Interactive Brokers Group Announces Decision to Cease Options Market Making Activities

March 08 2017 - 4:52PM

Business Wire

Interactive Brokers Group, Inc. (NASDAQ GS:IBKR) today announced

that it will discontinue options market making activities globally,

which are conducted through its Timber Hill companies. The Company

expects to phase out these operations substantially over the coming

months. The Company intends to continue conducting certain trading

activities in stocks and related instruments.

Thomas Peterffy, Chairman and CEO, said, “Having initiated the

first automated option market making operation in the mid ’80s,

which grew into the largest such business on a global scale over

the next 25 years, it’s been painful for me to see it deteriorating

in the last few years. But we do not have a choice in this matter.

Today retail order-flow is purchased by large order internalizers

and joining them would represent a conflict we do not wish to have.

On the other hand, providing liquidity to sophisticated,

professional synthesizers of short-term fundamental, technical and

big data is not a profitable activity.

“We must focus on continuing to build our brokerage platform to

empower our customers with first rate execution and account

management capabilities at very low cost. This remains our mission,

to which we must devote our full attention. In retrospect, 40 years

of market making gave us the financial resources and the unique

expertise to develop our superior brokerage platform for cost and

execution sensitive, professional investors and traders, and to

give them the edge to successfully compete in the marketplace.”

Management expects to complete its comprehensive review of

facilities and staffing in the near future with the goal of

optimizing the deployment of the Company’s resources.

In connection with this shift toward electronic brokerage, we

plan to rebalance the composition of currencies in the GLOBAL, a

basket of 15 major currencies in which we hold our equity, by

increasing the relative weight of the U.S. dollar vs. the other

currencies to approximately 70% from its current approximately 47%

weight. The new composition will be effective at the close of

business on March 31, 2017 and the conversion to the new targeted

currency holdings will take place shortly thereafter.

About Interactive Brokers Group, Inc.:Interactive Brokers

Group affiliates provide automated trade execution and custody of

securities, commodities and foreign exchange around the clock on

over 120 markets in numerous countries and currencies from a single

IB Universal AccountSM to customers worldwide. We service

individual investors, hedge funds, proprietary trading groups,

financial advisors and introducing brokers. Our four decades of

focus on technology and automation has enabled us to equip our

customers with a uniquely sophisticated platform to manage

their investment portfolios at extremely low cost relative to the

financial services industry. We strive to provide our customers

with advantageous execution prices and trading, risk and portfolio

management tools, research facilities and investment products, all

at unusually low prices, positioning them to achieve superior

returns compared to our competitors.

Cautionary Note Regarding Forward-Looking Statements:The

foregoing information contains certain forward-looking statements

that reflect the Company’s current views with respect to certain

current and future events and financial performance. These

forward-looking statements are and will be, as the case may be,

subject to many risks, uncertainties and factors relating to the

Company’s operations and business environment which may cause the

Company’s actual results to be materially different from any future

results, expressed or implied, in these forward-looking statements.

Any forward-looking statements in this release are based upon

information available to the company on the date of this release.

The company does not undertake to publicly update or revise its

forward-looking statements even if experience or future changes

make it clear that any statements expressed or implied therein will

not be realized. Additional information on risk factors that could

potentially affect the Company’s financial results may be found in

the Company’s filings with the Securities and Exchange

Commission.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170308006416/en/

For Interactive Brokers Group,

Inc.Investors:Nancy Stuebe,

203-618-4070orMedia:Kalen Holliday,

203-913-1369

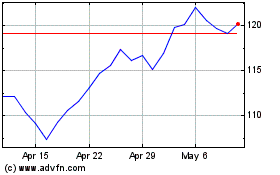

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

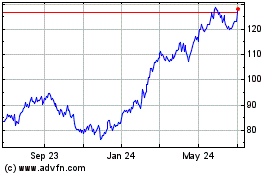

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Apr 2023 to Apr 2024