Exxon's $20 Billion Spending Plan Points to U.S. Energy Surge

March 06 2017 - 4:45PM

Dow Jones News

By Bradley Olson

HOUSTON -- Exxon Mobil Corp. plans to spend about $20 billion on

refineries, petrochemical plants and other projects in and around

the Gulf of Mexico, Chief Executive Darren Woods said Monday,

underscoring how the giants of the global energy industry are

turning to America.

Mr. Woods outlined the 11-project spending plan, largely aimed

at creating new outlets for U.S. natural gas, in a speech at the

annual CERAWeek conference. It came after a meeting with analysts

last week in which he said Exxon is poised to nearly double its

production from U.S. shale basins in the next decade.

Chevron Corp. is expected to unveil similar plans this week,

ramping up its operations in the already booming Permian basin in

West Texas and New Mexico. The company's output from the region

could reach 900,000 barrels a day by 2020 if oil prices continue to

rise, according to energy investment bank Tudor Pickering Holt

& Co. That would mean production from one company in just one

area would rival output from major world producers such as

Azerbaijan.

Exxon's announcement underscored the extent to which new

technology has unlocked vast new resources in the U.S., upending

the balance of power in global oil. Even as the Organization of the

Petroleum Exporting Countries and other nations moved late last

year to put a floor under the oil price by cutting production, U.S.

operators have vowed to return to the oilfields almost en masse to

make up the difference.

"Hydraulic fracturing has opened up a whole new energy future

for the United States, and potentially for many other countries,"

Mr. Woods said Monday. "We have managed, in the United States, to

accomplish what was practically unthinkable only a decade ago."

The conference is expected to be defined by similar bravado as

energy titans from companies and governments gather, eager to show

off their resilience after prices fell from more than $100 in

mid-2014 to below $30 in February of last year before beginning a

partial recovery. Prices have been hovering steadily above $50 for

weeks.

In his remarks, Mr. Woods also praised industry efforts to

respond to the threat of climate change, spending much of his

high-profile address discussing what Exxon is doing to reduce

emissions. The remarks, as well as others he has made since taking

over as chief executive, such as expressing support for the 2015

Paris climate deal, have signaled the company's plan to stay the

course in its environmental stance.

That comes even as some in President Donald Trump's inner circle

have pushed to walk away from the deal, while others have urged Mr.

Trump to keep the country's part in the agreement.

"We have an opportunity to contribute and help mitigate that

risk through technology," Mr. Woods said.

He also extolled the virtues of free trade as having an

elemental role in the U.S. energy renaissance.

Global energy executives have shown mixed responses to plans by

U.S. Republicans to change tax policy in a way that would favor

exports and burden imports into the country.

"It's hard to be in our business and not support open markets

and free trade," he said.

The U.S. will be the greatest contributor to new global supply

through 2022, with production from shale rising to 1.4 million

barrels a day if prices remain around $60 a barrel, according to

the Paris-based International Energy Agency. If prices rise to $80,

output from shale fields alone could reach 3 million barrels a day,

about the same as Kuwait, the IEA said Monday.

Companies such as Exxon are making immense investments in their

refining, chemicals and export operations to take advantage of the

new opportunity. From 2010 to 2020, such investments are expected

to reach almost $180 billion, according to the American Chemistry

Council, about 70% of which will go to the U.S. Gulf Coast.

In addition to Exxon's plans to build new plants or expand

facilities to turn natural gas into the building blocks of common

plastics, companies including Royal Dutch Shell PLC, Chevron

Phillips Chemical and others plan similar investments or will

expand production of fertilizer, polymers used to make lubricants,

and even tennis racket strings.

Write to Bradley Olson at Bradley.Olson@wsj.com

(END) Dow Jones Newswires

March 06, 2017 16:30 ET (21:30 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

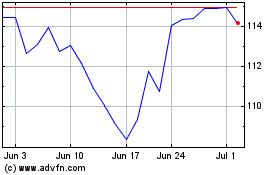

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

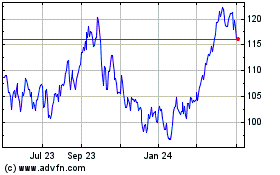

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024