Current Report Filing (8-k)

March 09 2017 - 4:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 9, 2017

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

OHIO

|

|

001-11302

|

|

34-6542451

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

127 Public Square

Cleveland, Ohio 44114-1306

(Address of principal executive offices and zip code)

(216)

689-3000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

On March 9, 2017, KeyCorp (the “Company”) announced that all of its 7.75%

Non-Cumulative

Perpetual Convertible Preferred Stock, Series A (NYSE: KEY.G) (the “Series A Preferred Stock”) will convert into the Company’s common shares, par value $1.00 (“Common

Shares”). The effective date of the conversion will be March 20, 2017 (the “Mandatory Conversion Date”).

On the Mandatory Conversion

Date, holders of the Series A Preferred Stock will receive 7.0922 Common Shares for each share of Series A Preferred Stock. Cash will be paid in lieu of fractional Common Shares. There are currently 2,900,234 shares of Series A Preferred Stock

outstanding. No action by holders of the Series A Preferred Stock is required.

The Company previously announced that a dividend payment of $1.9375 per

share of Series A Preferred Stock was declared by the Board of Directors on January 12, 2017, payable on March 15, 2017 to holders of record on February 28, 2017. This dividend payment will be made in the customary manner.

All shares of the Series A Preferred Stock are held in book-entry form through The Depository Trust Company (“DTC”) and will be converted in

accordance with the procedures of DTC. Upon conversion, the Series A Preferred Stock will no longer be outstanding and all rights with respect to the Series A Preferred Stock will cease and terminate, except the right to receive the number of whole

Common Shares issuable upon conversion of the Series A Preferred Stock and any required

cash-in-lieu

of fractional shares. Upon conversion, the Series A Preferred Stock

will be delisted from trading on the New York Stock Exchange.

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

99.1

|

|

Press release dated March 9, 2017

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

KeyCorp

|

|

Date: March 9, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Donald R. Kimble

|

|

|

|

|

|

|

|

Donald R. Kimble

|

|

|

|

|

|

|

|

Chief Financial Officer

|

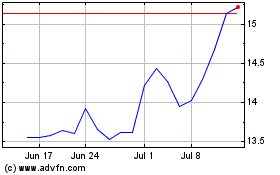

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

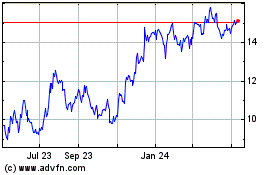

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Apr 2023 to Apr 2024