ICU Medical's 2017 Guidance Misses Expectations -- Update

March 01 2017 - 10:10PM

Dow Jones News

By Maria Armental

Medical-products company ICU Medical Inc., which had warned 2017

would be a "bumpy" year, on Wednesday gave financial projections

that largely missed Wall Street targets, weighed down by costs as

it brings into the fold what had been its largest customer.

The San Clemente, Calif. company last month bought Pfizer's

global infusion therapy business, Hospira Infusion Systems, in a

cash-and-stock deal that turned Pfizer into ICU Medical's largest

shareholder.

The biggest challenge, officials said, is IT conversion and the

goal is to improve margins -- then work on overall results.

"Our bias at the moment is to spend more if needed to enable the

integration faster," Chief Executive Vivek Jain said in a

conference call with analysts.

Mr. Janis said the company had found high-quality research and

development talent but also some problems, including inertia and

some "mistaken fondness for some corporate largesse."

Asked whether the rationale for the deal still made sense, Mr.

Janis said: "Economically, putting aside all the strategy stuff,

relative to the cards we were holding, it was the right thing to

do."

This year, ICU Medical said it expects to make $3.55 to $3.90 a

share in adjusted profit on $1.2 billion to $1.25 billion in

revenue, compared with analysts' projected $3.97 a share on $1.31

billion in revenue.

In 2016, the company made $4.88 a share in adjusted profit on

$379.4 million in sales.

The revenue surge is largely due to the Hospira acquisition.

The infusion therapy business, ICU Medical's main cash driver,

reported a 6.1% revenue increase in the most recent period.

Mr. Jain said in the first six weeks of the year company

officials had seen a "slight slowdown" to growth rates.

"A few weeks do not make a trend, but it just feels a touch

lighter to me," Mr. Jain said.

Over all, fourth-quarter profit surged to $9.5 million, or 54

cents a share. Excluding stock-based compensation, restructuring

costs and other items, profit rose to $1.20 a share from 96 cents a

year earlier.

Meanwhile, revenue rose 6% to $95.7 million.

Analysts surveyed by Thomson Reuters had expected $1.19 on $94.4

million in revenue.

Shares closed Wednesday at $152.30, up nearly two-thirds over

the past 12 months.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

March 01, 2017 21:55 ET (02:55 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

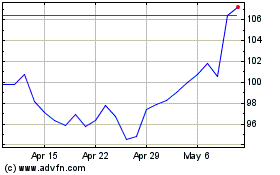

ICU Medical (NASDAQ:ICUI)

Historical Stock Chart

From Mar 2024 to Apr 2024

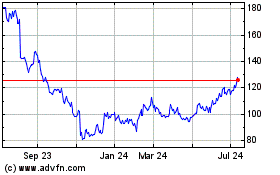

ICU Medical (NASDAQ:ICUI)

Historical Stock Chart

From Apr 2023 to Apr 2024