The St. Joe Company (NYSE:JOE) (the “Company”) today announced

Net Income for the fourth quarter of 2016 of $2.7 million, or $0.04

per share, compared with Net Loss of $(2.5) million, or $(0.03) per

share, for the fourth quarter of 2015. For the full year ended

December 31, 2016, the Company reported Net Income of $15.9

million, or $0.21 per share compared to Net Loss of $(1.7) million,

or $(0.02) per share for the full year 2015.

Total revenue for the quarter was $18.7 million as compared to

$21.1 million in the fourth quarter of 2015 due to a reduction in

real estate revenue partially offset by an increase in resorts and

leisure revenue, leasing revenue and timber revenue. For the full

year 2016, total revenue was $95.7 million compared to $103.9

million for the full year 2015 due to reduced real estate revenue

and timber revenue partially offset by an increase in resorts and

leisure revenue and leasing revenue.

Fourth Quarter 2016 highlights include:

- While revenue for the fourth quarter of

2016 was $2.4 million lower than the fourth quarter of 2015, Net

Income increased by $5.2 million due to lower operating and

corporate expenses and an increase in investment income.

- Real estate revenue decreased to $5.4

million in the fourth quarter of 2016 as compared to $9.4 million

in the fourth quarter of 2015. This decrease was primarily related

to timing of development of finished lots in the communities of

Watersound Origins and Breakfast Point as well as lower volume of

non-strategic commercial land sales.

- Resorts and leisure revenue increased

approximately $0.9 million, or 10%, in the fourth quarter of 2016

as compared to the fourth quarter of 2015. The increase was broad

based including an increase in average room rates in both the

WaterColor Inn and in the vacation rental program as well as an

increase in total membership, growth in rounds played at the golf

courses, strong showing in the food and beverage component and

increased membership revenue from the St. Joe Club & Resorts

private membership club.

- Timber sales increased to $1.2 million

during the fourth quarter of 2016 as compared to $0.7 million in

the fourth quarter of 2015 due to an increase in tons sold.

- Leasing revenue increased approximately

$0.2 million, or 11%, in the fourth quarter of 2016 as compared to

fourth quarter of 2015. As of December 31, 2016, the Company owned

approximately 604,000 square feet of rentable commercial space

which is 87% leased. Of this amount, the Pier Park North retail

center has approximately 320,000 square feet constructed and is 93%

leased.

- As of December 31, 2016, the Company

had cash, cash equivalents and investments of $416.8 million, as

compared to $404.0 million as of December 31, 2015, an increase of

$12.8 million.

Jorge Gonzalez, the Company’s President and Chief Executive

Officer, said, “Our ‘open for business’ strategy and focus on

maximizing the value of our assets while maintaining a low fixed

expense structure is gaining traction. The recent announcement of

GKN Aerospace locating a new world-class manufacturing facility in

VentureCrossings® Enterprise Centre in Bay County is an example of

both an investment in generating recurring income and in creating

quality aerospace manufacturing jobs with a high economic

multiplier effect that we believe will enhance long term value of

the area and the Company.” Mr. Gonzalez added, “With a strong

balance sheet, our plan for 2017 is to increase capital

expenditures particularly on projects that we believe will provide

recurring revenue and asset value while being selective about

one-off sales of our land holdings.”

FINANCIAL DATA Consolidated Results

($ in millions except share and per

share amounts)

Quarter

Ended

December

31,

Year

Ended

December

31,

2016

2015

2016

2015

Revenue

Real estate revenue $5.4 $9.4 $23.4

$33.7 Resorts and leisure revenue 9.7 8.8 57.3

54.5 Leasing revenue 2.4 2.2 9.8

9.0 Timber revenue

1.2

0.7

5.2

6.7

Total revenue

$18.7

$21.1

$95.7

$103.9

Expenses

Cost of real estate revenue 1.3 4.2 8.0

16.4 Cost of resorts and leisure revenue 9.8 8.8

50.2 47.1 Cost of leasing revenue 0.9

0.8 3.1 2.8 Cost of timber revenue 0.2

0.2 0.8 0.8 Other operating and corporate expenses

5.3 8.7 23.1 33.4 Depreciation,

depletion and amortization

2.1

2.2

8.6

9.5

Total expenses

19.6

24.9

93.8

110.0

Operating (loss) income

(0.9)

(3.8)

1.9

(6.1)

Other income (loss)

5.5

(0.1)

20.7

5.0

Income (loss) from operations before equity in income

from unconsolidated affiliates and income taxes 4.6

(3.9) 22.6 (1.1) Income tax expense (benefit)

2.0

(1.2)

7.1

0.8

Net income (loss) 2.6 (2.7) 15.5 (1.9)

Net loss attributable to non-controlling interest

0.1

0.2

0.4

0.2

Net income (loss) attributable to the Company

$2.7

$(2.5)

$15.9

$(1.7)

Net income (loss) per share attributable to the Company

$0.04

$(0.03)

$0.21

$(0.02)

Weighted average shares outstanding 74,342,826

75,329,557 74,457,541 87,827,869

Revenue

Detail ($ in millions)

Quarter

Ended

December

31,

Year

Ended

December

31,

2016

2015

2016

2015

Revenue:

Real estate revenue

Residential $3.6 $6.9 $19.5

$21.1 Commercial 1.5 2.5 2.1 7.2

Other real estate revenue

0.3

--

1.8

5.4

Total real estate revenue 5.4 9.4 23.4

33.7 Resorts and leisure revenue 9.7 8.8 57.3 54.5 Leasing

revenue 2.4 2.2 9.8 9.0 Timber revenue

1.2

0.7

5.2

6.7

Total revenue

$18.7

$21.1

$95.7

$103.9

Summary Balance Sheet

($ in millions)

December 31,

2016

December 31,

2015

Assets Investment in real

estate, net $314.6 $313.6 Cash and cash equivalents

241.1 212.8 Investments 175.7 191.2

Restricted investments 5.6 7.1 Income tax receivable

27.1 2.3 Claim settlement receivable 7.8

-- Other assets 38.4 36.8 Property and

equipment, net 9.0 10.1 Investments held by special

purpose entities

208.6

208.8

Total assets

$1,027.9

$982.7

Liabilities and Equity

Debt $55.0 $54.5 Other

liabilities 41.0 41.9 Deferred tax liabilities

68.8 36.8 Senior Notes held by special purpose entity

176.3

176.1

Total liabilities

341.1

309.3

Total equity

686.8

673.4

Total liabilities and equity

$1,027.9

$982.7

Debt Schedule ($ in millions)

December 31,

2016

December 31,

2015

Pier Park North JV

$47.5 $47.5 Community Development District debt

7.5

7.0

Total debt

$55.0

$54.5

Other Operating and Corporate

Expenses

($ in millions)

Quarter

Ended

December

31,

Year

Ended

December

31,

2016

2015

2016

2015

Employee costs $1.8 $3.8 $7.1 $13.8

401(k) contribution / pension costs -- 0.1 1.4

1.3 Non-cash stock compensation costs -- --

0.1 0.2 Property taxes and insurance 1.3

1.4 5.6 5.7 Professional fees 1.2

1.8 5.0 7.4 Marketing and owner association

costs 0.5 0.4 1.5 1.4 Occupancy,

repairs and maintenance 0.2 0.6 0.7 1.3

Other

0.3

0.6

1.7

2.3

Total other operating and corporate expenses

$5.3

$8.7

$23.1

$33.4

Important Notice Regarding

Forward-Looking Statements

This press release includes forward-looking statements,

including statements regarding the Company’s planned 2017 increase

in capital expenditures and its belief that the increase will

provide recurring revenue and asset value; selective one-off sales

of land holdings; the Company’s belief that the GKN Aerospace

facility will enhance long term value of the Bay County area and

the Company; and the Company’s expectations regarding its business

strategy, future operations and pursuit of value creation for its

shareholders. The Company wishes to caution readers that certain

important factors may have affected and could in the future affect

the Company’s actual results and could cause the Company’s actual

results for subsequent periods to differ materially from those

expressed in any forward-looking statement made by or on behalf of

the Company, including (1) changes in the Company’s strategic

objectives and its ability to implement such strategic objectives;

(2) economic or other conditions that affect the future prospects

for the Southeastern region of the United States and the demand for

the Company’s products, including a slowing of the population

growth in Florida, inflation, or unemployment rates or declines in

consumer confidence or the demand for, or the prices of, housing;

(3) any potential negative impact of the Company’s longer-term

property development strategy, including losses and negative cash

flows for an extended period of time if the Company continues with

the self-development of its entitlements; (4) the impact of natural

or man-made disasters or weather conditions, including hurricanes

and other severe weather conditions, on the Company’s business; (5)

the Company’s ability to capitalize on its leasing operations in

the Pier Park North joint venture; (6) the Company’s ability to

capitalize on opportunities relating to its development of mixed

use, active adult, and other communities, including its ability to

successfully and timely obtain land-use entitlements and

construction financing, maintain compliance with state law

requirements and address issues that arise in connection with the

use and development of its land, including the permits required for

the mixed use, active adult, and other communities; (7) the impact

of market volatility on the value of the Company’s investments,

including potential unrealized losses or the realization of losses

on its investments; (8) the Company’s ability to enter into a lease

with GKN Aerospace on favorable terms or at all; and (9) the

Company’s ability to effectively deploy and invest its assets,

including available-for-sale securities; as well as, the cautionary

statements and risk factor disclosures contained in the Company’s

Securities and Exchange Commission filings including the Company’s

Annual Report on Form 10-K filed with the Commission on March 2,

2016 as updated by subsequent Quarterly Reports on Form 10-Qs and

other current report filings.

About The St. Joe

Company

The St. Joe Company together with its consolidated subsidiaries

is a real estate development, asset management and operating

company concentrated primarily between Tallahassee and Destin,

Florida. More information about the Company can be found on its

website at www.joe.com.

© 2017, The St. Joe Company. “St. Joe®”, “JOE®”, the “Taking

Flight” Design®, “St. Joe (and Taking Flight Design)®”, and

“VentureCrossings®” are registered service marks of The St.

Joe Company.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170302006356/en/

St. JoeInvestor Relations Contact:Marek Bakun,

1-866-417-7132Chief Financial OfficerMarek.Bakun@Joe.Com

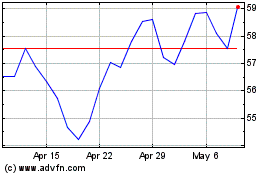

St Joe (NYSE:JOE)

Historical Stock Chart

From Mar 2024 to Apr 2024

St Joe (NYSE:JOE)

Historical Stock Chart

From Apr 2023 to Apr 2024