Additional Proxy Soliciting Materials (definitive) (defa14a)

March 13 2017 - 5:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Under Rule 14a-12

|

FIRST CITIZENS

BANCSHARES

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing:

|

|

|

|

|

|

|

|

(1)

|

|

Amount previously paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No:

|

|

|

|

(3)

|

|

Filing party:

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

|

A LETTER FROM THE

CHAIRMAN

Frank B. Holding, Jr.

|

Dear Shareholder:

I’m writing to tell you about the considerable strides we made during 2016 in our ongoing pursuit to be the best bank possible for our

customers, communities and associates.

Before we get to those highlights, I’d like to acknowledge what’s at the core of our

ability to fulfill our Forever First

®

promise – and that is the people who deliver our unique brand of banking every day. That’s why we’re featuring them in our new

“Pride” marketing campaign.

|

|

|

|

|

In simple, straightforward ads on television, in print and on the internet, our associates are sharing the

First Citizens story in their own unscripted, genuine words. We believe their fresh perspectives will show that we’re a company with heart, and that the decision to bank with us is a good decision.

|

|

|

|

|

|

|

Our consistently strong financial position is one hallmark that appeals to customers and prospects. First

Citizens posted total earnings of $225.5 million for 2016. Net interest income increased due to higher loan and investment income, as well as a continued reduction in funding costs. Balance sheet growth was solid, with originated loan growth of 7%

and deposit growth of 5%. Our core fee-based businesses contributed to higher noninterest income, led by growth in merchant services and credit/debit card income reflecting solid sales volume growth. Strategic cost management efforts continued,

which helped us hold our year-over-year expense growth to less than 1%. Asset quality continued to improve in 2016 and net charge-offs remained low.

A strong liquidity position and solid capital levels not only support internal growth, but also enable us to continue to pursue mergers and

acquisitions. Last year and early in 2017, we successfully completed four transactions, three of which were acquired through an agreement with the FDIC. Strategic mergers and acquisitions positively impact our future earnings and contribute to

capital growth.

In all markets, our overarching focus is building relationships with our customers to understand their current needs

and future dreams – and helping fulfill them with the right financial products and services.

|

|

|

|

|

|

|

Throughout 2016, we maintained our focus on elevating our wealth management offerings. First Citizens now provides a

comprehensive suite of investment, money management and banking solutions designed especially for the unique and often complex needs of high-net-

|

|

worth clients. In addition, we introduced a more robust wealth section on firstcitizens.com that features new

financial tools, client testimonials and other content designed to inspire site visitors to consider their needs and learn more from our advisors.

|

Continued on back

Chairman’s Letter, continued

Late in 2016, we introduced our new First Citizens Digital Banking solution to our retail

customers. Despite our best intentions and more than 18 months of planning and preparation, the platform’s launch was marred by technical problems that made it hard for customers to access the site and do the banking they needed to get done.

Thanks to our customers’ patience and associates’ teamwork, we’re on the other side of the challenging transition and clients are successfully using the platform. We’ll continue to introduce more of the innovative features we

promised, with the lessons we’ve learned informing our future direction.

We implemented a number of enhancements to the ways

businesses can bank with us, including an upgrade to Business Online Banking Bill Pay and an amplified business credit card suite that includes a rich rewards component. And our new Visa

®

Purchasing Card makes the traditional purchase process more streamlined and efficient for businesses.

Keeping our customers’ money

and information safe and secure is always one of our top priorities, and last year we amped up our efforts to fight the nationwide increase in ATM fraud. We also built a new state-of-the-art primary data center, which physically and safely separates

our servers and data from other operations.

|

|

|

|

|

Expectations continue to rise for the entire banking industry amid the changing regulatory landscape, and First

Citizens takes our responsibilities in the risk arena very seriously. Our growing enterprise risk management program engages our entire organization, focusing on transparency, clarity and reporting to make sure our business strategies and operations

protect our customers, assets, associates and company.

Being the best bank we possibly can also means giving back to the communities we serve. Last year we responded to market needs ranging from

natural disasters like the historic West Virginia flooding and East Coast devastation wreaked by hurricanes, to fighting childhood hunger in Atlanta, to supporting public television on both coasts. We focused particularly on our primary

corporate

|

|

|

|

|

|

|

philanthropy, Teen Cancer America (TCA), which works to develop specialized facilities and services for teens

and young adults with cancer. In 2016, we gained tremendous traction in building awareness and fundraising for the charity.

As I

expressed in this letter’s opening, First Citizens’ character – and indeed our ongoing success – is made possible by people. I appreciate our associates who embody the Forever First brand in everything they do for their customers

each day. And I’m grateful for the crucial support of our endeavors by our board of directors and shareholders. There is nothing we can’t accomplish together.

|

|

|

|

|

|

|

|

|

Sincerely,

|

|

|

|

|

|

|

Frank B. Holding, Jr.

|

|

|

|

|

|

March 13, 2017

|

|

|

Member FDIC. Equal Housing Lender

.

.

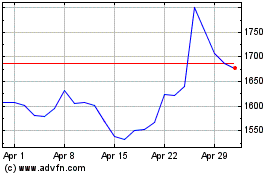

First Citizens BancShares (NASDAQ:FCNCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

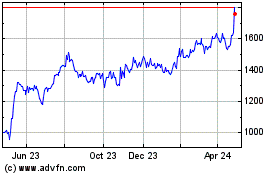

First Citizens BancShares (NASDAQ:FCNCA)

Historical Stock Chart

From Apr 2023 to Apr 2024