21Vianet Group, Inc. (Nasdaq:VNET) ("21Vianet" or the "Company"), a

leading carrier-neutral internet data center services provider in

China, today announced its unaudited financial results for the

fourth quarter and full year ended December 31, 2016. The Company

will hold a conference call at 8:00 p.m. Eastern Time on Wednesday,

March 8, 2017. Dial-in details are provided at the end of the

release.

Mr. Steve Zhang, Chief Executive Officer of the

Company, stated, "Despite facing severe headwinds in our managed

network services business, we continue to see stable growth in our

core IDC, VPN, and cloud businesses this quarter. Last December, in

partnership with Microsoft, we launched Power BI, a business data

analytics cloud service, adding to our wide-array of cloud

offerings for our customers. Most recently, we finalized and signed

an investment agreement with Warburg Pincus, which expands upon the

strategic agreement previously announced. The end result remains

the same, as we will establish joint ventures for our digital real

estate business with a focus on the customized wholesale data

center market, and will aim to build out 80,000 to 100,000

additional cabinets in the next five to seven years. Our core

retail colocation and cloud services will be supplemented with

wholesale data center services, providing more complete and

expanded service offerings to our customers. This restructuring of

our business will allow us to continue to fine-tune our Capex

structure, improve our operating leverage, and provide customers

with more value-added services such as hybrid cloud solutions. With

the evolving internet landscape in China and the strong demands of

internet traffic, computing, and data storage, we will solidify our

position as a leading internet infrastructure services provider and

meet the ever-changing needs of our customers."

Mr. Terry Wang, Chief Financial Officer of the

Company, further commented, "We are pleased to announce that we met

our fourth quarter and full year guidance for both top line net

revenues and adjusted EBITDA. In 2016, we increased our total

revenues to RMB3.64 billion, which was primarily driven by a 14.2%

year-over-year increase in revenues from our hosting and related

businesses. During the fourth quarter of 2016, we added over 300

cabinets in our self-built data centers, bringing the total number

of cabinets up to 26,380. Our cloud business maintained its growth

trajectory, which was mainly attributable to the robust results

from our partnerships with Microsoft and IBM. Looking forward, we

will aim to consistently deploy new cabinets and enhance our

monthly recurring revenues in order to reignite our top line growth

and realize margin expansion. Additionally, even though our MNS and

CDN businesses continued to experience pricing pressure and intense

competition in 2016, we began seeing signs of price stabilization.

We are confident that we will generate further value for our

shareholders through our continuous effort to optimize operations,

our sustainable investment in asset-light businesses and the

emerging opportunities in customized wholesale data centers."

Fourth Quarter 2016 Financial

Results

REVENUES: Net revenues for the

fourth quarter of 2016 were RMB900.6 million (US$129.7 million), as

compared with RMB983.4 million in the comparative period in 2015.

The decrease was primarily due to a decrease in MNS revenues.

Net revenues from hosting and related services

increased by 4.7% to RMB790.1 million (US$113.8 million) in the

fourth quarter of 2016 from RMB754.7 million in the comparative

period in 2015, primarily due to an increase in total number of

billable cabinets, partially offset by the lower utilization rate

and MRR, or monthly recurring revenue, per cabinet.

Net revenues from MNS were RMB110.6 million

(US$15.9 million) in the fourth quarter of 2016, as compared with

RMB228.7 million in the comparative period in 2015. The decrease

was primarily due to a 107 million decrease in Aipu revenues, which

was driven by intensified competition.

GROSS PROFIT: Gross profit for

the fourth quarter of 2016 was RMB183.4 million (US$26.4 million),

as compared with RMB219.2 million in the comparative period in

2015. Gross margin for the fourth quarter of 2016 was 20.4%, as

compared with 22.3% in the comparative period in 2015.

Adjusted gross profit, which excludes

share-based compensation expenses and amortization of intangible

assets derived from acquisitions, was RMB222.6 million (US$32.1

million) in the fourth quarter of 2016, as compared with RMB264.3

million in the comparative period in 2015. Adjusted gross margin

was 24.7% in the fourth quarter of 2016, compared with 26.9% in the

comparative period in 2015.

OPERATING EXPENSES: Total

operating expenses were RMB690.4 million (US$99.4 million) in the

fourth quarter of 2016, as compared with RMB314.5 million in the

comparative period in 2015. Adjusted operating expenses, which

exclude a one-time impairment of long-term asset, share-based

compensation expenses and changes in the fair value of contingent

purchase consideration payable, were RMB309.8 million (US$44.6

million), as compared with RMB275.9 million in the comparative

period in 2015. As a percentage of net revenues, adjusted operating

expenses were 34.4%, as compared with 28.1% in the comparative

period in 2015.

Sales and marketing expenses were RMB92.0

million (US$13.3 million) in the fourth quarter of 2016, as

compared with RMB101.8 million in the comparative period in 2015.

The decrease was primarily due to reduced agency fees.

General and administrative expenses were

RMB186.7 million (US$26.9 million) in the fourth quarter of 2016,

as compared with RMB141.0 million in the comparative period in

2015. The increase was primarily due to increased staff cost.

Research and development expenses were RMB38.4

million (US$5.5 million) in the fourth quarter of 2016, as compared

with RMB41.6 million in the comparative period in 2015.

Bad debt provisions were RMB47.5 million (US$6.8

million) in the fourth quarter of 2016, as compared with RMB25.1

million in the comparative period in 2015.

Changes in the fair value of contingent purchase

consideration payable was a gain of RMB67.2 million (US$9.7

million) in the fourth quarter of 2016, as compared with a loss of

RMB5.1 million in the comparative period in 2015.

One-time impairment of long-term asset was

RMB392.9 million (US$56.6 million) in the fourth quarter of

2016.

ADJUSTED EBITDA: Adjusted

EBITDA for the fourth quarter of 2016 was RMB52.0 million (US$7.5

million), as compared with RMB102.1 million in the comparative

period in 2015. The decrease in adjusted EBITDA was primarily due

to the inclusion of a RMB47.5 million bad debt provision. Adjusted

EBITDA margin for the fourth quarter of 2016 was 5.8% compared with

10.4% in the comparative period in 2015. Adjusted EBITDA for the

fourth quarter of 2016 excludes a one-time impairment of long-term

asset of RMB392.9 million (US$56.6 million), share-based

compensation expenses of RMB56.7 million (US$8.2 million) and

changes in the fair value of contingent purchase consideration

payable which was a gain of RMB67.2 million (US$9.7 million).

NET PROFIT/LOSS: Net loss for

the fourth quarter of 2016 was RMB485.2 million (US$69.9 million),

as compared with a net loss of RMB112.9 million in the comparative

period in 2015.

Adjusted net loss for the fourth quarter of 2016

was RMB66.1 million (US$9.5 million), as compared with an adjusted

net loss of RMB29.1 million in the comparative period in 2015.

Adjusted net loss in the fourth quarter of 2016 mainly excludes a

one-time impairment of long-term asset of RMB392.9 million (US$56.6

million) and changes in the fair value of contingent purchase

consideration payable and related deferred tax impact which was a

gain of RMB67.9 million (US$9.8 million). Adjusted net margin in

the fourth quarter of 2016 was negative 7.3%, as compared with

negative 3.0% in the comparative period in 2015.

LOSS PER SHARE: Diluted loss

per share for the fourth quarter of 2016 was RMB0.69, which

represents the equivalent of RMB4.14 (US$0.60) per American

Depositary Share ("ADS"). Each ADS represents six ordinary shares.

Adjusted diluted loss per share for the fourth quarter of 2016 was

RMB0.08, which represents the equivalent of RMB0.48 (US$0.07) per

ADS. Adjusted diluted loss per share is calculated using adjusted

net loss as discussed above divided by the weighted average number

of shares.

As of December 31, 2016, the Company had a total

of 679.8 million ordinary shares outstanding, or equivalent of

113.3 million ADSs.

BALANCE SHEET: As of December

31, 2016, the Company's cash and cash equivalents and short-term

investment were RMB1.58 billion (US$226.9 million).

Fourth Quarter 2016 Operational Highlights

- Monthly Recurring Revenues ("MRR") per cabinet was RMB8,490 in

the fourth quarter of 2016, compared with RMB8,696 in the third

quarter of 2016.

- Total cabinets under management increased to 26,380 as of

December 31, 2016 from 26,184 as of September 30, 2016, with 19,294

cabinets in the Company's self-built data centers and 7,086

cabinets in its partnered data centers.

- Utilization rate was 75.2% in the fourth quarter of 2016,

compared with 77.9% in the third quarter of 2016.

- Hosting churn rate, which is based on the Company’s core IDC

business, was 0.55% in the fourth quarter of 2016, compared with

0.95% in the third quarter of 2016.

Full Year 2016 Financial Performance

For the full year of 2016, net revenue increased

to RMB3.64 billion (US$524.5 million) from RMB3.63 billion in the

prior year. Adjusted EBITDA for the full year was RMB243.9 million

(US$35.1 million), as compared with RMB540.4 million in the prior

year. Adjusted EBITDA margin was 6.7%, as compared with 14.9% in

the prior year. Adjusted EBITDA for the full year excludes

impairment of long-term asset of RMB392.9 million (US$56.6

million), share-based compensation expenses of RMB118.7 million

(US$17.1 million) and changes in the fair value of contingent

purchase consideration payable of RMB93.3 million (US$13.4

million). Adjusted net loss for the full year was RMB332.9 million

(US$47.9 million), as compared with a loss of RMB10.8 million in

the prior year. Adjusted net loss in the full year excludes

impairment of long-term asset of RMB392.9 million (US$56.6

million), share-based compensation expenses of RMB118.7 million

(US$17.1 million), amortization of intangible assets derived from

acquisitions of RMB151.0 million (US$21.8 million), changes in the

fair value of contingent purchase consideration payable and related

deferred tax assets of RMB93.5 million (US$13.5 million), and a

one-time loss on debt extinguishment of RMB29.8 million (US$4.3

million). Adjusted diluted loss per share for the full year of 2016

was RMB0.40 (US$0.06), which represents the equivalent of RMB2.40

(US$0.35) per ADS.

Recent Developments

On March 5, 2017, the Company signed an

investment agreement (“IA”) with Warburg Pincus to establish a

multi-stage joint venture (“JV”) and build a digital real estate

platform in China. The IA supersedes the strategic agreement signed

on October 31, 2016. The overall structure remains the same, while

the IA added certain details on how the cooperation will be carried

out. Pursuant to the IA, 21Vianet will still seed the initial JV

with four existing high-performing IDC assets, valued at over

US$300 million, and Warburg Pincus will contribute direct capital

and extensive industry network and resources in the real estate

sector. Also pursuant to the IA, 21Vianet will own 51% of the

equity interest in the initial JV while Warburg Pincus will own the

remaining 49%. With respect to future JVs, 21Vianet will own 49% of

the equity interest while Warburg Pincus will own the remaining

51%.

Financial Outlook

For the first quarter of 2017, the Company

expects net revenues to be in the range of RMB820 million to RMB880

million, as compared with RMB862.3 million in the prior year

period. Adjusted EBITDA is expected to be in the range of RMB65

million to RMB85million, as compared with RMB108.6 million in the

prior year period.

For the full year of 2017, the Company now

expects net revenues to be in the range of RMB3.7 billion to RMB3.9

billion, as compared with RMB3.64 billion in the prior year.

Adjusted EBITDA for the full year 2017 is expected to be in the

range of RMB420 million to RMB460 million, as compared with

RMB243.9 million in the prior year. These forecasts reflect the

Company's current and preliminary view, which may be subject to

change.

Conference Call

The Company will hold a conference call on

Wednesday, March 8, 2017 at 8:00 pm U.S. Eastern Time, or Thursday,

March 9, 2017 at 9:00 am Beijing Time to discuss the financial

results.

|

Participants may access the call by dialing the following

numbers: |

| |

|

| United States

Toll Free: |

+1-855-500-8701

|

|

International: |

+65-6713-5440 |

| China

Domestic: |

400-120-0654 |

| Hong

Kong: |

+852-3018-6776 |

| Conference

ID: |

72616852 |

| |

|

| |

|

|

The replay will be accessible through March 16, 2017, by dialing

the following numbers: |

| |

|

| United States

Toll Free: |

+1-855-452-5696 |

|

International: |

+61-2-9003-4211 |

| Conference

ID: |

72616852 |

| |

|

A live and archived webcast of the conference

call will be available through the Company's investor relation

website at http://ir.21vianet.com.

Non-GAAP Disclosure

In evaluating its business, 21Vianet considers

and uses the following non-GAAP measures defined as non-GAAP

financial measures by the SEC as supplemental measure to review and

assess its operating performance: adjusted gross profit, adjusted

gross margin, adjusted operating expenses, adjusted net profit,

adjusted net margin, adjusted EBITDA, adjusted EBITDA margin,

adjusted basic earnings per share, adjusted diluted earnings per

share, adjusted basic earnings per ADS and adjusted diluted

earnings per ADS. The presentation of these non-GAAP financial

measures is not intended to be considered in isolation or as a

substitute for the financial information prepared and presented in

accordance with U.S. GAAP. For more information on these non-GAAP

financial measures, please see the table captioned "Reconciliations

of GAAP and non-GAAP results" set forth at the end of this press

release.

The non-GAAP financial measures are provided as

additional information to help investors compare business trends

among different reporting periods on a consistent basis and to

enhance investors' overall understanding of the Company's current

financial performance and prospects for the future. These non-GAAP

financial measures should be considered in addition to results

prepared in accordance with U.S. GAAP, but should not be considered

a substitute for, or superior to, U.S. GAAP results. In addition,

the Company's calculation of the non-GAAP financial measures may be

different from the calculation used by other companies, and

therefore comparability may be limited.

Exchange Rate

This announcement contains translations of

certain RMB amounts into U.S. dollars (“USD”) at specified rates

solely for the convenience of the reader. Unless otherwise stated,

all translations from RMB to USD were made at the rate of RMB6.9430

to US$1.00, the noon buying rate in effect on December 31, 2016 in

the H.10 statistical release of the Federal Reserve Board. The

Company makes no representation that the RMB or USD amounts

referred could be converted into USD or RMB, as the case may be, at

any particular rate or at all. For analytical presentation, all

percentages are calculated using the numbers presented in the

financial statements contained in this earnings release.

Statement Regarding Unaudited Condensed

Financial Information

The unaudited financial information set forth

above is preliminary and subject to potential adjustments.

Adjustments to the consolidated financial statements may be

identified when audit work has been performed for the Company's

year-end audit, which could result in significant differences from

this preliminary unaudited condensed financial information.

About 21Vianet

21Vianet Group, Inc. is a leading

carrier-neutral Internet data center services provider in China.

21Vianet provides hosting and related services, managed network

services, cloud services, content delivery network services,

last-mile wired broadband services and business VPN services,

improving the reliability, security and speed of its customers'

Internet infrastructure. Customers may locate their servers and

networking equipment in 21Vianet's data centers and connect to

China's Internet backbone through 21Vianet's extensive fiber optic

network. In addition, 21Vianet's proprietary smart routing

technology enables customers' data to be delivered across the

Internet in a faster and more reliable manner. 21Vianet operates in

more than 30 cities throughout China, servicing a diversified and

loyal base of more than 2,000 hosting enterprise customers that

span numerous industries ranging from Internet companies to

government entities and blue-chip enterprises to small- to

mid-sized enterprises.

Safe Harbor Statement

This announcement contains forward-looking

statements. These forward-looking statements are made under the

"safe harbor" provisions of the U.S. Private Securities Litigation

Reform Act of 1995. These statements can be identified by

terminology such as "will," "expects," "anticipates," "future,"

"intends," "plans," "believes," "estimates" and similar statements.

Among other things, quotations from management in this announcement

as well as 21Vianet's strategic and operational plans contain

forward-looking statements. 21Vianet may also make written or oral

forward-looking statements in its reports filed with, or furnished

to, the U.S. Securities and Exchange Commission, in its annual

reports to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including statements about 21Vianet's beliefs and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: 21Vianet's goals and strategies;

21Vianet's expansion plans; the expected growth of the data center

services market; expectations regarding demand for, and market

acceptance of, 21Vianet's services; 21Vianet's expectations

regarding keeping and strengthening its relationships with

customers; 21Vianet's plans to invest in research and development

to enhance its solution and service offerings; and general economic

and business conditions in the regions where 21Vianet provides

solutions and services. Further information regarding these and

other risks is included in 21Vianet's reports filed with, or

furnished to, the Securities and Exchange Commission. All

information provided in this press release and in the attachments

is as of the date of this press release, and 21Vianet undertakes no

duty to update such information, except as required under

applicable law.

| |

| 21VIANET GROUP, INC. |

| CONSOLIDATED BALANCE SHEETS |

| (Amount in thousands of Renminbi (“RMB”) and US

dollars (“US$”)) |

| |

|

|

| |

As of |

|

As of |

|

|

December 31, 2015 |

|

December 31, 2016 |

| |

RMB |

|

RMB |

|

US$ |

| |

(Audited) |

|

(Unaudited) |

|

(Unaudited) |

|

Assets |

|

|

|

|

Current assets: |

|

|

|

| Cash and

cash equivalents |

1,685,054 |

|

|

1,297,418 |

|

|

186,867 |

|

|

Restricted cash |

195,230 |

|

|

1,963,561 |

|

|

282,812 |

|

| Accounts

and notes receivable, net |

694,108 |

|

|

655,459 |

|

|

94,406 |

|

|

Short-term investments |

104,897 |

|

|

277,946 |

|

|

40,033 |

|

|

Inventories |

13,539 |

|

|

4,431 |

|

|

638 |

|

| Prepaid

expenses and other current assets |

642,553 |

|

|

777,131 |

|

|

111,930 |

|

| Deferred

tax assets |

31,113 |

|

|

43,362 |

|

|

6,245 |

|

| Amount

due from related parties |

105,137 |

|

|

182,615 |

|

|

26,302 |

|

|

Total current assets |

3,471,631 |

|

|

5,201,923 |

|

|

749,233 |

|

|

Non-current assets: |

|

|

|

| Property

and equipment, net |

3,653,071 |

|

|

3,781,613 |

|

|

544,666 |

|

|

Intangible assets, net |

1,274,166 |

|

|

977,341 |

|

|

140,766 |

|

| Land use

rights, net |

64,682 |

|

|

167,646 |

|

|

24,146 |

|

| Deferred

tax assets |

46,900 |

|

|

57,314 |

|

|

8,255 |

|

|

Goodwill |

1,755,970 |

|

|

1,755,970 |

|

|

252,912 |

|

| Long

term investments |

198,907 |

|

|

298,871 |

|

|

43,046 |

|

|

Restricted cash |

128,515 |

|

|

33,544 |

|

|

4,831 |

|

| Amount

due from related parties |

70,000 |

|

|

- |

|

|

- |

|

| Other

non-current assets |

183,868 |

|

|

147,302 |

|

|

21,216 |

|

|

Total non-current assets |

7,376,079 |

|

|

7,219,601 |

|

|

1,039,838 |

|

|

Total assets |

10,847,710 |

|

|

12,421,524 |

|

|

1,789,071 |

|

|

Liabilities and Shareholders' Equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Short-term bank borrowings |

276,000 |

|

|

1,683,676 |

|

|

242,500 |

|

| Accounts

and notes payable |

482,622 |

|

|

529,569 |

|

|

76,274 |

|

| Accrued

expenses and other payables |

637,957 |

|

|

787,916 |

|

|

113,484 |

|

| Deferred

revenue |

342,105 |

|

|

320,023 |

|

|

46,093 |

|

| Advances

from customers |

185,800 |

|

|

201,397 |

|

|

29,007 |

|

| Income

taxes payable |

49,959 |

|

|

21,899 |

|

|

3,154 |

|

| Amounts

due to related parties |

397,588 |

|

|

121,928 |

|

|

17,561 |

|

| Current

portion of long-term bank borrowings |

38,803 |

|

|

39,303 |

|

|

5,661 |

|

| Current

portion of capital lease obligations |

140,488 |

|

|

243,723 |

|

|

35,103 |

|

| Current

portion of deferred government grant |

6,332 |

|

|

5,107 |

|

|

736 |

|

| Current

portion of bonds payable |

263,365 |

|

|

419,316 |

|

|

60,394 |

|

|

Total current liabilities |

2,821,019 |

|

|

4,373,857 |

|

|

629,967 |

|

|

Non-current liabilities: |

|

|

|

|

Long-term bank borrowings |

103,421 |

|

|

268,221 |

|

|

38,632 |

|

| Deferred

revenue |

68,535 |

|

|

62,531 |

|

|

9,006 |

|

| Amounts

due to related parties |

27,384 |

|

|

- |

|

|

- |

|

|

Unrecognized tax benefits |

14,492 |

|

|

28,689 |

|

|

4,132 |

|

| Deferred

tax liabilities |

293,212 |

|

|

274,700 |

|

|

39,565 |

|

|

Non-current portion of capital lease obligations |

579,070 |

|

|

536,623 |

|

|

77,290 |

|

|

Non-current portion of deferred government grant |

31,288 |

|

|

25,886 |

|

|

3,728 |

|

| Bonds

payable |

1,984,685 |

|

|

- |

|

|

- |

|

|

Mandatorily redeemable noncontrolling interests |

100,000 |

|

|

- |

|

|

- |

|

|

Total non-current liabilities |

3,202,087 |

|

|

1,196,650 |

|

|

172,353 |

|

|

|

|

|

|

|

Redeemable noncontrolling interests |

790,229 |

|

|

700,000 |

|

|

100,821 |

|

|

|

|

|

|

|

Shareholders' equity |

|

|

|

| Treasury

stock |

(193,142 |

) |

|

(204,557 |

) |

|

(29,462 |

) |

| Ordinary

shares |

34 |

|

|

45 |

|

|

6 |

|

|

Additional paid-in capital |

6,403,117 |

|

|

9,199,248 |

|

|

1,324,967 |

|

|

Accumulated other comprehensive loss |

(24,236 |

) |

|

118,290 |

|

|

17,037 |

|

|

Statutory reserves |

63,174 |

|

|

64,622 |

|

|

9,308 |

|

|

Accumulated deficit |

(2,233,985 |

) |

|

(3,052,433 |

) |

|

(439,642 |

) |

|

Total 21Vianet Group, Inc. shareholders’

equity |

4,014,962 |

|

|

6,125,215 |

|

|

882,214 |

|

|

Noncontrolling interest |

19,413 |

|

|

25,802 |

|

|

3,716 |

|

|

Total shareholders' equity |

4,034,375 |

|

|

6,151,017 |

|

|

885,930 |

|

|

Total liabilities, redeemable noncontrolling interests and

shareholders' equity |

10,847,710 |

|

|

12,421,524 |

|

|

1,789,071 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| 21VIANET GROUP, INC. |

|

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

| (Amount in thousands of Renminbi (“RMB”) and

US dollars (“US$”) except for number of shares and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months

ended |

|

Year ended |

|

| |

December 31, 2015 |

|

September 30, 2016 |

|

December 31, 2016 |

|

December 31, 2015 |

|

December 31, 2016 |

|

| |

RMB |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

|

| |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

Net revenues |

|

|

|

|

|

|

|

|

|

| Hosting

and related services |

754,706 |

|

|

828,121 |

|

|

790,079 |

|

|

113,795 |

|

|

2,707,445 |

|

|

3,092,256 |

|

|

445,378 |

|

|

| Managed

network services |

228,677 |

|

|

139,885 |

|

|

110,568 |

|

|

15,925 |

|

|

926,927 |

|

|

549,518 |

|

|

79,147 |

|

|

| Total

net revenues |

983,383 |

|

|

968,006 |

|

|

900,647 |

|

|

129,720 |

|

|

3,634,372 |

|

|

3,641,774 |

|

|

524,525 |

|

|

| Cost of

revenues |

(764,214 |

) |

|

(781,124 |

) |

|

(717,276 |

) |

|

(103,309 |

) |

|

(2,780,614 |

) |

|

(2,929,638 |

) |

|

(421,956 |

) |

|

|

Gross profit |

219,169 |

|

|

186,882 |

|

|

183,371 |

|

|

26,411 |

|

|

853,758 |

|

|

712,136 |

|

|

102,569 |

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

| Sales

and marketing |

(101,797 |

) |

|

(100,138 |

) |

|

(92,018 |

) |

|

(13,253 |

) |

|

(359,460 |

) |

|

(352,926 |

) |

|

(50,832 |

) |

|

| Research

and development |

(41,569 |

) |

|

(36,079 |

) |

|

(38,425 |

) |

|

(5,534 |

) |

|

(142,835 |

) |

|

(149,337 |

) |

|

(21,509 |

) |

|

| General

and administrative |

(140,995 |

) |

|

(162,746 |

) |

|

(186,744 |

) |

|

(26,897 |

) |

|

(568,741 |

) |

|

(639,648 |

) |

|

(92,128 |

) |

|

| Bad debt

provision |

(25,069 |

) |

|

(27,103 |

) |

|

(47,450 |

) |

|

(6,834 |

) |

|

(32,199 |

) |

|

(117,564 |

) |

|

(16,933 |

) |

|

| Changes

in the fair value of contingent purchase consideration payable

|

(5,060 |

) |

|

12,285 |

|

|

67,197 |

|

|

9,678 |

|

|

(43,325 |

) |

|

93,307 |

|

|

13,439 |

|

|

|

Impairment of long-lived assets |

- |

|

|

- |

|

|

(392,947 |

) |

|

(56,596 |

) |

|

- |

|

|

(392,947 |

) |

|

(56,596 |

) |

|

| Other

operating income |

- |

|

|

6,783 |

|

|

- |

|

|

- |

|

|

8,569 |

|

|

6,783 |

|

|

977 |

|

|

|

Total operating expenses |

(314,490 |

) |

|

(306,998 |

) |

|

(690,387 |

) |

|

(99,436 |

) |

|

(1,137,991 |

) |

|

(1,552,332 |

) |

|

(223,582 |

) |

|

|

Operating loss |

(95,321 |

) |

|

(120,116 |

) |

|

(507,016 |

) |

|

(73,025 |

) |

|

(284,233 |

) |

|

(840,196 |

) |

|

(121,013 |

) |

|

| Interest

income |

5,692 |

|

|

3,716 |

|

|

4,839 |

|

|

697 |

|

|

53,494 |

|

|

21,078 |

|

|

3,036 |

|

|

| Interest

expense |

(60,963 |

) |

|

(49,490 |

) |

|

(40,652 |

) |

|

(5,855 |

) |

|

(274,184 |

) |

|

(198,589 |

) |

|

(28,603 |

) |

|

| Loss on

debt extinguishment |

- |

|

|

(29,841 |

) |

|

- |

|

|

- |

|

|

- |

|

|

(29,841 |

) |

|

(4,298 |

) |

|

| Other

income |

20,115 |

|

|

23,894 |

|

|

189 |

|

|

27 |

|

|

30,430 |

|

|

28,556 |

|

|

4,113 |

|

|

| Other

expense |

(1,848 |

) |

|

(1,010 |

) |

|

(1,825 |

) |

|

(263 |

) |

|

(3,701 |

) |

|

(16,449 |

) |

|

(2,369 |

) |

|

| Foreign

exchange gain |

7,248 |

|

|

8,511 |

|

|

28,849 |

|

|

4,155 |

|

|

72,394 |

|

|

56,341 |

|

|

8,115 |

|

|

|

Loss before income taxes and gain from equity method

investments |

(125,077 |

) |

|

(164,336 |

) |

|

(515,616 |

) |

|

(74,264 |

) |

|

(405,800 |

) |

|

(979,100 |

) |

|

(141,019 |

) |

|

| Income

tax (expense) benefit |

(28,044 |

) |

|

(10,064 |

) |

|

17,818 |

|

|

2,566 |

|

|

(47,830 |

) |

|

11,160 |

|

|

1,607 |

|

|

| Gain

from equity method investments |

40,231 |

|

|

2,852 |

|

|

12,591 |

|

|

1,813 |

|

|

52,355 |

|

|

36,018 |

|

|

5,188 |

|

|

| Net

loss |

(112,890 |

) |

|

(171,548 |

) |

|

(485,207 |

) |

|

(69,885 |

) |

|

(401,275 |

) |

|

(931,922 |

) |

|

(134,224 |

) |

|

| Net

(income) loss attributable to noncontrolling interest |

(11,194 |

) |

|

37,579 |

|

|

41,951 |

|

|

6,042 |

|

|

(26,824 |

) |

|

114,922 |

|

|

16,552 |

|

|

| Net loss

attributable to ordinary shareholders |

(124,084 |

) |

|

(133,969 |

) |

|

(443,256 |

) |

|

(63,843 |

) |

|

(428,099 |

) |

|

(817,000 |

) |

|

(117,672 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Loss per

share |

|

|

|

|

|

|

|

|

|

|

Basic |

(0.24 |

) |

|

(0.15 |

) |

|

(0.69 |

) |

|

(0.10 |

) |

|

(0.85 |

) |

|

(1.37 |

) |

|

(0.20 |

) |

|

|

Diluted |

(0.24 |

) |

|

(0.15 |

) |

|

(0.69 |

) |

|

(0.10 |

) |

|

(0.85 |

) |

|

(1.37 |

) |

|

(0.20 |

) |

|

| Shares

used in loss per share computation |

|

|

|

|

|

|

|

|

|

|

Basic* |

523,366,544 |

|

|

682,146,465 |

|

|

681,210,352 |

|

|

681,210,352 |

|

|

492,065,239 |

|

|

617,169,833 |

|

|

617,169,833 |

|

|

|

Diluted* |

523,366,544 |

|

|

682,146,465 |

|

|

681,210,352 |

|

|

681,210,352 |

|

|

492,065,239 |

|

|

617,169,833 |

|

|

617,169,833 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Loss per ADS (6

ordinary shares equal to 1 ADS) |

|

|

|

|

|

|

|

|

|

| Basic |

(1.44 |

) |

|

(0.90 |

) |

|

(4.14 |

) |

|

(0.60 |

) |

|

(5.10 |

) |

|

(8.22 |

) |

|

(1.18 |

) |

|

| Diluted |

(1.44 |

) |

|

(0.90 |

) |

|

(4.14 |

) |

|

(0.60 |

) |

|

(5.10 |

) |

|

(8.22 |

) |

|

(1.18 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| * Shares used in loss per share/ADS computation were computed

under weighted average method. |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| 21VIANET GROUP, INC. |

|

| RECONCILIATIONS OF GAAP AND NON-GAAP

RESULTS |

|

| (Amount in thousands of Renminbi (“RMB”) and

US dollars (“US$”) except for number of shares and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months

ended |

|

Year ended |

|

| |

December 31, 2015 |

|

September 30, 2016 |

|

December 31, 2016 |

|

December 31, 2015 |

|

December 31, 2016 |

|

| |

RMB |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

|

| Gross

profit |

219,169 |

|

|

186,882 |

|

|

183,371 |

|

|

26,411 |

|

|

853,758 |

|

|

712,136 |

|

|

102,569 |

|

|

| Plus:

share-based compensation expense |

6,582 |

|

|

1,173 |

|

|

1,865 |

|

|

269 |

|

|

12,422 |

|

|

(4,110 |

) |

|

(592 |

) |

|

| Plus:

amortization of intangible assets derived from acquisitions |

38,583 |

|

|

36,504 |

|

|

37,369 |

|

|

5,382 |

|

|

157,119 |

|

|

151,037 |

|

|

21,754 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted gross profit |

264,334 |

|

|

224,559 |

|

|

222,605 |

|

|

32,062 |

|

|

1,023,299 |

|

|

859,063 |

|

|

123,731 |

|

|

|

Adjusted gross margin |

26.9 |

% |

|

23.2 |

% |

|

24.7 |

% |

|

24.7 |

% |

|

28.2 |

% |

|

23.6 |

% |

|

23.6 |

% |

|

|

Operating expenses |

(314,490 |

) |

|

(306,998 |

) |

|

(690,387 |

) |

|

(99,436 |

) |

|

(1,137,991 |

) |

|

(1,552,332 |

) |

|

(223,582 |

) |

|

| Plus:

share-based compensation expense |

33,537 |

|

|

32,208 |

|

|

54,808 |

|

|

7,894 |

|

|

177,605 |

|

|

122,839 |

|

|

17,692 |

|

|

| Plus:

changes in the fair value of contingent purchase consideration

payable |

5,060 |

|

|

(12,285 |

) |

|

(67,197 |

) |

|

(9,678 |

) |

|

43,325 |

|

|

(93,307 |

) |

|

(13,439 |

) |

|

| Plus:

impairment of long-lived assets |

- |

|

|

- |

|

|

392,947 |

|

|

56,596 |

|

|

- |

|

|

392,947 |

|

|

56,596 |

|

|

|

Adjusted operating expenses |

(275,893 |

) |

|

(287,075 |

) |

|

(309,829 |

) |

|

(44,624 |

) |

|

(917,061 |

) |

|

(1,129,853 |

) |

|

(162,733 |

) |

|

| Net

loss |

(112,890 |

) |

|

(171,548 |

) |

|

(485,207 |

) |

|

(69,885 |

) |

|

(401,275 |

) |

|

(931,922 |

) |

|

(134,224 |

) |

|

| Plus:

share-based compensation expense |

40,119 |

|

|

33,381 |

|

|

56,673 |

|

|

8,163 |

|

|

190,027 |

|

|

118,729 |

|

|

17,101 |

|

|

| Plus:

amortization of intangible assets derived from acquisitions |

38,583 |

|

|

36,504 |

|

|

37,369 |

|

|

5,382 |

|

|

157,119 |

|

|

151,037 |

|

|

21,754 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Plus:

changes in the fair value of contingent purchase consideration

payable and related deferred tax impact |

5,060 |

|

|

(12,285 |

) |

|

(67,874 |

) |

|

(9,776 |

) |

|

43,325 |

|

|

(93,489 |

) |

|

(13,465 |

) |

|

| Plus:

loss on debt extinguishment |

- |

|

|

29,841 |

|

|

- |

|

|

- |

|

|

- |

|

|

29,841 |

|

|

4,298 |

|

|

| Plus:

impairment of long-lived assets |

- |

|

|

- |

|

|

392,947 |

|

|

56,596 |

|

|

- |

|

|

392,947 |

|

|

56,596 |

|

|

|

Adjusted net loss |

(29,128 |

) |

|

(84,107 |

) |

|

(66,092 |

) |

|

(9,520 |

) |

|

(10,804 |

) |

|

(332,857 |

) |

|

(47,940 |

) |

|

|

Adjusted net margin |

-3.0 |

% |

|

-8.7 |

% |

|

-7.3 |

% |

|

-7.3 |

% |

|

-0.3 |

% |

|

-9.1 |

% |

|

-9.1 |

% |

|

| Net

loss |

(112,890 |

) |

|

(171,548 |

) |

|

(485,207 |

) |

|

(69,885 |

) |

|

(401,275 |

) |

|

(931,922 |

) |

|

(134,224 |

) |

|

| Minus:

Provision for income taxes |

(28,044 |

) |

|

(10,064 |

) |

|

17,818 |

|

|

2,566 |

|

|

(47,830 |

) |

|

11,160 |

|

|

1,607 |

|

|

| Minus:

Interest income |

5,692 |

|

|

3,716 |

|

|

4,839 |

|

|

697 |

|

|

53,494 |

|

|

21,078 |

|

|

3,036 |

|

|

| Minus:

Interest expenses |

(60,963 |

) |

|

(49,490 |

) |

|

(40,652 |

) |

|

(5,855 |

) |

|

(274,184 |

) |

|

(198,589 |

) |

|

(28,603 |

) |

|

| Minus:

Loss on debt extinguishment |

- |

|

|

(29,841 |

) |

|

- |

|

|

- |

|

|

- |

|

|

(29,841 |

) |

|

(4,298 |

) |

|

| Minus:

Exchange gain |

7,248 |

|

|

8,511 |

|

|

28,849 |

|

|

4,155 |

|

|

72,394 |

|

|

56,341 |

|

|

8,115 |

|

|

| Minus:

Gain from equity method investment |

40,231 |

|

|

2,852 |

|

|

12,591 |

|

|

1,813 |

|

|

52,355 |

|

|

36,018 |

|

|

5,188 |

|

|

| Minus:

Other income |

20,115 |

|

|

23,894 |

|

|

189 |

|

|

27 |

|

|

30,430 |

|

|

28,556 |

|

|

4,113 |

|

|

| Minus:

Other expenses |

(1,848 |

) |

|

(1,010 |

) |

|

(1,825 |

) |

|

(263 |

) |

|

(3,701 |

) |

|

(16,449 |

) |

|

(2,369 |

) |

|

| Plus:

depreciation |

105,355 |

|

|

122,484 |

|

|

129,243 |

|

|

18,615 |

|

|

402,035 |

|

|

478,862 |

|

|

68,970 |

|

|

| Plus:

amortization |

46,917 |

|

|

44,452 |

|

|

47,335 |

|

|

6,818 |

|

|

189,257 |

|

|

186,901 |

|

|

26,919 |

|

|

| Plus:

share-based compensation expense |

40,119 |

|

|

33,381 |

|

|

56,673 |

|

|

8,163 |

|

|

190,027 |

|

|

118,729 |

|

|

17,101 |

|

|

| Plus:

changes in the fair value of contingent purchase consideration

payable |

5,060 |

|

|

(12,285 |

) |

|

(67,197 |

) |

|

(9,678 |

) |

|

43,325 |

|

|

(93,307 |

) |

|

(13,439 |

) |

|

| Plus:

impairment of long-lived assets |

- |

|

|

- |

|

|

392,947 |

|

|

56,596 |

|

|

- |

|

|

392,947 |

|

|

56,596 |

|

|

|

Adjusted EBITDA |

102,130 |

|

|

67,916 |

|

|

51,985 |

|

|

7,489 |

|

|

540,411 |

|

|

243,936 |

|

|

35,134 |

|

|

|

Adjusted EBITDA margin |

10.4 |

% |

|

7.0 |

% |

|

5.8 |

% |

|

5.8 |

% |

|

14.9 |

% |

|

6.7 |

% |

|

6.7 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted

net loss |

(29,128 |

) |

|

(84,107 |

) |

|

(66,092 |

) |

|

(9,520 |

) |

|

(10,804 |

) |

|

(332,857 |

) |

|

(47,940 |

) |

|

| Less:

Net (profit) loss attributable to noncontrolling interest |

(11,194 |

) |

|

37,579 |

|

|

41,951 |

|

|

6,042 |

|

|

(26,824 |

) |

|

114,922 |

|

|

16,552 |

|

|

| Adjusted

net loss attributable to the Company’s ordinary shareholders |

(40,322 |

) |

|

(46,528 |

) |

|

(24,141 |

) |

|

(3,478 |

) |

|

(37,628 |

) |

|

(217,935 |

) |

|

(31,388 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted

loss per share |

|

|

|

|

|

|

|

|

|

|

Basic |

(0.08 |

) |

|

(0.02 |

) |

|

(0.08 |

) |

|

(0.01 |

) |

|

(0.06 |

) |

|

(0.40 |

) |

|

(0.06 |

) |

|

|

Diluted |

(0.08 |

) |

|

(0.02 |

) |

|

(0.08 |

) |

|

(0.01 |

) |

|

(0.06 |

) |

|

(0.40 |

) |

|

(0.06 |

) |

|

| Shares

used in adjusted loss per share computation: |

|

|

|

|

|

|

|

|

|

|

Basic* |

523,366,544 |

|

|

682,146,465 |

|

|

681,210,352 |

|

|

681,210,352 |

|

|

492,065,239 |

|

|

617,169,833 |

|

|

617,169,833 |

|

|

|

Diluted* |

523,366,544 |

|

|

682,146,465 |

|

|

681,210,352 |

|

|

681,210,352 |

|

|

492,065,239 |

|

|

617,169,833 |

|

|

617,169,833 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

loss per ADS (6 ordinary shares equal to 1 ADS) |

|

|

|

|

|

|

|

|

|

|

Basic |

(0.48 |

) |

|

(0.12 |

) |

|

(0.48 |

) |

|

(0.07 |

) |

|

(0.36 |

) |

|

(2.40 |

) |

|

(0.35 |

) |

|

|

Diluted |

(0.48 |

) |

|

(0.12 |

) |

|

(0.48 |

) |

|

(0.07 |

) |

|

(0.36 |

) |

|

(2.40 |

) |

|

(0.35 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| * Shares used in adjusted loss/ADS per share computation were

computed under weighted average method. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| 21VIANET GROUP, INC. |

|

| CONSOLIDATED STATEMENT OF CASH

FLOWS |

|

| (Amount in thousands of Renminbi (“RMB”) and US

dollars (“US$”)) |

|

|

|

|

|

|

|

|

|

| |

Three months

ended |

|

| |

September 30,

2016 |

|

December 31, 2016 |

|

| |

RMB |

|

RMB |

|

US$ |

|

| |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

| CASH FLOWS FROM

OPERATING ACTIVITIES |

|

|

|

|

| Net

loss |

(171,548 |

) |

|

(485,207 |

) |

|

(69,885 |

) |

|

|

Adjustments to reconcile net loss to net cash generated

from operating

activities: |

|

|

|

|

| Foreign

exchange gain |

(8,511 |

) |

|

(28,849 |

) |

|

(4,155 |

) |

|

| Changes

in the fair value of contingent purchase consideration

payable |

(12,285 |

) |

|

(67,197 |

) |

|

(9,678 |

) |

|

|

Depreciation of property and equipment |

122,484 |

|

|

129,243 |

|

|

18,615 |

|

|

|

Amortization of intangible assets |

45,683 |

|

|

46,103 |

|

|

6,640 |

|

|

|

Provision for doubtful accounts and other receivables |

24,091 |

|

|

48,706 |

|

|

7,015 |

|

|

|

Share-based compensation expense |

33,382 |

|

|

56,672 |

|

|

8,162 |

|

|

| Loss on

debt extinguishment |

29,841 |

|

|

- |

|

|

- |

|

|

| Deferred

income taxes benefit |

(7,969 |

) |

|

(31,605 |

) |

|

(4,552 |

) |

|

| Gain

from equity method investment |

(2,852 |

) |

|

(12,591 |

) |

|

(1,813 |

) |

|

|

Impairment of long-lived assets |

- |

|

|

392,947 |

|

|

56,596 |

|

|

|

Changes in operating assets and

liabilities |

|

|

|

|

|

Restricted cash |

(67,455 |

) |

|

11,846 |

|

|

1,706 |

|

|

|

Inventories |

2,214 |

|

|

1,617 |

|

|

233 |

|

|

| Accounts

and notes receivable |

(32,229 |

) |

|

51,084 |

|

|

7,358 |

|

|

|

Unrecognized tax expense |

717 |

|

|

5,984 |

|

|

862 |

|

|

| Prepaid

expenses and other current assets |

32,589 |

|

|

(9,855 |

) |

|

(1,419 |

) |

|

| Amounts

due from related parties |

(8,839 |

) |

|

(6,359 |

) |

|

(916 |

) |

|

| Accounts

and notes payable |

(22,603 |

) |

|

(20,145 |

) |

|

(2,901 |

) |

|

| Accrued

expenses and other payables |

6,362 |

|

|

25,348 |

|

|

3,652 |

|

|

| Deferred

revenue |

(20,967 |

) |

|

(9,192 |

) |

|

(1,324 |

) |

|

| Advances

from customers |

27,288 |

|

|

12,473 |

|

|

1,796 |

|

|

| Income

taxes payable |

13,594 |

|

|

(14,864 |

) |

|

(2,141 |

) |

|

| Amounts

due to related parties |

834 |

|

|

4,031 |

|

|

581 |

|

|

| Deferred

government grants |

(2,291 |

) |

|

(1,344 |

) |

|

(194 |

) |

|

| Gain

from cost method investment |

(5,160 |

) |

|

- |

|

|

- |

|

|

|

Net cash (used in) generated from operating

activities |

(23,630 |

) |

|

98,846 |

|

|

14,238 |

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES |

|

|

|

|

|

Purchases of property and equipment |

(140,291 |

) |

|

(126,341 |

) |

|

(18,197 |

) |

|

|

Purchases of intangible assets |

(5,742 |

) |

|

(9,910 |

) |

|

(1,427 |

) |

|

| Payment

for asset acquisition |

(25,024 |

) |

|

(6,859 |

) |

|

(988 |

) |

|

| Receipt

of loans from third parties |

- |

|

|

40,000 |

|

|

5,761 |

|

|

| Payments

for short-term investments |

- |

|

|

(272,914 |

) |

|

(39,308 |

) |

|

| Proceeds

received from maturity of short-term investments |

- |

|

|

10,000 |

|

|

1,440 |

|

|

| Payments

for long-term investments |

- |

|

|

(5,025 |

) |

|

(724 |

) |

|

| Proceeds from long-term

investments |

11,269 |

|

|

- |

|

|

- |

|

|

| Minority investment in

ZJK Energy |

- |

|

|

4,000 |

|

|

576 |

|

|

| Net cash used

in investing activities |

(159,788 |

) |

|

(367,049 |

) |

|

(52,867 |

) |

|

| CASH FLOWS FROM

FINANCING ACTIVITIES |

|

|

|

|

|

Restricted cash |

(1,623,127 |

) |

|

(76,284 |

) |

|

(10,987 |

) |

|

| Proceeds

from exercise of stock options |

401 |

|

|

662 |

|

|

95 |

|

|

| Proceeds

from long-term bank borrowings |

49,650 |

|

|

54,620 |

|

|

7,867 |

|

|

| Proceeds

from short-term bank borrowings |

1,570,676 |

|

|

37,000 |

|

|

5,329 |

|

|

|

Repayments of short-term bank borrowings |

(30,000 |

) |

|

(123,000 |

) |

|

(17,716 |

) |

|

|

Repayments of long-term bank borrowings |

(6,084 |

) |

|

(27,003 |

) |

|

(3,889 |

) |

|

|

Repayments of 2017 Bonds |

(1,596,335 |

) |

|

- |

|

|

- |

|

|

|

Consideration paid to selling shareholders |

- |

|

|

(142 |

) |

|

(20 |

) |

|

|

Prepayment for shares repurchase plan |

(27,245 |

) |

|

28,004 |

|

|

4,033 |

|

|

| Payments

for shares repurchase plan |

(13,058 |

) |

|

(29,607 |

) |

|

(4,264 |

) |

|

| Payments

for capital leases |

(41,038 |

) |

|

(61,616 |

) |

|

(8,875 |

) |

|

| Net cash used

in financing activities |

(1,716,160 |

) |

|

(197,366 |

) |

|

(28,427 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Effect of

foreign exchange rate changes on cash and short

term

investments |

6,991 |

|

|

100,505 |

|

|

14,476 |

|

|

| Net decrease in

cash and cash equivalents |

(1,892,587 |

) |

|

(365,064 |

) |

|

(52,580 |

) |

|

| Cash and cash

equivalents at beginning of

period |

3,555,069 |

|

|

1,662,482 |

|

|

239,447 |

|

|

| Cash and cash

equivalents at end of period |

1,662,482 |

|

|

1,297,418 |

|

|

186,867 |

|

|

| |

|

|

|

|

Investor Relations Contacts:

21Vianet Group, Inc.

Calvin Jiang

+86 10 8456 2121

IR@21Vianet.com

ICR, Inc.

Xueli Song

+1 (646) 405-4922

IR@21Vianet.com

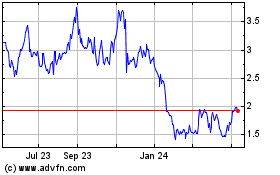

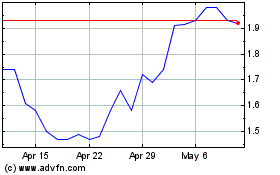

VNET (NASDAQ:VNET)

Historical Stock Chart

From Mar 2024 to Apr 2024

VNET (NASDAQ:VNET)

Historical Stock Chart

From Apr 2023 to Apr 2024