Arcadia Biosciences, Inc. (Nasdaq: RKDA), an agricultural

technology company that creates value for farmers while benefitting

the environment and enhancing human health, today released its

financial and business results for the fourth quarter and full year

of 2016.

The company’s loss from operations was $5.5 million in the

fourth quarter and $18.6 million for the full year of 2016 compared

to $4.1 million in the fourth quarter and $15.6 million for 2015.

Net loss attributable to common stockholders in the fourth quarter

and full year of 2016 was $5.7 million and $19.6 million, compared

to $3.9 million and $20.7 million for the comparable periods in

2015.

Cash on hand and investments at the end of the fourth quarter

totaled $53.1 million.

“2016 was a year of transition for Arcadia, as we focused on

high value yield and nutrition traits that we believe will deliver

near-term revenue,” said Raj Ketkar, president and CEO. “After a

comprehensive strategic review, in Q4 we realigned the organization

and operations to conserve cash, and we expect to see the benefits

of these changes in 2017.

“We will continue to work with our partners to advance our rich

pipeline of abiotic stress traits, such as nitrogen use efficiency,

water use efficiency and salinity tolerance,” he added.

Business and Technology Highlights

Arcadia made the following business and technical achievements

in the fourth quarter of 2016:

- SONOVA® GLA safflower oil use in pet food. Arcadia is

awaiting approval from the FDA on its regulatory submission for GLA

safflower oil use in pet food, which is expected to open a new

market for its highly concentrated SONOVA GLA product.

- Regulatory

submittal for HB4 soybeans in China. Through its Verdeca

joint venture with Bioceres, Arcadia submitted a regulatory dossier

in China for import approval of HB4 stress tolerant soybeans. The

trait has received regulatory approval in Argentina, with

additional approvals pending in Uruguay and the U.S.

- Kevin Comcowich

joined board of directors. Experienced business and

financial executive Kevin Comcowich joined Arcadia’s board of

directors on October 30, 2016. Comcowich most recently served as

the CEO and portfolio manager of HTX Energy Fund in Houston, Texas

and has extensive experience in investment management and global

capital market strategies. He will serve as an independent director

and member of the audit committee.

- Organizational

changes. Following a comprehensive strategic review of all

technology programs, partner progress and market conditions,

Arcadia realigned its organization to support near-term product

commercialization and preserve cash. This included a reduction in

workforce, management changes and consolidation of facilities to

reduce operating expenses by 15-20 percent

Since the close of the fourth quarter, Arcadia has announced the

following:

- Arcadia

Biosciences Obtains U.S. FDA GRAS Status for SONOVA® GLA Safflower

Oil. Arcadia followed FDA-proposed procedures to establish

its SONOVA® GLA safflower oil as GRAS under the intended conditions

of use. This process included convening an expert panel to review

the necessary product safety data and then submitting a

notification to the FDA.

- Study Shows

Arcadia’s Nitrogen Use Efficiency Trait Increases Yield in NERICA

Rice. In field evaluations over three growing seasons and in

both upland and lowland rice production systems, rice lines with

Arcadia’s NUE trait showed substantial yield increases under

different nitrogen application rates. The leading NUE rice line

showed a 34 percent increase over controls.

- Origin, Arcadia

Announce China Biotechnology Collaboration in Corn. Arcadia

announced a collaboration with Origin Agritech to deregulate insect

resistance/ herbicide tolerance traits in corn. The project

involves the first-ever export of a key corn biotechnology product

developed in China to the U.S., and Arcadia will assist Origin in

developing information for submission to regulatory authorities in

the U.S., China and other countries.

Arcadia Biosciences, Inc. Financial Snapshot

(Unaudited) ($ in thousands) Three

Months Ended December 31 Year Ended

December 31 2016 2015 % Favorable/

2016 2015 % Favorable/ (Unfavorable)

(Unfavorable)

Total Revenues 540 1,346 (60 %) 3,188 5,414

(41 %)

Total Operating Expenses 6,011 5,416 (11 %) 21,808

20,977 (4 %)

Loss From Operations (5,471 ) (4,070 ) (34 %)

(18,620 ) (15,563 ) (20 %)

Net Loss (5,708 ) (3,857 ) (48 %)

(19,624 ) (17,956 ) (9 %)

Net Loss Attributable to Common

Stockholders (5,708 ) (3,857 ) (48 %) (19,624 ) (20,727 ) 5 %

Revenues

In the fourth quarter of 2016, revenues were $540,000, compared

to revenues of $1.3 million in the fourth quarter of 2015. For

annual 2016, overall revenues decreased to $3.2 million compared to

$5.4 million during the same period of 2015. The

quarter-over-quarter and annual results were primarily impacted by

delays to the estimated commercialization dates within the

portfolio of license agreements as well as the conclusion of

certain contract research and government grant projects in

2015.

Operating Expenses

In the fourth quarter of 2016, operating expenses were $6.0

million, compared to $5.4 million in the fourth quarter of 2015.

For annual 2016, operating expenses were $21.8 million, compared to

$21.0 million during the same period in 2015. Research and

development (R&D) spending decreased by $303,000 in 2016, as a

result of reduced subcontract work, partially offset by increased

costs associated with Arcadia’s program in corn trait development

and commercialization initiated in early 2016. General and

administrative (SG&A) expenses increased by $1.1 million during

the same period, primarily due to severance costs associated with

the reductions in force.

Net Loss

Net loss for the fourth quarter of 2016 was $5.7 million,

compared to $3.9 million for the fourth quarter of 2015. Net loss

for the year was $19.6 million, compared to $18.0 million for

2015. The net loss in the fourth quarter of 2015 included the

effect of higher interest expense, and also was impacted by

non-cash adjustments to the value of financing-related

derivatives. Additionally, the fourth quarter of 2015 net loss

included the effect of a reduction to the income tax provision.

Net Loss Attributable to Common Stockholders

Net loss attributable to common stockholders for the fourth

quarter of 2016 was $5.7 million, compared to $3.9 million for the

fourth quarter of 2015. Net loss attributable to common

stockholders for the year was $19.6 million, compared to $20.7

million for 2015. The net loss attributable to stockholders

for 2015 included adjustments associated with preferred share

financing redemption rights and deemed dividends to a warrant

holder.

Per share net loss attributable to common stockholders for the

fourth quarter of 2016 was 13 cents, compared to 9 cents for the

fourth quarter of 2015, and 44 cents for 2016, compared to 73 cents

for 2015. The number of shares outstanding used to calculate the

per-share losses attributable to common stockholders for each

period is weighted and reflects the company’s change from a private

to a public company in May 2015.

Conference Call and Webcast

The company has scheduled a conference call for 4:30 p.m.

Eastern (1:30 p.m. Pacific) to discuss third-quarter and

year-to-date results and key strategic achievements.

Interested participants can join the conference call using the

following numbers:

U.S. Toll-Free Dial-In: +1-844-243-4690 International

Dial-In: +1-225-283-0138 Passcode: 68547235

A live webcast of the conference call will be available on the

“Investors” section of the Arcadia’s website at www.arcadiabio.com.

Following completion of the call, a recorded replay will be

available on the company’s investor website.

Safe Harbor Statement

“Safe Harbor” statement under the Private Securities Litigation

Reform Act of 1995: This press release and the accompanying

conference call contain forward-looking statements about the

company and its products, including statements relating to

components of the company’s long-term financial success and ongoing

plans; the company’s traits, commercial products, and

collaborations; and the company’s ability to manage the regulatory

processes for its traits and commercial products. Forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially, and reported results should

not be considered as an indication of future performance. These

risks and uncertainties include, but are not limited to: the

company’s and its partners’ ability to develop commercial products

incorporating its traits and to complete the regulatory review

process for such products; the company’s compliance with laws and

regulations that impact the company’s business, and changes to such

laws and regulations; and the company’s future capital requirements

and ability to satisfy its capital needs. Further information

regarding these and other factors that could affect the company’s

financial results is included in filings the company makes with the

Securities and Exchange Commission from time to time, including the

section entitled “Risk Factors” in the company’s Quarterly Report

on Form 10-Q for the quarter ended September 30, 2016 and

additional information that will be set forth in its Form 10-K for

the year ended December 31, 2016. These documents are or will be

available on the SEC Filings section of the Investor Relations

pages of the company’s website at www.arcadiabio.com. All

information provided in this release and in the attachments is as

of the date hereof, and Arcadia Biosciences, Inc. undertakes no

duty to update this information.

About Arcadia Biosciences, Inc.

Based in Davis, Calif., Arcadia Biosciences (Nasdaq: RKDA)

develops agricultural products that create added value for farmers

while benefitting the environment and enhancing human health.

Arcadia’s agronomic performance traits, including Nitrogen Use

Efficiency, Water Use Efficiency, Salinity Tolerance, Heat

Tolerance and Herbicide Tolerance, are all aimed at making

agricultural production more economically efficient and

environmentally sound. Arcadia’s nutrition traits and products are

aimed at creating healthier ingredients and whole foods with lower

production costs. For more information, visit

www.arcadiabio.com.

Arcadia Biosciences, Inc. Condensed Consolidated

Balance Sheets (Unaudited) (In thousands, except

share data) As of December 31, 2016

2015 Assets Current assets: Cash and cash

equivalents $ 2,013 $ 23,973 Short-term investments 48,547 26,270

Accounts receivable 349 706 Unbilled revenue 184 82 Inventories —

current 252 294 Prepaid expenses and other current assets

877 692 Total current assets 52,222 52,017 Property and

equipment, net 508 585 Inventories — noncurrent 1,327 1,867

Long-term investments 2,498 19,748 Other noncurrent assets

19 25 Total assets $ 56,574 $ 74,242

Liabilities and

stockholders’ equity Current liabilities: Accounts payable and

accrued expenses $ 2,359 $ 2,423 Amounts due to related parties 30

19 Unearned revenue — current 740 1,008 Total current liabilities

3,129 3,450 Notes payable 25,127 24,930 Unearned revenue —

noncurrent 3,120 2,637 Other noncurrent liabilities 3,000

3,000 Total liabilities 34,376 34,017

Stockholders’ equity: Common stock, $0.001 par value—400,000,000

shares authorized as of December 31, 2016 and December 31, 2015;

44,487,678 and 44,184,195 shares issued and outstanding as of

December 31, 2016 and December 31, 2015, respectively 44 44

Additional paid-in capital 173,723 172,222 Accumulated deficit

(151,550 ) (131,926 ) Accumulated other comprehensive loss

(19 ) (115 ) Total stockholders’ equity 22,198

40,225 Total liabilities and stockholders’ equity $ 56,574 $ 74,242

Arcadia Biosciences, Inc. Condensed Consolidated

Statements of Operations and Comprehensive Loss

(Unaudited) (In thousands, except share and per share

data) Year Ended December 31, 2016

2015 Revenues: Product $ 669 $ 466 License 144 1,216

Contract research and government grants 2,375 3,732

Total revenues (which includes $0 and $91

from related parties )

3,188 5,414 Operating expenses: Cost of product revenues 895 892

Research and development 8,663 8,966 Selling, general and

administrative 12,250 11,119 Total operating expenses

21,808 20,977 Loss from operations (18,620 ) (15,563

) Interest expense (1,319 ) (2,658 ) Other income, net 340 521 Loss

on extinguishment of debt — (230 ) Net loss before

income taxes (19,599 ) (17,930 ) Income tax provision (25 )

(26 ) Net loss (19,624 ) (17,956 ) Accretion

of redeemable convertible preferred stock to redemption value —

(2,574 ) Deemed dividends to warrant holder — (197 )

Net loss attributable to common stockholders $ (19,624 ) $ (20,727

) Net loss per share attributable to common stockholders: Basic and

diluted $ (0.44 ) $ (0.73 ) Weighted-average number of shares used

in per share calculations: — Basic and diluted 44,366,816

28,559,119 Other comprehensive income (loss), net of tax

Unrealized gains (losses) on available-for-sale securities

96 (115 ) Other comprehensive income (loss) 96

(115 ) Comprehensive loss attributable to common stockholders $

(19,528 ) $ (20,842 )

Arcadia Biosciences, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited) (In thousands) Year

Ended December 31, 2016 2015 CASH FLOWS

FROM OPERATING ACTIVITIES: Net loss $ (19,624 ) $ (17,956 )

Adjustments to reconcile net loss to cash used in operating

activities: Depreciation and amortization 304 294 Loss (gain) on

disposal of equipment 4 (10 ) Net amortization of investment

premium 140 85 Payment of research and develop fees with cost

investment — 500 Stock-based compensation 1,059 1,392 Change in

fair value of derivative liabilities related to convertible

promissory notes — 9 Gain on expiration of warrant and derivative

liability related to notes payable upon IPO — (437 ) Accretion of

debt discount 198 837 Loss on extinguishment of debt — 230 Changes

in operating assets and liabilities: Accounts receivable 357 336

Unbilled revenue (102 ) 298 Inventories 582 412 Prepaid expenses

and other current assets (185 ) (415 ) Other noncurrent assets 5 49

Accounts payable and accrued expenses (19 ) 125 Amounts due to

related parties 11 (37 ) Unearned revenue 215 (821 )

Net cash used in operating activities (17,055 )

(15,109 ) CASH FLOWS FROM INVESTING ACTIVITIES: Proceeds from sale

of property and equipment — 10 Purchases of property and equipment

(231 ) (151 ) Purchases of investments (41,385 ) (48,719 ) Proceeds

from sales and maturities of investments 36,315 2,500

Net cash used in investing activities (5,301 )

(46,360 ) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from

issuance of common stock upon IPO — 68,227 Payments of IPO issuance

costs — (8,205 ) Proceeds from issuance of notes payable — 45,000

Payments of debt issuance costs (46 ) (396 ) Payments of debt

extinguishment costs — (1,319 ) Proceeds from exercise of stock

options and purchases through ESPP 442 360 Payments on notes

payable to related party — (8,000 ) Payments on notes payable and

convertible promissory notes — (26,796 ) Net cash

provided by financing activities 396 68,871 Net

(decrease) increase in cash and cash equivalents (21,960 ) 7,402

Cash and cash equivalents — beginning of period 23,973

16,571 Cash and cash equivalents — end of period $ 2,013 $

23,973 SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: Cash paid

for interest $ 1,033 $ 2,050 Cash paid for income taxes $ 29 $ 149

NONCASH INVESTING AND FINANCING ACTIVITIES: Accretion of redeemable

convertible preferred stock $ — $ 2,574 Debt issuance costs

included in accounts payable and accrued expenses $ — $ 46

Reclassification of deferred IPO costs to equity $ — $ 5,022 Deemed

dividend to common stock warrant holder $ — $ 197 Issuance of

warrants and derivatives in connection with notes payable issuance

$ — $ 437 Stock option exercise cost included in accounts

receivable $ — $ 1 Conversion of preferred stock to common stock

upon IPO $ — $ 85,455

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170308006191/en/

Arcadia Biosciences, Inc.Jeff

Bergaujeff.bergau@arcadiabio.com+1-312-217-0419

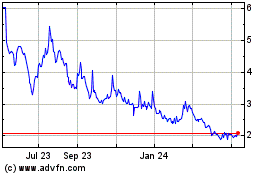

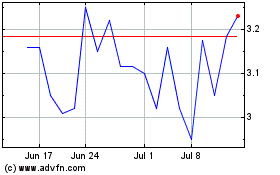

Arcadia Biosciences (NASDAQ:RKDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arcadia Biosciences (NASDAQ:RKDA)

Historical Stock Chart

From Apr 2023 to Apr 2024