WPP Shares Slide as Revenue Growth Slows -- 3rd Update

March 03 2017 - 12:32PM

Dow Jones News

By Nick Kostov

WPP PLC Chief Executive Martin Sorrell is struggling to sustain

revenue growth after losing two big-name accounts last

year--blaming belt tightening by advertisers and forecasting a

sluggish 2017.

The world's largest advertising firm by sales, whose agencies

include JWT and Ogilvy & Mather, reported its slowest quarter

of revenue growth since 2012. It forecast growth for this year at a

subdued 2%.

Shares closed down almost 8% in London trading.

WPP said it hadn't lined up new business fast enough to make up

for losing accounts with AT&T Inc. and Volkswagen AG, which

together accounted for about 1% of WPP's overall revenue. Mr.

Sorrell said advertisers are struggling with a low-growth,

low-inflation environment, while some are being distracted by

activist investors and industry-changing technological

disruptions.

"Clients are generally grinding it out in a highly competitive

ground game, rarely resorting to a passing game or Hail Marys," WPP

said Friday, as it reported full-year earnings.

WPP said net profit for the year rose 21% to GBP1.4 billion

($1.72 billion.) Revenue rose 18% to GBP14.39 billion. WPP raised

its 2016 dividend to 56.6 pence from 44.69 pence.

Investors focused on the lower revenue-growth outlook.

For years, big advertisers have struggled with the seismic shift

from traditional advertising platforms, like print and TV, to

digital. More recently, they have contended with major slowdowns in

industries that they have long relied upon for growth.

Consumer-goods giants like Procter & Gamble Co., Nestle SA,

Unilever PLC and Anheuser-Busch InBev NV have all struggled to

boost growth amid a so-far tepid global economy, cutthroat

competition and fast-shifting consumer tastes.

"It's a tough space, and two of WPP's three biggest clients are

having a tough time," said Paul Richards, an analyst at Numis,

referring to P&G and Unilever. "If some of your biggest

customers are having a tough time, then it's very hard to buck that

trend."

At many big advertisers, all that has forced aggressive

cost-cutting, driving down bids for advertising agencies, Mr.

Sorrell said Friday.

"There is fierce agency competition giving rise to excessive

discounting, " he said.

Global ad expenditure is poised to grow 3.6% in 2017, down from

a rise of 5.7% in 2016, according to a forecast from Magna Global,

the ad-buying agency owned by Interpublic Group of Cos.

WPP's slowdown comes as its closest competitors face a host of

their own, specific headwinds. Publicis Groupe SA is in the midst

of a rare leadership transition, in the wake of a failed merger

with U.S. rival Omnicom Group Inc. Amid those distractions, the

French firm has been stung by a series of lost accounts in North

America.

Havas SA, meanwhile, is struggling with a slowdown in emerging

markets.

Omnicom, which stole AT&T and Volkswagen from WPP and

entered 2017 with other new business, is suffering from the strong

dollar and reported lower-than-expected revenue in its most recent

quarter.

WPP reported January like-for-like net sales--a measure used to

judge the company's underlying performance--up 1.2% from the same

period last year. For the fourth quarter, like-for-like net sales

expanded 2.1%, its slowest rate since the third quarter of 2012.

All WPP's regions slowed in the final three months of last year

with the exception of emerging markets. Those markets makes up for

a third of WPP's business and accelerated slightly.

In North America, like-for-like revenue dropped 2.8% in the

final quarter of last year. The company's headline results in the

U.K. were boosted by the fall in the value of the pound since the

country's vote to leave the European Union. WPP warned that

prospects there were "mixed" as the post-Brexit vote scenarios play

out over the next two years.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

March 03, 2017 12:17 ET (17:17 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

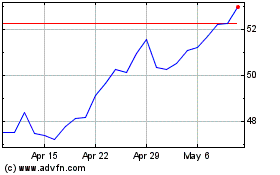

WPP (NYSE:WPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

WPP (NYSE:WPP)

Historical Stock Chart

From Apr 2023 to Apr 2024