As filed with the Securities and Exchange Commission on March 9, 2017

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

HELIOS AND MATHESON ANALYTICS INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

7380

|

|

13-3169913

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Primary Standard Industrial Classification Code Number)

|

|

(I.R.S. Employer Identification No.)

|

Empire State Building, 350 Fifth Avenue

New York, New York 10118

(212) 979-8228

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Theodore Farnsworth

Chief Executive Officer

Helios and Matheson Analytics Inc.

Empire State Building, 350 Fifth Avenue

New York, New York 10118

(212) 979-8228

(Name, address, including zip code, and telephone number, including area code, of agent for service)

with copies to:

Kevin Friedmann, Esq.

Mitchell Silberberg & Knupp LLP

11377 West Olympic Boulevard

Los Angeles, California 90064

(310) 312-3106

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement, as determined by market conditions and other factors.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

(Do not check if a smaller reporting company)

|

|

Smaller reporting company ☒

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered(1)

|

Amount to be

Registered(1)

|

Proposed

Maximum

Offering Price

per Unit(3)

|

Proposed

Maximum

Aggregate

Offering Price(3)

|

Amount of

Registration Fee

|

|

|

|

|

|

|

|

Common Stock, $0.01 par value

|

3,332,075(2)

|

$2.945

|

$9,812,960.88

|

$1,137.32

|

(1) Pursuant to Rule 416 of the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers such additional number of shares of common stock that may become issuable as a result of any stock splits, stock dividends, or other similar transactions.

(2) Represents shares issuable upon conversion of the Senior Secured Convertible Notes of Helios and Matheson Analytics Inc. issued to the selling security holder on February 8, 2017.

(3) Estimated solely for the purpose of computing the registration fee. The proposed maximum offering price per share and maximum aggregate offering price for the shares being registered hereby are calculated in accordance with Rule 457(c) under the Securities Act using the average of the high and low sales price per share of our common stock on March 8, 2017, as reported on the Nasdaq Capital Market.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling security holder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated March 9, 2017

PROSPECTUS

3,332,075

shares of common stock

This prospectus relates to the resale by the selling security holder of up to 3,332,075 shares of our common stock, $0.01 par value per share, issuable to the selling security holder upon conversion of principal and interest under the Senior Secured Convertible Notes, in the aggregate principal amount of $5,681,818 accruing interest at the rate of 6% per annum, issued to the selling security holder on February 8, 2017 (the “Convertible Notes”).

We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of shares by the selling security holder.

The selling security holder may sell the shares of common stock described in this prospectus in a number of different ways and at varying prices. See “Plan of Distribution” for more information about how the selling security holder may sell the shares of common stock being registered.

We will pay the expenses incurred in registering the shares, including legal and accounting fees.

Our common stock is listed on the Nasdaq Capital Market under the symbol “HMNY.” On March 8, 2017, the closing price of our common stock as reported by the Nasdaq Capital Market was $3.10 per share.

An investment in our common stock involves a high degree of risk. See “Risk Factors” on page 9 of this prospectus for more information on these risks.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2017.

TABLE OF CONTENTS

|

|

Page

|

|

|

|

|

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

|

1

|

|

OUR BUSINESS

|

2

|

|

RISK FACTORS

|

9

|

|

USE OF PROCEEDS

|

13

|

|

SELLING SECURITY HOLDER

|

13

|

|

PLAN OF DISTRIBUTION

|

14

|

|

LEGAL MATTERS

|

16

|

|

EXPERTS

|

16

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

17

|

|

INFORMATION INCORPORATED BY REFERENCE

|

17

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

18

|

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference, may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Forward-looking statements in this prospectus include, without limitation, statements related to our plans, strategies, objectives, expectations, intentions and adequacy of resources. Investors are cautioned that such forward-looking statements involve risks and uncertainties including, without limitation, the following: (i) our plans, strategies, objectives, expectations and intentions are subject to change at any time at our discretion; (ii) our plans and results of operations will be affected by our ability to manage competition; and (iii) other risks and uncertainties indicated from time to time in our filings with the Securities and Exchange Commission, or SEC. Important factors that could cause actual results to differ materially from those indicated in the forward-looking statements include, but are not limited to,

|

|

●

|

our capital requirements and whether or not we will be able to raise capital when we need it;

|

|

|

●

|

changes in local, state or federal regulations that will adversely affect our business;

|

|

|

●

|

our ability to retain our existing clients and market and sell our services to new clients;

|

|

|

●

|

whether we will continue to receive the services of certain officers and directors;

|

|

|

●

|

our ability to protect our intellectual property and operate our business without infringing upon the intellectual property rights of others;

|

|

|

|

|

|

|

●

|

our ability to integrate the operations of Zone Technologies, Inc. into our operations and our ability to successfully develop the RedZone Map™ application;

|

|

|

●

|

our ability to effectively react to other risks and uncertainties described from time to time in our filings with the Securities and Exchange Commission, such as fluctuation of quarterly financial results, reliance on third party consultants, litigation or other proceedings and stock price volatility; and

|

|

|

●

|

other uncertainties, all of which are difficult to predict and many of which are beyond our control.

|

In some cases, you can identify forward-looking statements by terminology such as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘could,’’ ‘‘expects,’’ ‘‘plans,’’ ‘‘intends,’’ ‘‘anticipates,’’ ‘‘believes,’’ ‘‘estimates,’’ ‘‘predicts,’’ ‘‘potential,’’ or ‘‘continue’’ or the negative of such terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We do not undertake any obligation to publicly update or review any forward-looking statement.

In this prospectus, unless the context otherwise requires, references to “we,” “us,” “our,” “our company”, “the Company” or “Helios” refer to Helios and Matheson Analytics Inc. and its subsidiaries.

OUR BUSINESS

This is only a summary and may not contain all the information that is important to you. You should carefully read this prospectus and any other offering materials, together with the additional information described under the heading “Where You Can Find More Information”.

About Helios and Matheson Analytics Inc.

Since 1983, we have provided high quality IT services and solutions to Fortune 1000 companies and other large organizations.

Rapid technological advances and the wide acceptance and use of the Internet as a driving force in commerce accelerated the growth of the IT industry. These advances, including more powerful and less expensive computer technology, fueled the transition from predominantly centralized mainframe computer systems to open and distributed computing environments and the advent of capabilities such as relational databases, imaging, software development productivity tools, and web-enabled software. These advances expand the benefits that users can derive from computer-based information systems and improve the price-to-performance ratios of such systems. As a result, an increasing number of companies are employing IT in new ways, often to gain competitive advantages in the marketplace, and IT services have become an essential component of many companies’ long-term growth strategies. The same advances that have enhanced the benefits of computer systems rendered the development and implementation of such systems increasingly complex, popularizing the partnering with IT service providers like us for application development, support and related services.

In the past 6 to 8 years, we have seen a significant change in the volume, velocity and variety of data due to emerging technologies in computing power and with the proliferation and use of smart phones. This has unleashed the potential of Big Data, a collection of data sets so large and complex that it becomes difficult to process using on-hand database management tools or traditional data processing applications. The amount of data in the world is growing fast. Traditional digital databases are challenged to capture, store, search, share, analyze, and visualize this data deluge. Companies are relentlessly innovating to satisfy the increasingly demanding 21st century customer who lives many lives at once – online, mobile, global, local, blurring the lines between work and play, spoilt for choice and hungry for meaning and connection. It is now essential for business and IT organizations to work hand-in-hand to truly leverage the potential of Big Data – deepen customer engagement, realize operational efficiencies and essentially institutionalize data driven decision making.

We endeavor to provide high-quality, value-based offerings in the areas of application value management, application development, integration, independent validation, infrastructure and information management and analytics services. We believe that our integrated service of Big Data technology, advanced analytics and data visualization empowers our clients to unlock the value of data to make better decisions.

Our clients consist primarily of Fortune 1000 companies and other large organizations. Our clients and prospective clients operate in a diverse range of industries and historically have been concentrated in the banking, financial services, insurance and healthcare industries. Our goal is to realize consistent growth and competitive advantage through the following strategic initiatives:

|

|

●

|

Expand Existing Client Market Share.

We are endeavoring to expand our penetration and market share within our existing client base through client focused sales and marketing initiatives allowing us to offer existing clients a broad suite of technology and analytics services.

|

|

|

●

|

Expand Client Base.

One of our goals is to expand our client base, particularly in the financial services sector. We are endeavoring to broaden the geography of our client base by offering services to many of our existing clients in their offices outside New York and New Jersey and using such contacts as a gateway into new geographies. During the second quarter of 2016, we began working with credit unions in Silicon Valley, California to transform their current systems to include data analytics and insights that will enhance the customer experience and modernize their legacy systems. We are also working with Terafina to implement an Omni Channel Sales and Service platform for the largest credit union in southeastern Washington state to help grow the credit union’s membership and enhance its relationships with its existing members.

|

|

|

●

|

Global Delivery.

We are dedicated to providing a flexible delivery model to our clients, which allows for dynamically configurable “right shoring” of service delivery based on each client’s needs.

|

|

|

●

|

Operational Efficiency.

We keep a tight rein on discretionary expenditures and selling, general and administrative expenses to enhance our competitiveness.

|

|

|

●

|

Merger with Zone Technologies, Inc.

Through the merger with Zone Technologies, Inc. (“Zone”), which we completed on November 9, 2016, we intend to leverage our artificial intelligence capabilities and deep learning and analytics expertise to enable RedZone Map, a fully functioning app available in the App Store and Google Play Store, to further enhance and expand its crime mapping capabilities globally. We believe that integrating our technology with RedZone Map will allow for a faster, more accurate and more precise mapping application. We intend to employ the latest tools to ingest crime data and to classify, normalize and unify the data as single source of truth (SSOT) to be analyzed using deep machine learning and artificial intelligence techniques to generate context related signals and draw insights.

|

Zone is the developer of the proprietary RedZone Map, a GPS-driven, real-time crime and navigation map application whose goal is to enhance personal safety worldwide by providing users with real time crime data and a platform for alerting other users to criminal and other safety related occurrences in a navigation map format. Zone’s mapping lets users be pro-active when traveling, allowing them to enter a number of different cautionary items such as traffic problems, police sightings, road hazards, accidents and road closures. It also allows users to report a crime and to video upload live incidents.

Zone’s business model has four components. The first component is providing user access to public safety information. Zone’s goal is to enhance the personal safety of its users by providing crime data to anyone using a mobile or stationary mapping application for navigation. Zone also provides tools for examining such things as neighborhoods for possible relocation, schools to attend, travel planning and lodging selection. The second component, when implemented, will provide enterprise business solutions, such as choosing a route for trucking and delivery services based on crime mapping analytics. The third component, when implemented, will be geared towards providing law enforcement agencies with tools to better understand crime patterns and to engage with their jurisdiction(s) more meaningfully. The fourth component, when implemented, will be to work with governmental agencies using advanced mapping and geo-fencing for counter-terrorism efforts.

Recent Developments

Sale of Senior Secured Convertible Notes

The Convertible Notes

On February 8, 2017 (the “Closing Date”), pursuant to a Securities Purchase Agreement (“SPA”) that we entered into on February 7, 2017 with an institutional investor (the “Investor” and sometimes referred to in this prospectus as the “selling security holder”), we sold and issued two Senior Secured Convertible Notes to the Investor, one in the principal amount of $681,818 (the “Initial Note”) and the other in the principal amount of $5,000,000 (the “Additional Note”), for an aggregate principal amount of $5,681,818 (each, a “Note” and collectively, the “Convertible Notes”) for consideration consisting of a secured promissory note payable by the Investor to the Company (the “Investor Note”) in the principal amount of $5,000,000 (the “Purchase Price Balance”) (collectively, the “Note Financing”). The proceeds from the sale of the Convertible Notes will be used for general corporate purposes of the Company and Zone. Unless earlier converted or redeemed, the Convertible Notes mature 8 months from the Closing Date. The Convertible Notes bear interest at a rate of 6% per annum, subject to an increase to 12% during the first 30 days following the occurrence and continuance of an Event of Default, as defined in the Convertible Notes, and to 18% thereafter. Interest on the Convertible Notes will be payable in arrears commencing on April 1, 2017 and on the first Trading Day of each calendar quarter thereafter and, so long as the Equity Conditions, as defined in the Convertible Notes, have been satisfied, may be paid in shares of common stock at the Company’s option. The Company may also elect to pay interest in whole or in part in cash. Interest on the Convertible Notes is computed on the basis of a 360-day year and twelve 30-day months.

The Investor may, at any time, elect to convert the Convertible Notes into shares of the Company’s common stock at the Conversion Price, subject to certain beneficial ownership limitations. For the Initial Note, the Conversion Price is defined as $4.00. For the Additional Note, the Conversion Price is defined as $4.50. The Conversion Price of the Convertible Notes is subject to proportionate adjustment for stock splits, dividends and combinations. The Company may, with the consent of the Investor, reduce the then-current Conversion Price to any amount equal to or greater than the Floor Price ($4.00) and for any period of time deemed appropriate by the Company’s Board of Directors.

Alternatively, the Investor may, at any time, elect to convert the Convertible Notes into shares of the Company’s common stock at the Alternate Conversion Price instead of the Conversion Price, subject to certain beneficial ownership limitations. The “Alternate Conversion Price” is defined in the Initial Note as that price which is the lower of (i) the applicable Conversion Price as in effect on the applicable Conversion Date of the applicable Alternate Conversion and (ii) $4.00 and in the Additional Note is defined as the greater of (I) the Floor Price and (II) 85% of the quotient of (x) the sum of the volume weighted average price (“VWAP”) of the Company’s common stock for each of the 5 consecutive trading days ending and including the trading day immediately preceding the delivery or deemed delivery of the applicable conversion notice, divided by (y) 5.

If and to the extent the Investor elects to convert the Initial Note, the Investor will elect to convert the Initial Note at the applicable Conversion Price of $4.00 per share (which is the same as the Alternate Conversion Price of the Initial Note).

We expect that, if and to the extent the Investor elects to convert the Additional Note, the Investor will elect to convert the Additional Note at the applicable Alternate Conversion Price if the preceding 5-trading day average VWAP of our common stock is less than the Conversion Price ($4.50) (unless the Company has, with the consent of the Investor, reduced the Conversion Price to a price lower than the applicable Alternate Conversion Price), whereas we expect that the Investor will convert the Additional Note at the Conversion Price ($4.50) if the preceding 5-trading day average VWAP of our common stock is equal to or greater than the Conversion Price ($4.50). Accordingly, in the case of voluntary conversions of the Additional Note by the Investor, in effect, the Conversion Price serves as the ceiling price and the applicable Alternate Conversion Price serves as the floor price at which the Additional Notes will be converted.

If the Equity Conditions are satisfied, the Company may require the holder of the Convertible Notes to convert all or any part of the Convertible Notes, up to the Maximum Mandatory Share Amount and the Maximum Mandatory Conversion Amount (each, a “Mandatory Conversion”). If on the fifth trading day immediately following a Mandatory Conversion Date and on each fifth trading day thereafter through and including the fifteenth trading day immediately following such Mandatory Conversion Date (each, a “True-Up Date”) the True-Up Price is less than the applicable Mandatory Conversion Price, the Company must deliver to the holder of the Convertible Notes an additional number of shares of the Company’s common stock equal to the difference between the number of shares of common stock delivered to the holder as a result of the Mandatory Conversion and the number of shares determined by dividing the principal, interest and late charges converted by the True-Up Price. The “True-Up Price” is defined as 85% of the lowest VWAP of the Company’s common stock on the trading day with the lowest VWAP during the 15 consecutive trading days following the Mandatory Conversion.

“Mandatory Conversion Date” means the third trading day following the delivery by the Company of a Mandatory Conversion Notice.

“Mandatory Conversion Price” means, with respect to any Mandatory Conversion that price which shall be the lowest of (i) the applicable Conversion Price as in effect on the applicable Mandatory Conversion Date, (ii) 80% the sum of (A) the VWAP of the Company’s common stock for each of the 3 trading days with the lowest VWAP of the Company’s common stock during the 20 consecutive trading day period ending on and including the trading day immediately prior to the applicable Mandatory Conversion Date, divided by (B) 3.

“Maximum Mandatory Share Amount” with respect to any Mandatory Conversion Date means 100% of the quotient of (x) the sum of the composite aggregate daily share trading volume of the Company’s common stock for each trading day during the 5 trading day period ending and including the trading day immediately prior to the applicable Mandatory Conversion Notice Date, divided by (y) 5.

“Maximum Mandatory Conversion Amount” with respect to any Mandatory Conversion Date means the difference of (x) $500,000 less (y) the sum of each Conversion Amount converted under the applicable Convertible Note during the 5 trading day period ending and including the applicable Mandatory Conversion Date.

Under the terms of a Registration Rights Agreement with the Investor, the Company is required to register for resale the shares of common stock that are issuable upon conversion of the Convertible Notes, additional shares that could be used as payment of monthly interest plus an additional number of shares so that the total number of shares of common stock registered equals 125% of the sum of the maximum number of shares issuable upon conversion of the Convertible Notes. The Registration Rights Agreement requires the Company to file the registration statement within 30 days after the Closing Date and to have the registration statement declared effective 90 days after the Closing Date (or 120 days after the Closing Date if the registration statement is subject to review by the Securities and Exchange Commission). The Company is required to keep the registration statement effective (and the prospectus contained therein available for use) pursuant to Rule 415 for resales on a delayed or continuous basis at then-prevailing market prices at all times until the earlier of (i) the date as of which the holders of the Convertible Notes may sell all of the common stock issuable pursuant thereto without restriction pursuant to Rule 144 or (ii) the date on which all of the common stock covered by the registration statement shall have been sold.

The Investor Note

The Investor Note will be payable in full by the Investor on October 8, 2017, which is eight months from the Closing Date. The Investor’s obligation to pay the Company the Purchase Price Balance pursuant to the Investor Note is secured by $5,000,000, in the aggregate, in cash, cash equivalents, any Group of Ten (“G10”) currency and any notes or other securities issued by any G10 country belonging to the Investor and provides for full recourse against the Investor in the event of a default from the failure of the Investor to pay the principal and interest when due or as a result of either a court entering a decree or order, or the Investor filing a petition or being the subject of an involuntary petition, under any applicable bankruptcy, insolvency or other similar law. The Company will receive a payment of principal and interest upon each voluntary or mandatory prepayment of the Investor Note. On or after February 28, 2017 (or earlier if the Company permits), the Investor may, at its option and at any time, voluntarily prepay the Investor Note, in whole or in part. The Investor Note is also subject to mandatory prepayment, in whole or in part, upon the occurrence of one or more of the following mandatory prepayment events:

(1) Mandatory Prepayment upon Conversion of Initial Note – At any time the Investor has converted $681,818 or more in principal amount of the Initial Note, the Investor will be required to prepay the Investor Note, on a dollar-for-dollar basis, for each subsequent conversion of the Additional Note.

(2) Mandatory Prepayment upon Mandatory Prepayment Notices – The Company may require the Investor to prepay the Investor Note by delivering a mandatory prepayment notice to the Investor, subject to (i) the satisfaction of the Equity Conditions, and (ii) the Investor’s receipt of a valid written notice by the Company electing to effect a mandatory conversion of Restricted Principal (defined as $5,000,000 of the principal amount of the Convertible Notes), not in excess of the Maximum Mandatory Share Amount or the Maximum Mandatory Conversion Amount.

The Investor Note also contains certain optional offset rights, which if exercised, would reduce the amount outstanding under the Additional Note and the Investor Note by the same amount and, accordingly, the cash proceeds received by the Company. These offset rights are triggered by specific occurrences that could jeopardize the Investor’s investment and include the following:

(i)

Optional Offset Right

: On or after March 1, 2017, if an Equity Conditions Failure, as defined in the Convertible Notes, exists, the Investor is entitled to satisfy any principal and related accrued and unpaid interest owed under the Investor Note in full by cancelling an equal amount of principal amount under the Additional Note.

(ii)

Event of Default Offset

: The Investor may, at any time on or after the occurrence of any Event of Default under the Additional Note, but prior to the date of cure thereof, satisfy all or any part of the principal due pursuant to the Investor Note by cancelling an equal amount of principal due pursuant to the Additional Note. Furthermore, in the event of a Bankruptcy Event of Default, as defined in the Convertible Notes, all of the principal and related accrued and unpaid interest of the Investor Note will be automatically satisfied in full by the deemed automatic surrender and concurrent cancellation of the outstanding obligations under the Additional Note equal to the portion of principal being satisfied.

(iii)

Automatic Offset Upon Prohibited Transfer of the Investor Note

. If for any reason the Additional Note or any interest therein is pledged, assigned or transferred to any person other than the Company without the prior written consent of the Investor, including by contract, operation of law, court order or otherwise, then, (i) all of the outstanding principal of the Investor Note will be automatically deemed satisfied in full, (ii) 75% of the remaining Restricted Principal will be automatically cancelled (with the remaining 25% of the Restricted Principal of the Additional Note automatically becoming unrestricted principal thereunder), and (iii) the Investor Note will be deemed to be paid in full and will be null and void.

Upon any of the foregoing offsets, any accrued and unpaid interest under the Investor Note shall be automatically cancelled with respect to the portion of the principal of the Investor Note being offset.

The Company, if it so chooses, is entitled to reduce the principal of the Investor Note, and any accrued but unpaid interest, by any cash amount then due and payable by the Company to the Investor under the Additional Note. This offset right allows the Company to satisfy any redemption amount or any other cash obligations then due and payable under the Additional Note.

The Additional Note also includes an offset right in favor of the Company. At any time no Equity Conditions Failure exists, the Company has the right to redeem all of the Conversion Amount then remaining under the Additional Note in cash at a price equal to 115% of the Conversion Amount being redeemed. Any Restricted Principal may be offset and reduced on a dollar for dollar basis by the surrender for cancellation of the portion of the Investor Note equal to the amount of Restricted Principal included in the Company’s redemption.

As of March 8, 2017, $681,818 is the amount of unpaid unrestricted principal amount of the Convertible Notes that we owe to the selling security, which is equal to the principal amount of the Initial Note.

The above does not purport to be a complete description of the Note Financing and is qualified in its entirety by reference to the full text of the documents which are attached as exhibits 10.1 through 10.8 to our Current Report on Form 8-K filed with the Securities and Exchange Commission on February 7, 2017 and which are incorporated by reference herein.

Potential Profit from Conversion of the Convertible Notes at the Option of the Selling Security Holder

The following table sets forth the potential profit to be realized upon conversion by the selling security holder of the Convertible Notes based on the Conversion Price on the Closing Date and the closing price of our common stock on the Closing Date:

|

Per share market price as of February 8, 2017

|

|

$

|

3.71

|

|

|

Per share Conversion Price as of February 8, 2017 (Initial Note)

|

|

$

|

4.00

|

|

|

Per share Conversion Price as of February 8, 2017 (Additional Note)

|

|

|

4.50

|

|

|

Total shares underlying Convertible Notes based on the Conversion Prices

|

|

|

1,332,831

|

*

|

|

Aggregate market value of underlying shares based on per share market price as of February 8, 2017

|

|

$

|

4,944,803

|

|

|

Aggregate Conversion Price of underlying shares

|

|

$

|

5,909,103

|

*

|

|

Aggregate cash purchase price for the Convertible Notes

|

|

$

|

5,000,000

|

|

|

Total premium to market price of underlying shares

|

|

None**

|

|

*Based on the principal amount of $681,818 of the Initial Note (converted at $4.00 per share) and $5,000,000 of the principal amount of the Additional Note (converted at $4.50 per share) and interest for a period of 8 months in the amount of $27,272 accrued at the rate of 6% on the principal amount of the Initial Note (converted at $4.00 per share) and at the rate of 6% on the principal amount of the Additional Note (converted at $4.50 per share).

** Based on per share market price as of February 8, 2017

Alternate Right of Conversion: Number of Shares Issuable in Satisfaction of the Convertible Notes Based on Various Assumed Alternate Conversion Prices

The Conversion Price and the Alternate Conversion Price are each designated in the Initial Note as $4.00, therefore the number of shares of common stock that could be issued upon the conversion of principal and interest under the Initial Note will not change based on the market price of our common stock prior to each installment date. We have computed the number of shares of common stock that could be issued upon conversion of the principal and interest under the Initial Note to be 177,274. The following table reflects changes in the number of shares of common stock that could be issued upon conversion of the principal and interest under the Additional Note, based on changes to the market price of our common stock.

|

Assumed Alternate Conversion Price**

|

|

Number of

Shares

Potentially

Issuable.*

|

|

|

|

|

|

|

|

|

Initial Conversion Price ($4.50 per share)

|

|

|

1,155,557

|

|

|

$4.35

|

|

|

1,195,403

|

|

|

$4.25

|

|

|

1,223,530

|

|

|

$4.15

|

|

|

1,253,013

|

|

|

Alternate Conversion Price ($4.00 per share)

|

|

|

1,300,000

|

|

*Based on the principal amount of $5,000,000 and interest in the amount of $200,000 accrued at the rate of 6% on the entire principal amount over a period of 8 months.

**Assumes the Alternate Conversion Price remains the same throughout the entire installment payment period, which is unlikely to occur because the Alternate Conversion Price applicable to each installment payment will be based on the market price of our common stock prior to each such installment date.

Payments to Selling Security Holder

In connection with the Convertible Notes, we are or may be required to make the following payments to the selling security holder:

|

Payee

|

|

Maximum

Interest

Payments(1)

|

|

|

Maximum

Event of

Default

Redemption(2)

|

|

|

Maximum

Change of

Control

Redemption(3)

|

|

|

Maximum

Registration

Penalties(4)

|

|

|

At Maturity(5)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling security holder

|

|

$

|

227,273

|

|

|

$

|

7,919,034

|

|

|

$

|

6,527,614

|

|

|

$

|

1,317,481

|

|

|

$

|

5,846,091

|

|

(1) Represents the maximum amount of interest payable by us to the selling security holder under the Convertible Notes assuming (a) that all installment payments of interest thereunder are timely made (beginning with the first installment payment due on April 1, 2017) and that no installment payments are accelerated or deferred, (b) that no payments of interest will be made prior to the first installment date, (c) that the Convertible Notes are not otherwise converted prior to the maturity date, (d) that interest is paid in cash and (e) that no event of default thereunder occurs. The Convertible Notes have a term of 8 months.

(2) Represents the cash amount that would be payable by us if we were required to redeem the Convertible Notes as a result of an Event of Default assuming (a) that the applicable premium to be applied upon the event of default is 125%, (b) that the event of default occurs on the Closing Date, and (c) that the required payments continue until October 8, 2017. The Convertible Notes bear interest at a rate of 6% per annum, subject to an increase to 12% during the first 30 days following the occurrence and continuance of an Event of Default and to 18% thereafter.

(3) Represents the cash amount that would be payable by us if we were required to redeem the Convertible Notes as a result of a change of control assuming (a) that the applicable premium to be applied upon the change of control under the Initial Note is 125% and the applicable premium to be applied upon the change of control under the Additional Note is 110% and (b) that the Change of Control Redemption occurs with respect to repayment of all principal and accrued interest through the maturity date of the Convertible Notes.

(4) Represents the maximum monetary penalties and interest that would be payable if we failed to timely file, obtain a declaration of effectiveness or maintain the effectiveness with respect to the registration statement required under the Registration Rights Agreement we signed in conjunction with the Note Financing. Assumes that (a) the monetary penalties accrue on March 10, 2017 (30 days after the Closing Date), (b) the monetary penalties continue to accrue for a period of 7 months, until October 8, 2017, and (c) the monetary penalties will not be paid until October 8, 2017. For purposes of this calculation, we have used $3.71, the market price of the common stock on the Closing Date.

(5) The term of the Convertible Notes is 8 months. This number represents the maximum amounts payable in cash at maturity and assumes there is no redemption due to an Event of Default or change of control and that the Investor Note in the amount of $5,000,000 is fully paid by the selling security holder to the Company prior to the time of maturity.

Net Proceeds from Private Offering of Convertible Notes

The following table sets forth the gross proceeds received from the private offering of the Convertible Notes and calculates the net proceeds thereof after deduction of the anticipated payments pursuant to the Convertible Notes and related documents. The gross and net proceeds are presented as if the Investor Note has been fully paid, thereby turning the $5,000,000 of Restricted Principal under the Additional Note into unrestricted principal that may be converted into shares of common stock or that is otherwise payable to the Investor upon maturity of the Additional Note. The net proceeds do not include the payment of any contingent payments, such as liquidated damages or repayment premiums in the case of an Event of Default or a change of control. The net proceeds assumes that all interest and principal will be paid in cash and that all interest payments are timely made (beginning with the first interest payment on April 1, 2017), notwithstanding that we may pay (and are expected to pay) interest and principal in shares of our common stock under specified circumstances. The interest amount reflected below assumes that all installment payments are made when due without any Event of Default, and the table assumes that none of the Convertible Notes are converted prior to maturity. Based on the foregoing assumptions, the net proceeds represent approximately 84.5% of the gross proceeds.

|

Gross proceeds

|

|

$

|

5,000,000

|

|

|

Approximate aggregate interest payments

|

|

$

|

227,273

|

|

|

Approximate transaction costs paid in cash

|

|

$

|

150,000

|

|

|

Placement agent fee

|

|

$

|

400,000

|

*

|

|

Net proceeds

|

|

$

|

4,222,727

|

|

*Fees are paid to the placement agent as and when the Investor makes a payment of the Investor Note. This number does not include the value of warrants issuable to the placement agent as partial payment for the placement agent services.

Comparison of Issuer Proceeds to Potential Investor Profit

The following table summarizes the potential proceeds we will receive pursuant to the Convertible Notes. The gross and net proceeds are presented as if the Investor Note has been fully paid, thereby turning the Restricted Principal of $5,000,000 under the Additional Note into unrestricted principal that may be converted into shares of common stock or that is otherwise payable to the selling security holder upon maturity of the Additional Note. For purposes of this table, we have assumed that the Convertible Notes will be held by the selling security holder through the maturity date and converted at the Alternate Conversion Price floor of $4.00 per share for the Initial Note and $4.50 per share for the Additional Note.

|

Amount of Convertible Notes issued to the selling security holder

|

|

$

|

5,681,818

|

|

|

Total gross proceeds payable to us (1)

|

|

$

|

5,000,000

|

|

|

Payments that have been made or may be required to be made by us until maturity (2)

|

|

$

|

227,273

|

|

|

Net proceeds to us assuming maximum payments made by us (without deduction for transaction costs) (3)

|

|

$

|

4,772,727

|

|

|

Total possible profit to the selling security holder (4)

|

|

$

|

909,091

|

|

|

Percentage of profit over gross proceeds (5)

|

|

|

18.2

|

%

|

(1) Gross proceeds payable to us under the Investor Note received by us as payment for the Convertible Notes.

(2) Total possible payments (excluding repayment of principal) payable by us to the selling security holder assuming the Convertible Notes remain outstanding until the maturity date and that interest is paid in cash. Assumes that no liquidated damages are incurred and that no redemption premium on the Convertible Notes will be applicable.

(3) Total net proceeds to us calculated by subtracting the amount in line 3 from the amount in line 2.

(4) This number represents the total possible profit to the selling security holder if all principal and accrued interest through maturity of the Convertible Notes are repaid in full in cash in the event the Investor does not elect to convert the Convertible Notes into Common Stock due to the market price of the Common Stock being lower than the applicable Alternate Conversion Price.

(5) Percentage of the total possible profit to the selling security holder as calculated in line 5 compared to the maximum gross proceeds paid by the Investor as disclosed in line 2.

Other Information

As of the date of this prospectus, we do not believe that we will have the financial ability to make all payments on the Convertible Notes in cash when due. Accordingly, we intend, as of the date of this prospectus, to make such payments in shares of our common stock to the greatest extent possible.

The selling security holder has advised us that it may enter into short sales in the ordinary course of its business of investing and trading securities. The selling security holder has agreed in the SPA that, so long as the selling security holder holds any Convertible Note, during certain periods designated in the SPA the selling security holder will not maintain a “short position” in our common stock.

Except as described below, we have not had any material relationships or arrangements with the selling security holder, its affiliates, or any person with whom the selling security holder has a contractual relationship regarding the Note Financing (or any predecessors of those persons).

On September 7, 2016 we sold Senior Secured Convertible Notes (the “September 2016 Notes”) to the selling security holder in the principal amount of $4,301,075 for consideration consisting of a cash payment by the selling security holder in the amount of $1,000,000 together with a secured promissory note payable by the selling security holder in the principal amount of $3,000,000. As of January 24, 2017, the September 2016 Notes were satisfied in full by the conversion of $4,301,075 in principal and $47,499 in accrued interest into an aggregate of 887,707 shares of our common stock and the payment in cash of $1,660 in interest. We received $4,000,000 in gross proceeds from the sale of the September 2016 Notes. The selling security holder paid $1,000,000 in cash on September 7, 2016 and made the following prepayments in accordance with the terms of the $3,000,000 promissory note: $1,000,000 on October 25, 2016; $1,100,000 on November 16, 2016; and $900,000 on December 2, 2016.

On December 2, 2016 we sold Senior Secured Convertible Notes (the “December 2016 Notes”) to the selling security holder in the amount of $6,720,000, consisting of an initial note in the amount of $1,820,000 (the “Initial December 2016 Note”) and an additional note in the amount of $4,900,000, for consideration consisting of a cash payment by the selling security holder in the amount of $1,100,000 together with a secured promissory note payable by the selling security holder in the principal amount of $4,900,000 (the “December 2016 Investor Note”). As of March 8, 2017, the selling security holder has converted a total of $1,525,000 in principal and $7,091.66 in accrued interest under the December 2016 Notes into an aggregate of 383,046 shares of our common stock. There remains registered for resale pursuant to our Registration Statement on Form S-3 (file number 333-215313), which the Commission declared effective on January 13, 2017, a total of 4,346,3213 shares of our common stock that may be issued pursuant to the December 2016 Notes. As of March 8, 2017, we have received $4,100,000 in gross proceeds from the sale of the December 2016 Notes. The selling security holder paid $1,100,000 in cash on December 2, 2016 and on February 8, 2017 made a prepayment of $3,000,000 in accordance with the terms of the December 2016 Investor Note.

As of March 8, 2017, $3,295,000 is the amount of unpaid unrestricted principal amount of the December 2016 Notes that we owe to the selling security, which represents the amount of the Initial December 2016 Note ($1,820,000) plus the amount we have received thus far as payment under the December 2016 Investor Note ($3,000,000) minus the principal amount of the December 2016 Notes converted thus far ($1,525,000).

Corporate Information

Our executive offices are located at The Empire State Building, 350 Fifth Avenue, New York, New York 10118, and our telephone number is (212) 979-8228. Additional information about us is available on our website at www.hmny.com. The information contained on or that may be obtained from our website is not, and shall not be deemed to be, a part of this prospectus. Our common stock, par value $0.01 per share, is currently traded on The Nasdaq Capital Market under the ticker symbol “HMNY”.

For a description of our business, financial condition, results of operations and other important information regarding us, we refer you to our filings with the SEC incorporated by reference in this prospectus. For instructions on how to find copies of these documents, see “

Where You Can Find More Information

.”

RISK FACTORS

Investing in our common stock involves a high degree of risk. Please see the risk factors set forth in Part I, Item 1A of our most recent Annual Report on Form 10-K and in Part II, Item 1A of our Quarterly Reports on Form 10-Q and other filings we make with the SEC, which are incorporated by reference in this prospectus. Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations. These risks could materially affect our business, results of operations or financial condition and cause the value of our securities to decline.

Risks Related to this Offering and our Common Stock

The sale of a substantial amount of our common stock in the public market by the selling security holder has adversely affected, and could continue to adversely affect, the prevailing market price of our common stock.

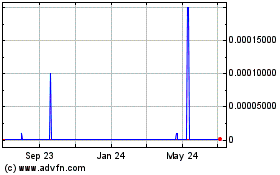

Prior to the sale of the September 2016 Notes, we had 2,330,438 shares of common stock issued and outstanding and on September 6, 2016 the closing price of our common stock was $9.46 per share. As of March 8, 2017 we had 5,861,191 shares of common stock issued and outstanding and the closing sale price of our common stock on that date was $3.10. Pursuant to the resale registration statement on Form S-3 (file number 333-213775) declared effective by the SEC on October 24, 2016, we initially registered 1,432,410 shares of common stock for the selling security holder in connection with the sale of the September 2016 Notes. We subsequently deregistered 544,703 shares of common stock from that registration statement after satisfying the September 2016 Notes in full by issuing 887,707 shares of common stock and payment in cash of $1,660 in interest. The selling security holder has since sold all 887,707 shares that it received upon conversion of the September 2016 Notes.

We also registered 3,926,293 shares of our common stock on Form S-3 (file number 333-215313 ) in connection with the sale of the December 2016 Convertible Notes, which registration statement was declared effective by the SEC on January 13, 2017. As of March 8, 2017, the selling security holder has sold or may have sold up to 383,046 shares of our common stock that it received upon conversion of the December 2016 Convertible Notes.

Assuming the registration statement of which this prospectus is a part is declared effective by the SEC, any shares registered for resale by and issued to the selling security holder will be generally available for immediate resale. On October 24, 2016, the closing price of our common stock was $9.80 per share. On October 25, 2016, the closing price of our common stock was $7.11 per share. Our stock price has generally declined since October 25, 2016 and continued sales of substantial amounts of shares of our common stock in the public market by the selling security holder, or the perception that such sales might occur, could continue to adversely affect the market price of our common stock.

The price of our common stock may be volatile, and the market price of our common stock may decrease.

The per share price of our common stock may vary from time to time. Even if an active market for our stock continues, our stock price nevertheless may be volatile. Market prices for securities of technology companies have historically been particularly volatile. The factors that may cause the market price of our common stock to fluctuate include, but are not limited to:

|

|

●

|

progress, or lack of progress, in developing and commercializing Zone’s RedZone Map technology;

|

|

|

●

|

our ability to recruit and retain qualified IT personnel;

|

|

|

●

|

changes in the perception of investors and securities analysts regarding the risks to our business or the condition of our business;

|

|

|

●

|

changes in our relationships with key clients;

|

|

|

●

|

changes in the market valuation or earnings of our competitors or companies viewed as similar to us;

|

|

|

●

|

changes in key personnel;

|

|

|

●

|

changes in our capital structure, such as future issuances of securities or the incurrence of debt;

|

|

|

●

|

the granting or exercise of employee stock options or other equity awards;

|

|

|

●

|

general market and economic conditions.

|

In addition, the equity markets have experienced significant price and volume fluctuations that have affected the market prices for the securities of technology companies for a number of reasons, including reasons that may be unrelated to our business or operating performance. These broad market fluctuations may result in a material decline in the market price of our common stock and you may not be able to sell your shares at prices you deem acceptable. In the past, following periods of volatility in the equity markets, securities class action lawsuits have been instituted against public companies. Such litigation, if instituted against us, could result in substantial cost and the diversion of management attention.

While we are no longer a controlled company, Helios and Matheson Information Technology Ltd. and Theodore Farnsworth, our two largest stockholders (the “Majority Stockholders”), together own approximately 59.4% of our issued and outstanding voting securities. This concentration of stock ownership gives them substantial influence over us and could delay or prevent a change in corporate control.

As the holders of approximately 59.4% of our common stock, the Majority Stockholders control the outcome of matters submitted to our stockholders for approval, including the election of directors and any merger, consolidation or sale of all or substantially all of our assets. In addition, the Majority Stockholders have significant influence over our management and affairs, particularly Mr. Farnsworth, who is our Chief Executive Officer and the Chairperson of our Board of Directors. This concentration of ownership might harm the market price of our common stock by:

|

|

●

|

delaying, deferring or preventing a change in control;

|

|

|

●

|

impeding a merger, consolidation, takeover or other business combination involving us; or

|

|

|

●

|

discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of us.

|

Our ongoing investment in new technology is inherently risky, and could disrupt our business.

To remain competitive and grow we must continue to invest in new products and technologies and explore strategic investments. There is no assurance that these investment endeavors will be successful or that the products and technologies developed by these investments will be well received by the users. As our competitors use or develop new technologies, competitive pressures may force us to invest in developing or implementing new technologies at a substantial cost. We cannot be certain that we will be able to develop or implement technologies on a timely basis or at a cost that is acceptable to us. If we fail to develop or implement new technologies in a cost-effective manner, our operations and financial condition may be adversely affected.

Risks Related to Our Merger with Zone Technologies, Inc.

The failure to successfully develop and monetize the RedZone app may adversely affect our future results of operations.

We believe that the acquisition of Zone will result in certain benefits, most importantly expanding our business to offer the RedZone app, an innovative new product. However, we may fail to realize the anticipated benefits of the merger for a variety of reasons including, but not limited to, the failure to quickly complete the development of the RedZone app, the failure of consumers to use the RedZone app, an inability to successfully monetize the RedZone app and the loss of key personnel, particularly loss of the services of Theodore Farnsworth. We anticipate that we will be required to invest a significant amount of time and money in developing and monetizing the RedZone app which, if our efforts are unsuccessful, may not be recovered. Our failure to successfully develop and monetize the RedZone app may adversely affect our results of operations.

If we fail to successfully integrate Zone into our internal control over financial reporting, the integrity of our financial reporting could be compromised which could result in a material adverse effect on our reported financial results.

As a private company, Zone was not subject to the requirements of the Securities Exchange Act of 1934, as amended, with respect to internal control over financial reporting. The integration of Zone into our internal control over financial reporting may require significant time and resources from our management and other personnel and may increase our compliance costs. If we fail to successfully integrate these operations, our internal control over financial reporting may not be effective. Failure to achieve and maintain an effective internal control environment could have a material adverse effect on our ability to accurately report our financial results and the market’s perception of our business and stock price.

Loss of the services of Theodore Farnsworth could have a material adverse effect on Zone’s operations.

Theodore Farnsworth is Zone’s founder and the developer of the RedZone app. Zone’s success largely depends on Mr. Farnsworth’s skills, experience and efforts. While we intend to enter into an employment contract with Mr. Farnsworth, he may terminate his employment at any time. The loss of Mr. Farnsworth’s services could harm our business.

We face intense competition. If we do not continue to innovate and provide top quality products and services that are useful to users, our operating results could be adversely affected.

Consumers have many map application choices like Google Maps and CrimeReports. While we believe that our offering of the RedZone app is unique given our advanced technology, crime data and navigation tool, there is no assurance that we may continue to incorporate the most advanced mapping and data technologies. Some of our competitors have greater financial, technical and personnel resources, which enable them to develop or use superior technologies and develop a user basis for their products and services that we are not able to afford. If our technologies become obsolete, we may be placed at a competitive disadvantage.

New technologies that block mobile advertising could adversely affect Zone’s business.

Zone’s long-term business model depends greatly on advertising revenue derived from fees paid to us by advertisers in connection with the display of advertisements. New technologies have been developed, and are likely to continue to be developed, that can block the display of online or mobile advertisements. As a result, advertisement-blocking technology could in the future adversely affect our operating results.

Any reduction in anticipated spending by advertisers could harm Zone’s business.

Advertising revenues are critical to Zone’s business model and if advertisers’ spending on online or mobile advertising is significantly reduced due to any political, economic, social or technological change or any other reason, our financial condition could be adversely affected.

Zone is reliant on crime data from several key providers. Should we experience difficulty in acquiring that data Zone’s business could be adversely affected.

Although our crime data comes from different sources, we have a few key providers. Should any of those providers discontinue providing data to us or we otherwise experience disruption in that pipeline, our operations may be adversely affected. If any of those providers require us to pay a much higher fee to use their data in the future, that could substantially drive up the costs of our services.

Zone’s business depends on mobile technology and continued, unimpeded access to Internet and wireless services. Adverse changes to that access could harm our business.

A few large companies provide wireless services to consumers. If our users’ access to Internet and wireless services is interfered with or limited due to any political, economic, social or technological reason, we may not be able to provide Zone’s services or may not be able to do so in an effective manner, including ensuring that Zone’s services will remain accessible within an acceptable load time. Failure to provide our services in a timely manner without interruption could generate consumer complaints and adversely affect our business.

Zone’s business model depends on branding and marketing and failure to maintain and expand its user base or maintain a positive image could harm our business.

We believe that continued marketing efforts will be critical to achieve widespread acceptance of Zone’s products. Our marketing campaigns may not be successful given the expense required. For example, failure to adequately maintain and develop Zone’s user base could cause our future revenue growth to decrease. In addition, RedZone Map provides navigation recommendations based on Zone’s database so that drivers can choose the safest routes. If Zone is subject to any criticism for inaccurate information or an unsound recommendation and such criticism negatively impacts the public perception of our technologies, products and services, that could harm our revenues and business.

Increased regulatory scrutiny, in particular, related to privacy and security issues may negatively impact Zone’s business.

Although we are not aware of any current or proposed federal, state or local laws or regulations that would have a material detrimental effect on Zone’s products, services or technologies, there may be increased legal and regulatory scrutiny on its data sources, technologies to process data and generate recommendations, the applicability of the recommendations and other aspects of its products, services or technologies. The increased legal and regulatory scrutiny may require us to make modifications or improvements to the current technologies we use or may otherwise increase our compliance costs, which may adversely affect Zone’s business.

In particular, the regulatory framework for privacy and security issues is evolving worldwide and is likely to remain in flux for the foreseeable future. Various government and consumer agencies have also called for new regulation and changes in industry practices. Practices regarding the collection, processing, storage, sharing, disclosure, use and security of personal and other information by companies offering online or mobile services is under increased public scrutiny. Zone’s business, including its ability to operate and expand in the United States and internationally or on new technology platforms, could be adversely affected if legislation or regulations are adopted, interpreted or implemented in a manner that is inconsistent with Zone’s current business practices and that require changes to these practices, the design of Zone’s website, mobile applications, products, features or Zone’s privacy policy. In particular, the success of our business will be driven by our ability to responsibly use the data that we collect from our key suppliers and other sources. Therefore, our business could be harmed by any significant change to applicable laws, regulations or industry standards or practices regarding the storage, use or disclosure of data we collect, or regarding the manner in which the express or implied consent of relevant persons for such use and disclosure is obtained. Such changes may require us to modify our products and features, possibly in a material manner, and may limit our ability to develop new products and features that make use of the data that we collect.

With an increasing user base and public awareness of our products and technologies and with potential promulgation of new laws or regulations, we could be subject to claims, lawsuits and other proceedings that may result in adverse outcomes.

Although we are committed to providing top quality products and services to our users and maintaining full compliance with applicable laws and regulations, there is no assurance that we will not be the subject of claims, lawsuits or other proceedings arising from our technologies, products or services, especially if any new laws or regulations are promulgated which may greatly increase the risk of litigation by users or third parties. Litigation could be costly and could divert us from focusing on our business operations. If any litigation occurs and results in an adverse outcome, it could negatively impact our public image and brand and have a detrimental effect on our expansion plans and operating results.

We may be subject to intellectual property claims, which are costly to defend and could result in and/or limit our ability to use certain technologies in the future.

A third party may sue us for infringing its intellectual property rights. Likewise, we may need to resort to litigation to enforce our intellectual property rights or to determine the scope and validity of third-party intellectual property rights. The cost to us of any litigation or other proceeding relating to intellectual property rights, even if resolved in our favor, could be substantial, and the litigation would divert our efforts from our business activities. If we do not prevail in this type of litigation, we may be required to pay monetary damages, stop commercial activities related to our products or obtain one or more licenses in order to secure the rights to continue marketing our products and services and using our technologies. Uncertainties resulting from the initiation and continuation of any litigation could limit our ability to continue some of our operations. In addition, a court may require that we pay expenses or damages.

If our security measures are breached, or if our services are subject to attacks that degrade or deny the ability of users to access our products and services, users may curtail or stop using our products and services, or we may be subject to protracted litigation, which could harm our business.

Any of our information security and processing systems, as well as third party data or network suppliers or our users, may experience damage or disruption of service from a number of causes, including power outages, computer and telecommunication failures, computer viruses, worms or other destructive software, internal design, manual or usage errors, cyber-attacks, terrorism, workplace violence or wrongdoing, catastrophic events, natural disasters and severe weather conditions. We may also become the target of malicious cyber-attack attempts. The security measures and procedures we, the third party suppliers and our users have in place to protect personal data and other information may not be successful or sufficient to counter all data breaches, cyber-attacks or system failures. Although we devote significant resources to our information security program and have implemented security measures to protect our systems and data, there can be no assurance that our efforts will prevent these known or unknown threats.

If our security measures are breached, we may incur significant expenses in addressing and resolving the resulting problems. If we are sued in connection with any data security breach, we could be subject to protracted litigation. If unsuccessful in defending such lawsuits, we may have to pay damages or change our business practices, any of which could harm our business. In addition, any reputational damage resulting from a data breach, cyber-attack or system failure could decrease the acceptance and use of our products and services, which could harm our prospective future growth.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of the offered shares by the selling security holder.

SELLING SECURITY HOLDER

The shares of common stock being offered by the selling security holder are those issuable to the selling security holder upon conversion of the Convertible Notes. We are registering the shares of common stock in order to permit the selling security holder to offer the shares for resale from time to time. Except for the purchase of the September 2016 Notes, the December 2016 Notes and the Note Financing described under “Recent Developments”, the selling security holder has not had any material relationship with us within the past three years.

The table below lists information regarding the beneficial ownership (as determined under Section 13(d) of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder) of the shares of common stock held by the selling security holder.

The second column lists the number of shares of common stock beneficially owned by the selling security holder as of March 8, 2017, based on the ownership of shares of common stock and assuming conversion of the Convertible Notes held by the selling security holder on that date, but taking account of any limitations on conversion set forth therein.

The third column lists the shares of common stock being offered by this prospectus by the selling security holder and does not take in account any limitations on conversion of the Convertible Notes set forth therein.

In accordance with the terms of a Registration Rights Agreement with the selling security holder, this prospectus generally covers the resale of, as of any given date, the sum of 125% of the maximum number of shares of common stock then issuable upon conversion of the Convertible Notes issued to the selling security holder, including conversion of interest on the Convertible Notes through the eighth month anniversary of the date of issuance, assuming the principal of the Convertible Notes (including interest on the Convertible Notes through the eighth month anniversary of the date of issuance) is converted in full (without regard to any limitations on conversion contained therein solely for the purpose of such calculation) at a conversion price equal to 50% of the conversion price of the Convertible Notes in effect on such given date and that the interest of the Convertible Notes is converted at the interest conversion price. Because the Mandatory Conversion Price of the Convertible Notes may differ from the Conversion Price in effect on such given date, the number of shares that will actually be issued may be more or less than the number of shares being offered by this prospectus.

The fourth column assumes the sale of all of the shares offered by the selling security holder pursuant to this prospectus.

Under the terms of the Convertible Notes, the selling security holder may not convert the Convertible Notes to the extent (but only to the extent) the selling security holder or any of its affiliates would beneficially own a number of shares of our common stock which would exceed (i) 9.99% of the outstanding shares of our common stock or (ii) the selling security holder’s pro rata portion of the aggregate number of shares of common stock which we may issue upon conversion of the Convertible Notes, as appropriate, or otherwise pursuant to the terms of the Convertible Notes without breaching our obligations under the rules or regulations of The Nasdaq Stock Market. The number of shares in the second column reflects these limitations. The selling security holder may sell all, some or none of its shares in this offering. See “Plan of Distribution.”

|

Name of Selling Security Holder

|

|

Number of Shares

of Common Stock

Owned Prior to

Offering

|

|

|

Maximum

Number of Shares

of Common Stock

t

o be Sold

Pursuant to this

Prospectus

|

|

|

Number of Shares

of Common Stock

of Owned After

Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hudson Bay Master Fund Ltd (1)

|

|

|

837,312

|

(2)

|

|

|

3,332,075

|

|

|

|

--

|

|

(1) Hudson Bay Capital Management, L.P., the investment manager of Hudson Bay Master Fund Ltd., has voting and investment power over these securities. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management, L.P. Each of Hudson Bay Master Fund Ltd. and Sander Gerber disclaims beneficial ownership over these securities.

(2) The Convertible Notes include a beneficial ownership limitation of 9.99% of the shares of common stock outstanding immediately after giving effect to any conversion. As of March 8, 2017 we had 5,861,191 shares of common stock outstanding. The number of shares reported in this column reflects the beneficial ownership limitation if the aggregate principal amount ($5,681,818) plus accrued interest at 6% per annum for 8 months ($227,273) were converted into 1,332,831 shares of common stock at the conversion prices of $4.00 under the Initial Note and $4.50 under the Additional Note and $5,195,000 in principal amount and $261,708 in interest were converted into 1,187,472 shares of common stock in satisfaction of the December 2016 Notes. However, pursuant to the Convertible Notes, if the selling security holder were to convert in full the aggregate principal amount of the Convertible Notes plus the accrued interest at the alternate conversion floor price of $4.00 per share without regard to the beneficial ownership limitations in the Convertible Notes, the selling security holder would receive a total of 1,420,455 shares of our common stock.

PLAN OF DISTRIBUTION

We are registering the shares of common stock issuable upon conversion of the Convertible Notes to permit the resale of these shares of common stock by the holder of the Convertible Notes from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling security holder of the shares of common stock. We will bear all fees and expenses incident to our obligation to register the shares of common stock.

The selling security holder may sell all or a portion of the shares of common stock held by it and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the shares of common stock are sold through underwriters or broker-dealers, the selling security holder will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of common stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions, pursuant to one or more of the following methods:

|

|

●