Metals: Weaker Dollar and Mine Strikes Lift Copper

March 13 2017 - 4:10PM

Dow Jones News

By Katherine Dunn

Copper prices closed at a one-week high Monday as the dollar

weakened and traders refocused on supply disruptions at mines in

Chile and Indonesia.

Copper for March delivery closed up 1.2% at $2.6255 a pound on

the Comex division of the New York Mercantile Exchange, the highest

settlement since March 6.

Gold prices were also higher, with the April contracts gaining

0.1% to $1,203.10 a troy ounce.

Over the weekend, the union at Chile's Escondida -- the world's

largest copper mine -- rejected efforts by BHP Billiton, the

majority-owner of the mine, to restart talks. The strike has now

been running for more than a month.

Those renegotiations are unlikely to restart before new Chilean

labor regulations go into force at the start of April that could

affect future negotiations, according to David Wilson, an analyst

at Citi in London.

"It's quite obvious that Escondida is going to go on for a

while," said Mr. Wilson.

On Friday, a strike at the Cerro Verde mine in Peru, which is

owned by Freeport-McMoRan Inc. began. A dispute over the terms of

an export license for Freeport's Grasberg mine in Indonesia also

continues to drag on.

Prices for both base metals and precious metals were also

gaining on the back of a weaker dollar on Monday, as traders

awaited a busy week of market news ahead of a potential rate

increase.

The WSJ Dollar Index, which weighs the dollar against a basket

of other currencies, was down 0.1% to 91.68.

The Federal Reserve will meet Tuesday and Wednesday, and is

widely expected to raise rates for the first time this year, while

offering cues on the timing of future rate increases this year.

Precious metals also advanced. Silver for March delivery was up

0.3% at $16.97 a troy ounce, April platinum was up 0.3% at $941.20

a troy ounce, and palladium was up 1.3% at $754.45 a troy

ounce.

Riva Gold and Ira Iosebashvili contributed to this article

Write to Katherine Dunn at Katherine.Dunn@wsj.com

(END) Dow Jones Newswires

March 13, 2017 15:55 ET (19:55 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

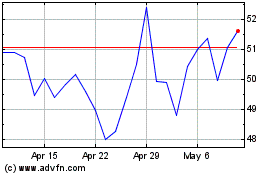

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024