ICU Medical's 2017 Guidance Misses Expectations

March 01 2017 - 5:08PM

Dow Jones News

By Maria Armental

Medical-products company ICU Medical Inc., which had warned 2017

would be a "bumpy" year as it brings into the fold what had been

its largest customer, on Wednesday gave financial projections that

largely missed Wall Street targets.

Last month, the San Clemente, Calif. company bought Pfizer's

global infusion therapy business, Hospira Infusion Systems, in a

cash-and-stock deal that turned Pfizer into ICU Medical's largest

shareholder.

On Wednesday, ICU Medical said it expects to make $3.55 to $3.90

a share in 2017 adjusted profit on $1.2 billion to $1.25 billion in

revenue, compared with analysts' projected $3.97 a share on $1.31

billion in revenue.

In 2016, the company made $4.88 a share in adjusted profit on

$379.4 million in sales.

The revenue surge is largely due to the Hospira acquisition.

The infusion therapy business, ICU Medical's main cash driver,

reported a 6.1% revenue increase in the most recent period.

Over all, fourth-quarter profit surged to $9.5 million, or 54

cents a share. Excluding stock-based compensation, restructuring

costs and other items, profit rose to $1.20 a share from 96 cents a

year earlier.

Meanwhile, revenue rose 6% to $95.7 million.

Analysts surveyed by Thomson Reuters had expected $1.19 on $94.4

million in revenue.

Shares closed Wednesday at $152.30, up nearly two-thirds over

the past 12 months.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

March 01, 2017 16:53 ET (21:53 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

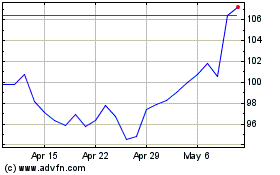

ICU Medical (NASDAQ:ICUI)

Historical Stock Chart

From Mar 2024 to Apr 2024

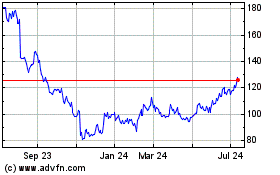

ICU Medical (NASDAQ:ICUI)

Historical Stock Chart

From Apr 2023 to Apr 2024