Ampco-Pittsburgh Corporation (NYSE: AP) reported consolidated

sales for the three and twelve months ended December 31, 2016, of

$92.1 and $331.9 million, respectively, versus $55.3 and $238.5

million for the comparable prior year periods. The current year

periods include sales of $41.9 and $128.6 million, respectively,

attributable to the Q1 2016 acquisition of Åkers AB and certain of

its affiliated companies (“Åkers”) and the Q4 2016 acquisition of

specialty steel maker, ASW Steel Inc. (“ASW”).

Loss from operations for the three months ended December 31,

2016, was $39.8 million and included impairment losses of $26.7

million, primarily from the impairment of goodwill in the Forged

and Cast Engineered Products reporting unit (“Impairment Charge”)

and a $4.6 million net charge associated primarily with revaluing

the estimated liabilities and insurance receivables for asbestos

litigation through 2026 (“Asbestos Charge”). This compares to

income from operations in the prior year quarter of $7.7 million,

which included approximately $14.0 million of proceeds received

from an insurance carrier in rehabilitation and $3.0 million in

costs related to potential acquisitions. Loss from operations for

the full year ended December 31, 2016, was $54.5 million and

included the aforementioned Impairment Charge, Asbestos Charge, and

approximately $7.5 million in acquisition-related costs and

purchase accounting impacts. This compares to income from

operations of $5.0 million for the full year ended December 31,

2015, which included the aforementioned proceeds received from

insurance carriers in rehabilitation and acquisition-related

costs.

Other expense – net for Q4 and full year 2016 exceeded prior

year amounts primarily due to higher interest expense on debt

related to the 2016 acquisitions and higher foreign exchange losses

linked to the stronger U.S. dollar.

Net loss for the three and twelve months ended December 31,

2016, was $43.1 million or $3.51 per common share, and $79.8

million or $6.68 per common share, respectively, compared to net

income for the three and twelve months ended December 31, 2015, of

$3.3 million or $0.32 per common share and $1.4 million or $0.13

per common share, respectively. Net loss for the current full year

includes valuation allowances of $30.4 million against certain of

the Corporation’s deferred income tax assets, which impacted net

loss per common share by $2.54.

Sales for the Forged and Cast Engineered Products segment for Q4

2016 doubled compared to prior year while full year 2016 sales

increased 63% over full year 2015, driven primarily by the

additions from the Åkers and ASW acquisitions. Operating loss

increased in both Q4 2016 and full year 2016 compared to prior year

periods. The increase in operating loss for the quarter was

primarily associated with the $26.7 million Impairment Charge,

current year operating losses related to excess capacity in the

cast roll market including the acquired Åkers businesses, and a

$1.5 million reserve against a receivable from a customer who filed

for Chapter 11 bankruptcy protection. The segment’s operating loss

for full year 2016 also includes the unfavorable effects of

purchase accounting, principally for the Åkers acquisition.

Sales for the Air and Liquid Processing segment increased nearly

5% for Q4 2016 compared to the prior year quarter as higher

shipment volumes of centrifugal pumps more than offset softer

shipments for custom air handlers and heat exchange coils. The

segment’s sales for full year 2016 decreased approximately 2% as

lower demand for heat exchange coils in the coal-fired power

generation market was only partly offset by the higher demand for

centrifugal pumps. The segment’s operating income for the quarter

and full year ended December 31, 2016 declined compared to prior

year due to the Asbestos Charge recorded in the current year

compared to the insurance recoveries received in the prior year.

Higher centrifugal pump shipment volumes, improved productivity,

and cost reductions across the segment more than offset the impact

of lower heat exchange coil volumes in underlying operations.

Remarking on the quarter and full year results, John Stanik,

Ampco-Pittsburgh’s Chief Executive Officer said, “2016 was a year

of restructuring and remaking Ampco-Pittsburgh’s future. We

acquired ASW in the fourth quarter, adding a key building block to

our open-die forging diversification strategy. The Åkers

acquisition made us a strong leader in the roll industry and

expanded our global reach and presence. These changes brought

challenges and costs. Executing them in the midst of a still very

weak global steel market and soft energy market, with prospects for

only slow expected recovery in the near term, has contributed

directly to charges we’ve recorded this year. But with these

impacts behind us, we are poised to capitalize as markets recover

and as we execute our strategic plan.”

Teleconference Access

Ampco-Pittsburgh Corporation (NYSE: AP) will hold a conference

call on Tuesday, March 14, 2017, at 10:30 a.m. Eastern Time (ET) to

discuss its financial results for the fourth quarter ended December

31, 2016. If you would like to participate in the conference call,

please register using the link below or by dialing 1-866-777-2509

at least five minutes before the 10:30 a.m. ET start time.

We encourage participants to pre-register for the conference

call using the following link. Callers who pre-register will be

given a conference passcode and unique PIN to gain immediate access

to the call and bypass the live operator. Participants may

pre-register at any time, including up to and after the call start

time.

To pre-register, please go to:

http://dpregister.com/10100411

Those without internet access or unable to pre-register may dial

in by calling:

Participant Dial-in (Toll Free): 1-866-777-2509 Participant

International Dial-in: 1-412-317-5413

For those unable to listen to the live broadcast, a replay will

be available one hour after the event concludes on our website

under the Investors menu at www.ampcopgh.com.

The Private Securities Litigation Reform Act of 1995 (the “Act”)

provides a safe harbor for forward-looking statements made by or on

our behalf. This news release may contain forward-looking

statements that reflect our current views with respect to future

events and financial performance. All statements in this document

other than statements of historical fact are statements that are,

or could be, deemed forward-looking statements within the meaning

of the Act. In this document, statements regarding future financial

position, sales, costs, earnings, cash flows, other measures of

results of operations, capital expenditures or debt levels and

plans, objectives, outlook, targets, guidance or goals are

forward-looking statements. Words such as “may,” “intend,”

“believe,” “expect,” “anticipate,” “estimate,” “project,”

“forecast” and other terms of similar meaning that indicate future

events and trends are also generally intended to identify

forward-looking statements. Forward-looking statements speak only

as of the date on which such statements are made, are not

guarantees of future performance or expectations, and involve risks

and uncertainties. For Ampco-Pittsburgh, these risks and

uncertainties include, but are not limited to, those described

under Item 1A, Risk Factors, of Ampco-Pittsburgh’s Annual Report on

Form 10-K. In addition, there may be events in the future that we

are not able to predict accurately or control which may cause

actual results to differ materially from expectations expressed or

implied by forward-looking statements. Except as required by

applicable law, we assume no obligation, and disclaim any

obligation, to update forward-looking statements whether as a

result of new information, events or otherwise.

AMPCO-PITTSBURGH

CORPORATION

FINANCIAL

SUMMARY

(Dollars in thousands except per share

amounts; shares outstanding in thousands)

Three Months

Ended

Twelve Months

Ended

December

31

December

31

2016

2015

2016

2015

Sales

$ 92,126

$ 55,326 $

331,866 $ 238,480

Cost of products sold (excl. depreciation

and amortization)

80,672 47,195 276,496 196,091 Selling and administrative 14,435

11,863 58,175 39,510 Depreciation and amortization 5,518 2,512

20,463 11,787 Charge (credit) for asbestos litigation 4,565 (14,000

) 4,565 (14,333 ) Impairment losses 26,676 - 26,676 - Loss on

disposal of assets

30

48 21

378 Total operating expense

131,896 47,618

386,396 233,433

(Loss) income from operations (1) (39,770 ) 7,708

(54,530 ) 5,047 Other expense – net

(2,355

) (316 )

(2,990 ) (527

) (Loss) income before income taxes (42,125 )

7,392 (57,520 ) 4,520 Income tax provision (1,085 ) (3,785 )

(22,712 ) (2,633 )

Equity earnings (loss) from Chinese joint

venture

308 (275

) 423

(514 )

Net (loss) income before noncontrolling

interest

(42,902 ) 3,332 (79,809 ) 1,373

Net income attributable to noncontrolling

interest

160 -

11 -

Net (loss) income attributable to Ampco

(2)

$ (43,062 ) $

3,332 $ (79,820

) $ 1,373

Net (loss) per common share attributable

to Ampco:

Basic(2)

$ (3.51 )

$ 0.32 $

(6.68 ) $ 0.13

Diluted (2)

$ (3.51 )

$ 0.32 $

(6.68 ) $ 0.13

Weighted-average number of common shares

outstanding:

Basic

12,271 10,440

11,951 10,435

Diluted

12,271

10,440 11,951

10,447 (1) For the three and

twelve months ended December 31, 2016, includes charges of $26,676

principally for the write-off of goodwill in the Forged and Cast

Engineered Products reporting unit deemed to be impaired and $4,565

for estimated costs of asbestos-related litigation through 2026 net

of estimated insurance recoveries and a settlement with an

insurance carrier for an amount in excess of the receivable

estimated. For the twelve months ended December 31, 2016, also

includes approximately $7,500 in acquisition-related costs and

purchase accounting impacts. For the three months ended 2015,

includes proceeds received from an insurance carrier in

rehabilitation of $14,000 offset by costs incurred related to

potential acquisitions of approximately $3,000. For the twelve

months ended 2015, includes proceeds received from insurance

carriers in rehabilitation of $14,333 offset by costs incurred

related to potential acquisitions of approximately $3,400.

(2) For the three months ended December 31, 2016, includes charges

of $26,676 or $2.17 per common share principally for the write-off

of goodwill in the Forged and Cast Engineered Products reporting

unit deemed to be impaired and $4,565 or $0.37 per common share for

estimated costs of asbestos litigation through 2026 net of

estimated insurance recoveries and a settlement with an insurance

carrier for an amount in excess of the receivable estimated. For

the twelve months ended December 31, 2016, includes charges of

$26,676 or $2.23 per common share principally for the write-off of

goodwill in the Forged and Cast Engineered Products reporting unit

deemed to be impaired, $30,405 or $2.54 per common share to

recognize a valuation allowance against certain deferred income tax

assets, approximately $7,500 or $0.63 per common share in

acquisition-related costs and purchase accounting impacts, and

$4,565 or $0.38 per common share for estimated costs of

asbestos-related litigation through 2026 net of estimated insurance

recoveries and a settlement with an insurance carrier for an amount

in excess of the receivable estimated. For the three months ended

December 31, 2015, includes an after-tax credit of $6,140 or $0.59

per share for the net benefit of proceeds received from an

insurance carrier in rehabilitation offset by acquisition-related

costs. For the twelve months ended December 31, 2015, includes an

after-tax credit of $5,088 or $0.49 per share for the net benefit

of proceeds received from insurance carriers in rehabilitation

offset by acquisition-related costs.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170314005807/en/

Ampco-Pittsburgh CorporationMichael G. McAuley, 412-429-2472Vice

President, Chief Financial Officer, and Treasurermmcauley@ampcopgh.com

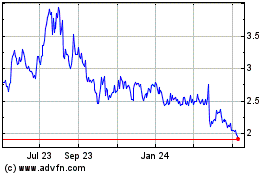

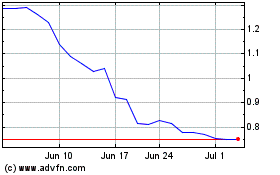

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Apr 2023 to Apr 2024