Current Report Filing (8-k)

March 14 2017 - 5:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): March 9, 2017

Commercial Vehicle Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-34365

|

|

41-1990662

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

7800 Walton Parkway, New Albany, Ohio

|

|

43054

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: 614-289-5360

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02.

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 9, 2017, the Compensation Committee of the Board of Directors of Commercial Vehicle Group, Inc. (the “Company”) approved the Commercial Vehicle Group, Inc. 2017 Annual Incentive Plan (the “2017 Bonus Plan”). Each executive officer is eligible to participate in the 2017 Bonus Plan. The 2017 Bonus Plan is based solely on Company-wide financial performance goals represented as “Company Factor”.

The “Company Factor”, is based on the Company achieving, on a consolidated level, net sales (weighted 20%), operating profit margin (weighted 60%) and return on average invested capital (“ROAIC”) (weighted 20%).

The Company’s net sales is defined as revenues as shown in the Company’s audited financial statements for the fiscal year ending December 31, 2017. The Company’s operating profit margin is defined as operating profit divided by net sales as shown in the Company’s audited financial statements for the fiscal year ending December 31, 2017. ROAIC is defined as net income as shown in the Company’s audited financial statements divided by the average of the beginning and ending values of net debt (total debt less cash and cash equivalents) plus stockholders’ equity as shown in the Company’s audited financial statements for the fiscal year ending December 31, 2017.

The 2017 Bonus Plan reflects the following formula for calculating the annual cash incentive payment: base salary will be multiplied by the individuals’ “Target Factor” which is a percentage of base salary, multiplied by the “Company Factor” achievement, multiplied by the weighting of each component. Award funding will be calculated independently for each component, with no payouts for below-threshold performance. The minimum payout of 25% of an individual’s target bonus opportunity will be paid at the threshold level of performance, except in the case of the Operating Profit Margin metric for which the minimum payout at threshold performance is 0%. 100% of an individual’s target bonus opportunity will be paid at the target level of performance. 200% of an individual’s target bonus opportunity will be paid at the maximum level of performance. For 2017, intermediate payout goals were established above and below target. Performance between any points will be calculated using straight line interpolation.

The Target Factor was set as follows: for Mr. Miller, 91.6% of his base salary; and for Mr. Trenary; 75% of his base salary.

The Compensation Committee has the discretion to review, modify and approve the calculation of the annual performance goals and determine the amount of any bonuses payable under the 2017 Bonus Plan for the sole purpose of ensuring that the incentive payments are calculated with the same intentions in which the targets were set for the year, including making adjustments to eliminate the effects of restructuring and other (income) expenses not foreseen at the time the 2017 Bonus Plan was established.

In addition, the Compensation Committee has the discretion to increase or decrease the payouts based on significant differences in individual performance for each of the executive officers.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMERCIAL VEHICLE GROUP, INC.

|

|

|

|

|

|

|

March 14, 2017

|

|

|

|

By:

|

|

/s/ Patrick E. Miller

|

|

|

|

|

|

Name:

|

|

Patrick E. Miller

|

|

|

|

|

|

Title:

|

|

Chief Executive Officer

|

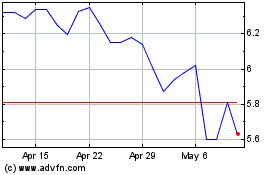

Commercial Vehicle (NASDAQ:CVGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

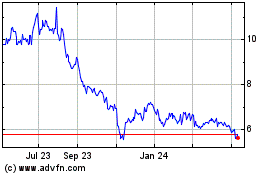

Commercial Vehicle (NASDAQ:CVGI)

Historical Stock Chart

From Apr 2023 to Apr 2024