Report of Foreign Issuer (6-k)

March 06 2017 - 12:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF MARCH 2017

COMMISSION FILE NUMBER 0-20115

METHANEX CORPORATION

(Registrant’s name)

SUITE 1800, 200 BURRARD STREET, VANCOUVER, BC V6C 3M1 CANADA

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

o

NEWS RELEASE

Methanex Corporation

1800 - 200 Burrard St.

Vancouver, BC Canada V6C 3M1

Investor Relations: 604-661-2600

Toll-Free: 1-800-661-8851

http://www.methanex.com

For immediate release

March 6, 2017

METHANEX ANNOUNCES A 5% SHARE REPURCHASE PROGRAM

Methanex Corporation (the “Company”) (TSX:MX) (NASDAQ:MEOH) announced today that its Board of Directors has approved a Normal Course Issuer Bid (“NCIB”) whereby the Company will purchase for cancellation up to 4,492,141 common shares ("Shares"), representing approximately 5% of the 89,842,838 Shares issued and outstanding.

John Floren, President and CEO of Methanex commented, “Our announcement of a new share repurchase program builds on a long track record of returning excess cash to shareholders. Our methanol production and sales volumes are at record levels and we are benefiting from a strong methanol price environment. With a solid liquidity position and strong cash generation capability, we have the financial strength and flexibility to meet all of our financial and capital commitments, pursue investment opportunities, and continue to return excess cash to shareholders.”

Purchases pursuant to the NCIB will be made on the open market through the facilities of the NASDAQ Global Select Market (“NASDAQ”) and alternative trading systems in the United States pursuant to Rule 10b-18 under the U.S. Securities Exchange Act of 1934. Notification of the NCIB has been provided to NASDAQ. Purchases under the program will commence on March 13, 2017 and end no later than March 12, 2018. Purchases will be made from time to time at the then current market price of the Shares and all Shares purchased will be cancelled. Subject to certain exceptions for block purchases, daily repurchases under the program will not exceed 25 percent of the Company’s average daily trading volume for the four week period preceding the date of purchase. The Company has entered into an automatic securities purchase plan with its broker in connection with purchases to be made under this program.

Methanex is a Vancouver-based, publicly traded company and is the world's largest producer and supplier of methanol to major international markets. Methanex shares are listed for trading on the Toronto Stock Exchange in Canada under the trading symbol "MX" and on the NASDAQ Global Select Market in the United States under the trading symbol "MEOH".

FORWARD-LOOKING INFORMATION WARNING

This press release contains certain forward-looking statements with respect to us and our industry. These statements relate to future events or our future performance. All statements other than statements of historical fact are forward looking statements. Statements that include the words "expect", and "continue" or other comparable terminology and similar statements of a future or forward-looking nature identify forward-looking statements. More particularly and without limitation, any statements regarding the following are forward-looking statements:

|

|

|

|

•

|

Methanex’s expected future financial strength and cash generation capability, and

|

|

|

|

|

•

|

Methanex's ability to continue to return excess cash to shareholders.

|

We believe that we have a reasonable basis for making such forward-looking statements. The forward-looking statements in this document are based on our experience, our perception of trends, current conditions and expected future developments as well as other factors. Certain material factors or assumptions were applied in drawing the conclusions or making the forecasts

or projections that are included in these forward-looking statements, including, without limitation, future expectations and assumptions concerning the following:

|

|

|

|

•

|

the supply of, demand for, and price of methanol, methanol derivatives, natural gas, coal, oil and oil derivatives,

|

|

|

|

|

•

|

operating rates of our facilities,

|

|

|

|

|

•

|

operating costs including natural gas feedstock and logistics costs, capital costs, tax rates, cash flows, foreign exchange rates and interest rates,

|

|

|

|

|

•

|

global and regional economic activity (including industrial production levels).

|

However, forward-looking statements, by their nature, involve risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements. The risks and uncertainties primarily include those attendant with producing and marketing methanol and successfully carrying out major capital expenditure projects in various jurisdictions, including without limitation:

|

|

|

|

•

|

conditions in the methanol and other industries including fluctuations in the supply, demand for and price of methanol and its derivatives, including demand for methanol for energy uses,

|

|

|

|

|

•

|

the price of natural gas, coal, oil and oil derivatives,

|

|

|

|

|

•

|

the ability to successfully carry out corporate initiatives and strategies,

|

|

|

|

|

•

|

actions of competitors, suppliers and financial institutions,

|

|

|

|

|

•

|

world-wide economic conditions, and

|

|

|

|

|

•

|

other risks described in our 2015 Annual Management's Discussion and Analysis and our Fourth Quarter 2016 Management's Discussion and Analysis.

|

Having in mind these and other factors, investors and other readers are cautioned not to place undue reliance on forward-looking statements. They are not a substitute for the exercise of one's own due diligence and judgment. The outcomes anticipated in forward-looking statements may not occur and we do not undertake to update forward-looking statements except as required by applicable securities laws.

- end -

For further information, contact:

Sandra Daycock

Director, Investor Relations

Tel: 604 661-2600

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

METHANEX CORPORATION

|

|

|

Date: March 6, 2017

|

By:

|

/s/ KEVIN PRICE

|

|

|

|

|

Name:

|

Kevin Price

|

|

|

|

|

Title:

|

General Counsel & Corporate Secretary

|

|

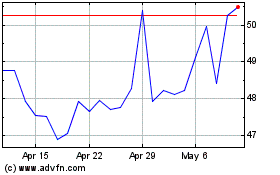

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

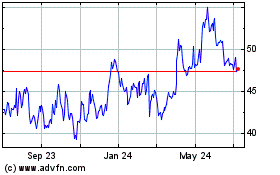

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Apr 2023 to Apr 2024