By Samantha Pearson and Sarah Nassauer

SÃO PAULO -- Facing lackluster sales in the world's

fifth-largest consumer market, Wal-Mart Stores Inc. is making a

contrarian bet in Brazil, investing heavily to revamp its

U.S.-style big-box stores even as shoppers increasingly flock to

smaller, cheaper options.

Wal-Mart has said it plans to spend 1 billion reais, or some

$320 million, over three years on upgrades to its hypermarkets in

Brazil, mostly sticking with a strategy it has followed here for

two decades. Wal-Mart's net sales in the country have been sluggish

in recent years compared with its other international markets,

falling 4.1% for the three months ended Jan. 31, versus increases

for the same period of 8.9% across Mexico and Central America, and

5.4% in China.

"Ever since it entered Brazil, Wal-Mart has found it difficult

to integrate itself into the market," says Flávio Tayra, a

professor of the Federal University of São Paulo, who specializes

in food retailing. "It occupies a modest space here given all the

potential it has."

As in the U.S., Wal-Mart's main big-box stores in Brazil sell

everything from bananas to car tires. They were popular with

Brazilians during the hyperinflation of the 1980s and early 1990s,

when prices were rising at stratospheric rates. Many shoppers would

get paid, then rush to the hypermarket on the outskirts of town to

stock up before prices rose further.

Now, that mode of shopping has lost its appeal for many here.

Hellish traffic in mushrooming cities makes hypermarkets hard to

reach. Small neighborhood convenience stores are attracting

Brazilians who increasingly live alone, not in large family

homes.

Meanwhile, a newer discount retail format is attracting Brazil's

bargain-hunters: Warehouse-style stores known as "cash and carries"

-- many owned by France-based Carrefour and Groupe Casino's GPA and

originally targeted at small businesses -- sell household items and

a small selection of groceries in bulk to families at steep

discounts. Since 2015, when Brazil plunged into its worst recession

on record, cash-and-carries have become more popular. Shoppers tend

to go once a month or so to stock up on items like cleaning

products and beer and rely on neighborhood supermarkets for most

food and grocery items.

Against that trend, Wal-Mart is redoubling its focus on

hypermarkets, with investments in two regional chains, Hiper

Bompreço and BIG, which it acquired in the mid-2000s. The chains

will be rebranded with the Wal-Mart name, and existing Wal-Mart

branded big-box stores will also get a face-lift, with upgraded

fresh produce, wider overall assortment and lower prices, according

to a statement by Flavio Cotini, president of Walmart Brazil, on

the retailer's Portuguese-language website.

Some analysts say Wal-Mart's focus on hypermarkets is

ill-advised. "Focusing on a format that is clearly losing market

share and is no longer very attractive to Brazilians doesn't seem

appropriate," says Bruna Pezzin, an analyst at São Paulo-based

investment broker XP Investimentos.

Wal-Mart executives have said they see some improvement in the

Brazil operations, especially after efforts at their own

cash-and-carry chain, Maxxi Wholesales and a similar concept, Sam's

Club, which together make up less than a fifth of Wal-Mart's 500

Brazil stores. Wal-Mart in 2017 also plans to open stores under its

neighborhood-grocer brand, TodoDia, and remodel supermarkets, a

company spokesman said.

Wal-Mart doesn't disclose detailed financial statements for

Brazil and declined to comment about whether it is profitable

there. Senior management has acknowledged that Brazil is a

consistent weak spot in its 11,700-store global portfolio. The

Brazil unit has changed chief executives four times since 2008;

early last year Wal-Mart announced it would close 60 loss-making

stores in the country.

Brazil "is proving to be an increasingly challenging economic

environment," Wal-Mart chief executive Doug McMillon said last

year. Wal-Mart reported revenue in Brazil of 29.3 billion reais

($9.39 billion) for the 2015 calendar year, according to its

website, a tiny slice of its total revenue of $482.1 billion for

the fiscal year that ended in January 2016.

Wal-Mart has had difficulties in the past penetrating

international markets. It left Germany and South Korea in 2006

after failing to boost profits there.

Some analysts and former executives in Brazil say they see

Wal-Mart's renewed investment in hypermarkets as emblematic of a

U.S.-centric strategy that has led it to several highly visible

blunders in Brazil. When Wal-Mart first arrived here in the

mid-1990s, its stores raised eyebrows by trying to sell golf

equipment in a nation obsessed with soccer, and winter coats during

the southern hemisphere's summer -- issues that were "quickly

corrected," the spokesman said.

Rebranding the Hiper Bompreço and BIG chains could be especially

risky, analysts say. Both retailers have well-recognized names in

their regions -- an advantage in a recession, when shoppers tend to

gravitate to trusted local names and family-run operations.

While "Everday Low Prices" were a cornerstone of Wal-Mart's rise

to dominance in the U.S., its insistence on that type of pricing in

Brazil doesn't account for poorer shoppers' tendency to want to

cherry-pick promotional prices, said Thales Teixeira, a Harvard

Business School professor. "In the U.S., most of us will not go to

more than one supermarket in a weekend," he said. "But in Brazil,

people are more conscious about price...so they are willing to go

to multiple supermarkets."

And while an average "shopping basket" of items may consistently

cost less at Wal-Mart than at other stores, the retailer rarely

offers the lowest price for any single item, Prof. Teixeira

said.

Wal-Mart's Tamboré hypermarket on the outskirts of São Paulo was

the first store to be renovated. On a recent visit, customers

praised the brighter lighting, wider aisles and better selection of

fruits and vegetables. But few said they were regular shoppers

there. "I normally go to the Carrefour nearby but it's so chaotic,"

said Ósia Nascimento, a retired teacher, shopping with her

grandson. "I like it here, though," she said. "It's emptier."

Write to Samantha Pearson at samantha.pearson@wsj.com and Sarah

Nassauer at Sarah.Nassauer@wsj.com

(END) Dow Jones Newswires

March 13, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

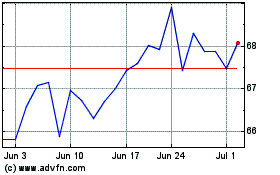

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

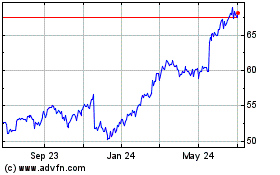

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024