Ducommun Incorporated (NYSE:DCO) (“Ducommun” or the “Company”)

today reported results for its fourth quarter and year ended

December 31, 2016.

Fourth Quarter 2016

Highlights

- Fourth quarter revenue was $142.5 million

- Operating income was $9.0 million

- GAAP net income for the quarter was $2.8 million, or $0.25 per

diluted share

- Adjusted net income for the quarter was $5.1 million, or $0.45

per diluted share, which excludes a $1.2 million final pre-tax net

working capital adjustment and a $1.0 million tax adjustment

related to divestitures

- Adjusted EBITDA for the quarter was $15.1 million

- Cash flow from operations for the quarter was $15.8

million

- Backlog increased to $600 million

- Net voluntary principal prepayments on credit facilities

totaled $10 million during the quarter - for a net total of

$75 million in voluntary principal prepayments during 2016

“Ducommun again posted improved operating

results and excellent cash flow during the quarter, paying down an

additional $10 million in debt before year end,” said Stephen G.

Oswald, president and chief executive officer. “For 2016 as a

whole, we eliminated $75 million of indebtedness, and our backlog

rose to $600 million due to recent commercial aerospace awards -

leaving us very well positioned for 2017 and beyond.

“Looking back, the Company took a number of

decisive steps in 2016 that streamlined and focused our operations,

and I’m excited to lead this innovative organization going forward.

In 2017, the higher commercial platform build rates expected later

this year, along with the potential for increased defense spending,

make me confident we have a strong foundation to leverage our

leading position in composites, titanium, and advanced

electronics.”

Fourth Quarter Results

Net revenue for the fourth quarter of 2016 was

$142.5 million, compared to $156.6 million for the fourth quarter

of 2015. The year-over-year decline was due to the following:

- $17.5 million lower revenue within the Company’s industrial,

medical and other (“Industrial”) end-use markets mainly due to the

divestiture of the Pittsburgh operation in January 2016 and closure

of the Houston operation in December 2015; and

- $4.5 million lower revenue within the Company’s military and

space end-use markets mainly due to the divestiture of the Miltec

operation in March 2016; partially offset by

- $7.8 million higher revenue in the Company’s commercial

aerospace end-use markets mainly due to added content with existing

customers.

Net income for the fourth quarter of 2016 was

$2.8 million, or $0.25 per diluted share, compared to a net loss of

$(65.2) million, or $(5.88) per share, for the fourth quarter of

2015. The fourth quarter of 2016 included a $1.2 million (pre-tax)

net working capital adjustment for which there was no related tax

benefit and a $1.0 million tax adjustment related to the

finalization of a divestiture. The impact of these two

non-recurring items was $2.2 million or $0.20 per diluted

share.

The increase in net income for the fourth

quarter of 2016 compared to the fourth quarter of 2015 was

primarily due to the following:

- $57.2 million non-cash pre-tax goodwill impairment charge

within the Structural Systems segment recorded in the fourth

quarter of 2015;

- $32.9 million non-cash pre-tax charge related to the impairment

of an indefinite-lived trade name within the Electronic Systems

segment recorded in the fourth quarter of 2015; and

- Improved operating performance in the fourth quarter of 2016;

partially offset by

- $28.0 million higher income tax expense.

Gross profit for the fourth quarter of 2016 was

$27.8 million, or 19.5% of revenue, compared to gross profit of

$22.8 million, or 14.6% of revenue, for the fourth quarter of 2015.

The higher gross margin percentage year-over-year was primarily due

to improved product mix (reflecting the aforementioned

divestitures), ongoing supply chain initiatives, and improved

operating performance.

Operating income for the fourth quarter of 2016

was $9.0 million, or 6.3% of revenue, compared to an operating loss

of $(88.6) million, or (56.6)% of revenue, for the comparable

period in 2015. The increase in operating income in the fourth

quarter of 2016 was primarily due to the items that affected

operating income (loss) described in net income (loss) above.

Interest expense decreased slightly to $2.0

million in the fourth quarter of 2016, compared to $2.2 million in

the previous year’s fourth quarter, primarily due to a lower

outstanding debt balance as a result of net voluntary principal

prepayments on the Company’s credit facilities.

Adjusted EBITDA for the fourth quarter of 2016

was $15.1 million, or 10.6% of revenue, compared to $11.0 million,

or 7.1% of revenue, for the comparable period in 2015.

During the fourth quarter of 2016, the Company

generated $15.8 million of cash from operations, compared to $11.6

million during the fourth quarter of 2015. The increase in cash

flow from operations in the fourth quarter of 2016 was primarily

due to the higher net income.

Business Segment

Information

Structural Systems

Structural Systems reported net revenue for the

current quarter of $60.8 million, compared to $61.0 million for the

fourth quarter of 2015. The slight decrease year-over-year was

primarily due to a $2.9 million decline in military and space

revenue, reflecting program delays and budget changes which

impacted scheduled deliveries on the Company’s fixed-wing and

helicopter platforms. This decline was partially offset by a $2.8

million increase in the Company’s commercial aerospace revenue,

mainly due to added content with existing customers.

Structural Systems reported operating income for

the current fourth quarter of $3.2 million, or 5.2% of revenue,

compared to an operating loss of $(56.0) million, or (91.8)% of

revenue, in the fourth quarter of 2015. The increase in operating

income was primarily due to the fact that the prior year quarter

included a non-cash goodwill impairment charge of $57.2 million and

the current year period benefited from higher operating

margins.

Adjusted EBITDA was $5.2 million for the current

quarter, or 8.5% of revenue, compared to $4.6 million, or 7.6% of

revenue, for the comparable quarter in 2015.

Electronic Systems

Electronic Systems reported net revenue for the

current quarter of $81.7 million, compared to $95.6 million for the

fourth quarter of 2015. The lower net revenue year-over-year was

primarily due to the following:

- $17.5 million decrease in Industrial revenue mainly due to the

divestiture of the Company’s Pittsburgh operation in January 2016

and closure of the Houston operation in December 2015; and

- $1.5 million decrease in military and space revenue mainly due

to the divestiture of the Company’s Miltec operation in March 2016;

partially offset by

- $5.1 million increase in commercial aerospace revenue mainly

due to added content with the Company’s existing customers.

Electronic Systems operating income for the

current year fourth quarter was $9.2 million, or 11.3% of revenue,

compared to an operating loss of $(27.0) million, or (28.3)% of

revenue, for the fourth quarter of 2015. The increase in operating

income year-over-year was primarily due to the following:

- Fourth quarter 2015 included a non-cash charge related to the

impairment of the indefinite-lived trade name intangible asset of

$32.9 million; and

- Higher operating margins in the fourth quarter of 2016 as a

result of the aforementioned divestitures and improved operating

performance.

Adjusted EBITDA was $12.8 million for the

current quarter, or 15.7% of revenue, compared to $11.3 million, or

11.8% of revenue, in the comparable quarter in 2015.

Corporate General and Administrative

(“CG&A”) Expense

CG&A expense for the current fourth quarter

was $3.4 million, or 2.4% of total Company revenue, compared to

$5.6 million, or 3.6% of total Company revenue, in the comparable

quarter in 2015. The decrease in CG&A expense in the current

year quarter was primarily due to lower professional fees of $1.7

million and lower compensation and benefit costs of $0.5

million.

Conference Call

A teleconference hosted by Anthony J. Reardon,

the Company’s chairman of the board, Stephen G. Oswald, the

Company’s president and chief executive officer, and Douglas L.

Groves, the Company’s vice president, chief financial officer and

treasurer, will be held today, March 6, 2017 at 2:00 p.m. PT (5:00

p.m. ET) to review these financial results. To participate in the

teleconference, please call 844-239-5278 (international

574-990-1017) approximately ten minutes prior to the conference

time. The participant passcode is 56842062. Mr. Reardon, Mr.

Oswald, and Mr. Groves will be speaking on behalf of the Company

and anticipate the meeting and Q&A period to last approximately

45 minutes.

This call is being webcast by Thomson Reuters

and can be accessed directly at the Ducommun website at

www.ducommun.com. Conference call replay will be available after

that time at the same link or by dialing 855-859-2056, passcode

56842062.

About Ducommun Incorporated

Ducommun Incorporated delivers value-added

innovative manufacturing solutions to customers in the aerospace,

defense and industrial markets. Founded in 1849, the Company

specializes in two core areas - Electronic Systems and Structural

Systems - to produce complex products and components for commercial

aircraft platforms, mission-critical military and space programs,

and sophisticated industrial applications. For more information,

visit www.ducommun.com.

Forward Looking Statements

This press release and any attachments include

“forward-looking statements,” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, including, in

particular, earnings guidance and any statements about the

Company’s plans, strategies and prospects. The Company generally

uses the words “may,” “will,” “could,” “expect,” “anticipate,”

“believe,” “estimate,” “plan,” “intend” and similar expressions in

this press release and any attachments to identify forward-looking

statements. The Company bases these forward-looking statements on

its current views with respect to future events and financial

performance. Actual results could differ materially from those

projected in the forward-looking statements. These forward-looking

statements are subject to risks, uncertainties and assumptions,

including, among other things: competition from other industry

participants; the Company’s ability to continue to develop

innovative new products and services and enhance its existing

products and services, or the failure of its products and services

to continue to appeal to the market; the effectiveness of the

Company’s marketing and advertising programs; the Company’s ability

to successfully make acquisitions or enter into joint ventures,

including its ability to successfully integrate, operate or realize

the projected benefits of such businesses; uncertainties related to

a downturn in general economic conditions or consumer confidence;

uncertainties regarding the satisfactory operation of the Company’s

information technology or systems; the impact of existing and

future laws and regulations; the impact of existing and future

accounting standards and tax rules and regulations; the impact of

the Company’s debt service obligations and restrictive debt

covenants; and other risks and uncertainties, including those

detailed from time to time in the Company’s periodic reports filed

with the Securities and Exchange Commission. You should not put

undue reliance on any forward-looking statements. You should

understand that many important factors, including those discussed

herein, could cause the Company’s results to differ materially from

those expressed or suggested in any forward-looking statement.

Except as required by law, the Company does not undertake any

obligation to update or revise these forward-looking statements to

reflect new information or events or circumstances that occur after

the date of this news release or to reflect the occurrence of

unanticipated events or otherwise. Readers are advised to review

the Company’s filings with the Securities and Exchange Commission

(which are available from the SEC’s EDGAR database at www.sec.gov,

at various SEC reference facilities in the United States and

through the Company’s website).

Note Regarding Non-GAAP Financial

Information

This release contains non-GAAP financial

measures, including Adjusted EBITDA (which excludes interest

expense, income tax expense (benefit), depreciation, amortization,

stock-based compensation expense, net gain on divestitures, loss on

extinguishment of debt, goodwill impairment, intangible asset

impairment, and restructuring charges) and Adjusted Net Income

(Loss) as well as Adjusted Earnings Per Share (which excludes

divestiture net working capital adjustment and divestiture tax

basis adjustment).

The Company believes the presentation of these

non-GAAP measures provide important supplemental information to

management and investors regarding financial and business trends

relating to its financial condition and results of operations. The

Company’s management uses these non-GAAP financial measures along

with the most directly comparable GAAP financial measures in

evaluating the Company’s actual and forecasted operating

performance, capital resources and cash flow. The non-GAAP

financial information presented herein should be considered

supplemental to, and not as a substitute for, or superior to,

financial measures calculated in accordance with GAAP. The Company

discloses different non-GAAP financial measures in order to provide

greater transparency and to help the Company’s investors to more

meaningfully evaluate and compare Ducommun’s results to its

previously reported results. The non-GAAP financial measures that

the Company uses may not be comparable to similarly titled

financial measures used by other companies.

[Financial Tables Follow]

| |

| DUCOMMUN INCORPORATED AND SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (Unaudited) |

| (In thousands) |

| |

|

|

|

December 31, 2016 |

|

December 31, 2015 |

|

Assets |

|

|

|

|

| Current Assets |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

7,432 |

|

|

$ |

5,454 |

|

| Accounts

receivable, net |

|

76,239 |

|

|

77,089 |

|

|

Inventories |

|

119,896 |

|

|

115,404 |

|

|

Production cost of contracts |

|

11,340 |

|

|

10,290 |

|

| Other

current assets |

|

11,034 |

|

|

13,389 |

|

| Assets

held for sale |

|

— |

|

|

41,636 |

|

| Total

Current Assets |

|

225,941 |

|

|

263,262 |

|

| Property and Equipment,

Net |

|

101,590 |

|

|

96,551 |

|

| Goodwill |

|

82,554 |

|

|

82,554 |

|

| Intangibles, Net |

|

101,573 |

|

|

110,621 |

|

| Non-Current Deferred

Income Taxes |

|

286 |

|

|

324 |

|

| Other Assets |

|

3,485 |

|

|

3,769 |

|

| Total

Assets |

|

$ |

515,429 |

|

|

$ |

557,081 |

|

| Liabilities and

Shareholders’ Equity |

|

|

|

|

| Current

Liabilities |

|

|

|

|

| Current

portion of long-term debt |

|

$ |

3 |

|

|

$ |

26 |

|

| Accounts

payable |

|

57,024 |

|

|

40,343 |

|

| Accrued

liabilities |

|

29,279 |

|

|

36,458 |

|

|

Liabilities held for sale |

|

— |

|

|

6,780 |

|

| Total

Current Liabilities |

|

86,306 |

|

|

83,607 |

|

| Long-Term Debt, Less

Current Portion |

|

166,896 |

|

|

240,661 |

|

| Non-Current Deferred

Income Taxes |

|

31,417 |

|

|

28,125 |

|

| Other Long-Term

Liabilities |

|

18,707 |

|

|

18,954 |

|

| Total

Liabilities |

|

303,326 |

|

|

371,347 |

|

| Commitments and

Contingencies |

|

|

|

|

| Shareholders’

Equity |

|

|

|

|

| Common

stock |

|

112 |

|

|

111 |

|

|

Additional paid-in capital |

|

76,783 |

|

|

75,200 |

|

| Retained

earnings |

|

141,287 |

|

|

116,026 |

|

|

Accumulated other comprehensive loss |

|

(6,079 |

) |

|

(5,603 |

) |

| Total

Shareholders’ Equity |

|

212,103 |

|

|

185,734 |

|

| Total

Liabilities and Shareholders’ Equity |

|

$ |

515,429 |

|

|

$ |

557,081 |

|

| |

|

|

|

|

|

|

|

|

| DUCOMMUN INCORPORATED AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Quarterly Information Unaudited) |

| (In thousands, except per share amounts) |

| |

| |

|

Three Months Ended |

|

Years Ended |

| |

|

December 31, 2016 |

|

December 31, 2015 |

|

December 31, 2016 |

|

December 31, 2015 |

| Net Revenues |

|

$ |

142,486 |

|

|

$ |

156,576 |

|

|

$ |

550,642 |

|

|

$ |

666,011 |

|

| Cost of Sales |

|

114,700 |

|

|

133,780 |

|

|

444,449 |

|

|

565,219 |

|

| Gross Profit |

|

27,786 |

|

|

22,796 |

|

|

106,193 |

|

|

100,792 |

|

| Selling, General and

Administrative Expenses |

|

18,829 |

|

|

21,214 |

|

|

77,625 |

|

|

85,921 |

|

| Goodwill

Impairment |

|

— |

|

|

57,243 |

|

|

— |

|

|

57,243 |

|

| Intangible Asset

Impairment |

|

— |

|

|

32,937 |

|

|

— |

|

|

32,937 |

|

| Operating Income

(Loss) |

|

8,957 |

|

|

(88,598 |

) |

|

28,568 |

|

|

(75,309 |

) |

| Interest Expense |

|

(1,995 |

) |

|

(2,210 |

) |

|

(8,274 |

) |

|

(18,709 |

) |

| (Loss) Gain on

Divestitures, Net |

|

(1,211 |

) |

|

— |

|

|

17,604 |

|

|

— |

|

| Loss on Extinguishment

of Debt |

|

— |

|

|

— |

|

|

— |

|

|

(14,720 |

) |

| Other Income, Net |

|

74 |

|

|

638 |

|

|

215 |

|

|

2,148 |

|

| Income (Loss) Before

Taxes |

|

5,825 |

|

|

(90,170 |

) |

|

38,113 |

|

|

(106,590 |

) |

| Income Tax Expense

(Benefit) |

|

2,989 |

|

|

(24,997 |

) |

|

12,852 |

|

|

(31,711 |

) |

| Net Income (Loss) |

|

$ |

2,836 |

|

|

$ |

(65,173 |

) |

|

$ |

25,261 |

|

|

$ |

(74,879 |

) |

| Earnings (Loss) Per

Share |

|

|

|

|

|

|

|

|

| Basic

earnings (loss) per share |

|

$ |

0.25 |

|

|

$ |

(5.88 |

) |

|

$ |

2.27 |

|

|

$ |

(6.78 |

) |

| Diluted

earnings (loss) per share |

|

$ |

0.25 |

|

|

$ |

(5.88 |

) |

|

$ |

2.24 |

|

|

$ |

(6.78 |

) |

| Weighted-Average Number

of Common Shares Outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

11,182 |

|

|

11,084 |

|

|

11,151 |

|

|

11,047 |

|

|

Diluted |

|

11,383 |

|

|

11,084 |

|

|

11,299 |

|

|

11,047 |

|

| |

|

|

|

|

|

|

|

|

| Gross Profit % |

|

19.5 |

% |

|

14.6 |

% |

|

19.3 |

% |

|

15.1 |

% |

| SG&A % |

|

13.2 |

% |

|

13.5 |

% |

|

14.1 |

% |

|

12.9 |

% |

| Operating Income (Loss)

% |

|

6.3 |

% |

|

(56.6 |

)% |

|

5.2 |

% |

|

(11.3 |

)% |

| Net Income (Loss)

% |

|

2.0 |

% |

|

(41.6 |

)% |

|

4.6 |

% |

|

(11.2 |

)% |

| Effective Tax (Benefit)

Rate |

|

51.3 |

% |

|

(27.7 |

)% |

|

33.7 |

% |

|

(29.7 |

)% |

| DUCOMMUN INCORPORATED AND SUBSIDIARIES |

| BUSINESS SEGMENT PERFORMANCE |

| (Unaudited) |

| (In thousands) |

| |

| |

|

Three Months Ended |

|

Years Ended |

| |

|

%Change |

|

December 31, 2016 |

|

December 31, 2015 |

|

%of Net Revenues2016 |

|

%of Net Revenues2015 |

|

% Change |

|

December 31, 2016 |

|

December 31, 2015 |

|

% of Net Revenues 2016 |

|

% of Net Revenues 2015 |

| Net

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Structural Systems |

|

(0.3 |

)% |

|

$ |

60,823 |

|

|

$ |

61,013 |

|

|

42.7 |

% |

|

39.0 |

% |

|

(9.8 |

)% |

|

$ |

246,465 |

|

|

$ |

273,319 |

|

|

44.8 |

% |

|

41.0 |

% |

|

Electronic Systems |

|

(14.5 |

)% |

|

81,663 |

|

|

95,563 |

|

|

57.3 |

% |

|

61.0 |

% |

|

(22.5 |

)% |

|

304,177 |

|

|

392,692 |

|

|

55.2 |

% |

|

59.0 |

% |

| Total Net

Revenues |

|

(9.0 |

)% |

|

$ |

142,486 |

|

|

$ |

156,576 |

|

|

100.0 |

% |

|

100.0 |

% |

|

(17.3 |

)% |

|

$ |

550,642 |

|

|

$ |

666,011 |

|

|

100.0 |

% |

|

100.0 |

% |

| Segment

Operating Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Structural Systems |

|

|

|

$ |

3,150 |

|

|

$ |

(55,990 |

) |

|

5.2 |

% |

|

(91.8 |

)% |

|

|

|

$ |

16,497 |

|

|

$ |

(53,010 |

) |

|

6.7 |

% |

|

(19.4 |

)% |

|

Electronic Systems |

|

|

|

9,214 |

|

|

(27,047 |

) |

|

11.3 |

% |

|

(28.3 |

)% |

|

|

|

28,983 |

|

|

(4,472 |

) |

|

9.5 |

% |

|

(1.1 |

)% |

| |

|

|

|

12,364 |

|

|

(83,037 |

) |

|

|

|

|

|

|

|

|

|

45,480 |

|

|

(57,482 |

) |

|

|

|

|

|

|

| Corporate

General and Administrative Expenses (1) |

|

|

|

(3,407 |

) |

|

(5,561 |

) |

|

(2.4 |

)% |

|

(3.6 |

)% |

|

|

|

(16,912 |

) |

|

(17,827 |

) |

|

(3.1 |

)% |

|

(2.7 |

)% |

| Total

Operating Income (Loss) |

|

|

|

$ |

8,957 |

|

|

$ |

(88,598 |

) |

|

6.3 |

% |

|

(56.6 |

)% |

|

|

|

$ |

28,568 |

|

|

$ |

(75,309 |

) |

|

5.2 |

% |

|

(11.3 |

)% |

| Adjusted

EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Structural Systems |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Income (Loss) (2)(3) |

|

|

|

$ |

3,150 |

|

|

$ |

(55,990 |

) |

|

|

|

|

|

|

|

|

|

$ |

16,497 |

|

|

$ |

(53,010 |

) |

|

|

|

|

|

|

| Other

Income (4) |

|

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

141 |

|

|

1,510 |

|

|

|

|

|

|

|

|

Depreciation and Amortization |

|

|

|

2,005 |

|

|

2,408 |

|

|

|

|

|

|

|

|

|

|

8,688 |

|

|

9,417 |

|

|

|

|

|

|

|

| Goodwill

Impairment |

|

|

|

— |

|

|

57,243 |

|

|

|

|

|

|

|

|

|

|

— |

|

|

57,243 |

|

|

|

|

|

|

|

|

Restructuring Charges |

|

|

|

— |

|

|

980 |

|

|

|

|

|

|

|

|

|

|

— |

|

|

1,294 |

|

|

|

|

|

|

|

| |

|

|

|

5,155 |

|

|

4,641 |

|

|

8.5 |

% |

|

7.6 |

% |

|

|

|

25,326 |

|

|

16,454 |

|

|

10.3 |

% |

|

6.0 |

% |

|

Electronic Systems |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Income (Loss) (3)(5) |

|

|

|

9,214 |

|

|

(27,047 |

) |

|

|

|

|

|

|

|

|

|

28,983 |

|

|

(4,472 |

) |

|

|

|

|

|

|

| Other

Income |

|

|

|

— |

|

|

712 |

|

|

|

|

|

|

|

|

|

|

— |

|

|

712 |

|

|

|

|

|

|

|

|

Depreciation and Amortization |

|

|

|

3,426 |

|

|

4,339 |

|

|

|

|

|

|

|

|

|

|

14,087 |

|

|

17,267 |

|

|

|

|

|

|

|

|

Intangible Asset Impairment |

|

|

|

— |

|

|

32,937 |

|

|

|

|

|

|

|

|

|

|

— |

|

|

32,937 |

|

|

|

|

|

|

|

|

Restructuring Charges |

|

|

|

182 |

|

|

363 |

|

|

|

|

|

|

|

|

|

|

182 |

|

|

831 |

|

|

|

|

|

|

|

|

|

|

|

|

12,822 |

|

|

11,304 |

|

|

15.7 |

% |

|

11.8 |

% |

|

|

|

43,252 |

|

|

47,275 |

|

|

14.2 |

% |

|

12.0 |

% |

| Corporate

General and Administrative Expenses (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

loss |

|

|

|

(3,407 |

) |

|

(5,561 |

) |

|

|

|

|

|

|

|

|

|

(16,912 |

) |

|

(17,827 |

) |

|

|

|

|

|

|

| Other

Expense (Income) |

|

|

|

74 |

|

|

(74 |

) |

|

|

|

|

|

|

|

|

|

74 |

|

|

(74 |

) |

|

|

|

|

|

|

|

Depreciation and Amortization |

|

|

|

9 |

|

|

35 |

|

|

|

|

|

|

|

|

|

|

85 |

|

|

162 |

|

|

|

|

|

|

|

|

Stock-Based Compensation Expense |

|

|

|

428 |

|

|

703 |

|

|

|

|

|

|

|

|

|

|

3,007 |

|

|

3,495 |

|

|

|

|

|

|

|

|

|

|

|

|

(2,896 |

) |

|

(4,897 |

) |

|

|

|

|

|

|

|

|

|

(13,746 |

) |

|

(14,244 |

) |

|

|

|

|

|

|

| Adjusted

EBITDA |

|

|

|

$ |

15,081 |

|

|

$ |

11,048 |

|

|

10.6 |

% |

|

7.1 |

% |

|

|

|

$ |

54,832 |

|

|

$ |

49,485 |

|

|

10.0 |

% |

|

7.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital

Expenditures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Structural Systems |

|

|

|

$ |

5,512 |

|

|

$ |

3,479 |

|

|

|

|

|

|

|

|

$ |

15,661 |

|

|

$ |

11,559 |

|

|

|

|

|

|

Electronic Systems |

|

|

|

1,331 |

|

|

1,223 |

|

|

|

|

|

|

|

|

3,032 |

|

|

4,419 |

|

|

|

|

|

| Corporate

Administration |

|

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

— |

|

|

10 |

|

|

|

|

|

| Total

Capital Expenditures |

|

|

|

$ |

6,843 |

|

|

$ |

4,702 |

|

|

|

|

|

|

|

|

$ |

18,693 |

|

|

$ |

15,988 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes costs not allocated to either the Structural

Systems or Electronic Systems operating segments.(2) Goodwill

impairment related to Structural Systems operating segment.(3) 2015

includes restructuring charges for severance and benefits and loss

on early exit from leases.(4) Insurance recoveries related to

property and equipment included as other income in 2015.(5)

Intangible asset impairment related to Electronic Systems operating

segment.

| |

| |

| DUCOMMUN INCORPORATED AND SUBSIDIARIES |

| GAAP TO NON-GAAP EARNINGS PER SHARE

RECONCILIATION |

| (Unaudited) |

| (In thousands, except per share amounts) |

| |

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, 2016 |

|

December 31, 2015 |

|

December 31, 2016 |

|

December 31, 2015 |

| GAAP Net income

(loss) |

|

$ |

2,836 |

|

|

$ |

(65,173 |

) |

|

$ |

25,261 |

|

|

$ |

(74,879 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Divestiture of Miltec operation net working capital adjustment |

|

1,211 |

|

|

— |

|

|

1,211 |

|

|

— |

|

|

Divestiture of Miltec operation tax basis adjustment |

|

1,027 |

|

|

— |

|

|

1,027 |

|

|

— |

|

| Total

adjustments |

|

2,238 |

|

|

— |

|

|

2,238 |

|

|

— |

|

| Income

tax impact on adjustments |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Adjusted net income

(loss) |

|

$ |

5,074 |

|

|

$ |

(65,173 |

) |

|

$ |

27,499 |

|

|

$ |

(74,879 |

) |

| |

|

|

|

|

|

|

|

|

| Adjusted diluted

earnings (loss) per share |

|

$ |

0.45 |

|

|

$ |

(5.88 |

) |

|

$ |

2.43 |

|

|

$ |

(6.78 |

) |

| |

|

|

|

|

|

|

|

|

| Diluted shares used for

adjusted earnings per share |

|

11,383 |

|

|

11,084 |

|

|

11,299 |

|

|

11,047 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

CONTACTS:

Douglas L. Groves,

Vice President, Chief Financial Officer

and Treasurer,

310.513.7200

Chris Witty,

Investor Relations,

646.438.9385,

cwitty@darrowir.com

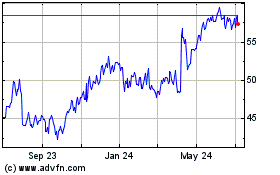

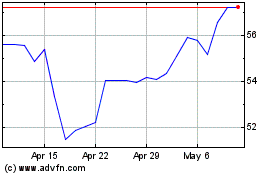

Ducommun (NYSE:DCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ducommun (NYSE:DCO)

Historical Stock Chart

From Apr 2023 to Apr 2024