SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement Under Section

14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

Safe Bulkers, Inc.

(Name of Subject Company

(Issuer) and Filing Person (Offeror))

8.00% Series B Cumulative Redeemable Perpetual

Preferred Shares, par value $0.01 per share,

liquidation preference $25.00 per share

|

|

Y7388 L111

|

|

(Title of Class of Securities)

|

|

(CUSIP Number of Class of Securities)

|

Dr. Loukas Barmparis

President

Apt. D11,

Les Acanthes

6, Avenue des Citronniers

MC98000 Monaco

+30 2 111 888 400

+357 25 887 200

(Name, Address and Telephone Number of

Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

Copy to:

Richard M. Brand

Joshua A. Apfelroth

Cadwalader, Wickersham & Taft LLP

One World Financial Center

New York, New York 10281

(212) 504-6000

Calculation of Filing Fee

|

Transaction

Valuation(1)

|

|

Amount

of Filing Fee(2)

|

|

$35,658,432

|

|

$4,133

|

|

|

|

(1)

|

Estimated solely for purpose of calculating the filing fee. This Tender Offer Statement on Schedule TO relates to an exchange offer (the “Exchange Offer”) through which Safe Bulkers, Inc. seeks to acquire any and all of its outstanding 8.00% Series B Cumulative Redeemable Perpetual Preferred Shares (the “Series B Preferred Shares”). The transaction valuation was calculated in accordance with Rule 0-11 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as follows:

|

|

|

|

|

|

The product of (i) $24.00, the average of the high and low prices per Series B Preferred Shares on the New York Stock Exchange on March 3, 2017, and (ii) 1,485,768, the maximum number of Series B Preferred Shares that could be accepted for exchange in the Exchange Offer.

|

|

(2)

|

The Amount of Filing Fee calculated in accordance with Rule 0-11(b) of the Exchange Act, equals $115.90 for each $1,000,000 of the value of the transaction.

|

|

|

|

|

¨

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and date of its filing.

|

|

|

Amount Previously Paid: N/A

|

Filing Party: N/A

|

|

|

Form or Registration No.: N/A

|

Date Filed: N/A

|

|

¨

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

|

|

|

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

|

|

¨

|

third-party tender offer subject to Rule 14d-1.

|

|

|

|

|

x

|

issuer tender offer subject to Rule 13e-4.

|

|

|

|

|

¨

|

going-private transaction subject to Rule 13e-3.

|

|

|

|

|

¨

|

amendment to Schedule 13D under Rule 13d-2.

|

|

|

|

|

Check the following box if the filing is a final amendment reporting the results of the tender offer:

¨

|

|

|

|

|

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

|

|

|

|

|

¨

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer).

|

|

|

|

|

¨

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer).

|

|

|

|

SCHEDULE TO

This Tender Offer Statement on Schedule TO

(this “Tender Offer Statement”) relates to an offer (the “Exchange Offer”) by Safe Bulkers, Inc., a Republic

of Marshall Islands corporation (the “Company”), to acquire any and all outstanding shares of 8.00% Series B Cumulative

Redeemable Perpetual Preferred Stock of the Company, par value $0.01 per share, liquidation preference $25.00 per share (NYSE:

SB.PR.B) (the “Series B Preferred Shares”) from all tendering holders of Series B Preferred Shares, pursuant

to the terms and subject to the conditions described in the offer to exchange, dated March 9, 2017 (the “Offer to Exchange”),

filed as Exhibit (a)(1)(A) hereto and the related letter of transmittal for the Series B Preferred Shares (the “Letter of

Transmittal”), filed as Exhibit (a)(1)(B) hereto.

This Tender Offer Statement is intended to

satisfy the reporting requirements of Rule 13e-4 under the Securities Exchange Act of 1934, as amended. The information contained

in the Offer to Exchange and the related Letter of Transmittal is incorporated herein by reference in response to all of the items

of this Schedule TO, as more particularly described below.

|

Item 1.

|

Summary Term Sheet.

|

The information set forth under the heading

“Summary Term Sheet” in the Offer to Exchange is incorporated by reference herein.

|

Item 2.

|

Subject Company Information.

|

(a) Name and Address.

The name

of the Company and the address and telephone number of its principal executive offices are as follows:

|

|

Safe Bulkers, Inc.

|

|

|

Apt. D11,

|

|

|

Les Acanthes

|

|

|

6, Avenue des Citronniers

|

|

|

MC98000 Monaco

|

|

|

+30 2 111 888 400

|

|

|

+357 25 887 200

|

(b) Securities.

The information

set forth on the front cover page of the Offer to Exchange and under the heading “Summary Term Sheet” in the Offer

to Exchange is incorporated by reference herein.

(c) Trading Market and Price.

The

information with respect to the Series B Preferred Shares and the Common Stock, par value $0.001 per share, of the Company (the

“Common Stock”) set forth in the Offer to Exchange under the heading “Market Price and Dividend Information”

in the Offer to Exchange is incorporated by reference herein.

|

Item 3.

|

Identity and Background of Filing Person.

|

(a) Name and Address.

The filing

person is the Company. The business address and telephone number of the Company are as set forth under Item 2(a) above and are

incorporated by reference herein.

Pursuant to Instruction C to Schedule TO,

the following persons are the directors and/or executive officers of the Company:

|

Name

|

|

Position

|

|

Polys Hajioannou

|

|

Chief Executive Officer, Chairman of the Board and Director

|

|

Dr. Loukas Barmparis

|

|

President, Secretary and Director

|

|

Ioannis Foteinos

|

|

Chief Operating Officer and Director

|

|

Konstantinos Adamopoulos

|

|

Chief Financial Officer and Director

|

|

Christos Megalou

|

|

Director

|

|

Ole Wikborg

|

|

Director

|

|

Frank Sica

|

|

Director

|

The business address and telephone number

of each of the above directors and executive officers is c/o Safe Bulkers, Inc., Apt. D11, Les Acanthes, 6, Avenue des Citronniers,

MC98000 Monaco, telephone number: +30 2 111 888 400 or +357 25 887 200.

|

Item 4.

|

Terms of the Transaction.

|

(a) Material Terms.

The information

set forth in the Offer to Exchange under the headings “Summary Term Sheet,” “Questions and Answers About the

Exchange Offer,” “The Exchange Offer,” “Certain U.S. Federal Income Tax Considerations” and “Comparison

of Rights Between the Series B Preferred Shares and the Common Stock” is incorporated by reference herein.

(b) Purchases.

As of March 8, 2017,

(i) our Chief Executive Officer and Chairman of the Board, Polys Hajioannou, owned, directly or indirectly, 280,000 shares of the

Series B Preferred Shares, and (ii) all executive officers and directors (including Polys Hajioannou) as a group owned 309,000

shares of the Series B Preferred Shares.

|

Item 5.

|

Past Contacts, Transactions, Negotiations and Agreements.

|

(e) Agreements Involving the Subject

Company’s Securities.

The information set forth in the Offer to Exchange under the headings “Summary Term Sheet,”

“The Exchange Offer” and “Comparison of Rights Between the Series B Preferred Shares and the Common Stock”

is incorporated by reference herein.

|

|

The Company has entered into the following agreements with respect to the Series B Preferred Shares:

|

|

|

|

|

|

·

|

Specimen Copy of Certificate representing the 8.00% Series B Cumulative Redeemable Perpetual Preferred Shares (filed as Exhibit 4.1 to the Company’s Registration Statement on Form 8-A (File No. 001-34077), filed on June 18, 2013, and incorporated by reference herein);

|

|

|

|

|

|

|

·

|

Statement of Designation of 8.00% Series B Cumulative Redeemable

Perpetual Preferred Shares (Par Value $0.01 Per Share), (filed as Exhibit 3.4 to the Company’s Registration Statement

on Form 8-A (File No. 001-34077), filed on June 18, 2013, and incorporated by reference herein);

|

|

|

|

|

|

|

·

|

Underwriting Agreement, dated as of June 6, 2013, by and among Safe Bulkers, Inc., and Incapital LLC and DNB Markets, Inc., as representatives of the several underwriters named therein, relating to the purchase of 800,000 shares of the Company’s 8.00% Series B Cumulative Redeemable Perpetual Preferred Shares, par value $0.01 per share, liquidation preference $25.00 per share (filed as Exhibit 1.1 to the Company’s Form 6-K (File No. 001-34077), filed on June 13, 2013, and incorporated by reference herein); and

|

|

|

|

|

|

|

·

|

Offer to Exchange dated March 9, 2017, and filed as Exhibit (a)(1)(A) to this Schedule TO.

|

|

|

|

|

|

|

The Company has entered into the following agreements with respect to the Company’s other securities:

|

|

|

|

|

|

|

·

|

Shareholder Rights Agreement, dated as of May 14, 2008, between Safe Bulkers. Inc. and American Stock Transfer & Trust Company LLC (filed as Exhibit 10.5 to the Company’s Registration Statement on Form F-1 (File No. 333-150995), filed on May 16, 2008, and incorporated by reference herein);

|

|

|

·

|

Form of Registration Rights Agreement between Safe Bulkers, Inc. and Vorini Holdings Inc. (filed as Exhibit 4.2 to the Company’s Registration Statement on Form F-1/A (File No. 333-150995), filed on May 23, 2008, and incorporated by reference herein);

|

|

|

|

|

|

|

·

|

Specimen Common Share Certificate (filed as Exhibit 4.1 to the

Company’s Registration Statement on Form F-1 (File No. 333-150995), filed on May 16, 2008, and incorporated by

reference herein);

|

|

|

|

|

|

|

·

|

Specimen Copy of 8.00% Series C Cumulative Redeemable Perpetual

Preferred Share Certificate (filed as Exhibit 4.1 to the Company’s Registration Statement on Form 8-A (File No.

001-34077), filed on May 7, 2014, and incorporated by reference herein);

|

|

|

|

|

|

|

·

|

Statement of Designation of the 8.00% Series C Cumulative Redeemable Perpetual Preferred Shares (Par Value $0.01 Per Share) (filed as Exhibit 3.4 to the Company’s Registration Statement on Form 8-A (File No. 001-34077), filed on May 7, 2014, and incorporated by reference herein);

|

|

|

|

|

|

|

·

|

Underwriting Agreement, dated as of April 30, 2014, by and among Safe

Bulkers, Inc., and Morgan Stanley & Co. LLC and UBS Securities LLC, as representatives of the several underwriters named

therein, relating to the purchase of 2,000,000 shares of the Company’s 8.00% Series C Cumulative Redeemable Perpetual

Preferred Shares, par value $0.01 per share, liquidation preference $25.00 per share (filed as Exhibit 1.1 to the

Company’s Form 6-K (File No. 001-34077), filed on May 7, 2014, and incorporated by reference herein);

|

|

|

|

|

|

|

·

|

Specimen Copy of 8.00% Series D Cumulative Redeemable Perpetual Preferred Share Certificate (filed as Exhibit 4.1 to the Company’s Registration Statement on Form 8-A (File No. 001-34077), filed on June 30, 2014, and incorporated by reference herein);

|

|

|

|

|

|

|

·

|

Statement of Designation of the 8.00% Series D Cumulative Redeemable Perpetual Preferred Shares (Par Value $0.01 Per Share) (filed as Exhibit 3.4 to the Company’s Registration Statement on Form 8-A (File No. 001-34077), filed on June 30, 2014, and incorporated by reference herein);

|

|

|

|

|

|

|

·

|

Underwriting Agreement, dated as of June 23, 2014, by and among Safe Bulkers, Inc., Morgan Stanley & Co. LLC, UBS Securities LLC and each of the other underwriters named in Schedule A therein, relating to the purchase of 2,800,000 shares of the Company’s 8.00% Series D Cumulative Redeemable Perpetual Preferred Shares, par value $0.01 per share, liquidation preference $25.00 per share (filed as Exhibit 1.1 to the Company’s Form 6-K (File No. 001-34077), filed on June 30, 2014, and incorporated by reference herein);

|

|

|

|

|

|

|

·

|

Purchase Agreement, dated as of April 12, 2011 between Safe Bulkers, Inc., Morgan Stanley &

Co. Incorporated and Merrill Lynch, Pierce, Fenner & Smith Incorporated, relating to the purchase of 5,000,000 shares Common

Stock (filed as Exhibit 1.1 to the Company’s Form 6-K (File No.

001-34077

),

filed on April 15, 2011, and incorporated by reference herein);

|

|

|

|

|

|

|

·

|

Purchase Agreement, dated March 13, 2012, between Safe Bulkers, Inc., Morgan Stanley & Co.

LLC, and Merrill Lynch, Pierce, Fenner & Smith Incorporated, relating to the purchase of 5,000,000 shares Common Stock (filed

as Exhibit 1.1 to the Company’s Form 6-K (File No.

001-34077

),

filed on March 16, 2012, and incorporated by reference herein);

|

|

|

|

|

|

|

·

|

Underwriting Agreement, dated as of November 13, 2013, by and among Safe Bulkers, Inc., and Morgan

Stanley & Co. LLC as representatives of the several underwriters named therein, , relating to the purchase of 5,000,000 shares

Common Stock (filed as Exhibit 1.1 to the Company’s Form 6-K (File No.

001-34077

),

filed on November 18, 2013, and incorporated by reference herein); and

|

|

|

|

|

|

|

·

|

Underwriting Agreement, dated as of December 6, 2016, by and among Safe Bulkers, Inc., Stifel,

Nicolaus & Company, Incorporated, DNB Markets, Inc. and each of the other underwriters named in Schedule A therein, for whom

Stifel, Nicolaus & Company, Incorporated and DNB Markets, Inc. are acting as representatives, relating to the purchase of 13,600,000

shares Common Stock (filed as Exhibit 1.1 to the Company’s Form 6-K (File No.

001-34077

),

filed on December 9, 2016, and incorporated by reference herein).

|

|

Item 6.

|

Purposes of the Transaction and Plans or Proposals.

|

(a) Purposes.

The information set

forth in the Offer to Exchange under the heading “Questions and Answers about the Exchange Offer—What is the purpose

of the Exchange Offer?” is incorporated by reference herein.

(b) Use of Securities Acquired.

The Series B Preferred Shares acquired in the Exchange Offer will be cancelled. The information set forth in the Offer to Exchange

under the heading “The Exchange Offer—Tender of Series B Preferred Shares; Acceptance of Series B Preferred Shares

” is incorporated by reference herein.

(c) Plans.

The

information set forth in the Offer to Exchange under the heading “Risk Factors,” “Questions and Answers

about the Exchange Offer—What is the purpose of the Exchange Offer?”, “Questions and Answers about the

Exchange Offer—Will the Series B Preferred Shares remain listed on the NYSE following the consummation of the

Exchange Offer?” and “The Exchange Offer—Subsequent Repurchases of Series B Preferred Shares” is

incorporated by reference herein.

|

Item 7.

|

Source and Amount of Funds or Other Consideration.

|

(a) Source of Funds.

The information

set forth in the Offer to Exchange under the heading “The Exchange Offer—Source and Amount of Funds” is incorporated

by reference herein.

(b) Conditions.

Not applicable.

(d) Borrowed Funds.

Not applicable.

|

Item 8.

|

Interest in Securities of the Subject Company.

|

(a) Securities Ownership.

The information

set forth in the Offer to Exchange under the heading “Share Ownership of Directors and Executive Officers” is incorporated

by reference herein.

(b) Securities Transactions.

On

November 24, 2015, the Company announced a share repurchase program under which it may from time to time purchase Series B Preferred

Shares or other preferred shares for up to $20.0 million in the aggregate on the open market. Rule 14e-5 under the Exchange Act

prohibits us and our affiliates from purchasing Series B Preferred Shares outside of the Exchange Offer from the time that the

Exchange Offer is first announced until the expiration of the Exchange Offer, subject to certain exceptions. In addition, Rule

13e-4 under the Exchange Act us and our affiliates from purchasing any Series B Preferred Shares other than pursuant to the Exchange

Offer until ten business days after the date of expiration of the Exchange Offer, subject to certain exceptions.

The following repurchases of our

Series B Preferred Shares have been effected by the Company in the past 60 days:

|

Purchaser

|

Date of Purchase

|

Number of Shares

|

Price per Share

|

Type of Transaction

|

|

Safe Bulkers, Inc.

|

1/20/2017

|

200

|

$23.49

|

Open Market

|

|

Safe Bulkers, Inc.

|

1/20/2017

|

2,300

|

$23.50

|

Open Market

|

|

Safe Bulkers, Inc.

|

1/25/2017

|

249

|

$23.15

|

Open Market

|

|

Safe Bulkers, Inc.

|

1/26/2017

|

1,984

|

$23.50

|

Open Market

|

|

Safe Bulkers, Inc.

|

1/31/2017

|

2

|

$23.14

|

Open Market

|

|

Safe Bulkers, Inc.

|

2/15/2017

|

100

|

$23.50

|

Open Market

|

On June 22, 2016, the Company announced

a share repurchase program under which it may from time to time purchase up to 2,000,000 shares of Common Stock in the aggregate

on the open market. Rule 14e-5 under the Exchange Act prohibits us and our affiliates from purchasing Common Stock outside of the

Exchange Offer from the time that the Exchange Offer is first announced until the expiration of the Exchange Offer, subject to

certain exceptions. In addition, Rule 13e-4 under the Exchange Act prohibits us and our affiliates from purchasing any Common Stock

other than pursuant to the Exchange Offer until ten business days after the date of expiration of the Exchange Offer, subject to

certain exceptions.

None of the Company, its subsidiaries

or the Company’s or its subsidiaries’ executive officers or directors have effected any transactions with respect to

the Common Stock in the past 60 days.

|

Item 9.

|

Persons/Assets, Retained, Employed, Compensated or Used.

|

(a)

We have not employed or retained

and will not pay any commission or other remuneration to any broker, dealer, salesman or other person for making recommendations

and soliciting tenders of Series B Preferred Shares. The information set forth in the Offer to Exchange under the heading “The

Exchange Offer—Terms of the Exchange Offer” is incorporated by reference herein.

|

Item 10.

|

Financial Statements.

|

(a) Financial Information.

|

|

(1)

|

The consolidated financial statements and other information set forth under Part II, Item 18 of the Company’s Annual Report on Form 20-F for the fiscal year ended December 31, 2016 (the “Annual Report”), are incorporated by reference herein and can also be accessed electronically on the SEC’s website at http://www.sec.gov.

|

|

|

|

|

|

|

(2)

|

Not applicable.

|

|

|

|

|

|

|

(3)

|

The information set forth in the Offer to Exchange under the heading “Ratio of Earnings to Combined Fixed Charges and Preferred Distributions” is incorporated by reference herein.

|

|

|

(4)

|

At December 31, 2016, book value per Series B Preferred Shares of the Company was $25.00.

|

(b) Pro Forma Information.

Not

applicable.

|

Item 11.

|

Additional Information.

|

(a) Agreements, Regulatory Requirements

and Legal Proceedings.

|

|

(1)

|

The information set forth in the Offer to Exchange under the

heading “Share Ownership of Directors and Executive Officers” is incorporated by reference herein. The

information set forth under the heading “Major Shareholders and Related Party Transactions” in the

Company’s Annual Report is incorporated by reference herein.

|

|

|

|

|

|

|

(2)

|

The information set forth in the Offer to Exchange under the heading “The Exchange Offer—Certain Legal and Regulatory Matters” is incorporated by reference herein.

|

|

|

|

|

|

|

(3)

|

Not applicable.

|

|

|

|

|

|

|

(4)

|

Not applicable.

|

|

|

|

|

|

|

(5)

|

Not applicable.

|

(c) Other Material Information

.

Not applicable.

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

(a)(1)(A)

|

|

Offer to Exchange, dated March 9, 2017.

|

|

|

|

|

|

(a)(1)(B)

|

|

Letter of Transmittal to the holders of Series B Preferred Shares, dated March 9, 2017.

|

|

|

|

|

|

(a)(1)(C)

|

|

Form of Letter to Brokers, Dealers and Other Securities Intermediaries.

|

|

|

|

|

|

(a)(1)(D)

|

|

Form of Letter to Clients for use by Brokers, Dealers and Other Securities Intermediaries.

|

|

|

|

|

|

(a)(3)

|

|

Not applicable.

|

|

|

|

|

|

(a)(4)

|

|

Not applicable.

|

|

|

|

|

|

(a)(5)(A)

|

|

Press release.

|

|

|

|

|

|

(b)

|

|

Not applicable.

|

|

|

|

|

|

(d)(1)(A)

|

|

Specimen Copy of 8.00% Series B Cumulative Redeemable Perpetual Preferred Share Certificate (filed as Exhibit 4.1 to

the Company’s Registration Statement on Form 8-A (File No. 001-34077), filed on June 18, 2013, and incorporated by

reference herein).

|

|

|

|

|

|

(d)(1)(B)

|

|

Statement of Designation of 8.00% Series B Cumulative Redeemable Perpetual Preferred Shares (Par Value $0.01 Per Share)

(filed as Exhibit 3.4 to the Company’s Registration Statement on Form 8-A (File No. 001-34077), filed

on June 18, 2013, and incorporated by reference herein).

|

|

|

|

|

|

(d)(1)(C)

|

|

Underwriting Agreement, dated as of June 6, 2013, by and among Safe Bulkers, Inc., and Incapital LLC and DNB Markets, Inc., as representatives of the several underwriters named therein, relating to the purchase of 800,000 shares of the Company?s 8.00% Series B Cumulative Redeemable Perpetual Preferred Shares, par value $0.01 per share, liquidation preference $25.00 per share (filed as Exhibit 1.1 to the Company?s Form 6-K (File No. 001-34077), filed on June 13, 2013, and incorporated by reference herein).

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

d(2)

|

|

Shareholder Rights Agreement, dated as of May 14, 2008, between Safe Bulkers. Inc. and American Stock Transfer & Trust Company LLC (filed as Exhibit 10.5 to the Company’s Registration Statement on Form F-1 (File No. 333-150995), filed on May 16, 2008, and incorporated by reference herein).

|

|

|

|

|

|

d(3)

|

|

Form of Registration Rights Agreement between Safe Bulkers,

Inc. and Vorini Holdings Inc. (filed as Exhibit 4.2 to the Company’s Registration Statement on Form F-1/A (File No. 333-150995),

filed on May 23, 2008, and incorporated by reference herein).

|

|

|

|

|

|

d(4)

|

|

Specimen Common Share Certificate (filed as Exhibit 4.1 to the Company’s Registration Statement on Form F-1 (File No. 333-150995), filed on May 16, 2008, and incorporated by reference herein).

|

|

|

|

|

|

d(5)

|

|

Specimen Copy of 8.00% Series C Cumulative Redeemable Perpetual Preferred Share Certificate (filed as Exhibit 4.1 to the Company’s Registration Statement on Form 8-A (File No. 001-34077), filed on May 7, 2014, and incorporated by reference herein).

|

|

|

|

|

|

d(6)

|

|

Statement of Designation of the 8.00% Series C Cumulative Redeemable Perpetual Preferred Shares (Par Value $0.01 Per Share) (filed as Exhibit 3.4 on the Company’s Form 8-A (File No. 001-34077), filed on May 7, 2014, and incorporated by reference herein).

|

|

|

|

|

|

d(7)

|

|

Underwriting Agreement, dated as of April 30, 2014, by and among Safe Bulkers, Inc., and Morgan Stanley & Co. LLC and UBS Securities LLC, as representatives of the several underwriters named therein, relating to the purchase of 2,000,000 shares of the Company’s 8.00% Series C Cumulative Redeemable Perpetual Preferred Shares, par value $0.01 per share, liquidation preference $25.00 per share (filed as Exhibit 1.1 to the Company’s Form 6-K (File No. 001-34077), filed on May 7, 2014, and incorporated by reference herein).

|

|

|

|

|

|

d(8)

|

|

Specimen Copy of 8.00% Series D Cumulative Redeemable Perpetual Preferred Share Certificate (filed as Exhibit 4.1 to the Company’s Registration Statement on Form 8-A (File No. 001-34077), filed on June 30, 2014, and incorporated by reference herein).

|

|

|

|

|

|

d(9)

|

|

Statement of Designation of the 8.00% Series D Cumulative Redeemable Perpetual Preferred Shares (Par Value $0.01 Per Share) (filed as Exhibit 3.4 on the Company’s Form 8-A (File No. 001-34077), filed on June 30, 2014, and incorporated by reference herein).

|

|

|

|

|

|

d(10)

|

|

Underwriting Agreement, dated as of June 23, 2014, by and

among Safe Bulkers, Inc., Morgan Stanley & Co. LLC, UBS Securities LLC and each of the other underwriters named

in Schedule A therein, relating to the purchase of 2,800,000 shares of the Company’s 8.00% Series D Cumulative

Redeemable Perpetual Preferred Shares, par value $0.01 per share, liquidation preference $25.00 per share (filed as Exhibit

1.1 to the Company’s Form 6-K (File No. 001-34077), filed on June 30, 2014, and incorporated by reference herein).

|

|

|

|

|

|

(d)(11)

|

|

Purchase Agreement, dated as of April 12, 2011 between

Safe Bulkers, Inc., Morgan Stanley & Co. Incorporated and Merrill Lynch, Pierce, Fenner & Smith Incorporated, relating

to the purchase of 5,000,000 shares Common Stock (filed as Exhibit

1.1 to the Company’s Form 6-K (File No. 001-34077),

filed on April 15, 2011, and incorporated by reference herein).

|

|

|

|

|

|

(d)(12)

|

|

Purchase Agreement, dated March 13, 2012, between Safe

Bulkers, Inc., Morgan Stanley & Co. LLC, and Merrill Lynch, Pierce, Fenner & Smith Incorporated, relating to the purchase

of 5,000,000 shares Common Stock (filed as Exhibit 1.1 to the Company’s Form 6-K (File No. 001-34077),

filed on March 16, 2012, and incorporated by reference herein).

|

|

|

|

|

|

(d)(13)

|

|

Underwriting Agreement, dated as of November 13, 2013,

by and among Safe Bulkers, Inc., and Morgan Stanley & Co. LLC as representatives of the several underwriters named therein,

relating to the purchase of 5,000,000 shares Common Stock (filed as Exhibit 1.1 to the Company’s

Form 6-K (File No. 001-34077),

filed on November 18, 2013, and incorporated by reference herein).

|

|

|

|

|

|

(d)(14)

|

|

Underwriting Agreement, dated as of December 6, 2016, by

and among Safe Bulkers, Inc., Stifel, Nicolaus & Company, Incorporated, DNB Markets, Inc. and each of the other underwriters

named in Schedule A therein, for whom Stifel, Nicolaus & Company, Incorporated and DNB Markets, Inc. are acting as representatives,

relating to the purchase of 13,600,000 shares Common Stock (filed as Exhibit 1.1

to the Company’s Form 6-K (File No. 001-34077),

filed on December 9, 2016, and incorporated by reference herein).

|

|

|

|

|

|

(g)

|

|

Not applicable.

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

(h)

|

|

Not applicable.

|

|

Item 13.

|

Information Required by Schedule 13E-3

|

Not applicable.

SIGNATURE

After due inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

SAFE BULKERS, INC.

|

|

|

|

|

|

|

|

Date: March 9, 2017

|

By:

|

/s/ Dr. Loukas Barmparis

|

|

|

|

Name:

|

Dr. Loukas Barmparis

|

|

|

|

Title:

|

President

|

|

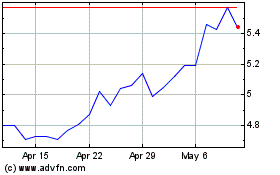

Safe Bulkers (NYSE:SB)

Historical Stock Chart

From Mar 2024 to Apr 2024

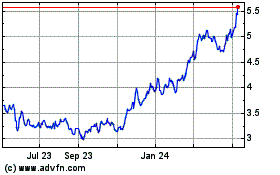

Safe Bulkers (NYSE:SB)

Historical Stock Chart

From Apr 2023 to Apr 2024