Meta Financial Group, Inc.® (Nasdaq:CASH) (the “Company”) announced

today preliminary 2017 tax season results at its bank subsidiary,

MetaBank®. From December 12, 2016 through February 28, 2017,

MetaBank originated approximately $1.26 billion in interest-free

tax advance loans across its multiple tax partners, of which

approximately $686 million were sold to its various bank partners

and $576 million were retained. During the 2016 tax season,

MetaBank originated less than $100 million of interest-free tax

advance loans. The Company also expects to process over 2.4 million

refund transfers through its EPS Financial (“EPS”) and Refund

Advantage (“RA”) divisions. MetaBank processed just over 1 million

refund transfers in 2016 at its RA division.

“The 2017 tax season has been very exciting and we would like to

highlight some of our many successes,” said Chairman and CEO J.

Tyler Haahr. “While it was difficult to forecast loan volumes for

this tax season, and some partners fell below and some above our

forecasts, we were very pleased with the processing efficiency and

effectiveness. In addition to our record breaking tax loan volumes,

MetaBank was able to successfully integrate Specialty Consumer

Services (“SCS”) and EPS into our existing business model and both

are on track to meet our expectations. With the acquisition of SCS

and their credit underwriting platform, we expect to be able to

lower our loss rates across all of our channels relative to what we

experienced last year. The infrastructure that we built performed

extremely well this tax season and we believe MetaBank is well

positioned to originate significantly more volume in the

future.”

This press release and other important information about the

Company are available at metafinancialgroup.com.

Forward-Looking Safe Harbor Statement

The Company and MetaBank (the “Bank”) may from time to time make

written or oral “forward-looking statements,” including statements

contained in this press release, the Company’s filings with the

Securities and Exchange Commission (“SEC”), the Company’s reports

to stockholders, and in other communications by the Company and the

Bank, which are made in good faith by the Company pursuant to the

“safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995.

You can identify forward-looking statements by words such as

“may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “believe,” “estimate,” “predict,” “potential,”

“continue,” “could,” “future,” or the negative of those terms, or

other words of similar meaning or similar expressions. You should

carefully read statements that contain these words because they

discuss our future expectations or state other “forward-looking”

information. These forward-looking statements are based on

information currently available to us and assumptions about future

events, and include statements with respect to the Company’s

beliefs, expectations, estimates, and intentions, which are subject

to significant risks and uncertainties, and are subject to change

based on various factors, some of which are beyond the Company’s

control. Such risks, uncertainties and other factors may cause our

actual growth, results of operations, financial condition, cash

flows, performance and business prospects and opportunities to

differ materially from those expressed in, or implied by, these

forward-looking statements. Such statements address, among others,

the following subjects: the potential benefits of the acquisitions

of assets from SCS and EPS, including, but not limited to, whether

such acquisitions may increase the Company's growth; future

operating results; customer retention; loan and other product

demand; important components of the Company's statements of

financial condition and operations; growth and expansion; new

products and services, such as those offered by the Bank or Meta

Payment Systems ("MPS"), a division of the Bank; credit quality and

adequacy of reserves; technology; and the Company's employees. The

following factors, among others, could cause the Company's

financial performance and results of operations to differ

materially from the expectations, estimates, and intentions

expressed in such forward-looking statements: the risk that sales

of EPS and SCS products by the Bank may not be as high as

anticipated; the risk that the expected growth opportunities or

cost savings from the EPS and SCS acquisitions may not be fully

realized or may take longer to realize than expected, that customer

losses and business disruption following the EPS and SCS

acquisitions, including adverse effects on relationships with

former or current employees of EPS and SCS, may be greater than

expected; the risk that the Company may incur unanticipated or

unknown losses or liabilities in connection with the EPS and SCS

acquisitions; the risk that loan production levels and other

anticipated benefits related to the recent agreements signed with

H&R Block and Jackson Hewitt may not be as much as anticipated,

and that the Company may incur unanticipated or unknown risks,

losses or liabilities in connection with such transactions;

maintaining our executive management team; the strength of the

United States' economy, in general, and the strength of the local

economies in which the Company conducts operations; the effects of,

and changes in, trade, monetary, and fiscal policies and laws,

including interest rate policies of the Board of Governors of the

Federal Reserve System (the “Federal Reserve”), as well as efforts

of the United States Treasury in conjunction with bank regulatory

agencies to stimulate the economy and protect the financial system;

inflation, interest rate, market, and monetary fluctuations; the

timely development of, and acceptance of new products and services

offered by the Company, as well as risks (including reputational

and litigation) attendant thereto, and the perceived overall value

of these products and services by users; the risks of dealing with

or utilizing third parties; any actions which may be initiated by

our regulators in the future; the impact of changes in financial

services laws and regulations, including, but not limited to, laws

and regulations relating to the tax refund industry and the

insurance premium finance industry, our relationship with our

primary regulators, the Office of the Comptroller of the Currency

(“OCC”) and the Federal Reserve, as well as the Federal Deposit

Insurance Corporation (“FDIC”), which insures the Bank’s deposit

accounts up to applicable limits; technological changes, including,

but not limited to, the protection of electronic files or

databases; acquisitions; litigation risk, in general, including,

but not limited to, those risks involving the Bank's divisions; the

growth of the Company’s business, as well as expenses related

thereto; continued maintenance by the Bank of its status as a

well-capitalized institution, particularly in light of our growing

deposit base, a substantial portion of which has been characterized

as “brokered”; changes in consumer spending and saving habits; and

the success of the Company at maintaining its high quality asset

level and managing and collecting assets of borrowers in default

should problem assets increase.

The foregoing list of factors is not exclusive. We caution you

not to place undue reliance on these forward-looking statements.

The forward-looking statements included in this press release speak

only as of the date hereof. Additional discussions of factors

affecting the Company’s business and prospects are reflected under

the caption “Risk Factors” and in other sections of the Company’s

Annual Report on Form 10-K for the Company’s fiscal year ended

September 30, 2016, and in other filings made with the SEC. The

Company expressly disclaims any intent or obligation to update any

forward-looking statements, whether written or oral, that may be

made from time to time by or on behalf of the Company or its

subsidiaries, whether as a result of new information, changed

circumstances or future events or for any other reason.

About Meta Financial GroupMeta Financial Group,

Inc. ("MFG") is the holding company for MetaBank®, a federally

chartered savings bank. MFG shares are traded on the NASDAQ Global

Select Market® under the symbol CASH. Headquartered in Sioux Falls,

SD, MetaBank operates in both the Banking and Payments industries

through: MetaBank, its traditional retail banking operation; Meta

Payment Systems, its electronic payments division; AFS/IBEX, its

insurance premium financing division; and Refund Advantage, EPS and

SCS, its tax-related financial solutions divisions.

Media Contact:

Katie LeBrun

Corporate Communications Director

605.362.5140

klebrun@metabank.com

Investor Relations Contact:

Brittany Kelley Elsasser

Investor Relations

605.362.2423

bkelley@metabank.com

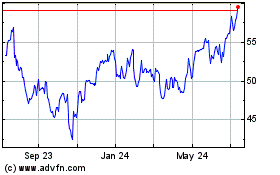

Pathward Financial (NASDAQ:CASH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pathward Financial (NASDAQ:CASH)

Historical Stock Chart

From Apr 2023 to Apr 2024