL

MATTERS

The

validity of the shares of our common stock covered hereby will be passed upon for us by Reed Smith LLP, San Francisco, California.

WHERE

YOU CAN FIND MORE INFORMATION

This

prospectus is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain

all the information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts,

agreements, or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the

registration statement or the exhibits to the reports or other documents incorporated by reference in this prospectus supplement

and the accompanying prospectus for a copy of such contract, agreement, or other document. Because we are subject to

the information and reporting requirements of the Exchange Act, we file annual, quarterly, and current reports, proxy statements,

and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s

website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference

Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on

the operation of the Public Reference Room. Our website address is www.neonode.com. Information contained in, or accessible

through, our website is not a part of this prospectus.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The

SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that

we can disclose important information to you by referring you to those documents. The information incorporated by reference

is considered to be part of this prospectus. Information contained in any supplement to this prospectus and information that we

file with the SEC in the future and incorporate by reference in this prospectus will automatically update and supersede the information

contained in this prospectus. We incorporate by reference the documents listed below and any future filings (other than current

reports on Form 8-K furnished under Item 2.02 or Item 7.01 and exhibits filed on such form that are related to such items) we

make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the initial filing date of the registration

statement of which this prospectus forms a part and prior to the termination of this offering covered by this prospectus:

|

|

●

|

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2016 filed on March 15, 2017; and

|

|

|

|

|

|

|

●

|

The

description of our common stock included in our registration statement on Form 8-A filed on April 26, 2012.

|

We

will provide without charge upon written or oral request, to each person, including any beneficial owner, to whom a prospectus

is delivered, a copy of any or all of the documents incorporated by reference, including exhibits to these documents. You should

direct any requests for documents to:

Neonode

Inc.

Storgatan

23C, 114 55

Stockholm,

Sweden

+46

(0) 8 667 17 17

info@neonode.com

PART

II

INFORMATION

NOT REQUIRED IN THE PROSPECTUS

Item 14.

Other Expenses of Issuance and Distribution

|

SEC registration fee

|

|

$

|

2,318

|

|

|

Legal fees and expenses

|

|

$

|

*

|

|

|

Accounting fees and expenses

|

|

$

|

*

|

|

|

Nasdaq Stock Market LLC fee

|

|

$

|

*

|

|

|

Miscellaneous fees and expenses

|

|

$

|

*

|

|

|

Total

|

|

$

|

*

|

|

*

These fees and expenses depend on the securities offered and the number of securities issuances and cannot be estimated at this

time.

Item 15.

Indemnification of Directors and Officers

Neonode

Inc. (the “registrant”) is incorporated under the laws of the State of Delaware. Section 145 of the Delaware General

Corporation Law (“DGCL”) provides that a Delaware corporation may indemnify any persons who are, or are threatened

to be made, parties to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative,

or investigative (other than an action by or in the right of such corporation), by reason of the fact that such person was an

officer, director, employee, or agent of such corporation, or is or was serving at the request of such person as an officer, director,

employee, or agent of another corporation or enterprise. The indemnity may include expenses (including attorneys’ fees),

judgments, fines, and amounts paid in settlement actually and reasonably incurred by such person in connection with such action,

suit or proceeding, provided that such person acted in good faith and in a manner he or she reasonably believed to be in or not

opposed to the corporation’s best interests and, with respect to any criminal action or proceeding, had no reasonable cause

to believe that his or her conduct was illegal. No indemnification is permitted without judicial approval if the officer or director

is adjudged to be liable to the corporation. Where an officer or director is successful on the merits or otherwise in the defense

of any action referred to above, the corporation must indemnify him or her against the expenses which such officer or director

has actually and reasonably incurred. The registrant’s Certificate of Incorporation and Bylaws provide for the indemnification

of directors and officers of the registrant to the fullest extent permitted under the DGCL.

Section

102(b)(7) of the DGCL permits a corporation to provide in its certificate of incorporation that a director of the corporation

shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duties as a

director, except for liability:

|

|

●

|

for

any breach of a director’s duty of loyalty to the corporation or its stockholders;

|

|

|

|

|

|

|

●

|

for

acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

|

|

|

|

|

|

|

●

|

for

improper payment of dividends or redemptions of shares; or

|

|

|

|

|

|

|

●

|

for

any transaction from which the director derives an improper personal benefit.

|

As

permitted by Section 145 of the DGCL, the registrant’s Bylaws provide that (i) the registrant is required to indemnify its

directors and executive officers to the fullest extent permitted by the DGCL, (ii) the registrant may, in its discretion, indemnify

other officers, employees and agents as set forth in the DGCL, (iii) to the fullest extent permitted by the DGCL, the registrant

is required to advance all expenses incurred by its directors and executive officers in connection with a legal proceeding (subject

to certain exceptions), (iv) the rights conferred in the registrant’s Bylaws are not exclusive, (v) the registrant is authorized

to enter into indemnification agreements with its directors, officers, employees and agents, and (vi) the registrant may not retroactively

amend its Bylaws provisions relating to indemnity.

The

registrant has an insurance policy covering its officers and directors with respect to certain liabilities, including liabilities

arising under the Securities Act or otherwise.

At

present, there is no pending litigation or proceeding involving any of the registrant’s directors, officers, or key employees

as to which indemnification is being sought nor is the registrant aware of any threatened litigation that may result in claims

for indemnification by any of its officers or directors.

Indemnification

for liabilities arising under the Securities Act may be permitted to the registrant’s directors, officers, and controlling

persons under the foregoing provisions, or otherwise. The registrant has been advised that in the opinion of the Securities and

Exchange Commission this indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

The

above discussion of the DGCL and the registrant’s Certificate of Incorporation and Bylaws is not intended to be exhaustive

and is qualified in its entirety by such statutes, Certificate of Incorporation, and Bylaws.

Item 16.

Exhibits

|

Number

|

|

Exhibit

|

|

|

|

|

|

1.1

|

|

Form

of Underwriting Agreement relating to the common stock offered by this registration statement*

|

|

|

|

|

|

5.1

|

|

Opinion

of Reed Smith LLP

|

|

|

|

|

|

23.1

|

|

Consent

of Independent Registered Public Accounting Firm

|

|

|

|

|

|

23.2

|

|

Consent

of Reed Smith LLP (included in the opinion filed as Exhibit 5.1)

|

|

|

|

|

|

24

|

|

Power

of Attorney (included in signature page hereto)

|

* To

be filed by amendment or as an exhibit to a document to be incorporated by reference herein in connection with an offering of

the shares of common stock registered

Item 17.

Undertakings

The

undersigned registrant hereby undertakes:

To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

(i)

|

To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

|

To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most

recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information

set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered

(if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low

or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and

Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a

20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee”

table in the effective registration statement.

|

|

|

(iii)

|

To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement.

|

Provided,

however

, that paragraphs (i), (ii), and (iii) do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the

registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference

in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration

statement.

That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial

bona fide

offering thereof.

To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at

the termination of the offering.

That,

for purposes of determining liability under the Securities Act of 1933 to any purchaser:

(A) Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement;

(B) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance

on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information

required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of

the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of

securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any

person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement

relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by

reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with

a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement

or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

That,

for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution

of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant

pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if

the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant

will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424;

(ii) Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to

by the undersigned registrant;

(iii) The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

The

undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing

of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934, as

amended that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof.

Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion

of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and

is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by

the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense

of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities

being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed

in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it

meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf

by the undersigned, thereunto duly authorized, in the City of Stockholm, Country of Sweden, on the 15th day of March, 2017.

|

|

NEONODE

INC.

|

|

|

|

|

|

|

By:

|

/s/

Lars Lindqvist

|

|

|

|

Lars

Lindqvist

|

|

|

|

Chief

Financial Officer, Vice President,

Finance, Treasurer and Secretary

|

POWER

OF ATTORNEY

KNOW

ALL BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Thomas Eriksson and Lars Lindqvist,

and each of them, as his true and lawful attorney-in-fact and agent, each with the full power of substitution and resubstitution,

for him and in his name, place or stead, in any and all capacities, to sign any and all amendments to this registration statement

(including any and all post-effective amendments), and to sign any registration statement for the same offering covered by this

registration statement that is to be effective upon filing pursuant to Rule 462(b) promulgated under the Securities Act of 1933,

and all post-effective amendments thereto, and to file the same, with exhibits thereto and other documents in connection therewith,

with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and

authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully

to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact

and agents, or their or his or substitutes, may lawfully do or cause to be done by virtue hereof. This Power of Attorney may be

signed in several counterparts. Pursuant to the requirements of the Securities Act of 1933, this registration statement has been

signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title(s)

|

|

Date

|

|

|

|

|

|

/s/

Thomas Eriksson

|

|

President

and Chief Executive Officer, and Director

|

|

March

15, 2017

|

|

Thomas

Eriksson

|

|

(

Principal

Executive Officer

)

|

|

|

|

|

|

|

|

/s/

Lars Lindqvist

|

|

Chief

Financial Officer, Vice President, Finance,

|

|

March

15, 2017

|

|

Lars

Lindqvist

|

|

Treasurer

and Secretary

|

|

|

|

|

|

(

Principal

Financial and Accounting Officer

)

|

|

|

|

|

|

|

|

/s/

Per Bystedt

|

|

Chairman

|

|

March

15, 2017

|

|

Per

Bystedt

|

|

|

|

|

|

|

|

|

|

/s/

Mats Dahlin

|

|

Director

|

|

March

15, 2017

|

|

Mats

Dahlin

|

|

|

|

|

|

|

|

|

|

/s/

Per Löfgren

|

|

Director

|

|

March

15, 2017

|

|

Per

Löfgren

|

|

|

|

|

|

|

|

|

|

|

|

/s/

John Reardon

|

|

Director

|

|

March

15, 2017

|

|

John

Reardon

|

|

|

|

|

INDEX

OF EXHIBITS

|

Number

|

|

Exhibit

|

|

|

|

|

|

5.1

|

|

Opinion

of Reed Smith LLP

|

|

|

|

|

|

23.1

|

|

Consent

of Independent Registered Public Accounting Firm

|

II-5

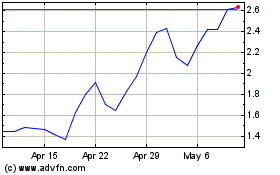

Neonode (NASDAQ:NEON)

Historical Stock Chart

From Mar 2024 to Apr 2024

Neonode (NASDAQ:NEON)

Historical Stock Chart

From Apr 2023 to Apr 2024