Statement of Changes in Beneficial Ownership (4)

March 03 2017 - 6:23PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Zakrzewski Joseph S

|

2. Issuer Name

and

Ticker or Trading Symbol

INSULET CORP

[

PODD

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__

X

__ Director

_____ 10% Owner

_____ Officer (give title below)

_____ Other (specify below)

|

|

(Last)

(First)

(Middle)

C/O INSULET CORPORATION, 600 TECHNOLOGY PARK DRIVE, SUITE 200

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/2/2017

|

|

(Street)

BILLERICA, MA 01821

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common Stock

|

3/2/2017

|

|

M

|

|

9520

|

A

|

$18.75

|

37369

(1)

|

D

|

|

|

Common Stock

|

3/2/2017

|

|

M

|

|

18480

|

A

|

$7.06

|

55849

(1)

|

D

|

|

|

Common Stock

|

3/2/2017

|

|

M

|

|

4000

|

A

|

$14.48

|

59849

(1)

|

D

|

|

|

Common Stock

|

3/2/2017

|

|

M

|

|

4000

|

A

|

$20.90

|

63849

(1)

|

D

|

|

|

Common Stock

|

3/2/2017

|

|

M

|

|

4000

|

A

|

$17.75

|

67849

(1)

|

D

|

|

|

Common Stock

|

3/2/2017

|

|

S

|

|

4000

|

D

|

$48.031

|

63849

(1)

|

D

|

|

|

Common Stock

|

3/2/2017

|

|

S

|

|

13721

|

D

|

$46.3133

(2)

|

50128

(1)

|

D

|

|

|

Common Stock

|

3/2/2017

|

|

S

|

|

22279

|

D

|

$46.9907

(3)

|

27849

(1)

|

D

|

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Stock Option (Right to Buy)

|

$18.75

|

3/2/2017

|

|

M

|

|

|

9520

|

(4)

|

5/8/2018

|

Common Stock

|

9520

|

$0

|

0

|

D

|

|

|

Stock Option (Right to Buy)

|

$7.06

|

3/2/2017

|

|

M

|

|

|

18480

|

(5)

|

7/30/2019

|

Common Stock

|

18480

|

$0

|

0

|

D

|

|

|

Stock Option (Right to Buy)

|

$14.48

|

3/2/2017

|

|

M

|

|

|

4000

|

(5)

|

6/1/2020

|

Common Stock

|

4000

|

$0

|

0

|

D

|

|

|

Stock Option (Right to Buy)

|

$20.90

|

3/2/2017

|

|

M

|

|

|

4000

|

(6)

|

5/12/2021

|

Common Stock

|

4000

|

$0

|

0

|

D

|

|

|

Stock Option (Right to Buy)

|

$17.75

|

3/2/2017

|

|

M

|

|

|

4000

|

(7)

|

6/1/2022

|

Common Stock

|

4000

|

$0

|

0

|

D

|

|

|

Explanation of Responses:

|

|

(

1)

|

Includes 3,810 restricted stock units granted on May 11, 2016, which vest on April 30, 2017; 1,000 restricted stock units granted on June 2, 2014, which vest on April 30, 2017; and 2,020 restricted stock units granted on May 13, 2015, which vest 50% of the total units on April 30, 2017 and 50% of the total units on April 30, 2018, subject to continued service as a director or consultant. Vested shares will be delivered to the reporting person as soon as practiable following a vesting date.

|

|

(

2)

|

The price reported represents the weighted average sale price of the shares sold. The shares were sold at varying prices in the range of $45.65 to $46.645. The Reporting Person hereby undertakes, upon request of the Staff of the U.S. Securities Exchange Commission, the Issuer or a security holder of the Issuer, to provide full information regarding the number of shares sold at each separate price.

|

|

(

3)

|

The price reported represents the weighted average sale price of the shares sold. The shares were sold at varying prices in the range of $46.66 to $47.54. The Reporting Person hereby undertakes, upon request of the Staff of the U.S. Securities Exchange Commission, the Issuer or a security holder of the Issuer, to provide full information regarding the number of shares sold at each separate price.

|

|

(

4)

|

This option is subject to a three-year vesting period with 50% of the total award vesting one year after the grant date, 25% of the total award vesting two years after the grant date and 25% of the total award vesting three years after the grant date, subject to continued service as a director or consultant.

|

|

(

5)

|

This option is subject to a three-year vesting period with 50% of the total award vesting on the first anniversary of the date of grant and 25% on each of the second and third anniversaries of the date of grant, subject to continued service as a director or consultant.

|

|

(

6)

|

This option shall vest as to 100% of the total award on April 30, 2017, subject to continued service as a director or consultant.

|

|

(

7)

|

This option is subject to a three-year vesting period with 50% of the total award vesting on April 30, 2013, 25% of the total award vesting on April 30, 2014 and 25% of the total award vesting on April 30, 2015, subject to continued service as a director or consultant.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Zakrzewski Joseph S

C/O INSULET CORPORATION

600 TECHNOLOGY PARK DRIVE, SUITE 200

BILLERICA, MA 01821

|

X

|

|

|

|

Signatures

|

|

/s/ David Colleran, attorney-in-fact

|

|

3/3/2017

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

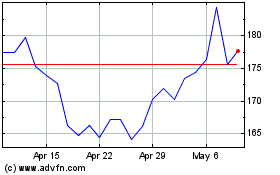

Insulet (NASDAQ:PODD)

Historical Stock Chart

From Mar 2024 to Apr 2024

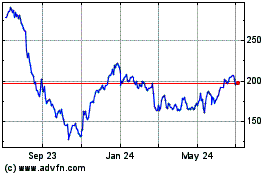

Insulet (NASDAQ:PODD)

Historical Stock Chart

From Apr 2023 to Apr 2024