Some directors feared a potential fight with billionaire if CEO

Hancock stayed

By Joann S. Lublin and Leslie Scism

The person at the center of last week's surprise change atop

insurance giant American International Group Inc. wasn't Peter

Hancock. It was activist investor Carl Icahn.

The 58-year-old Mr. Hancock agreed to resign as chief executive

after several directors met with him Wednesday evening in his AIG

office in downtown Manhattan, according to people familiar with the

matter. Some directors at the time were worried about the CEO's

ability to continue improving the company's results, while several

also feared a potential fight with Mr. Icahn.

The huddle followed a private session of the company's

independent directors in which they had discussed Mr. Hancock's

successes and shortcomings, adding new detail to last week's sudden

shake-up at AIG.

That "executive session" occurred after a two-day board meeting,

during which Mr. Hancock and his team highlighted accomplishments

in trying to bring AIG's results in line with the best of its

peers. Mr. Hancock has agreed to stay on until a successor is

found.

Last month, AIG posted one of its worst quarterly results since

the financial crisis, with major setbacks in the global insurance

firm's turnaround plan. The AIG directors feared disruption if they

didn't quickly address concerns from Mr. Icahn and some directors

about the CEO's ability to complete the turnaround, people familiar

with the matter said.

So they pushed for Mr. Hancock to step aside, the people

said.

A decision "to stand by [Mr. Hancock] would carry the threat if

not the reality of a battle with Carl," said a person familiar with

the matter.

Despite the coming change atop AIG, the board remains committed

to the current turnaround plan developed by Mr. Hancock and won't

consider "breaking up the company," AIG Chairman Douglas Steenland

said in taped comments to employees Monday night. He said AIG

previously rejected such a breakup plan, which Mr. Icahn proposed

in 2015.

In his taped comments Monday night, Mr. Steenland also said

directors have begun their search for AIG's next chief executive

and likely will pick an outsider. "We are highly focused on the

search to bring in the right person to lead the company at this

important time," he added. "

Mr. Icahn, who disclosed a stake in AIG in fall 2015, had called

for Mr. Hancock's firing before reaching an agreement in early 2016

for a board seat for an Icahn representative. Fellow billionaire

investor John Paulson also obtained a board seat.

Waging a campaign against an activist is typically distracting

for management. For a financial firm like AIG, such fights can be

tricky as managers try to maintain the confidence of ratings

companies and customers. The uncertainty of potential change in the

company's strategy can slow new business.

The next CEO at AIG will be the firm's seventh since 2005, when

a period of turmoil began. In 2008, AIG nearly collapsed and

required one of the biggest bailouts of the financial crisis, at

nearly $185 billion. AIG fully repaid taxpayers by the end of 2012

by selling almost half of its assets and began to focus on

improving results in the remaining businesses.

Mr. Hancock said in a memo to employees last week that he was

leaving because, "without wholehearted shareholder support for my

continued leadership, a protracted period of uncertainty could

undermine" turnaround efforts. Mr. Icahn said last week he

supported the board's actions.

Mr. Hancock appeared to be making headway in improving results,

but AIG shares fell 9% on the Feb. 14 disclosure of a $3.04 billion

fourth-quarter loss and additional bad news the next day: lowered

targets for improving two closely watched profit measures.

The results included a $5.6 billion boost to claim reserves.

Some of the charge applied to policies sold during the financial

crisis, when rival executives have said AIG undercut them on prices

to keep revenue flowing.

More alarming to some analysts and investors, the charge also

applied to policies sold from 2011 through 2015. Mr. Hancock

directed the property-casualty unit from 2011 to 2014 and became

CEO in 2014.

At last week's board meeting, Mr. Hancock explained how his team

had reduced the risk of additional reserve charges by signing a

reinsurance agreement in January with Berkshire Hathaway Inc. In

addition, the company has dramatically reduced its exposure to some

types of liability insurance sold to U.S. businesses such as

trucking firms, while also sharply reducing expenses, among other

steps.

Some AIG board members found management's presentation

compelling. "Peter and his team were doing a good job," one person

said.

Still, the independent directors leaned toward his departure

during their executive session, the people said. Such sessions

exclude the CEO and other members of management.

Mr. Steenland and several other directors then summarized the

sentiments to Mr. Hancock in his 30th-floor corner office

overlooking the East River, the people said.

Mr. Hancock told the group he should step down "if he does not

have the unwavering full support of the entire board," according to

a person familiar with the matter.

As part of the transition process, AIG has hired a

executive-search firm to help it look for a new CEO, a person

said.

Write to Joann S. Lublin at joann.lublin@wsj.com and Leslie

Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

March 15, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

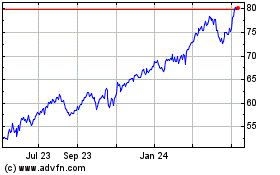

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

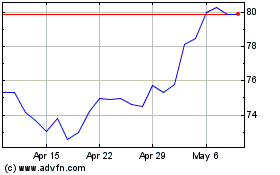

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024