Marathon Oil to Sell Canadian Subsidiary for $2.5 Billion

March 09 2017 - 2:56AM

Dow Jones News

By WSJ Staff

Marathon Oil Corp. (MRO) said it would sell its Canadian

subsidiary, which includes the company's 20% interest in the

Athabasca Oil Sands Project to Royal Dutch Shell PLC (RDSA.LN) and

Canadian Natural Resources Ltd. (CNQ) for $2.5 billion in cash.

In a press release Thursday, Marathon Oil also said it would buy

about 70,000 net surface acres in the U.S.'s Permian Basin from BC

Operating Inc. and other entities for $1.1 billion in cash.

The Permian Basin deal, Marathon Oil said, includes 51,500 acres

in the Northern Delaware basin of New Mexico, and current

production is about 5,000 net barrels of oil equivalent a day.

Marathon Oil said the Canadian oil sands deal is expected to

close in mid-2017, while the Permian Basin deal will close in the

second quarter of 2017.

(END) Dow Jones Newswires

March 09, 2017 02:41 ET (07:41 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

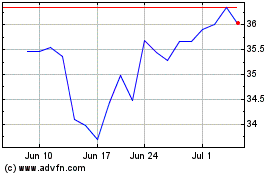

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

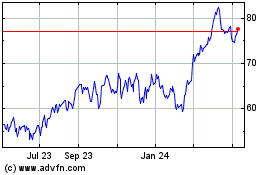

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Apr 2023 to Apr 2024