As filed with the Securities and Exchange Commission on

March 3, 2017

Registration No. 333-121996

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 15

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NACCO INDUSTRIES, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

3537

|

|

34-1505819

|

|

(State or Other Jurisdiction of

|

|

(Primary Standard Industrial

|

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

|

Classification Code Number)

|

|

Identification Number)

|

5875 Landerbrook Drive

Cleveland, Ohio 44124-4069

(440) 229-5151

(Address, Including Zip Code, and Telephone Number, Including Area Code, of

Registrant’s Principal Executive Offices)

John D. Neumann, Esq.

Vice President, General Counsel and Secretary

NACCO Industries, Inc.

5875 Landerbrook Drive, Suite 220

Cleveland, Ohio 44124-4069

(440) 229-5151

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent For Service)

Copies to:

Kimberly J. Pustulka

Jones Day

North Point

901 Lakeside Avenue

Cleveland, Ohio 44114-1190

(216) 586-3939

Approximate date of commencement of proposed sale to the public:

As soon as practicable following the effective date of this registration statement.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box.

o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

o

|

|

Accelerated filer

þ

|

|

Non-accelerated filer

o

|

|

Smaller reporting company

o

|

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

o

Pursuant to Rule 429(a) under the Securities Act of 1933, the prospectus contained in this Post-effective Amendment No. 15 (this “Post-effective Amendment”) to the Registration Statement on Form S-4 filed by the Company on January 12, 2005 (Registration No. 333-121996), which was amended by the Pre-effective Amendment No. 1 to Form S-4 and declared effective on February 7, 2005, further amended by the Post-effective Amendment No. 1, declared effective on March 23, 2005, further amended by Post-effective Amendment No. 2, declared effective on March 6, 2006, further amended by Post-effective Amendment No. 3, declared effective on March 6, 2007, further amended by Post-effective Amendment No. 4, declared effective on February 29, 2008, further amended by Post-effective Amendment No. 5, declared effective on March 30, 2009, further amended by Post-effective Amendment No. 6, declared effective on March 30, 2010, further amended by Post-effective Amendment No. 7, declared effective on March 25, 2011, further amended by Post-effective Amendment No. 8, declared effective on March 22, 2012, further amended by Post-effective Amendment No. 9, declared effective on April 11, 2013, further amended by Post-effective Amendment No. 10, declared effective on April 11, 2013, further amended by Post-effective Amendment No. 11, declared effective on March 4, 2014, further amended by Post-effective Amendment No. 12, declared effective on March 31, 2015 and further amended by Post-effective Amendment No. 14, declared effective on March 22, 2016 (as amended, the “Previous Registration Statement #3”) is a combined prospectus relating to up to 342,503 shares of securities registered and remaining unsold under the Previous Registration Statement #3. The Previous Registration Statement #3 included 355,703 shares of securities registered and remaining unsold under the Registration Statement on Form S-4 filed by the Company on September 5, 2003 (Registration No. 333-108538), as amended, which was declared effective on May 3, 2004 (the “Previous Registration Statement #2”). The Previous Registration Statement #2 included 64,795 shares of securities registered and remaining unsold under the Registration Statement on Form S-3 filed by the Company on July 13, 2001 (Registration No. 333-65134), which was amended by Pre-effective Amendment No. 1 to Form S-3 filed on Form S-4 and declared effective on November 19, 2001 (as amended, the “Previous Registration Statement #1”).

Pursuant to Rule 429(b), upon effectiveness, this Post-effective Amendment will constitute Post-effective Amendment No. 15 to the Previous Registration Statement #3, Post-effective Amendment No. 16 to the Previous Registration Statement #2 and Post-effective Amendment No. 21 to the Previous Registration Statement #1, which Post-effective Amendment No. 15, Post-effective Amendment No. 16 and Post-effective Amendment No. 21 shall hereafter become effective concurrently with the effectiveness of this Post-effective Amendment and in accordance with Section 8(c) of the Securities Act of 1933.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with

Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be exchanged until the post-effective amendment to the registration statement, of which this prospectus forms a part, filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, Dated

March 3, 2017

Prospectus

OFFER BY SELLING STOCKHOLDERS

TO EXCHANGE UP TO 342,503 SHARES OF

CLASS A COMMON STOCK

FOR 342,503 SHARES OF

CLASS B COMMON STOCK

NACCO INDUSTRIES, INC.

Under the terms of NACCO Industries, Inc.'s certificate of incorporation and a stockholders' agreement, shares of Class B common stock are generally not transferable except to persons who are permitted transferees as specified in those documents. In accordance with those documents, parties to the stockholders' agreement may transfer shares of Class B common stock to the selling stockholders for shares of Class A common stock, on a share for share basis. As a result, the selling stockholders named in this prospectus are offering to transfer from time to time up to 342,503 shares of our Class A common stock under this prospectus on a share for share basis, upon receipt, from time to time of shares of our Class B common stock from holders of Class B common stock that are parties to the stockholders' agreement and are permitted to transfer those shares to the selling stockholders pursuant to our certificate of incorporation and the stockholders' agreement. Each exchange will result in one or more of the selling stockholders transferring one share of Class A common stock for each share of Class B common stock transferred to the selling stockholder or selling stockholders. We will not receive any proceeds from these transactions.

As of the date of this prospectus, the selling stockholders have already exchanged 460,133 shares of Class A common stock registered by the registration statement and prospectus initially filed on July 13, 2001, as amended, and declared effective on November 19, 2001, the registration statement and prospectus initially filed on September 5, 2003, as amended, and declared effective on May 3, 2004, and the registration statement and prospectus initially filed on January 12, 2005, as amended, and initially declared effective on February 7, 2005. The remaining shares of Class A common stock registered by those previously filed registration statements and prospectuses are included in the 342,503 shares of Class A common stock offered by this prospectus. See “Selling Stockholders” beginning on page 6.

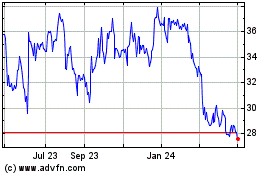

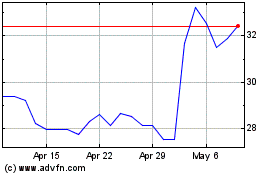

Our Class A common stock is listed on the New York Stock Exchange under the symbol “NC.” On March 2, 2017, the last sale price of our Class A common stock as reported by the New York Stock Exchange was $69.10 per share. Our Class B common stock is not publicly traded. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to ten votes per share.

Persons who receive shares of Class A common stock from the selling stockholders may resell those shares of Class A common stock in brokerage transactions on the New York Stock Exchange in compliance with Rule 144 under the Securities Act of 1933, except that the six-month holding period requirement of Rule 144 will not apply.

Please consider carefully the “Risk Factors” beginning on page 5.

Neither the Securities and Exchange Commission nor any state securities commission has approved or

disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is March , 2017

You should rely only on the information contained in this prospectus and in the reports and other information that we file with the Securities and Exchange Commission. We have not authorized any person to make a statement that differs from what is in this prospectus. If any person makes a statement that differs from what is in this prospectus, you should not rely on it. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of its date, but the information may change after that date.

TABLE OF CONTENTS

WHERE YOU CAN FIND MORE INFORMATION

We have filed this prospectus as part of a registration statement on Form S-4 with the Securities and Exchange Commission, or the Commission, under the Securities Act of 1933, or the Securities Act. The registration statement contains exhibits and other information that are not contained in this prospectus. Our descriptions in this prospectus of the provisions of documents filed as exhibits to the registration statement or otherwise filed with the Commission are only summaries of those documents' material terms. If you want a complete description of the contents of those documents, you should obtain the documents yourself by following the procedures described below.

We are subject to the reporting requirements of the Securities Exchange Act of 1934, or the Exchange Act, and, in accordance therewith, file reports and other information with the Commission. Our reports and other information filed by us can be inspected and copied at the Public Reference Room of the Commission at 100 F. Street, N.E., Washington, D.C. 20549. Please call the Commission at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. The Commission also maintains a website that contains reports, proxy and information statements and other information regarding us that is filed electronically with the Commission. The address of the site is: http://www.sec.gov. Our Class A common stock is quoted on the New York Stock Exchange and in connection therewith, reports and other information concerning us may also be inspected at the offices of the New York Stock Exchange. For further information on obtaining copies of our reports and other information concerning us at the New York Stock Exchange, please call (212) 656-3000. In addition, we make our annual and quarterly reports and other information that we file with the Commission available on our website. The address of our website is http://www.nacco.com. However, other than the information incorporated into this document by reference, the information on our website and the Commission's website is not a part of this prospectus, and you should rely only on the information contained in or incorporated by reference into this prospectus when making a decision to exchange shares of Class B common stock for shares of Class A common stock

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The Commission allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring to other documents filed separately with the Commission. This prospectus incorporates important business and financial information about us that is not included in or delivered with this document. The information incorporated by reference is considered to be a part of this prospectus. We incorporate by reference the following documents that we have filed with the Commission and any filings that we will make with the Commission in the future under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act until this exchange offer is completed:

|

|

|

|

•

|

Annual Report on Form 10-K for the fiscal year ended December 31, 2016; and

|

|

|

|

|

•

|

The descriptions of Class A common stock set forth in the registration statement on Form 8-B filed June 6, 1986.

|

We will not, however, incorporate by reference any documents or portions thereof that are not deemed “filed” with the Commission, including any information furnished pursuant to Item 2.02 or Item 7.01 of our Current Reports on Form 8-K unless, and except to the extent, specified in such reports.

We will provide without charge to each person to whom this prospectus is delivered, upon the written or oral request of the person, a copy (without exhibits other than exhibits specifically incorporated by reference) of any or all documents incorporated by reference into this prospectus. Requests for copies of those documents should be directed to NACCO Industries, Inc., 5875 Landerbrook Drive, Suite 220, Cleveland, OH 44124-4069, Attention: Secretary, telephone (440) 229-5151. To obtain timely delivery, you must request the information no later than five business days before the date you intend to elect to exchange shares of Class B common stock.

SUMMARY

This prospectus contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause a material difference include, but are not limited to, those discussed under “Risk Factors” and elsewhere in this prospectus. Investors should consider carefully the information set forth under the heading “Risk Factors” beginning on page 5. In this prospectus, the terms “NACCO,” “we,” “us” and “our” refer to NACCO Industries, Inc.

NACCO

NACCO Industries, Inc. is an operating holding company with the following principal businesses: mining, small appliances and specialty retail.

North American Coal.

Our wholly owned subsidiary, The North American Coal Corporation and its affiliated mining companies, which we refer to in this prospectus collectively as North American Coal, mine coal primarily for use in power generation and provide value-added services for natural resource companies.

Hamilton Beach Brands.

Our wholly owned subsidiary, Hamilton Beach Brands, Inc., which we refer to in this prospectus as Hamilton Beach, is a leading designer, marketer and distributor of small electric household and specialty housewares appliances, as well as commercial products for restaurants, bars and hotels.

Kitchen Collection.

Our wholly owned subsidiary, The Kitchen Collection, LLC, which we refer to in this prospectus as Kitchen Collection, is a national specialty retailer of kitchenware in outlet and traditional malls throughout the United States.

NACCO was incorporated as a Delaware corporation in 1986 in connection with the formation of a holding company structure for a predecessor corporation organized in 1913.

Our principal executive offices are located at 5875 Landerbrook Drive, Suite 220, Cleveland, Ohio 44124-4069, and our telephone number is (440) 229-5151.

The Exchange Offer

The selling stockholders named in this prospectus are offering to transfer from time to time up to 342,503 shares of our Class A common stock on a share for share basis, upon receipt, from time to time of shares of our Class B common stock from holders of Class B common stock that are parties to the stockholders' agreement and are permitted to transfer those shares to the selling stockholders pursuant to our certificate of incorporation and the stockholders' agreement. Each exchange will result in one or more of the selling stockholders transferring one share of Class A common stock for each share of Class B common stock transferred to the selling stockholder or selling stockholders. See “Selling Stockholders” beginning on page 6.

As of

February 28, 2017

, the participating stockholders under the stockholders' agreement beneficially owned 98% of the Class B common stock issued and outstanding on that date. Holders of shares of Class B common stock that are not subject to the stockholders' agreement are permitted to transfer those shares subject to the transfer restrictions set forth in our certificate of incorporation, which include the ability of holders of shares of Class B common stock that are not subject to the stockholders' agreement to transfer the shares to persons who are permitted transferees as specified in our certificate of incorporation or convert such shares of Class B common stock into shares of Class A common stock on a one-for-one basis. Only holders of shares of Class B common stock that are subject to the stockholders' agreement may exchange their shares of Class B common stock for shares of Class A common stock pursuant to this prospectus.

Material U.S. Federal Income Tax Consequences

Gain or loss will generally not be recognized by NACCO stockholders who exchange shares of their Class B common stock for shares of Class A common stock held by the selling stockholders. See “Material U.S. Federal Income Tax Consequences” beginning on page 19.

The tax consequences of an exchange will depend on the stockholder's particular facts and circumstances. Persons acquiring shares of Class A common stock by exchanging shares of their Class B common stock with the selling stockholders are urged to consult their own tax advisors to fully understand the tax consequences to them of an exchange.

Summary Historical Consolidated Financial Data

The following tables present a summary of our historical consolidated financial data. The statement of operations and other data for each of the three years in the period ended December 31, 2016 and the balance sheet data as of December 31, 2016 and 2015 have been derived from our audited consolidated financial statements and related notes, which are incorporated into this prospectus by reference from our Annual Report on Form 10-K for the fiscal year ended December 31, 2016. The statement of operations and other data for the years ended December 31, 2013 and 2012, and the balance sheet data as of December 31, 2014, 2013 and 2012 have been derived from our audited consolidated financial statements and related notes that are not included in this prospectus or incorporated by reference. These consolidated financial statements have been filed with the Commission. See “Where You Can Find More Information” on page ii. The historical consolidated data are presented for informational purposes only and do not purport to project our financial position as of any future date or our results of operations for any future period. The following information is only a summary and should be read together with “Management's Discussion and Analysis of Financial Condition and Results of Operations” and our historical consolidated financial statements and related notes, which are incorporated by reference into this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31

|

|

|

2016

(1)

|

|

2015

|

|

2014

(1)

|

|

2013

|

|

2012

(2)

|

|

|

(In thousands, except per share data)

|

|

Operating Statement Data:

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

$

|

856,438

|

|

|

$

|

915,860

|

|

|

$

|

896,782

|

|

|

$

|

932,666

|

|

|

$

|

873,364

|

|

|

Operating profit (loss)

|

$

|

41,715

|

|

|

$

|

31,827

|

|

|

$

|

(66,309

|

)

|

|

$

|

61,336

|

|

|

$

|

67,642

|

|

|

Income (loss) from continuing operations

|

$

|

29,607

|

|

|

$

|

21,984

|

|

|

$

|

(38,118

|

)

|

|

$

|

44,450

|

|

|

$

|

42,163

|

|

|

Discontinued operations, net of tax

(2)

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

66,535

|

|

|

Net income (loss)

|

$

|

29,607

|

|

|

$

|

21,984

|

|

|

$

|

(38,118

|

)

|

|

$

|

44,450

|

|

|

$

|

108,698

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

Continuing operations

|

$

|

4.34

|

|

|

$

|

3.14

|

|

|

$

|

(5.02

|

)

|

|

$

|

5.48

|

|

|

$

|

5.04

|

|

|

Discontinued operations

(2)

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

7.93

|

|

|

Basic earnings (loss) per share

|

$

|

4.34

|

|

|

$

|

3.14

|

|

|

$

|

(5.02

|

)

|

|

$

|

5.48

|

|

|

$

|

12.97

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

Continuing operations

|

$

|

4.32

|

|

|

$

|

3.13

|

|

|

$

|

(5.02

|

)

|

|

$

|

5.47

|

|

|

$

|

5.02

|

|

|

Discontinued operations

(2)

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

7.90

|

|

|

Diluted earnings (loss) per share

|

$

|

4.32

|

|

|

$

|

3.13

|

|

|

$

|

(5.02

|

)

|

|

$

|

5.47

|

|

|

$

|

12.92

|

|

|

|

|

|

(1)

|

During 2014, NACoal recorded a non-cash, asset impairment charge of $105.1 million for Centennial Natural Resource's ("Centennial") long-lived asset group. Centennial ceased active mining operations at the end of 2015. During the third quarter of 2016, North American Coal recorded an additional non-cash impairment charge of $17.4 million related to Centennial's assets.

|

|

|

|

|

(2)

|

During 2012, NACCO spun-off Hyster-Yale

Materials Handling, Inc. ("Hyster-Yale")

, a former subsidiary. The results of operations of Hyster-Yale are reflected as discontinued operations in the table above.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31

|

|

|

2016

|

|

2015

|

|

2014

|

|

2013

|

|

2012

|

|

|

(In thousands, except per share data, share amounts and employee data)

|

|

Balance Sheet Data at December 31:

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

$

|

668,021

|

|

|

$

|

655,408

|

|

|

$

|

770,520

|

|

|

$

|

809,956

|

|

|

$

|

776,306

|

|

|

Long-term debt

|

$

|

120,295

|

|

|

$

|

160,113

|

|

|

$

|

191,431

|

|

|

$

|

152,431

|

|

|

$

|

135,448

|

|

|

Stockholders' equity

|

$

|

220,293

|

|

|

$

|

201,138

|

|

|

$

|

211,474

|

|

|

$

|

297,780

|

|

|

$

|

281,331

|

|

|

Other Data:

|

|

|

|

|

|

|

|

|

|

|

Per share data:

|

|

|

|

|

|

|

|

|

|

|

Cash dividends

(1)

|

$

|

1.0650

|

|

|

$

|

1.0450

|

|

|

$

|

1.0225

|

|

|

$

|

1.0000

|

|

|

$

|

5.3775

|

|

|

Market value at December 31

|

$

|

90.55

|

|

|

$

|

42.20

|

|

|

$

|

59.36

|

|

|

$

|

62.19

|

|

|

$

|

60.69

|

|

|

Stockholders' equity at December 31

|

$

|

32.50

|

|

|

$

|

29.42

|

|

|

$

|

29.23

|

|

|

$

|

37.83

|

|

|

$

|

33.68

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actual shares outstanding at December 31

|

6.779

|

|

|

6.837

|

|

|

7.236

|

|

|

7.872

|

|

|

8.353

|

|

|

Basic weighted average shares outstanding

|

6.818

|

|

|

7.001

|

|

|

7.590

|

|

|

8.105

|

|

|

8.384

|

|

|

Diluted weighted average shares outstanding

|

6.854

|

|

|

7.022

|

|

|

7.590

|

|

|

8.124

|

|

|

8.414

|

|

|

Total employees at December 31

(2)

|

3,600

|

|

|

3,600

|

|

|

4,000

|

|

|

4,100

|

|

|

4,300

|

|

|

|

|

|

(1)

|

2012 cash dividends include a one-time special cash dividend of $3.50 per share. The 25 cent dividend paid in the fourth quarter of 2012 was the first regular quarterly dividend following the spin-off of Hyster-Yale.

|

|

|

|

|

(2)

|

Includes employees of Weston Brands beginning in 2014, Centennial from 2012 to 2014 and the unconsolidated mines for all years presented. Excludes employees of Hyster-Yale for all years presented.

|

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated herein by reference contain statements that constitute “forward-looking statements”. These forward-looking statements are made subject to certain risks and uncertainties, which could cause actual results to differ materially from those presented in these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof. Such risks and uncertainties with respect to each subsidiary's operations include, without limitation:

North American Coal:

(1) changes in tax laws or regulatory requirements, including changes in mining or power plant emission regulations and health, safety or environmental legislation, (2) changes in costs related to geological conditions, repairs and maintenance, new equipment and replacement parts, fuel or other similar items, (3) regulatory actions, changes in mining permit requirements or delays in obtaining mining permits that could affect deliveries to customers, (4) weather conditions, extended power plant outages or other events that would change the level of customers' coal or limerock requirements, (5) weather or equipment problems that could affect deliveries to customers, (6) changes in the power industry that would affect demand for North American Coal's reserves, (7) changes in the costs to reclaim North American Coal mining areas, (8) costs to pursue and develop new mining opportunities, (9) changes to or termination of a long-term mining contract, or a customer default under a contract, (10) the timing and pricing of transactions to dispose of assets at the Centennial operations, (11) delays or reductions in coal deliveries at North American Coal's newer mines, and (12) increased competition, including consolidation within the industry.

Hamilton Beach

: (1) changes in the sales prices, product mix or levels of consumer purchases of small electric and specialty housewares appliances, (2) changes in consumer retail and credit markets, (3) bankruptcy of or loss of major retail customers or suppliers, (4) changes in costs, including transportation costs, of sourced products, (5) delays in delivery of sourced products, (6) changes in or unavailability of quality or cost effective suppliers, (7) exchange rate fluctuations, changes in the import tariffs and monetary policies and other changes in the regulatory climate in the countries in which Hamilton Beach buys, operates and/or sells products, (8) product liability, regulatory actions or other litigation, warranty claims or returns of products, (9) customer acceptance of, changes in costs of, or delays in the development of new products, (10) increased competition, including consolidation within the industry and (11) changes mandated by federal, state and other regulation, including tax, health, safety or environmental legislation.

Kitchen Collection:

(1) increased competition, including through online channels, (2) shift in consumer shopping patterns, gasoline prices, weather conditions, the level of consumer confidence and disposable income as a result of economic conditions, unemployment rates or other events or conditions that may adversely affect the number of customers visiting Kitchen Collection

®

stores, (3) changes in the sales prices, product mix or levels of consumer purchases of kitchenware and small electric appliances, (4) changes in costs, including transportation costs, of inventory, (5) delays in delivery or the unavailability of inventory, (6) customer acceptance of new products, (7) the anticipated impact of the opening of new stores, the ability to renegotiate existing leases and effectively and efficiently close under-performing stores and (8) changes in the import tariffs and monetary policies and other changes in the regulatory climate in the countries in which Kitchen Collection buys, operates and/or sells products.

RISK FACTORS

Prospective investors in the shares of Class A common stock offered hereby should consider carefully the following risk factors as well as the risk factors set forth in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, which is incorporated into this prospectus by reference, in addition to the other information contained in this prospectus. This prospectus contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause a material difference include, but are not limited to, those discussed below, as well as those discussed elsewhere in this prospectus and the documents incorporated into this prospectus by reference

.

Risks Related to This Offering

The voting power of holders of Class B common stock who transfer their shares to the selling stockholders and receive shares of Class A common stock will diminish.

Holders of Class B common stock have ten votes per share of Class B common stock, while holders of Class A common stock have one vote per share of Class A common stock. Holders of Class B common stock who transfer their shares to the selling stockholders in exchange for shares of Class A common stock will reduce their voting power.

The voting power of the selling stockholders will increase if the selling stockholders exchange their shares of Class A common stock for shares of Class B common stock in the exchange offer.

Holders of Class A common stock and holders of Class B common stock vote together on matters submitted to a vote of NACCO's stockholders. Consequently, if holders of Class B common stock transfer their shares of Class B common stock to the selling stockholders, the voting power of the selling stockholders will increase. As of

February 28, 2017

, the selling stockholders collectively controlled 58.8% of the voting power of outstanding shares of NACCO's common stock based on the number of outstanding shares as of

February 28, 2017

. As of that date, there were 5,260,048 shares of Class A common stock and 1,570,915 shares of Class B common stock outstanding. If all shares of Class A common stock offered by this prospectus are exchanged for shares of Class B common stock and the selling stockholders act together when voting their shares of Class B common stock, they will control 73.5% of the voting power of outstanding shares of NACCO's common stock based on the number of outstanding shares as of

February 28, 2017

, as well as the outcome of any class vote of the Class B common stock that requires the vote of at least a majority of the outstanding Class B common stock.

USE OF PROCEEDS

We will not receive any proceeds from the exchange of any shares by the selling stockholders.

SELLING STOCKHOLDERS

Class A Common Stock Beneficial Ownership Table for Selling Stockholders.

The following table sets forth, as of

February 28, 2017

, certain information with respect to the selling stockholders, including:

|

|

|

|

•

|

the name of each selling stockholder;

|

|

|

|

|

•

|

the number of shares of Class A common stock owned by each selling stockholder immediately prior to the sale of shares offered by this prospectus;

|

|

|

|

|

•

|

the number of shares of Class A common stock offered for exchange by each selling stockholder by this prospectus; and

|

|

|

|

|

•

|

the percentage of ownership of Class A common stock of each selling stockholder immediately following the exchange of shares offered by this prospectus based on the number of shares of Class A common stock outstanding on

February 28, 2017

.

|

A total of 342,503 shares of Class A common stock is being offered by this prospectus. Alfred M. Rankin, Jr., Thomas T. Rankin, Claiborne R. Rankin and Roger F. Rankin, or in each case their revocable trusts, and Rankin Associates IV, L.P., or Rankin IV, are offering to exchange the following numbers of shares of Class A common stock: Alfred M. Rankin, Jr., 93,874; Thomas T. Rankin, 52,920; Claiborne R. Rankin, 28,128; Roger F. Rankin, 75,509; and Rankin IV, 92,072. Because each individual selling stockholder or his revocable trust will offer to exchange the shares, both the individual selling stockholder and his trust are listed separately in the tables below. However, each individual, together with his revocable trust, will only offer to exchange the number of shares of Class A common stock listed above and, accordingly, an aggregate of 342,503 shares are being offered for exchange by this prospectus. In the tables below, the disclosure of the beneficial ownership of shares for the individual selling stockholders reflects all shares deemed to be beneficially owned by such selling stockholders (including those shares held in each selling stockholder's revocable trust). The disclosure of the beneficial ownership of shares for each selling stockholder's revocable trust includes only those shares held directly by such trust.

Because the selling stockholders may offer all, a portion or none of the Class A common stock offered by this prospectus, we cannot assure you as to the number of shares of Class A common stock or Class B common stock that will be held by the selling stockholders immediately following the offering. The tables below assume that the beneficial ownership of Class A common stock for each selling stockholder, including shares held directly and indirectly by an individual selling stockholder's revocable trust, will decrease by an aggregate of the number of shares of Class A common stock described above or the number of shares held by such a trust as a result of this offering and that the beneficial ownership of Class B common stock for each selling stockholder, including shares held directly and indirectly by an individual selling stockholder's revocable trust, will increase by the same number of shares of Class B common stock. The tables do not, however, account for any changes in each selling stockholder's beneficial ownership that may result from transactions not contemplated by this prospectus such as an acquisition or disposition of shares of Class A common stock or Class B common stock.

As of the date of this prospectus, the selling stockholders have already exchanged 460,133 shares of the Class A common stock offered by the registration statement and prospectus related to the exchange offer that was initially filed on July 13, 2001, the registration statement and prospectus related to the exchange offer that was initially filed on September 5, 2003 and the registration statement and prospectus related to the exchange offer that was initially filed on January 12, 2005.

Class A Common Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Title of Class

|

|

Shares Beneficially

Owned Before this Offering(1)

|

|

Shares Offered

Pursuant to this Offering(1)

|

|

Shares Beneficially

Owned After this Offering(1)

|

|

Percentage of

Shares Owned After this Offering(1)

|

|

Alfred M. Rankin, Jr.

(2)

|

|

Class A

|

|

824,853

|

|

|

93,874

|

|

|

638,907

|

|

|

12.15

|

%

|

|

Alfred M. Rankin, Jr., as Trustee of the Main Trust of Alfred M. Rankin Jr. created under the Agreement, dated September 28, 2000, as supplemented, amended and restated (the “Alfred Rankin Trust”)

(2)

|

|

Class A

|

|

300,191

|

|

|

93,874

|

|

|

206,317

|

|

|

3.92

|

%

|

|

Thomas T. Rankin

(3)

|

|

Class A

|

|

487,081

|

|

|

52,920

|

|

|

342,089

|

|

|

6.50

|

%

|

|

Thomas T. Rankin, as Trustee under the Agreement, dated December 29, 1967, as supplemented, amended and restated, with Thomas T. Rankin creating a revocable trust for the benefit of Thomas T. Rankin (the “Thomas Rankin Trust”)

(3)

|

|

Class A

|

|

53,085

|

|

|

52,920

|

|

|

165

|

|

|

**

|

|

|

Claiborne R. Rankin

(4)

|

|

Class A

|

|

458,495

|

|

|

28,128

|

|

|

338,295

|

|

|

6.43

|

%

|

|

Claiborne R. Rankin, as Trustee under the Agreement, dated June 22, 1971, as supplemented, amended and restated, with Claiborne R. Rankin creating a revocable trust for the benefit of Claiborne R. Rankin (the “Claiborne Rankin Trust”)

(4)

|

|

Class A

|

|

25,768

|

|

|

25,768

|

|

|

—

|

|

|

—

|

|

|

Roger F. Rankin

(5)

|

|

Class A

|

|

518,820

|

|

|

75,509

|

|

|

351,239

|

|

|

6.68

|

%

|

|

Roger F. Rankin, as Trustee under the Agreement, dated September 11, 1973, as supplemented, amended and restated, with Roger F. Rankin creating a trust for the benefit of Roger F. Rankin (the “Roger Rankin Trust”)

(5)

|

|

Class A

|

|

75,461

|

|

|

75,461

|

|

|

—

|

|

|

—

|

|

|

Rankin Associates IV, L.P.

(1)(6)

|

|

Class A

|

|

92,072

|

|

|

92,072

|

|

|

—

|

|

|

—

|

|

**Less than 1.0%.

(1)

Each of the Alfred Rankin Trust, Thomas Rankin Trust, Claiborne Rankin Trust and Roger Rankin Trust is a General and Limited Partner of Rankin IV. As trustee and primary beneficiary of their respective trusts, each of Alfred M. Rankin, Jr., Thomas T. Rankin, Claiborne R. Rankin and Roger F. Rankin shares the power to vote the 92,072 shares of Class A common stock held by Rankin IV with the other General Partners of Rankin IV and shares the power to dispose of the 92,072 shares of Class A common stock held by Rankin IV with the other General and Limited Partners of Rankin IV. As such, each of Alfred M. Rankin, Jr., Thomas T. Rankin, Claiborne R. Rankin and Roger F. Rankin and each of their respective trusts are deemed to beneficially own the 92,072 shares of Class A common stock held by Rankin IV.

(2)

Alfred M. Rankin, Jr.

|

|

|

|

•

|

shares with his mother the power to vote and dispose of 9,600 shares of Class A common stock pursuant to an agreement with his mother, creating a trust for the benefit of her grandchildren;

|

|

|

|

|

•

|

shares with PNC Bank, N.A. (“PNC”) the power to vote and dispose of 21,286 shares of Class A common stock held by the A.M. Rankin Sr. GST Trusts for the benefit of Alfred M. Rankin, Sr.'s grandchildren;

|

|

|

|

|

•

|

shares with Rankin Management, Inc. ("RMI"), and the other partners of Rankin Associates II, L.P. ("Associates"), the power to dispose of 338,295 shares of Class A common stock held by the partnership;

|

|

|

|

|

•

|

shares with the other selling stockholders the power to vote the 92,072 shares of Class A common stock held by Rankin IV;

|

|

|

|

|

•

|

shares with the other partners of Rankin IV the power to dispose of the 92,072 shares of Class A common stock held by Rankin IV;

|

|

|

|

|

•

|

has the sole power to vote and dispose of 300,191 shares of Class A common stock held by the Alfred Rankin Trust;

|

|

|

|

|

•

|

has the sole power to vote and dispose of an additional 14,160 shares of Class A common stock held by him directly in an individual retirement account;

|

|

|

|

|

•

|

is deemed to share with his spouse the power to vote and dispose of 34,936 shares of Class A common stock owned by his spouse;

|

|

|

|

|

•

|

shares with his brother the power to vote and dispose of 14,313 shares of Class A common stock held in trust for the benefit of that brother; and

|

|

|

|

|

•

|

has acquired 63,098 shares of Class B common stock in exchange for 63,098 shares of Class A common stock pursuant to exchanges effected pursuant to the previously filed registration statements and prospectuses related to the exchange offer.

|

In addition to Mr. Alfred M. Rankin, Jr.'s beneficial ownership of the 92,072 shares of Class A common stock held by Rankin IV, an aggregate of 93,874 shares of Class A common stock are offered to be exchanged by Mr. Rankin pursuant to this prospectus, consisting of shares held directly by Mr. Rankin or shares currently held by the Alfred Rankin Trust. Mr. Rankin, as a trustee, may choose to conduct exchanges through the Alfred Rankin Trust. Alternatively, Mr. Rankin may choose to withdraw shares of Class A common stock from the Alfred Rankin Trust and conduct any exchange directly. Mr. Alfred M. Rankin, Jr. is the Chairman, President and Chief Executive Officer of NACCO and the Chairman and a Director of NACCO, North American Coal, Hamilton Beach and Kitchen Collection.

(3) Thomas T. Rankin:

|

|

|

|

•

|

has sole power to vote and dispose of 53,085 shares of Class A common stock held by the Thomas Rankin Trust;

|

|

|

|

|

•

|

has the sole power to vote and dispose of seven shares, held by him directly in an individual account;

|

|

|

|

|

•

|

is deemed to share with his spouse the power to vote and to dispose of 3,622 shares of Class A common stock owned by his spouse;

|

|

|

|

|

•

|

shares with RMI and the other partners of Associates the power to dispose of 338,295 shares of Class A common stock held by the partnership;

|

|

|

|

|

•

|

shares with the other selling stockholders the power to vote the 92,072 shares of Class A common stock held by Rankin IV;

|

|

|

|

|

•

|

shares with the other partners of Rankin IV the power to dispose of the 92,072 shares of Class A common stock held by Rankin IV; and

|

|

|

|

|

•

|

has acquired 27,351 shares of Class B common stock in exchange for 27,351 shares of Class A common stock pursuant to exchanges effected pursuant to the previously filed registration statements and prospectuses related to the exchange offer.

|

In addition to Mr. Thomas T. Rankin's beneficial ownership of the 92,072 shares of Class A common stock held by Rankin IV, an aggregate of 52,920 shares of Class A common stock are offered to be exchanged by Mr. Rankin pursuant to this prospectus, consisting of shares currently held by the Thomas Rankin Trust. Mr. Rankin may choose to conduct exchanges through the Thomas Rankin Trust. Alternatively, Mr. Rankin may choose to withdraw shares of Class A common stock from the Thomas Rankin Trust and conduct any exchange directly. Mr. Thomas T. Rankin is a Director of North American Coal, Hamilton Beach and Kitchen Collection.

(4) Claiborne R. Rankin:

|

|

|

|

•

|

has sole power to vote and dispose of 25,768 shares of Class A common stock held by the Claiborne Rankin Trust;

|

|

|

|

|

•

|

is deemed to share with his spouse the power to vote and dispose of 2,360 shares of Class A common stock owned by his spouse;

|

|

|

|

|

•

|

shares with RMI and the other partners of Associates the power to dispose of 338,295 shares of Class A common stock held by the partnership;

|

|

|

|

|

•

|

shares with the other selling stockholders the power to vote the 92,072 shares of Class A common stock held by Rankin IV;

|

|

|

|

|

•

|

shares with the other partners of Rankin IV the power to dispose of the 92,072 shares of Class A common stock held by Rankin IV; and

|

|

|

|

|

•

|

has acquired 27,489 shares of Class B common stock in exchange for 27,489 shares of Class A common stock pursuant to exchanges effected pursuant to the previously filed registration statements and prospectuses related to the exchange offer.

|

In addition to Mr. Claiborne R. Rankin's beneficial ownership of the 92,072 shares of Class A common stock held by Rankin IV, an aggregate of 28,128 shares of Class A common stock are offered to be exchanged by Mr. Rankin pursuant to this prospectus, consisting in part of shares currently held by the Claiborne Rankin Trust. Mr. Rankin may choose to conduct

exchanges through the Claiborne Rankin Trust. Alternatively, Mr. Rankin may choose to withdraw shares of Class A common stock from the Claiborne Rankin Trust and conduct any exchange directly.

(5)

Roger F. Rankin:

|

|

|

|

•

|

has sole power to vote and dispose of 75,461 shares of Class A common stock held by the Roger Rankin Trust;

|

|

|

|

|

•

|

is deemed to share with his spouse the power to vote and dispose of 4,133 shares of Class A common stock held in trust for their child, and 2,246 shares of Class A common stock held in trust for a second child held by his spouse as trustee of both trusts;

|

|

|

|

|

•

|

is deemed to share with his spouse the power to vote and dispose of 6,613 shares of Class A common stock owned by his spouse;

|

|

|

|

|

•

|

shares with RMI and the other partners of Associates the power to dispose of 338,295 shares of Class A common stock held by the partnership;

|

|

|

|

|

•

|

shares with the other selling stockholders the power to vote the 92,072 shares of Class A common stock held by Rankin IV;

|

|

|

|

|

•

|

shares with the other partners of Rankin IV the power to dispose of the 92,072 shares of Class A common stock held by Rankin IV; and

|

|

|

|

|

•

|

has acquired 42,734 shares of Class B common stock in exchange for 42,734 shares of Class A common stock pursuant to exchanges effected pursuant to the previously filed registration statements and prospectuses related to the exchange offer.

|

In addition to Mr. Roger F. Rankin's beneficial ownership of the 92,072 shares of Class A common stock held by Rankin IV, an aggregate of 75,509 shares of Class A common stock are offered to be exchanged by Mr. Rankin pursuant to this prospectus, consisting in part of shares currently held by the Roger Rankin Trust. Mr. Rankin may choose to conduct exchanges through the Roger Rankin Trust. Alternatively, Mr. Rankin may choose to withdraw shares of Class A common stock from the Roger Rankin Trust and effect any exchange directly. Mr. Roger F. Rankin is a Director of North American Coal, Hamilton Beach and Kitchen Collection.

(6) Rankin Associates IV, L.P.: The trusts holding limited partnership interests in Rankin IV may be deemed to be a “group” as defined under the Exchange Act and therefore may be deemed as a group to beneficially own 92,072 shares of Class A common stock held by Rankin IV. Although Rankin IV holds the 92,072 shares of Class A common stock, it does not have any power to vote or dispose of such shares of Class A common stock other than effecting exchanges pursuant to this prospectus. Alfred M. Rankin, Jr., Thomas T. Rankin, Claiborne R. Rankin and Roger F. Rankin, as trustees and primary beneficiaries of trusts acting as general partners of Rankin IV, share the power to vote such shares of Class A common stock. Voting actions are determined by the general partners owning at least a majority of the general partnership interests of Rankin IV. Each of the trusts holding limited partnership interests in Rankin IV share with each other the power to dispose of such shares. Under the terms of the Amended and Restated Limited Partnership Agreement of Rankin IV, Rankin IV may not dispose of Class B common stock or convert Class B common stock into Class A common stock without the consent of the general partners owning more than 75% of the general partnership interests of Rankin IV and the consent of partners owning more than 75% of all partnership interests of Rankin IV. Rankin IV may not transfer Class A common stock, other than pursuant to a share for share exchange to acquire Class B common stock, without the consent of the general partners owning more than 75% of the general partnership interests in Rankin IV and the consent of partners owning more than 75% of all partnership interests in Rankin IV.

Rankin IV has acquired 307,928 shares of Class B common stock in exchange for 307,928 shares of Class A common stock pursuant to an exchange effected pursuant to the registration statement and prospectus related to the exchange offer that was initially declared effective on February 7, 2005.

Each of the selling stockholders is a party to the stockholders’ agreement, dated as of March 15, 1990, as amended, by and among NACCO, the selling stockholders and the additional signatories that are parties thereto.

Class B Common Stock Beneficial Ownership Table for Selling Stockholders.

The following table sets forth, as of

February 28, 2017

, certain information with respect to the selling stockholders, including:

|

|

|

|

•

|

the name of each selling stockholder;

|

|

|

|

|

•

|

the number of shares of Class B common stock owned by each selling stockholder immediately prior to the exchange of shares offered by this prospectus;

|

|

|

|

|

•

|

the number of shares of Class B common stock that each selling stockholder may obtain if all of the shares of Class A common stock that each selling stockholder is offering by this prospectus are exchanged for shares of Class B common stock;

|

|

|

|

|

•

|

the percentage of ownership of Class B common stock of each selling stockholder immediately following the exchange of shares offered by this prospectus; and

|

|

|

|

|

•

|

the percentage of combined voting power of shares of Class A common stock and Class B common stock each selling stockholder will have immediately following the exchange of shares of Class A common stock for Class B common stock offered by this prospectus based on the number of shares of Class A and Class B common stock outstanding on

February 28, 2017

.

|

Class B Common Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Title of Class

|

|

Shares Beneficially

Owned Before this Offering(1)

|

|

Shares Offered

Pursuant to this Offering(1)

|

|

Shares Beneficially

Owned After this Offering(1)

|

|

Percentage of

Shares Owned After this Offering(1)

|

|

Percentage of

Combined Voting

Power of Shares of

Class A and Class B

Common Stock After this Offering(1)

|

|

Alfred M. Rankin, Jr.

(2)

|

|

Class B

|

|

824,961

|

|

|

93,874

|

|

|

1,010,907

|

|

|

64.35

|

%

|

|

51.26

|

%

|

|

Alfred M. Rankin, Jr., as Trustee of the Alfred Rankin Trust

(2)

|

|

Class B

|

|

44,662

|

|

|

93,874

|

|

|

138,536

|

|

|

8.82

|

%

|

|

7.59

|

%

|

|

Thomas T. Rankin

(3)

|

|

Class B

|

|

873,172

|

|

|

52,920

|

|

|

1,018,164

|

|

|

64.81

|

%

|

|

50.19

|

%

|

|

Thomas T. Rankin, as Trustee of the Thomas Rankin Trust

(3)

|

|

Class B

|

|

92,873

|

|

|

52,920

|

|

|

145,793

|

|

|

9.28

|

%

|

|

6.95

|

%

|

|

Claiborne R. Rankin

(4)

|

|

Class B

|

|

877,611

|

|

|

28,128

|

|

|

997,811

|

|

|

63.52

|

%

|

|

49.20

|

%

|

|

Claiborne R. Rankin, as Trustee of the Claiborne Rankin Trust

(4)

|

|

Class B

|

|

97,312

|

|

|

25,768

|

|

|

123,080

|

|

|

7.83

|

%

|

|

5.87

|

%

|

|

Roger F. Rankin

(5)

|

|

Class B

|

|

898,424

|

|

|

75,509

|

|

|

1,066,005

|

|

|

67.86

|

%

|

|

52.51

|

%

|

|

Roger F. Rankin, as Trustee of the Roger Rankin Trust

(5)

|

|

Class B

|

|

118,125

|

|

|

75,461

|

|

|

193,586

|

|

|

12.32

|

%

|

|

9.23

|

%

|

|

Rankin Associates IV, L.P.

(1)

|

|

Class B

|

|

307,928

|

|

|

92,072

|

|

|

400,000

|

|

|

25.46

|

%

|

|

19.08

|

%

|

|

|

|

|

(1)

|

Each of the Alfred Rankin Trust, Thomas Rankin Trust, Claiborne Rankin Trust and Roger Rankin Trust is a General

and Limited Partner of Rankin IV. As trustee and primary beneficiary of their respective trusts, each of Alfred M. Rankin, Jr., Thomas T. Rankin, Claiborne R. Rankin and Roger F. Rankin shares the power to vote the 307,928 shares of Class B common stock held by Rankin IV with the other General Partners of Rankin IV and shares the power to dispose of the 307,928 shares of Class B common stock held by Rankin IV with the other General and Limited Partners of Rankin IV. As such, each of Alfred M. Rankin, Jr., Thomas T. Rankin, Claiborne R. Rankin and Roger F. Rankin and each of their respective trusts are deemed to beneficially own the 307,928

shares of Class B common stock held by Rankin IV. In addition, as trustee and primary beneficiary of each of their respective trusts, each of Alfred M. Rankin, Jr., Thomas T. Rankin, Claiborne R. Rankin and Roger F. Rankin will share the power to vote the 400,000 shares of Class B common stock held by Rankin IV after the exchange offer with the other General Partners of Rankin IV and will share the power to dispose of the 400,000 shares of Class B common stock held by Rankin IV after the exchange offer with the other General and Limited Partners of Rankin IV. As such, each of Alfred M. Rankin, Jr., Thomas T. Rankin, Claiborne R. Rankin and Roger F. Rankin and each of their respective trusts will be deemed to beneficially own the 400,000 shares of Class B common stock held by Rankin IV after the exchange offer.

|

(2)

Alfred M. Rankin, Jr.:

|

|

|

|

•

|

has the sole power to vote and dispose of 44,662 shares of Class B common stock held by the Alfred Rankin Trust;

|

|

|

|

|

•

|

shares with the other selling stockholders the power to vote 472,371 shares of Class B common stock held by Rankin Associates I, L.P, which is referred to as Rankin I.;

|

|

|

|

|

•

|

shares with the other partners of Rankin I the power to dispose of 472,371 shares of Class B common stock held by Rankin I;

|

|

|

|

|

•

|

shares with the other selling stockholders the power to vote 307,928 shares of Class B common stock held by Rankin IV; and

|

|

|

|

|

•

|

shares with the other partners of Rankin IV the power to dispose of 307,928 shares held by Rankin IV.

|

(3) Thomas T. Rankin:

|

|

|

|

•

|

has the sole power to vote and dispose of 92,873 shares of Class B common stock held by the Thomas Rankin Trust;

|

|

|

|

|

•

|

shares with the other selling stockholders the power to vote 472,371 shares of Class B common stock held by Rankin I;

|

|

|

|

|

•

|

shares with the other partners of Rankin I the power to dispose of 472,371 shares of Class B common stock held by Rankin I;

|

|

|

|

|

•

|

shares with the other selling stockholders the power to vote 307,928 shares of Class B common stock held by Rankin IV; and

|

|

|

|

|

•

|

shares with the other partners of Rankin IV the power to dispose of 307,928 shares held by Rankin IV.

|

(4) Claiborne R. Rankin:

|

|

|

|

•

|

has the sole power to vote and dispose of 97,312 shares of Class B common stock held by the Claiborne Rankin Trust;

|

|

|

|

|

•

|

shares with the other selling stockholders the power to vote 472,371 shares of Class B common stock held by Rankin I;

|

|

|

|

|

•

|

shares with the other partners of Rankin I the power to dispose of 472,371 shares of Class B common stock held by Rankin I;

|

|

|

|

|

•

|

shares with the other selling stockholders the power to vote 307,928 shares of Class B common stock held by Rankin IV; and

|

|

|

|

|

•

|

shares with the other partners of Rankin IV the power to dispose of 307,928 shares held by Rankin IV.

|

(5) Roger F. Rankin:

|

|

|

|

•

|

has the sole power to vote and dispose of 118,125 shares of Class B common stock held by the Roger Rankin Trust;

|

|

|

|

|

•

|

shares with the other selling stockholders the power to vote 472,371 shares of Class B common stock held by Rankin I;

|

|

|

|

|

•

|

shares with the other partners of Rankin I the power to dispose of 472,371 shares of Class B common stock held by Rankin I;

|

|

|

|

|

•

|

shares with the other selling stockholders the power to vote 307,928 shares of Class B common stock held by Rankin IV; and

|

|

|

|

|

•

|

shares with the other partners of Rankin IV the power to dispose of 307,928 shares held by Rankin IV.

|

BENEFICIAL OWNERSHIP OF CLASS A COMMON STOCK AND CLASS B COMMON STOCK

Set forth in the following tables is the indicated information as of

February 28, 2017

(except as otherwise indicated) with respect to (1) each person who is known to us to be the beneficial owner of more than five percent of the Class A Common, (2) each person who is known to us to be the beneficial owner of more than five percent of the Class B Common and (3) the beneficial ownership of Class A Common and Class B Common by our directors, principal executive officer, principal financial officer and the three other most highly compensated executive officers during 2016 and all of our executive officers and directors as a group. Beneficial ownership of Class A Common and Class B Common has been determined for this purpose in accordance with Rules 13d-3 and 13d-5 under the Exchange Act. Accordingly, the amounts shown in the tables do not purport to represent beneficial ownership for any purpose other than compliance with SEC reporting requirements. Further, beneficial ownership as determined in this manner does not necessarily bear on the economic incidence of ownership of Class A Common or Class B Common.

Holders of shares of Class A Common and Class B Common are entitled to different voting rights with respect to each class of stock. Each share of Class A Common is entitled to one vote per share. Each share of Class B Common is entitled to ten votes per share. Holders of Class A Common and holders of Class B Common generally vote together as a single class on matters submitted to a vote of our stockholders. Shares of Class B Common are convertible into shares of Class A Common on a one-for-one basis, without cost, at any time at the option of the holder of the Class B Common.

Amount and Nature of Beneficial Ownership

Class A Common Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Title of Class

|

Sole Voting and Investment Power

|

|

Shared Voting or Investment Power

|

|

Aggregate Amount

|

|

Percent of Class

|

|

Dimensional Fund Advisors LP (1)

6300 Bee Cave Road

Austin, Texas 78746

|

Class A

|

445,222

|

|

(1)

|

—

|

|

|

445,222

|

|

(1)

|

8.46

|

%

|

|

Rankin Associates II, L.P. (2)

Suite 300

5875 Landerbrook Drive

Cleveland, OH 44124-4069

|

Class A

|

338,295

|

|

(2)

|

—

|

|

|

338,295

|

|

(2)

|

6.43

|

%

|

|

Zuckerman Investment Group, LLC (3)

155 N. Wacker Drive, Suite 1700

Chicago, IL 60606

|

Class A

|

—

|

|

|

334,439

|

|

(3)

|

334,439

|

|

(3)

|

6.36

|

%

|

|

BlackRock, Inc. (4)

55 East 52nd Street

New York, NY 10055

|

Class A

|

282,637

|

|

(4)

|

—

|

|

|

282,637

|

|

(4)

|

5.37

|

%

|

|

FMR LLC (5)

245 Summer Street

Boston, Massachusetts 02210

|

Class A

|

254,049

|

|

(5)

|

—

|

|

|

254,049

|

|

(5)

|

4.83

|

%

|

|

John P. Jumper (6)

|

Class A

|

6,358

|

|

|

—

|

|

|

6,358

|

|

|

**

|

|

|

Dennis W. LaBarre (6)

|

Class A

|

16,959

|

|

|

—

|

|

|

16,959

|

|

|

**

|

|

|

Michael S. Miller (6)

|

Class A

|

427

|

|

|

—

|

|

|

427

|

|

|

**

|

|

|

Richard de J. Osborne (6)

|

Class A

|

12,904

|

|

|

—

|

|

|

12,904

|

|

|

**

|

|

|

Alfred M. Rankin, Jr.

|

Class A

|

314,351

|

|

|

510,502

|

|

(7)

|

824,853

|

|

(7)

|

15.68

|

%

|

|

James A. Ratner (6)

|

Class A

|

10,791

|

|

|

—

|

|

|

10,791

|

|

|

**

|

|

|

Britton T. Taplin (6)

|

Class A

|

40,773

|

|

|

61,875

|

|

(8)

|

102,648

|

|

(8)

|

1.95

|

%

|

|

David F. Taplin (6)

|

Class A

|

18,372

|

|

|

100

|

|

|

18,472

|

|

|

**

|

|

|

David B.H. Williams (6)

|

Class A

|

8,292

|

|

|

504,941

|

|

(9)

|

513,233

|

|

(9)

|

9.76

|

%

|

|

J.C. Butler, Jr.

|

Class A

|

74,448

|

|

|

498,461

|

|

(10)

|

572,909

|

|

(10)

|

10.89

|

%

|

|

Elizabeth I. Loveman

|

Class A

|

4,114

|

|

|

—

|

|

|

4,114

|

|

|

**

|

|

|

R. Scott Tidey

|

Class A

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Gregory H. Trepp

|

Class A

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

All executive officers and directors as a group (32 persons)

|

Class A

|

513,972

|

|

|

715,284

|

|

(11)

|

1,229,256

|

|

(11)

|

23.37

|

%

|

** Less than 1.0%.

|

|

|

|

(1)

|

A Schedule 13G/A filed with the SEC with respect to Class A Common on February 9, 2017 reported that Dimensional Fund Advisors LP ("Dimensional") may be deemed to beneficially own the shares of Class A Common reported above as a result of being an investment adviser registered under Section 203 of the Investment Advisers Act of 1940 that furnishes investment advice to four investment companies registered under the Investment Company Act of 1940 and serves as an investment manager or sub-adviser to certain other commingled funds, group trusts and separate accounts (the "Dimensional Funds"), which own the shares of Class A Common. In its role as investment adviser or manager, Dimensional possesses the sole power to vote 445,222 shares of Class A Common owned by the Dimensional Funds and the sole power to invest 433,922 shares of Class A Common owned by the Dimensional Funds. However, all shares of Class A Common reported above are owned by the Dimensional Funds. Dimensional disclaims beneficial ownership of all such shares.

|

|

|

|

|

(2)

|

A Schedule 13G/A filed with the SEC with respect to Class A Common on February 14, 2017 reported that Associates, which is made up of the individuals and entities holding limited partnership interests in Associates and RMI, the general partner of Associates, may be deemed to be a “group” as defined under the Exchange Act that beneficially owns the 338,295 shares of Class A Common held by Associates. Although Associates holds the 338,295 shares of Class A Common, it does not have any power to vote or dispose of such shares of Class A Common. RMI has the sole power to vote such shares and shares the power to dispose of such shares with the other individuals and entities

|

holding limited partnership interests in Associates. RMI exercises such powers by action of its board of directors, which acts by majority vote and consists of Alfred M. Rankin, Jr., Thomas T. Rankin, Claiborne R. Rankin and Roger F. Rankin, the individual trusts of whom are the shareholders of RMI. Under the terms of the Limited Partnership Agreement of Associates, Associates may not dispose of Class A Common without the consent of RMI and the approval of the holders of more than 75% of all of the partnership interests of Associates.

|

|

|

|

(3)

|

A Schedule 13G/A filed with the SEC with respect to Class A Common on February 14, 2017 reported that Zuckerman Investment Group, LLC may be deemed to beneficially own the shares of Class A Common reported above as a result of being an investment adviser.

|

|

|

|

|

(4)

|

A Schedule 13G filed with the SEC with respect to Class A Common on January 30, 2017 reported that BlackRock, Inc. may be deemed to beneficially own the shares of Class A Common reported above.

|

|

|

|

|

(5)

|

A Schedule 13G/A filed with the SEC with respect to Class A Common on February 13, 2017 reported that FMR LLC may be deemed to beneficially own the shares of Class A Common reported above.

|

|

|

|

|

(6)

|