As filed with the Securities and Exchange Commission on March 1, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Amarin Corporation plc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

England and Wales

|

|

Not Required

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

Amarin Corporation plc

2 Pembroke House

Upper

Pembroke Street 28-32

Dublin 2, Ireland

+353 1 6699 020

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John F. Thero

President and Chief Executive Officer

Amarin Corporation plc

c/o Amarin Pharma, Inc.

1430 Route 206

Bedminster, New Jersey 07921, USA

Telephone: (908) 719-1315

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Michael

H. Bison, Esq.

William D. Collins, Esq.

Goodwin Procter LLP

100

Northern Avenue

Boston, MA 02210

Telephone: (617) 570-1000

Facsimile: (617) 523-1231

Approximate date of

commencement of proposed sale to the public:

From time to time or at one time after the effective date of the Registration Statement as the registrant shall determine.

If the only securities being registered on this Form are being offered pursuant to dividend or interest

reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a

delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and

list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

If this Form is a

post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that

shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the

following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated

filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☒

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered

|

|

Proposed

Maximum

Offering Price

Per Share

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee (1)

|

|

Ordinary shares, par value £0.50 per share (2)

|

|

10,416,672 (3)

|

|

$3.34

|

|

$34,791,684.48

|

|

$4,032.36

|

|

|

|

|

|

(1)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act based upon a $3.34 per share average of the high and low sale prices of the registrant’s common

stock as reported by the NASDAQ Global Market (NASDAQ) on February 24, 2017.

|

|

(2)

|

The ordinary shares, par value £0.50 per share, may be represented by American Depositary Shares (“

ADSs

”), each of which currently represents one ordinary share. A separate

Registration Statement on Form F-6 has been filed for the registration of ADSs and was declared effective on August 12, 2016 (Reg. File No. 333-213106).

|

|

(3)

|

Represents the maximum number of ordinary shares represented by ADSs issuable upon the exchange of 3.50% Exchangeable Senior Notes due 2047 issued on January 25, 2017 by Corsicanto II Designated Activity Company, a

company formed under the laws of Ireland and a wholly-owned subsidiary of Amarin Corporation plc. The aggregate number of ordinary shares represented by ADSs actually issued upon such an exchange may be less.

|

The information in this prospectus is not complete and may be changed. The selling

shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these

securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED March 1, 2017

10,416,672 American Depositary Shares

Representing 10,416,672 Ordinary Shares

Offered by the Selling Shareholders

This prospectus covers the

resale by the selling shareholders identified in this prospectus and any related prospectus supplement of up to an aggregate amount of 10,416,672 American Depositary Shares (which we refer to as ADSs), each representing one of our ordinary shares,

par value £0.50 per share, which we refer to as our ordinary shares. We are not selling any ADSs or ordinary shares under this prospectus and we will not receive any of the proceeds from the sale or other disposition of ADSs or ordinary

shares by the selling shareholders.

The selling shareholders may sell or otherwise dispose of the ADSs covered by this prospectus in a number of

different ways and at varying prices. We provide more information about how the selling shareholders may sell or otherwise dispose of their ADSs in the section entitled “Plan of Distribution” beginning on page 17.

Any discount, concession, commissions and similar selling expenses attributable to the sale of ADSs covered by this prospectus will be borne by the selling

shareholders. We will pay all expenses (other than discounts, concessions, commissions and similar selling expenses) relating to the issuance and registration of the ADSs with the Securities and Exchange Commission.

Our ADSs are traded on the NASDAQ Capital Market under the symbol “AMRN”. A separate Registration Statement on Form F-6 for the registration of ADSs

issuable upon deposit of the ordinary shares was previously filed with the Securities and Exchange Commission and was effective on August 12, 2016 (Reg. File

No. 333-213106).

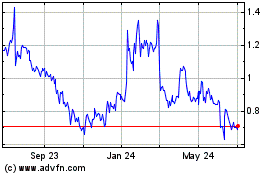

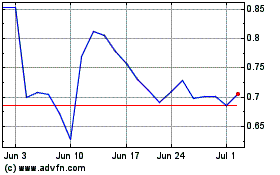

On February 28, 2017,

the closing price of our ADSs on the NASDAQ Capital Market was $3.40 per share.

Investing in our securities

involves certain risks. See “

Risk Factors

” beginning on page 4 of this prospectus.

Neither the Securities and

Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 1, 2017.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of an automatic shelf registration statement that we filed with the Securities and Exchange Commission, or the SEC, as

a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended, or the Securities Act. Under this shelf registration, selling shareholders may offer our ADSs registered pursuant to the registration

statement from time to time in one or more offerings. This prospectus only provides you with a general description of the securities selling shareholders may offer. Each time selling shareholders offer our ADSs pursuant to this prospectus, we will

provide a prospectus supplement, if required, that will contain more specific information about the specific terms of the offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material

information relating to these offerings. Each such prospectus supplement and any free writing prospectus that we may authorize to be provided to you may also add, update or change information contained in this prospectus or in documents incorporated

by reference into this prospectus.

We urge you to carefully read this prospectus, any applicable prospectus supplement and any related free writing prospectus, together with the information incorporated herein by reference as described under the

headings “Where You Can Find More Information” and “Documents Incorporated by Reference” before you invest in our securities.

You should rely only on the information incorporated by reference or provided in this document. Neither we nor any selling shareholder have

authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurances as to the reliability of, any

information not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus that we or a selling shareholder may authorize to be provided to you. This prospectus is an offer to sell only the securities

offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only as

of the date on the front of the document and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus

supplement or any related free writing prospectus, or any sale of a security.

This prospectus contains summaries of certain provisions

contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to

herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where

You Can Find More Information.”

1

PROSPECTUS SUMMARY

About Amarin Corporation plc

We are a biopharmaceutical

company with expertise in lipid science focused on the commercialization and development of therapeutics to improve cardiovascular health.

Our lead

product, Vascepa

®

(icosapent ethyl) capsules, is approved by the U.S. Food and Drug Administration, or FDA, for use as an adjunct to diet to reduce triglyceride levels in adult patients with

severe (TG

³

500mg/dL) hypertriglyceridemia. In August 2015, based on a federal court decision, we also began marketing Vascepa in the United States for the treatment of patients with high

triglyceride levels (TG

³

200mg/dL and <500mg/dL) who are also on statin therapy for elevated low-density lipoprotein cholesterol. Vascepa is available in the United States by prescription only. We

began selling and marketing Vascepa in the United States in January 2013. We sell Vascepa principally to a limited number of major wholesalers, as well as selected regional wholesalers and specialty pharmacy providers, or collectively, its

Distributors, that in turn resell Vascepa to retail pharmacies for subsequent resale to patients and health care providers. We market Vascepa through our sales force of approximately 150 sales professionals, including sales representatives and their

managers. In addition, in March 2014, we entered into a co-promotion agreement with Kowa Pharmaceuticals America, Inc. under which approximately 250 Kowa Pharmaceuticals America, Inc. sales representatives began to devote a substantial portion of

their time to promoting Vascepa starting in May 2014. In February 2015, we entered into an agreement with Eddingpharm (Asia) Macao Commercial Offshore Limited related to the development and commercialization of Vascepa in Mainland China, Hong Kong,

Macau and Taiwan. We are currently focused on completing the ongoing REDUCE-IT (Reduction of Cardiovascular Events with EPA—Intervention Trial) cardiovascular outcomes study of Vascepa, which we started in December 2011. REDUCE-IT, a

multinational, prospective, randomized, double-blind, placebo-controlled study, is the first prospective cardiovascular outcomes study of any drug in a population of patients who, despite stable statin therapy, have elevated triglyceride levels.

Based on the results of REDUCE-IT, we plan to seek additional indicated uses for Vascepa. In REDUCE-IT, cardiovascular event rates for patients on stable statin therapy plus 4 grams per day of Vascepa will be compared to cardiovascular event rates

for patients on stable statin therapy plus placebo. In 2016, we completed patient enrollment and randomization of 8,175 individual patients into the REDUCE-IT study, exceeding the 8,000 patients targeted for the trial. We operate in one business

segment. ADSs representing our ordinary shares are listed on the NASDAQ Capital Market under the symbol “AMRN.”

Corporate Information

Amarin Corporation plc (formerly Ethical Holdings plc) is a public limited company listed in the United States on the NASDAQ Capital

Market. Amarin was originally incorporated in England as a private limited company on March 1, 1989 under the Companies Act 1985, and re-registered in England as a public limited company on March 19, 1993.

Our registered office is located at One New Change, London EC4M 9AF, England. Our principal executive offices are located at 2 Pembroke House, Upper

Pembroke Street 28-32, Dublin 2, Ireland. Our primary office in the United States is located at 1430 Route 206, Bedminster, New Jersey 07921. Our telephone number at that location is (908) 719-1315. Our website address is

www.amarincorp.com

. Information contained on, or accessible through, our website is not a part of this prospectus.

For additional information

about our company, please refer to other documents we have filed with the SEC and that are incorporated by reference into this prospectus, as listed under the heading “Incorporation of Certain Information by Reference.” Additional

information about us can be found in our periodic and current reports filed with the SEC. Copies of our current and periodic reports filed with the SEC are available at the SEC Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549, and

online at

www.sec.gov

.

2

ABOUT THE OFFERING

On January 25, 2017, we entered into separate, privately negotiated agreements with certain investors pursuant to which Corsicanto II Designated Activity

Company, a company formed under the laws of Ireland and a wholly-owned subsidiary of Amarin, or Corsicanto II, agreed to issue and sell $30 million in aggregate principal amount of 3.50% Exchangeable Senior Notes due 2047, or the 2017 Notes. The

private placement closed on January 25, 2017. The 2017 Notes are exchangeable under certain conditions by Corsicanto II or the holders of the 2017 Notes for up to an aggregate of 10,416,672 of our ordinary shares, to be represented by ADSs. The

aggregate number of ordinary shares represented by ADSs actually issued upon such an exchange may be less. The 2017 Notes are governed by the terms of an Indenture, dated January 25, 2017, or the Indenture. Pursuant to Section 7.10 of the

Indenture, we agreed to file the registration statement of which this prospectus forms a part with the Securities and Exchange Commission, which we refer to as the SEC or the Commission, to register the resale by the holders of the 2017 Notes of the

ADSs representing ordinary shares issuable upon exchange of the 2017 Notes, with each ADS representing one of our ordinary shares. This prospectus relates to the potential resale of up to 10,416,672 of our ADSs representing such ordinary shares

issuable upon exchange of the 2017 Notes, which is the maximum number of ADSs issuable upon such exchange. We may also issue fewer ADSs upon the exchange of the 2017 Notes, in which case fewer than 10,416,672 ADSs will be eligible for resale under

this registration statement. See “Use of Proceeds,” “Selling Shareholders” and “Plan of Distribution” for additional information concerning this offering.

3

RISK FACTORS

Investing in our securities involves significant risks. Before making an investment decision, you should carefully consider the risks and other information

we include or incorporate by reference in this prospectus and any prospectus supplement. In particular, you should consider the risk factors under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2016, which are incorporated by reference in this prospectus, as those risk factors may be amended or supplemented by our subsequent filings with the SEC. If any of these risks actually occur, they may materially harm our business,

prospects, financial condition and results of operations. In this event, the market price of our securities could decline and you could lose part or all of your investment. Additional risks and uncertainties not currently known to us or that we

currently deem immaterial may also affect our business operations.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus and the documents incorporated by reference into it contain forward-looking statements. Forward-looking statements relate

to future events or our future financial performance. We generally identify forward-looking statements by terminology such as “may,” “would,” “should,” “expects,” “plans,” “anticipates,”

“could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “assume,” “intend,” “potential,”

“continue” or other similar words or the negative of these terms. These statements are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial

trends that we believe may affect our business, financial condition and results of operations. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors referenced under in

“Risk Factors” in this prospectus and described in any prospectus supplement and our periodic filings with the SEC incorporated by reference in this prospectus or any prospectus supplement. Accordingly, you should not place undue reliance

upon these forward-looking statements. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur, the timing of events and circumstances and actual results could differ materially

from those projected in the forward looking statements. Forward-looking statements contained in this prospectus include, but are not limited to, statements about:

|

|

•

|

|

our ability to generate revenue and otherwise maintain sufficient cash and other liquid resources to meet our operating and any debt service requirements;

|

|

|

•

|

|

the success of our current and future research and development activities and clinical trials, including the timing and nature of any interim or final results of such trials;

|

|

|

•

|

|

decisions by regulatory authorities regarding whether and when to approve our drug applications, as well as their decisions regarding labeling and other matters that could affect the commercial potential of our

products;

|

|

|

•

|

|

the speed with which regulatory authorizations, pricing approvals and product launches may be achieved;

|

|

|

•

|

|

whether we can execute on our existing strategic collaborations with respect to our products or product candidates;

|

|

|

•

|

|

whether and when we will be able to enter into and consummate strategic collaborations with respect to our products or product candidates on acceptable terms;

|

|

|

•

|

|

the success with which developed products may be commercialized and otherwise accepted by our approved markets;

|

|

|

•

|

|

competitive developments affecting our products or product candidates, including generic and branded competition;

|

|

|

•

|

|

the effect of possible domestic and foreign legislation or regulatory action affecting, among other things, pharmaceutical pricing and reimbursement, including under Medicaid and Medicare in the United States, and

involuntary approval of prescription medicines for over-the-counter use and the trend toward managed care and health care cost containment;

|

|

|

•

|

|

our reliance on third party manufacturers and suppliers;

|

|

|

•

|

|

our ability to protect our patents and other intellectual property;

|

4

|

|

•

|

|

claims and concerns that may arise regarding the safety or efficacy of our products or product candidates;

|

|

|

•

|

|

governmental laws and regulations affecting our operations, including those affecting taxation; and

|

|

|

•

|

|

growth in costs and expenses.

|

The forward-looking statements made or incorporated by reference in this

prospectus relate only to events as of the date on which the statements are made. We have included important factors in the cautionary statements included in this prospectus and incorporated herein by reference, including under the caption entitled

“Risk Factors” that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions,

mergers, dispositions, joint ventures or investments we may make. Except as required by law, we do not assume any intent to update any forward-looking statements after the date on which the statement is made, whether as a result of new information,

future events or circumstances or otherwise.

5

USE OF PROCEEDS

This prospectus relates to the securities that may be offered and sold from time to time by the selling shareholders who will receive all of the proceeds from

any sale of the securities. We will not receive any of the proceeds from any sales of the securities by any selling shareholder. However, we will pay certain issuance and registration expenses, including filing fees, listing fees, printing expenses

and fees of our counsel and other advisers.

SELLING SHAREHOLDERS

This prospectus relates to the possible sale by the selling shareholders, of up to 10,416,672 of our ADSs representing such ordinary shares issuable upon

exchange of the 2017 Notes, which is the maximum number of ADSs issuable upon such exchange. We may also issue fewer ADSs upon the exchange of the 2017 Notes, in which case fewer than 10,416,672 ADSs will be eligible for resale under this

registration statement. The selling shareholders will be former holders of our 2017 Notes at the time of the exchange.

The applicable prospectus

supplement will set forth the name of each of the selling shareholders and the number of securities beneficially owned by such selling shareholder that are covered by such applicable prospectus supplement. The applicable prospectus supplement will

also disclose whether any of the selling shareholders has held any position or office with, has been employed by, or otherwise has had a material relationship with us during the three years prior to the date of the applicable prospectus supplement.

Selling shareholders may not sell any of our ADSs representing such ordinary shares issuable upon exchange of the 2017 Notes pursuant to this prospectus until we have identified those selling shareholders and the ADSs being offered for resale by

those selling shareholders in a subsequent prospectus supplement, or otherwise absent an exemption from the registration requirements from the Securities Act of 1933, as amended.

6

DESCRIPTION OF SECURITIES

The selling shareholders may offer our ADSs, each representing one of our ordinary shares, from time to time under this prospectus in the manner set forth

under “Plan of Distribution” below.

In the following summary, a “shareholder” is the person registered in our register of members as

the holder of the relevant securities, including ordinary shares that have been deposited in our ADS facility with Citibank, N.A., or the Depositary.

Description of Ordinary Shares

Dividends

Holders of ordinary shares are entitled to receive such dividends as may be declared by the board of directors. All dividends are declared and

paid according to the amounts paid up on the ordinary shares in respect of which the dividend is paid. To date there have been no dividends paid to holders of ordinary shares.

Any dividend unclaimed after a period of twelve years from the date of declaration of such dividend shall be forfeited and shall revert to us. In addition,

the payment by the board of directors of any unclaimed dividend, interest or other sum payable on or in respect of an ordinary share into a separate account shall not constitute us as a trustee in respect thereof.

Rights in a Liquidation

Holders of ordinary

shares are entitled to participate in any distribution of assets upon a liquidation, subject to prior satisfaction of the claims of creditors and preferential payments to holders of outstanding preference shares.

Voting Rights

Voting at any general meeting of

ordinary shareholders is by a show of hands, unless a poll is demanded. A poll may be demanded by:

|

|

•

|

|

the chairman of the meeting;

|

|

|

•

|

|

at least two shareholders entitled to vote at the meeting;

|

|

|

•

|

|

any shareholder or shareholders representing in the aggregate not less than one-tenth of the total voting rights of all shareholders entitled to vote at the meeting; or

|

|

|

•

|

|

any shareholder or shareholders holding shares conferring a right to vote at the meeting on which there have been paid up sums in the aggregate equal to not less than one-tenth of the total sum paid up on all the shares

conferring that right.

|

In a vote by a show of hands, every shareholder who is present in person or by proxy at a general meeting has one

vote. In a vote on a poll, every shareholder who is present in person or by proxy shall have one vote for every share of which they are registered as the holder (provided that no shareholder shall have more than one vote on a show of hands

notwithstanding that he may have appointed more than one proxy to vote on his behalf). The quorum for a shareholders’ meeting is a minimum of two persons, present in person or by proxy. To the extent the Articles of Association provide for a

vote by a show of hands in which each shareholder has one vote, this differs from U.S. law, under which each shareholder typically is entitled to one vote per share at all meetings.

Unless otherwise required by law or the Articles of Association, voting in a general meeting is by ordinary resolution. An ordinary resolution is approved by

a majority vote of the shareholders present at a meeting at which there is a quorum. Examples of matters that can be approved by an ordinary resolution include:

|

|

•

|

|

the election of directors;

|

|

|

•

|

|

the approval of financial statements;

|

|

|

•

|

|

the declaration of final dividends;

|

|

|

•

|

|

the appointment of auditors; or

|

7

|

|

•

|

|

the grant of authority to issue shares.

|

A special resolution requires the affirmative vote of not less than

three-fourths of the eligible votes of shareholders present at the meeting. Examples of matters that must be approved by a special resolution include modifications to the rights of any class of shares, changes to the Articles of Association, or our

winding-up.

Capital Calls

The board of

directors has the authority to make calls upon the shareholders in respect of any money unpaid on their shares and each shareholder shall pay to us as required by such notice the amount called on his shares. If a call remains unpaid after it has

become due and payable, and the fourteen days’ notice provided by the board of directors has not been complied with, any share in respect of which such notice was given may be forfeited by a resolution of the board.

Limitations on Ownership

Under English law and

the Articles of Association, there are no limitations on the right of nonresidents of the United Kingdom or owners who are not citizens of the United Kingdom to hold or vote our ordinary shares.

Description of American Depositary Shares

Citibank, N.A.

acts as the depositary bank for ADSs. Citibank’s depositary offices are located at 388 Greenwich Street, New York, New York 10013. American Depositary Shares are frequently referred to as “ADSs” and represent ownership interests in

securities that are on deposit with the depositary bank. ADSs may be represented by certificates that are commonly known as “American Depositary Receipts” or “ADRs.” The Depositary typically appoints a custodian to safekeep the

securities on deposit. In this case, the custodian is Citibank, N.A., London Branch, having its principal office at Citigroup Centre, Canada Square, Canary Wharf, London E14 5LB, England.

We have appointed Citibank as the Depositary for the ADSs pursuant to an amended and restated deposit agreement dated as of November 4, 2011. A copy of

the deposit agreement is on file with the SEC under cover of a Registration Statement on Form F-6 filed on September 16, 2011. You may obtain a copy of the deposit agreement from the SEC’s Public Reference Room at 100 F Street, N.E.,

Washington, D.C. 20549 and from the SEC’s website (www.sec.gov). Please refer to Registration Number 333-176898 or 333-213106 when retrieving such copy.

We are providing you with a summary description of the material terms of the ADSs and of the material rights of the holders of ADSs. Please remember that

summaries by their nature lack the precision of the information summarized and that the rights and obligations of a holder of ADSs will be determined by reference to the terms of the deposit agreement and not by this summary. Holders should review

the deposit agreement in its entirety.

Each ADS represents the right to receive one ordinary share on deposit with the custodian. An ADS also represents

the right to receive any other property received by the depositary bank or the custodian on behalf of the owner of the ADS but that has not been distributed to the owners of ADSs because of legal restrictions or practical considerations. The

custodian, the depositary bank and their respective nominees will hold all deposited property for the benefit of the holders and beneficial owners of ADSs. The deposited property does not constitute the proprietary assets of the depositary bank, the

custodian or their nominees. Beneficial ownership in the deposited property will under the terms of the deposit agreement be vested in the beneficial owners of the ADSs. The depositary bank, the custodian and their respective nominees will be the

record holders of the deposited property represented by the ADSs for the benefit of the holders and beneficial owners of the corresponding ADSs. Owners of ADSs will be able to exercise beneficial ownership interests in the deposited property only

through the registered holders of the ADSs, by the registered holders of the ADSs (on behalf of the applicable ADS owners) only through the depositary bank, and by the depositary bank (on behalf of the owners of the corresponding ADSs) directly, or

indirectly through the custodian or their respective nominees, in each case upon the terms of the deposit agreement.

If you become an owner of ADSs, you

will become a party to the deposit agreement and therefore will be bound to its terms and to the terms of any ADR that represents your ADSs. The deposit agreement and the ADR specify our rights and obligations as well as your rights and obligations

as owner of ADSs and those of the depositary bank. As

8

an ADS holder you appoint the depositary bank to act on your behalf in certain circumstances. The deposit agreement and the ADRs are governed by New York law. However, our obligations to the

holders of ordinary shares will continue to be governed by the laws of England and Wales, which may be different from the laws in the United States.

A

holder of ADSs may hold its ADSs either by means of an ADR registered in its name, through a brokerage or safekeeping account, or through an account established by the depositary bank in its name reflecting the registration of uncertificated ADSs

directly on the books of the depositary bank (commonly referred to as the “direct registration system” or “DRS”). The direct registration system reflects the uncertificated (book-entry) registration of ownership of ADSs by the

depositary bank. Under the direct registration system, ownership of ADSs is evidenced by periodic statements issued by the depositary bank to the holders of the ADSs. The direct registration system includes automated transfers between the depositary

bank and The Depository Trust Company, or DTC, the central book-entry clearing and settlement system for equity securities in the United States. If the ADSs are held through your brokerage or safekeeping account, you must rely on the procedures of

your broker or bank to assert your rights as ADS owner. Banks and brokers typically hold securities such as the ADSs through clearing and settlement systems such as DTC. The procedures of such clearing and settlement systems may limit your ability

to exercise your rights as an owner of ADSs. Please consult with your broker or bank if you have any questions concerning these limitations and procedures. All ADSs held through DTC will be registered in the name of a nominee of DTC. This summary

description assumes you have opted to own the ADSs directly by means of an ADS registered in your name and, as such, we will refer to you as the “holder.” When we refer to “you,” we assume the reader owns ADSs and will own ADSs

at the relevant time.

Dividends and Distributions

As a holder of ADSs, you generally have the right to receive the distributions we make on the securities deposited with the custodian. Your receipt of these

distributions may be limited, however, by practical considerations and legal limitations. Holders of ADSs will receive such distributions under the terms of the deposit agreement, in proportion to the number of ADSs held as of a specified record

date, after deduction of applicable fees, taxes and expenses.

Distributions of Cash

If we make a cash distribution for the securities on deposit with the custodian, we will deposit the funds with the custodian. Upon receipt of confirmation of

the deposit of the requisite funds, the Depositary will arrange for the funds to be converted into U.S. dollars and for the distribution of the U.S. dollars to the holders, subject to applicable laws and regulations.

The conversion into U.S. dollars will take place only if practicable and if the U.S. dollars are transferable to the United States. The Depositary will apply

the same method for distributing the proceeds of the sale of any deposited property (such as undistributed rights) held by the Depositary or the custodian in respect of ADSs.

The distribution of cash will be made net of the fees, expenses, taxes and governmental charges payable by holders under the terms of the deposit agreement.

The Depositary will hold any cash amounts it is unable to distribute in a non-interest bearing account for the benefit of the applicable holders and beneficial owners of ADSs until the distribution can be effected or the funds that the Depositary

holds must be escheated as unclaimed property in accordance with the laws of the relevant states of the United States.

Distributions of Shares

Whenever we make a free distribution of shares for the securities on deposit with the Depositary or the custodian, we will deposit the applicable

number of shares with the Depositary or the custodian. Upon receipt of confirmation of such deposit, the Depositary will

either

distribute to holders new ADSs representing the ordinary shares deposited

or

modify the ADS-to-shares

ratio, in which case each ADS you hold will represent rights and interests in the additional ordinary shares so deposited. Only whole new ADSs will be distributed. Fractional entitlements will be sold and the proceeds of such sale will be

distributed as in the case of a cash distribution.

The distribution of new ADSs or the modification of the ADS-to-ordinary shares ratio upon a

distribution of ordinary shares will be made net of the fees, expenses, taxes and governmental charges payable by holders under the terms of the deposit agreement, as applicable. In order to pay such taxes or governmental charges, the Depositary may

sell all or a portion of the new ordinary shares so distributed.

9

No such distribution of new ADSs will be made if it would violate a law (

i.e.

, the U.S. securities laws)

or if it is not operationally practicable. If the Depositary does not distribute new ADSs as described above, it may sell the shares received upon the terms described in the deposit agreement, as applicable, and will distribute the proceeds of the

sale as in the case of a distribution of cash.

Distributions of Rights

Whenever we intend to distribute rights to purchase additional ordinary shares, we will give prior notice to the Depositary, indicate to the Depositary whether

we wish to make such distributions available to holders of ADSs and assist the Depositary in determining whether it is lawful and reasonably practicable to distribute rights to purchase additional ADSs to holders.

The Depositary will establish procedures to distribute rights to purchase additional ADSs to holders and to enable such holders to exercise such rights if it

is lawful and reasonably practicable to make the rights available to holders of ADSs, and if we provide all of the documentation contemplated in the deposit agreement, as applicable (such as opinions to address the lawfulness of the transaction).

You may have to pay fees, expenses, taxes and other governmental charges to subscribe for the new ADSs upon the exercise of your rights. The Depositary is not obligated to establish procedures to facilitate the distribution and exercise by holders

of rights to purchase new ordinary shares other than in the form of ADSs.

The Depositary will

not

distribute the rights to you if:

|

|

•

|

|

We do not request that the rights be distributed to you or we request that the rights not be distributed to you; or

|

|

|

•

|

|

We fail to deliver satisfactory documents to the Depositary; or

|

|

|

•

|

|

It is not reasonably practicable to distribute the rights.

|

The Depositary will sell the rights that are not

exercised or not distributed if such sale is lawful and reasonably practicable. The proceeds of such sale will be distributed to holders as in the case of a cash distribution. If the Depositary is unable to sell the rights, it will allow the rights

to lapse.

Elective Distributions

Whenever we

intend to distribute a dividend payable at the election of shareholders either in cash or in additional shares, we will give prior notice thereof to the Depositary and will indicate whether we wish the elective distribution to be made available to

you. In such case, we will assist the Depositary in determining whether such distribution is lawful and reasonably practicable.

The Depositary will make

the election available to you only if it is reasonably practicable and if we have provided all of the documentation contemplated in the deposit agreement, as applicable, and indicate to the Depositary that we wish the elective distributions be made

available to you. In such case, the Depositary will establish procedures to enable you to elect to receive either cash or additional ADSs, in each case as described in the deposit agreement, as applicable.

If the election is not made available to you, you will receive either cash or additional ADSs, depending on what a shareholder under English law would receive

upon failing to make an election, as more fully described in the deposit agreement, as applicable.

Other Distributions

Whenever we intend to distribute property other than cash, ordinary shares or rights to purchase additional ordinary shares, we will notify the Depositary in

advance and will indicate whether we wish such distribution to be made to you. If so, we will assist the Depositary in determining whether such distribution to holders is lawful and reasonably practicable.

10

If it is reasonably practicable to distribute such property to you and if we provide all of the documentation

contemplated in the deposit agreement, as applicable, the Depositary will distribute the property to the holders in a manner it deems practicable.

The

distribution will be made net of fees, expenses, taxes and governmental charges payable by holders under the terms of the deposit agreement. In order to pay such taxes and governmental charges, the Depositary may sell all or a portion of the

property received.

The Depositary will

not

distribute the property to you and will sell the property if:

|

|

•

|

|

We do not request that the property be distributed to you or if we ask that the property not be distributed to you; or

|

|

|

•

|

|

We do not deliver satisfactory documents to the Depositary; or

|

|

|

•

|

|

The Depositary determines that all or a portion of the distribution to you is not reasonably practicable.

|

The

proceeds of such a sale will be distributed to holders as in the case of a cash distribution.

Redemption

Whenever we decide to redeem any of the securities on deposit with the custodian, we will notify the Depositary in advance. If it is practicable and if we

provide all of the documentation contemplated in the deposit agreement, the Depositary will provide notice of the redemption to the holders.

The

custodian will be instructed to surrender the shares being redeemed against payment of the applicable redemption price. You may have to pay fees, expenses, taxes and other governmental charges upon the redemption of your ADSs. If less than all ADSs

are being redeemed, the ADSs to be retired will be selected by lot or on a

pro rata

basis, as the Depositary may determine.

Changes

Affecting Shares

The shares held on deposit for your ADSs may change from time to time. For example, there may be a change in nominal or par

value, a split-up, cancellation, consolidation or reclassification of such shares or a recapitalization, reorganization, merger, consolidation or sale of assets.

If any such change were to occur, your ADSs would, to the extent permitted by law, represent the right to receive the property received or exchanged in

respect of the shares held on deposit. The Depositary may in such circumstances deliver new ADSs to you, call for the exchange of your existing ADSs for new ADSs and take any other actions that are appropriate to reflect as to the ADSs the change

affecting the shares. If the Depositary may not lawfully distribute such property to you, the Depositary may sell such property and distribute the net proceeds to you as in the case of a cash distribution.

Transfer, Combination and Split Up of ADRs

As an

ADR holder, you will be entitled to transfer, combine or split up your ADRs and the ADSs evidenced thereby. For transfers of ADRs, you will have to surrender the ADRs to be transferred to the Depositary and also must:

|

|

•

|

|

ensure that the surrendered ADR is properly endorsed or otherwise in proper form for transfer;

|

|

|

•

|

|

provide such proof of identity and genuineness of signatures as the Depositary deems appropriate;

|

|

|

•

|

|

provide any transfer stamps required by the State of New York or the United States; and

|

|

|

•

|

|

pay all applicable fees, charges, expenses, taxes and other government charges payable by ADR holders pursuant to the terms of the deposit agreement, upon the transfer of ADRs.

|

To have your ADRs either combined or split up, you must surrender the ADRs in question to the Depositary with your request to have them combined or split up,

and you must pay all applicable fees, charges and expenses payable by ADR holders, pursuant to the terms of the deposit agreement, upon a combination or split up of ADRs.

11

Withdrawal of Shares Upon Cancellation of ADSs

As an ADS holder, you will be entitled to present your ADSs to the Depositary for cancellation and then receive the corresponding number of underlying ordinary

shares or other deposited securities at the custodian’s offices. Your ability to withdraw the ordinary shares may be limited by U.S. and U.K. legal considerations applicable at the time of withdrawal. In order to withdraw the ordinary shares

represented by your ADSs, you will be required to pay to the Depositary the fees for cancellation of ADSs and any charges and taxes payable upon the transfer of the ordinary shares being withdrawn. You assume the risk for delivery of all funds and

securities upon withdrawal. Once canceled, the ADSs will not have any rights under the deposit agreement.

If you hold ADSs registered in your name, the

Depositary may ask you to provide proof of identity and genuineness of any signature and such other documents as the Depositary may deem appropriate before it will cancel your ADSs. The withdrawal of the shares represented by your ADSs may be

delayed until the Depositary receives satisfactory evidence of compliance with all applicable laws and regulations. Please keep in mind that the Depositary will only accept ADSs for cancellation that represent a whole number of securities on

deposit.

You will have the right to withdraw the securities represented by your ADSs at any time except for:

|

|

•

|

|

Temporary delays that may arise because (i) the transfer books for the ordinary shares or ADSs are closed, or (ii) shares are immobilized on account of a shareholders’ meeting or a payment of dividends.

|

|

|

•

|

|

Obligations to pay fees, taxes and similar charges.

|

|

|

•

|

|

Restrictions imposed because of laws or regulations applicable to ADSs or the withdrawal of securities on deposit.

|

The deposit agreement may not be modified to impair your right to withdraw the securities represented by your ADSs except to comply with mandatory provisions

of law.

Voting Rights

As a holder of ADSs,

you generally have the right under the deposit agreement to instruct the Depositary to exercise the voting rights for the ordinary shares represented by your ADSs. The voting rights of holders of ordinary shares are described under the heading

“Description of Securities–Description of Ordinary Shares”.

At our request, the Depositary will distribute to you any notice of

shareholders’ meeting received from us together with information explaining how to instruct the Depositary to exercise the voting rights of the securities represented by ADSs.

If the Depositary timely receives voting instructions from a holder of ADSs, it will endeavor to vote the securities (in person or by proxy) represented by

the holder’s ADSs in accordance with such voting instructions, provided that if such timely received instructions fail to specify the manner in which the Depositary is to vote, such holder shall be deemed to have instructed the Depositary to

vote in favor if the items set forth in such instructions.

Please note that the ability of the Depositary to carry out voting instructions may be limited

by practical and legal limitations and the terms of the securities on deposit. We cannot assure you that you will receive voting materials in time to enable you to return voting instructions to the Depositary in a timely manner. Securities for which

no voting instructions have been received will not be voted.

Fees and Charges

As an ADS holder, you will be required to pay the following service fees to the Depositary:

|

|

|

|

|

Service

|

|

Fees

|

|

• Issuance of ADSs upon deposit of Shares (excluding issuances as a

result of distributions described in the fourth paragraph below).

|

|

Up to U.S. $5.00 per 100 ADSs (or fraction thereof) issued.

|

|

|

|

|

• Delivery of Deposited Securities against surrender of ADSs.

|

|

Up to U.S. $5.00 per 100 ADSs (or fraction thereof) surrendered.

|

12

|

|

|

|

|

|

|

|

• Distribution of cash dividends or other cash distributions

(

i.e.

, sale of rights and other entitlements).

|

|

Up to U.S. $5.00 per 100 ADSs (or fraction thereof) held.

|

|

|

|

|

• Distribution of ADSs pursuant to (i) stock dividends or other

free stock distributions, or (ii) exercise of rights to purchase additional ADSs.

|

|

Up to U.S. $5.00 per 100 ADSs (or fraction thereof) held.

|

|

|

|

|

• Distribution of securities other than ADSs or rights to purchase

additional ADSs (

i.e.

, spin-off shares).

|

|

Up to U.S. $5.00 per 100 ADSs (or fraction thereof) held.

|

|

|

|

|

• Depositary Services.

|

|

Up to U.S. $5.00 per 100 ADSs (or fraction thereof) held on the applicable record date(s) established by the Depositary.

|

As an ADS holder you will also be responsible to pay certain fees and expenses incurred by the Depositary and certain taxes

and governmental charges such as:

|

|

•

|

|

Fees for the transfer and registration of shares charged by the registrar and transfer agent for the shares in England (

i.e.

, upon deposit and withdrawal of ordinary shares).

|

|

|

•

|

|

Expenses incurred for converting foreign currency into U.S. dollars.

|

|

|

•

|

|

Expenses for cable, telex and fax transmissions and for delivery of securities.

|

|

|

•

|

|

Taxes and duties upon the transfer of securities (

i.e.

, when ordinary shares are deposited or withdrawn from deposit).

|

|

|

•

|

|

Fees and expenses incurred in connection with the delivery or servicing of ordinary shares on deposit.

|

Depositary fees payable upon the issuance and cancellation of ADSs are typically paid to the Depositary by the brokers (on behalf of their clients) receiving

the newly issued ADSs from the Depositary and by the brokers (on behalf of their clients) delivering the ADSs to the Depositary for cancellation. The brokers in turn charge these fees to their clients. Depositary fees payable in connection with

distributions of cash or securities to ADS holders and the depositary services fee are charged by the Depositary to the holders of record of ADSs as of the applicable ADS record date.

The Depositary fees payable for cash distributions are generally deducted from the cash being distributed. In the case of distributions other than cash

(

i.e.

, stock dividend, rights), the Depositary charges the applicable fee to the ADS record date holders concurrent with the distribution. In the case of ADSs registered in the name of the investor (whether certificated or uncertificated in

direct registration), the Depositary sends invoices to the applicable record date ADS holders. In the case of ADSs held in brokerage and custodian accounts (via DTC), the Depositary generally collects its fees through the systems provided by DTC

(whose nominee is the registered holder of the ADSs held in DTC) from the brokers and custodians holding ADSs in their DTC accounts. The brokers and custodians who hold their clients’ ADSs in DTC accounts in turn charge their clients’

accounts the amount of the fees paid to the Depositary.

In the event of refusal to pay the depositary fees, the Depositary may, under the terms of the

deposit agreement, refuse the requested service until payment is received or may set off the amount of the depositary fees from any distribution to be made to the ADS holder.

Note that the fees and charges you may be required to pay may vary over time and may be changed by us and by the Depositary. You will receive prior notice of

such changes.

The Depositary may reimburse us for certain expenses incurred by us in respect of the ADR program established pursuant to the deposit

agreement, by making available a portion of the depositary fees charged in respect of the ADR program or otherwise, upon such terms and conditions as we and the Depositary may agree from time to time.

13

Amendments and Termination

We may agree with the Depositary to modify the deposit agreement or any ADR at any time without your consent. We undertake to give holders 30 days’ prior

notice of any modifications that would materially prejudice any of their substantial rights under the deposit agreement. We will not consider to be materially prejudicial to your substantial rights any modifications or supplements that are

reasonably necessary for the ADSs to be registered under the Securities Act or to be eligible for book-entry settlement, in each case without imposing or increasing the fees and charges you are required to pay. In addition, we may not be able to

provide you with prior notice of any modifications or supplements that are required to accommodate compliance with applicable provisions of law.

You will

be bound by the modifications to the deposit agreement or any ADR if you continue to hold your ADSs after the modifications to such agreement or any ADR become effective. Neither the deposit agreement nor any ADR can be amended to prevent you from

withdrawing the securities represented by your ADSs (except in order to comply with applicable law).

We have the right to direct the Depositary to

terminate the deposit agreement. Similarly, the Depositary may in certain circumstances on its own initiative terminate the deposit agreement. In either case, the Depositary must give notice to the holders at least 30 days before termination. Until

termination, your rights under either agreement will be unaffected.

After termination, the Depositary will continue to collect distributions received

(but will not distribute any such property until you request the cancellation of your ADSs) and may sell the securities held on deposit. After the sale, the Depositary will hold the proceeds from such sale and any other funds then held for the

holders of ADSs in a non-interest bearing account. At that point, the Depositary will have no further obligations to holders other than to account for the funds then held for the holders of ADSs still outstanding (after deduction of applicable fees,

taxes and expenses).

Books of Depositary

The

Depositary will maintain ADS holder records at its depositary office. You may inspect such records at such office during regular business hours but solely for the purpose of communicating with other holders in the interest of business matters

relating to the ADSs and the deposit agreement.

The Depositary will maintain in New York facilities to record and process the issuance, cancellation,

combination, split-up and transfer of ADSs. These facilities may be closed from time to time, to the extent not prohibited by law.

Limitations on

Obligations and Liabilities

The deposit agreement limits our obligations and the Depositary’s obligations to you. Please note the following:

|

|

•

|

|

We and the Depositary are obligated only to take the actions specifically stated in the deposit agreement, as applicable, without negligence or bad faith.

|

|

|

•

|

|

The Depositary disclaims any liability for any failure to carry out voting instructions, for any manner in which a vote is cast or for the effect of any vote, provided it acts in good faith and in accordance with the

terms of the deposit agreement, as applicable.

|

|

|

•

|

|

The Depositary disclaims any liability for any failure to determine the lawfulness or practicality of any action, for the content of any document forwarded to you on our behalf or for the accuracy of any translation of

such a document, for the investment risks associated with investing in ordinary shares or other deposited securities, for the validity or worth of such securities, for any tax consequences that result from the ownership of ADSs, for the

credit-worthiness of any third party, for allowing any rights to lapse under the terms of the deposit agreement, for the timeliness of any of our notices or for our failure to give notice.

|

|

|

•

|

|

We and the Depositary will not be obligated to perform any act that is inconsistent with the terms of the deposit agreement.

|

|

|

•

|

|

We and the Depositary disclaim any liability if we or the Depositary are prevented or forbidden from or subject to any civil or criminal penalty or restraint on account of, or delayed in, doing or performing any act or

thing required by the terms of the deposit agreement, by reason of any provision, present or future of any law or regulation, or by reason of present or future provision of any provision of our Articles of Association, or any provision of or

governing the securities on deposit, or by reason of any act of God or war or other circumstances beyond our control.

|

14

|

|

•

|

|

We and the Depositary disclaim any liability by reason of any exercise of, or failure to exercise, any discretion provided for in the deposit agreement or in our Articles of Association or in any provisions of or

governing the securities on deposit.

|

|

|

•

|

|

We and the Depositary further disclaim any liability for any action or inaction in reliance on the advice or information received from legal counsel, accountants, any person presenting securities for deposit, any holder

of ADSs or authorized representatives thereof, or any other person believed by either of us in good faith to be competent to give such advice or information.

|

|

|

•

|

|

We and the Depositary also disclaim liability for the inability by a holder to benefit from any distribution, offering, right or other benefit that is made available to holders of ordinary shares but is not, under the

terms of the deposit agreement, made available to you.

|

|

|

•

|

|

We and the Depositary may rely without any liability upon any written notice, request or other document believed to be genuine and to have been signed or presented by the proper parties.

|

|

|

•

|

|

We and the Depositary also disclaim liability for any consequential or punitive damages for any breach of the terms of the deposit agreement.

|

|

|

•

|

|

No disclaimer of any Securities Act liability is intended by any provision of the deposit agreement.

|

Pre-Release Transactions

Subject to the terms and

conditions of the deposit agreement, the Depositary may issue ADSs before receiving a deposit of ordinary shares or release ordinary shares before receiving ADSs for cancellation. These transactions are commonly referred to as “pre-release

transactions,” and are entered into between the Depositary and the applicable person. The deposit agreement limits the aggregate size of pre-release transactions (generally not to exceed 30% of the number of ADSs outstanding, which limit may be

modified or disregarded in the Depositary’s discretion) and imposes a number of conditions on such transactions (i.e., the need to receive collateral, the type of collateral required, the representations required from persons entering into such

transactions, etc.). The Depositary may retain the compensation received from the pre-release transactions.

Taxes

You will be responsible for the taxes and other governmental charges payable on the ADSs and the securities represented by the ADSs. We, the Depositary and the

custodian may deduct from any distribution the taxes and governmental charges payable by holders and may sell any and all property on deposit to pay the taxes and governmental charges payable by holders. You will be liable for any deficiency if the

sale proceeds do not cover the taxes that are due.

The Depositary may refuse to issue ADSs, to deliver, transfer, split and combine ADRs or to release

securities on deposit until all taxes and charges are paid by the applicable holder. The Depositary and the custodian may take reasonable administrative actions to obtain tax refunds and reduced tax withholding for any distributions on your behalf.

However, you may be required to provide to the Depositary and to the custodian proof of taxpayer status and residence and such other information as the Depositary and the custodian may require to fulfill legal obligations. You are required to

indemnify us, the Depositary and the custodian for any claims with respect to taxes based on any tax benefit obtained for you.

Foreign Currency

Conversion

The Depositary will arrange for the conversion of all foreign currency received into U.S. dollars if such conversion is practicable,

and it will distribute the U.S. dollars in accordance with the terms of the deposit agreement. You may have to pay fees and expenses incurred in converting foreign currency, such as fees and expenses incurred in complying with currency exchange

controls and other governmental requirements.

15

If the conversion of foreign currency is not practicable or lawful, or if any required approvals are denied or

not obtainable at a reasonable cost or within a reasonable period, the Depositary may take the following actions in its discretion:

|

|

•

|

|

Convert the foreign currency to the extent practicable and lawful and distribute the U.S. dollars to the holders for whom the conversion and distribution is lawful and practicable.

|

|

|

•

|

|

Distribute the foreign currency to holders for whom the distribution is lawful and practicable.

|

|

|

•

|

|

Hold the foreign currency (without liability for interest) for the applicable holders.

|

16

PLAN OF DISTRIBUTION

We are registering ADSs issuable upon the exchange of the 2017 Notes and each representing one of our ordinary shares to permit the resale of such ADSs by

such holder from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale or other distribution of ADSs by the selling shareholders pursuant to this prospectus. We will bear all fees and expenses incident

to our obligation to register or cause the issuance of the ADSs.

The selling shareholders may offer, sell, transfer or otherwise dispose of all or a

portion of the ADSs covered by this prospectus from time to time on any stock exchange on which the ADSs, or underlying ordinary shares, are listed, in the over-the-counter market, in privately negotiated transactions or otherwise, at fixed prices

that may be changed, at market prices prevailing at the time of sale, at prices related to prevailing market prices or at prices otherwise negotiated. The selling shareholders will act independently of us in making decisions with respect to the

timing, manner and size of each sale, and we cannot assure you that the selling shareholders will sell all or any portion of its securities offered hereby.

The selling shareholders may offer and sell the ADSs covered by this prospectus by one or more of the following methods:

|

|

•

|

|

block trades in which a broker or dealer will be engaged to attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

|

purchases by a broker or dealer as principal and resale by the broker or dealer for its own account;

|

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker solicits purchases;

|

|

|

•

|

|

“at the market” transactions to or through market makers or into an existing market for our ADSs;

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

•

|

|

options, swaps or other derivative transactions that may or may not be listed on an exchange;

|

|

|

•

|

|

one or more underwritten offerings on a firm commitment or best efforts basis;

|

|

|

•

|

|

distributions to their respective partners, members, managers, directors, employees, consultants or affiliates; or

|

|

|

•

|

|

any combination of the above.

|

The selling shareholders may engage brokers and dealers, and any brokers or

dealers may arrange for other brokers or dealers to participate in effecting sales of the ADSs. These brokers, dealers or underwriters may act as principals, or as agents of the selling shareholder. Broker-dealers may agree with the selling

shareholders to sell a specified number of ADSs at a stipulated price per share. If a broker-dealer is unable to sell shares acting as agent for the selling shareholder, it may purchase as principal any unsold shares at the stipulated price.

Broker-dealers that acquire ADSs as principals may thereafter resell the shares from time to time in transactions on any stock exchange on which the shares are then listed, at prices and on terms then prevailing at the time of sale, at prices

related to the then-current market price or in negotiated transactions. Broker-dealers may use block transactions and sales to and through broker-dealers, including transactions of the nature described above.

The selling shareholders may, from time to time, pledge or grant a security interest in some or all of the ADSs owned by them and, if the selling shareholders

defaults in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares, from time to time, under this prospectus, or under an amendment to this prospectus under an applicable provision of the

Securities Act amending the list of selling shareholders to include the pledgee, transferee or other successors in interest as selling shareholders under this prospectus. The selling shareholders also may transfer the ADSs in other circumstances, in

which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The selling

shareholders and any brokers, dealers or agents that participate in the distribution of ADSs may be deemed to be “underwriters” within the meaning of the Securities Act, and any discounts, concessions, commissions or fees received by them

and any profit on the resale of shares sold by them may be deemed to be underwriting

17

discounts and commissions. At the time a particular offering of shares is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of ADSs being

offered and the terms of the offering, including the name or names of any brokers, dealers or agents, any discounts, commissions and other terms constituting compensation from the selling shareholders and any discounts, commissions or concessions

allowed or reallowed or paid to broker-dealers. The selling shareholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the

Securities Act.

The selling shareholders may enter into hedging transactions with broker-dealers, and the broker-dealers may engage in short sales of

ADSs in the course of hedging the positions they assume with the selling shareholder, including, without limitation, in connection with distributions of shares by those broker-dealers. The selling shareholders may enter into option or other

transactions with broker-dealers that involve the delivery of ADSs registered hereby to the broker-dealers, who may then resell or otherwise transfer those securities. The selling shareholders and other persons participating in the sale or

distribution of ADSs will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, and we have advised the selling shareholders that Regulation M may apply. This regulation

may limit the timing of purchases and sales of any ADSs by the selling shareholders or any other person. The anti-manipulation rules under the Exchange Act may apply to sales of ADSs in the market and to the activities of the selling shareholders

and its affiliates. Furthermore, Regulation M may restrict the ability of any person engaged in the distribution of ADSs to engage in market-making activities with respect to the particular shares being distributed for a period of up to five

business days before the distribution. These restrictions may affect the marketability of the ADSs and the ability of any person or entity to engage in market-making activities with respect to the shares.

The selling shareholders may also sell ADSs in accordance with Rule 144 under the Securities Act rather than pursuant to this prospectus, regardless of

whether the shares are covered by this prospectus.

We will make copies of this prospectus available to the selling shareholders and any of their

successors in interest for purposes of satisfying the prospectus delivery requirements of the Securities Act, if applicable.

In order to comply with the

securities laws of certain states, if applicable, the ADSs offered by this prospectus must be sold in such jurisdictions only through registered or licensed brokers or dealers. In addition, in certain states, ADSs may not be sold unless they have

been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

The ADSs representing our ordinary shares are listed on the NASDAQ Capital Market under the symbol “AMRN.”

To the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution.

18

CERTAIN MATERIAL U.K. TAX CONSIDERATIONS

The following discussion is limited to an overview of the tax consequences of ownership and disposition of ordinary shares, or such shares represented by

ADSs. Tax considerations applicable to other types of securities will be described in the related prospectus supplement. Each shareholder should however seek individual tax advice as specific rules may apply in certain circumstances.

Capital Gains

If you are not resident in the United

Kingdom (“

UK

”) for UK tax purposes, you will not be liable for UK tax on capital gains realized or accrued on the sale or other disposition of shares or ADSs unless the shares or ADSs are held in connection with your trade

carried on in the UK through a branch or agency and the shares or ADSs are or have been used, held or acquired for the purposes of such trade or such branch or agency.

An individual holder of shares or ADSs who ceases to be resident in the UK for UK tax purposes for a period of 5 years or less and who disposes of shares or

ADSs during that period may also be liable on returning to the UK for UK capital gains tax despite the fact that the individual may not be resident in the UK at the time of the disposal.

Inheritance Tax

If you are an individual domiciled in

the United States and are not a national of the UK for the purposes of the Estate and Gift Tax Convention 1980 between the United States and the UK, any shares or ADS beneficially owned by you will not generally be subject to UK inheritance tax on

your death or on a gift made by you during your lifetime, provided that any applicable United States federal gift or estate tax liability is paid, except where the share or ADS is part of the business property of your UK permanent establishment.

Where the shares or ADSs have been placed in trust by a settlor who, at the time of the settlement, was domiciled in the United States and not a national

of the UK, the shares or ADSs will not generally be subject to UK inheritance tax.

Stamp Duty and Stamp Duty Reserve Tax

Transfer of ADSs

No UK stamp duty will be payable

on an instrument transferring an ADS or on a written agreement to transfer an ADS provided that the instrument of transfer or the agreement to transfer is executed and remains at all times outside the UK and there is nothing else to be done in the

UK. Where these conditions are not met, the transfer of, or agreement to transfer, an ADS could, depending on the circumstances, attract a charge to ad valorem stamp duty at the rate of 0.5% of the value of the consideration.

No stamp duty reserve tax will be payable in respect of an agreement to transfer an ADS, whether made in or outside the UK.

Issue and Transfer of Shares

The issue of shares

by Amarin will not give rise to a charge to UK stamp duty or stamp duty reserve tax under current UK and European Union law; it is not currently known whether this position will continue for UK stamp duty reserve tax in relation to the issue of

shares in return for an issue of ADSs after the United Kingdom leaves the European Union. We would be responsible for any UK stamp duty reserve tax payable on the issue of shares in return for the issue of ADSs.

Transfers of shares, as opposed to ADSs, will attract ad valorem stamp duty at the rate of 0.5% of the amount or value of the consideration. A charge to stamp