Indian Rupee At Near 15-month High Vs U.S. Dollar After WPI Data

March 14 2017 - 3:18AM

RTTF2

The Indian rupee firmed against the U.S. dollar in evening

trading on Tuesday, after data showing bigger-than-expected

increase in wholesale price inflation in February prompted

investors to rule out the possibility of rate cut any time

soon.

Preliminary data from the Ministry of Commerce & Industry

showed that India's wholesale price inflation accelerated at a

faster-than-expected pace in February.

Wholesale prices climbed 6.55 percent year-over-year in

February, following a 5.25 percent increase in the prior month.

Economists had expected the inflation to rise to 6.1 percent.

Further underpinning the currency was the sweeping state

election victory of ruling party, which helped bolster expectations

for continuation of key reform measures.

The Indian rupee advanced to 65.86 against the greenback, a

level unseen since December 2015. At Monday's close, the pair was

valued at 66.15. Continuation of the rupee's uptrend may see it

challenging resistance around the 64.5 region.

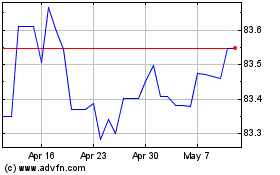

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

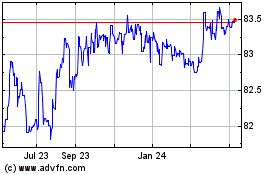

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024