AXT, Inc. Announces Pricing of Public Offering of Common Stock

March 02 2017 - 7:00AM

AXT, Inc. (NASDAQ:AXTI), a leading manufacturer of compound

semiconductor substrates, today announced that it has priced its

previously announced underwritten public offering of 4,615,385

shares of its common stock at a price to the public of $6.50 per

share. The offering is expected to close on or about March 7,

2017 subject to satisfaction of customary closing conditions.

AXT also granted the underwriters a 30-day option to purchase at

the public offering price up to an additional 692,307 shares of its

common stock. After deducting the underwriting discount and

estimated offering expenses payable by the Company, the Company

expects to receive net proceeds of approximately $27.7 million,

assuming no exercise of the over-allotment option.

Needham & Company, LLC is acting as the sole book-running

manager and Craig-Hallum Capital Group LLC is acting as co-manager

for the offering.

AXT intends to use the net proceeds from the offering for

general corporate purposes, which may include the relocation of its

gallium arsenide product line, working capital, capital

expenditures and other corporate expenses.

A shelf registration statement relating to the shares of common

stock was previously filed with the Securities and Exchange

Commission (the “SEC”) and declared effective on November 4,

2016. A prospectus supplement and accompanying prospectus

relating to the offering will be filed with the SEC and will be

available on the SEC’s website. Copies of the prospectus supplement

(when available) and accompanying prospectus may be obtained from

Needham & Company, LLC, 445 Park Avenue, New York, NY 10022,

via telephone at (800) 903-3268 or by email to

prospectus@needhamco.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or other jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such state or other jurisdiction. Any offer, if at all, will be

made only by means of the prospectus supplement and accompanying

prospectus forming a part of the effective registration

statement.

About AXT, Inc.

AXT designs, develops, manufactures and distributes

high-performance compound and single element semiconductor

substrates comprising indium phosphide (InP), gallium arsenide

(GaAs) and germanium (Ge) through its manufacturing facilities in

Beijing, China. In addition, AXT maintains its sales,

administration and customer service functions at its headquarters

in Fremont, California. The company’s substrate products can

be used primarily in fiber optic communications, 3-D sensing, solar

cell, lighting display applications and wireless communications.

Its vertical gradient freeze (VGF) technique for manufacturing

semiconductor substrates provides significant benefits over other

methods and enabled AXT to become a leading manufacturer of such

substrates. AXT has manufacturing facilities in China and, as part

of its supply chain strategy, has partial ownership in ten

companies in China producing raw materials.

“Safe Harbor” Statement Under the Private Securities

Litigation Reform Act of 1995

This press release contains forward-looking statements within

the meaning of the federal securities laws. These statements

involve risks and uncertainties that could cause actual results to

differ materially, including, but not limited to, the satisfaction

of customary closing conditions and whether or not AXT will

consummate the offering, prevailing market conditions, the

anticipated use of the proceeds of the offering, which could change

as a result of market conditions or for other reasons, and the

impact of general economic, industry or political conditions in the

United States or internationally. There can be no assurance

that AXT will be able to complete the offering on the anticipated

terms, or at all. Additional risks and uncertainties relating

to the offering, AXT and its business can be found under the

heading “Risk Factors” in AXT’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2016 and in the prospectus

supplement and accompanying prospectus relating to the offering to

be filed with the Securities and Exchange Commission. AXT

assumes no duty or obligation to update or revise any

forward-looking statements for any reason.

Contacts:

Gary L. Fischer

Chief Financial Officer

(510) 438-4700

Leslie Green

Green Communications Consulting, LLC

(650) 312-9060

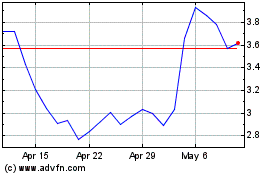

AXT (NASDAQ:AXTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

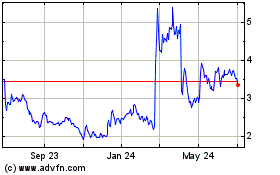

AXT (NASDAQ:AXTI)

Historical Stock Chart

From Apr 2023 to Apr 2024