Bookseller Blames Online Shopping -- WSJ

March 03 2017 - 3:02AM

Dow Jones News

By Jeffrey A. Trachtenberg

Barnes & Noble Inc. reported a disappointing holiday quarter

and provided a downbeat prognosis for the fiscal year that ends in

April as consumers spent less time shopping in its stores and more

time making their purchases online.

The issue of declining store traffic has affected other leading

retailers. Earlier this week, Target Corp. reported lower sales and

profits for its holiday quarter and said its 2017 profit would be

significantly lower than previously expected.

Barnes & Noble reported sales of $1.3 billion in the quarter

that ended Jan. 28, down 8% from a year earlier. Profit fell 12% to

$70.3 million, or 96 cents a share, from $80.3 million, or $1.04 a

share. Analysts had projected earnings of $1.13 a share on $1.28

billion in revenue.

Barnes & Noble shares fell 8.6% to $9.05 on the New York

Stock Exchange on Thursday.

During an investor call, Chief Executive Leonard Riggio said

Demos Parneros, who was named chief operating officer in November,

is a leading candidate to succeed him. Mr. Riggio, 76 years old,

returned as CEO in 2016 instead of retiring. He didn't offer

investors any insight into how long he intends to remain in his

post.

Same-store sales fell 8.3% in the fiscal third quarter, largely

due to lower traffic and a decline in sales of coloring books and

artist supplies. There was also a tough comparison to last year

when a new album from singer Adele sold briskly. Those items

accounted for nearly one-third of the sales decline.

"We are witnessing a major shift in the way retail works and the

type of stores that need to be opened," said Mr. Riggio, who noted

that book subjects aren't appearing as much on evening news

programs or morning news and entertainment shows. "All the talk now

is politics."

Barnes & Noble, which has closed a number of stores in

recent years, has now opened three test stores designed to make it

easier for consumers to find the titles they want. All three offer

full-service restaurants. It is unclear whether the final prototype

will have such a restaurant, Mr. Riggio said in an interview.

Barnes & Noble now expects comparable-store sales will

decline about 7% for the full fiscal year and consolidated earnings

before interest, taxes, depreciation and amortization will be

between $180 million and $190 million. In early January, the

retailer forecast full-year Ebitda would be around $200 million

while comparable-store sales would decline approximately 6%.

"Retail is soft in general," said John Tinker, an analyst with

Gabelli & Co. "The big issue is that there is less foot

traffic."

Barnes & Noble ended its fiscal third quarter with $18.2

million in long-term debt compared with no long-term debt a year

earlier. The retailer returned $14.4 million to shareholders during

the quarter in the form of dividends and share repurchases.

--

Anne Steele contributed to this article.

Write to Jeffrey A. Trachtenberg at

jeffrey.trachtenberg@wsj.com

(END) Dow Jones Newswires

March 03, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

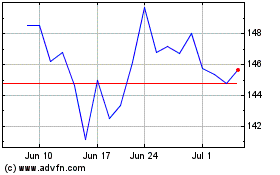

Target (NYSE:TGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

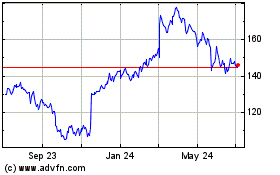

Target (NYSE:TGT)

Historical Stock Chart

From Apr 2023 to Apr 2024