Current Report Filing (8-k)

March 09 2017 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 2, 2017

PennyMac Mortgage Investment Trust

(Exact name of registrant as specified in its charter)

|

Maryland

(State or other jurisdiction of incorporation)

|

|

001-34416

(Commission File Number)

|

|

27-0186273

(IRS Employer

Identification No.)

|

|

3043 Townsgate Road, Westlake Village, California

(Address of principal executive offices)

|

|

91361

(Zip Code)

|

Registrant’s telephone number, including area code:

(818) 224-7442

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

On March 9, 2017, in connection with the closing of the offering by PennyMac Mortgage Investment Trust, a Maryland real estate investment trust (the “Company”), of 4,600,000 shares of 8.125% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Shares of Beneficial Interest, liquidation preference $25.00 per share, $0.01 par value per share (the “Series A Preferred Shares”), PennyMac GP OP, Inc., a wholly-owned subsidiary of the Company and the general partner of PennyMac Operating Partnership, L.P., a Delaware limited partnership and the operating partnership of the Company (the “Operating Partnership”), amended the Operating Partnership’s Amended and Restated Limited Partnership Agreement (the “First Amendment”) to designate limited partnership units (the “Series A Preferred Units”) with substantially the same terms as the Series A Preferred Shares to be issued to the Company in exchange for the net proceeds from the Company’s sale of the Series A Preferred Shares.

A copy of the First Amendment is filed as Exhibit 10.1 to this Current Report on Form 8-K, and the information in the First Amendment is incorporated into this Item 1.01 by reference. The description of the terms of the First Amendment in this Item 1.01 is qualified in its entirety by reference to Exhibit 10.1.

Item 3.03. Material Modification to Rights of Security Holders.

On March 6, 2017, the Company filed Articles Supplementary (the “Articles Supplementary”) to the Company’s Declaration of Trust, as amended and restated (the “Declaration of Trust”), with the State Department of Assessments and Taxation of the State of Maryland. The Articles Supplementary classified and designated 5,290,000 shares of the Company’s authorized but unissued preferred shares of beneficial interest, par value $0.01 per share (“Preferred Shares”), as a separate class of Preferred Shares identified as the 8.125% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Shares of Beneficial Interest, with the preferences, conversion and other rights, voting powers, restrictions, limitations as to dividends and other distributions, qualifications, and terms and conditions of redemption as set forth in the Articles Supplementary. The Articles Supplementary became effective upon filing on March 6, 2017.

The Articles Supplementary provide that the Company will pay, when, as and if authorized by the Board of Trustees of the Company, cumulative cash dividends (i) from, and including, the date of original issuance of the Series A Preferred Shares (the “Original Issuance Date”) (which was March 9, 2017) to, but not including, March 15, 2024, at a fixed rate equal to 8.125% per annum based on the $25.00 per share liquidation preference, or $2.03125 per share, and (ii) from, and including, March 15, 2024 and thereafter, at a floating rate equal to three-month LIBOR plus a spread of 5.831% per annum based on the $25.00 per share liquidation preference. Dividends on the Series A Preferred Shares will be payable in arrears on the 15th day of March, June, September and December of each year (provided that if any dividend payment date is not a business day, then the dividend which would otherwise have been payable on that dividend payment date may be paid on the next succeeding business day). The first dividend on the Series A Preferred Shares is scheduled to be paid on June 15, 2017 in the amount of

2

$0.54167 per share and will represent accrual for more than the full quarterly period, covering the period from, and including, the Original Issuance Date to, but not including, June 15, 2017.

The Series A Preferred Shares will not be redeemable by the Company prior to March 15, 2024, except in connection with the Company’s qualification as a real estate investment trust for U.S. federal income tax purposes and except upon the occurrence of a Change of Control (as defined in the Articles Supplementary). On and after March 15, 2024, the Company may, at its option, upon not less than 30 nor more than 60 days’ written notice, redeem the Series A Preferred Shares, in whole or in part, at any time or from time to time, for cash at a redemption price of $25.00 per share, plus any accumulated and unpaid dividends thereon to, but not including, the redemption date.

In addition, upon the occurrence of a Change of Control, the Company may, at its option, upon not less than 30 nor more than 60 days’ written notice, redeem the Series A Preferred Shares, in whole or in part, within 120 days after the first date on which such Change of Control occurred, for cash at a redemption price of $25.00 per share, plus any accumulated and unpaid dividends thereon to, but not including, the redemption date.

The Series A Preferred Shares have no stated maturity and will not be subject to any sinking fund or mandatory redemption, and will remain outstanding indefinitely unless (i) the Company decides to redeem or otherwise repurchase the Series A Preferred Shares or (ii) the Series A Preferred Shares become convertible and are actually converted into the Company’s common shares of beneficial interest, $0.01 par value per share (“Common Shares”), in connection with a Change of Control by the holders of Series A Preferred Shares.

Upon the occurrence of a Change of Control, each holder of Series A Preferred Shares will have the right (unless, prior to the Change of Control Conversion Date (as defined in the Articles Supplementary), the Company has provided notice of its election to redeem some or all of the Series A Preferred Shares held by such holder, as described above, in which case such holder will have the right only with respect to Series A Preferred Shares that are not called for redemption) to convert some or all of the Series A Preferred Shares held by such holder on the Change of Control Conversion Date into a number of Common Shares per Series A Preferred Shares to be converted determined by a formula, in each case, on the terms and subject to the conditions described in the Articles Supplementary, including provisions for the receipt, under specified circumstances, of alternative consideration.

The Series A Preferred Shares rank, with respect to rights to the payment of dividends and the distribution of assets in the event of any liquidation, dissolution or winding up of the Company, (i) senior to all classes or series of Common Shares and to all other equity securities issued by the Company other than equity securities referred to in clauses (ii) and (iii) below; (ii) on a parity with all equity securities issued by the Company with terms specifically providing that those equity securities rank on a parity with the Series A Preferred Shares with respect to rights to the payment of dividends and the distribution of assets upon any liquidation, dissolution or winding up of the Company; and (iii) junior to all equity securities issued by the Company with terms specifically providing that those equity securities rank senior to the Series A Preferred Shares with respect to rights to the payment of dividends and the distribution of assets upon any

3

liquidation, dissolution or winding up of the Company.

The term “equity securities” in the foregoing does not include convertible or exchangeable debt securities.

The Series A Preferred Shares are subject to the restrictions on ownership and transfer set forth in Article VII of the Company’s Declaration of Trust. Except under the limited circumstances set forth in the Articles Supplementary, holders of the Series A Preferred Shares generally have no voting rights.

A copy of the Articles Supplementary and a specimen certificate for the Series A Preferred Shares are filed as Exhibits 3.1 and 4.1, respectively, to this Current Report on Form 8-K, and the information in the Articles Supplementary is incorporated into this Item 3.03 by reference. The description of the terms of the Articles Supplementary in this Item 3.03 is qualified in its entirety by reference to Exhibit 3.1.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information set forth above under Item 3.03 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 5.03.

Item 8.01. Other Events.

On March 2, 2017, the Company, the Operating Partnership and PNMAC Capital Management, LLC, a Delaware limited liability company and the manager of the Company (the “Manager”), entered into a Purchase Agreement (the “Purchase Agreement”) with Morgan Stanley & Co. LLC, Keefe, Bruyette & Woods, Inc. and RBC Capital Markets, LLC (collectively, the “Underwriters”), relating to the issuance and sale by the Company and the purchase by the Underwriters, severally, of 4,600,000 Series A Preferred Shares at a public offering price of $25.00 per share. Pursuant to the Purchase Agreement, the Company granted the Underwriters a 30-day option to purchase up to an additional 690,000 Series A Preferred Shares solely to cover over-allotments. The Company received net proceeds from the offering of approximately $111.2 million (or approximately $127.9 million if the Underwriters exercise in full their option to purchase additional Series A Preferred Shares), after deducting the underwriting discounts and commissions and the Company’s estimated expenses. The offering closed on March 9, 2017.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

1.1

|

|

Purchase Agreement, dated March 2, 2017, among the Company, the Operating Partnership, the Manager and Morgan Stanley & Co. LLC, Keefe, Bruyette & Woods, Inc. and RBC Capital Markets, LLC

|

|

|

|

|

|

3.1

|

|

Articles Supplementary classifying and designating the 8.125% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Shares of Beneficial Interest (incorporated by reference to Exhibit 3.2 of the Company’s Registration Statement on Form 8-A, filed on March 7, 2017)

|

4

|

4.1

|

|

Specimen Certificate for 8.125% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Shares of Beneficial Interest (incorporated by reference to Exhibit 4.1 of the Company’s Registration Statement on Form 8-A, filed on March 7, 2017)

|

|

|

|

|

|

5.1

|

|

Opinion of Venable LLP as to the legality of the 8.125% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Shares of Beneficial Interest

|

|

|

|

|

|

10.1

|

|

First Amendment to the Amended and Restated Limited Partnership Agreement of PennyMac Operating Partnership, L.P., dated as of March 9, 2017

|

|

|

|

|

|

23.1

|

|

Consent of Venable LLP (included in Exhibit 5.1)

|

5

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: March 9, 2017

|

PENNYMAC MORTGAGE INVESTMENT TRUST

|

|

|

|

|

|

|

By:

|

/s/ Andrew S. Chang

|

|

|

Name:

|

Andrew S. Chang

|

|

|

Title:

|

Senior Managing Director and

Chief Financial Officer

|

6

EXHIBIT INDEX

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

1.1

|

|

Purchase Agreement, dated March 2, 2017, among the Company, the Operating Partnership, the Manager and Morgan Stanley & Co. LLC, Keefe, Bruyette & Woods, Inc. and RBC Capital Markets, LLC

|

|

|

|

|

|

3.1

|

|

Articles Supplementary classifying and designating the 8.125% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Shares of Beneficial Interest (incorporated by reference to Exhibit 3.2 of the Company’s Registration Statement on Form 8-A, filed on March 7, 2017)

|

|

|

|

|

|

4.1

|

|

Specimen Certificate for 8.125% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Shares of Beneficial Interest (incorporated by reference to Exhibit 4.1 of the Company’s Registration Statement on Form 8-A, filed on March 7, 2017)

|

|

|

|

|

|

5.1

|

|

Opinion of Venable LLP as to the legality of the 8.125% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Shares of Beneficial Interest

|

|

|

|

|

|

10.1

|

|

First Amendment to the Amended and Restated Limited Partnership Agreement of PennyMac Operating Partnership, L.P., dated as of March 9, 2017

|

|

|

|

|

|

23.1

|

|

Consent of Venable LLP (included in Exhibit 5.1)

|

7

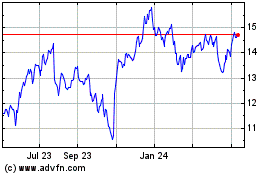

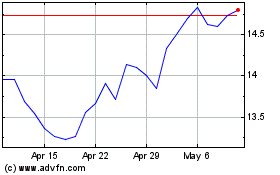

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Apr 2023 to Apr 2024