Tender Offer Statement by Issuer (sc To-i)

March 01 2017 - 4:34PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________

SCHEDULE

TO

(RULE 14d-100)

TENDER OFFER STATEMENT UNDER SECTION

14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

_______________________

YY INC.

(Name of Subject Company (Issuer))

YY INC.

(Name of Filing Person (Issuer))

_______________________

2.25% Convertible Senior Notes due 2019

(Title of Class of Securities)

98426TAB2

(CUSIP Number of Class of Securities)

_______________________

Eric

He

Chief Financial Officer

YY Inc.

Building B-1, North Block of Wanda Plaza

No. 79 Wanbo Er Road

Nancun Town, Panyu District, Guangzhou

511442

People’s Republic of China

+86 (20) 8212-0088

with copy to:

Z. Julie Gao, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

c/o 42/F, Edinburgh Tower, The Landmark

15 Queen’s Road, Central

Hong Kong

+852 3740-4700

|

Haiping Li, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

JingAn Kerry Centre, Tower II, 46th Floor

1539 Nanjing West Road

Shanghai 200040, China

+86 21 6193-8200

|

(Name, address and telephone number of person

authorized to receive notices and communications on behalf of the

filing person)

_______________________

CALCULATION OF FILING FEE

|

Transaction Valuation

|

|

Amount of Filing Fee

|

|

US$400,000,000

(1)

|

|

US$46,360.00

(2)

|

|

|

(1)

|

Calculated solely for purposes of determining the filing fee. The purchase price of the 2.25% Convertible Senior Notes due

2019 (the “

Notes

”), as described herein, is US$1,000 per US$1,000 principal amount outstanding. As of February

28, 2017, there was US$400,000,000 aggregate principal amount of Notes outstanding, resulting in an aggregate maximum purchase

price of US$400,000,000 (excluding accrued but unpaid interest).

|

|

|

(2)

|

The amount of the filing fee was calculated in accordance with Rule 0-11 of the Securities Exchange Act of 1934, as amended,

and equals US$115.90 for each US$1,000,000 of the value of the transaction.

|

|

|

¨

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the

filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the

Form or Schedule and the date of its filing.

|

|

Amount Previously Paid: Not applicable

|

Filing Party: Not applicable

|

|

Form or Registration No.: Not applicable

|

Date Filed: Not applicable

|

|

|

¨

|

Check the box if the filing

relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes to designate any transactions to

which the statement relates:

|

|

¨

|

third-party tender offer

subject to Rule 14d-1.

|

|

|

x

|

issuer tender offer subject

to Rule 13e-4.

|

|

|

¨

|

going-private transaction

subject to Rule 13e-3.

|

|

|

¨

|

amendment to Schedule 13D

under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting the results of the tender offer:

¨

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s)

relied upon:

|

|

¨

|

Rule 13e-4(i) (Cross-Border

Issuer Tender Offer)

|

|

|

¨

|

Rule 14d-1(d) (Cross-Border

Third-Party Tender Offer)

|

INTRODUCTORY

STATEMENT

Pursuant to the terms of and subject to

the conditions set forth in the Indenture dated as of March 24, 2014 (the “

Indenture

”), by and between YY Inc.

(the “

Company

”) and Deutsche Bank Trust Company Americas, as trustee and paying agent, for the Company’s

2.25% Convertible Senior Notes due 2019 (the “

Notes

”), this Tender Offer Statement on Schedule TO (“

Schedule

TO

”) is filed by the Company with respect to the right of each holder (the “Holder”) of the Notes to require

the Company to repurchase the Notes, as set forth in the Company’s Notice to the Holders dated March 1, 2017 (the “

Repurchase

Right Notice

”) and the related notice materials filed as exhibits to this Schedule TO (which Repurchase Right Notice

and related notice materials, as amended or supplemented from time to time, collectively constitute the “

Repurchase Right

”).

This Schedule TO is intended to satisfy

the disclosure requirements of Rule 13e-4(c)(2) under the Securities Exchange Act of 1934, as amended.

ITEMS 1 through 9.

The Company is the issuer of the Notes and

is obligated to repurchase all of the Notes if properly surrendered by the Holders under the terms and subject to the conditions

set forth in the Repurchase Right. The Notes are convertible into the Company’s American depositary shares (“

ADSs

”),

each representing 20 Class A common shares, par value US$0.00001 per share of the Company, subject to the terms, conditions and

adjustments specified in the Indenture and the Notes. The Company maintains its principal executive offices at Building B-1, North

Block of Wanda Plaza, No. 79 Wanbo Er Road, Nancun Town, Panyu District, Guangzhou 511442, People’s Republic of China, and

the telephone number at this address is +86 (20) 8212-0000. The Company’s registered office in the Cayman Islands is located

at the offices of Codan Trust Company (Cayman) Limited of Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman,

KYI-1111, Cayman Islands.

As permitted by General Instruction F to

Schedule TO, all of the information set forth in the Repurchase Right is incorporated by reference into this Schedule TO.

ITEM 10. FINANCIAL STATEMENTS.

(a) Pursuant

to Instruction 2 to Item 10 of Schedule TO, the Company’s financial condition is not material to a Holder’s decision

whether to put the Notes to the Company because (i) the consideration being paid to Holders surrendering Notes consists solely

of cash, (ii) the Repurchase Right is not subject to any financing conditions, (iii) the Repurchase Right applies to all outstanding

Notes, and (iv) the Company is a public reporting company that files reports electronically on EDGAR. The financial condition and

results of operations of the Company and its subsidiaries are reported electronically on EDGAR on a consolidated basis.

(b) Not

applicable.

ITEM 11. ADDITIONAL INFORMATION.

(a) Not

applicable.

(c) Not applicable.

ITEM 12. EXHIBITS.

|

|

(a)(1)

|

Repurchase Right Notice to Holders of 2.25% Convertible Senior Notes due 2019 Issued by YY Inc., dated March 1, 2017.

|

|

|

(a)(5)

|

Press release issued by the Company, dated March 1, 2017.

|

|

|

(d)

|

Indenture, dated as of March 24, 2014, between the Company and Deutsche Bank Trust Company Americas, as trustee, incorporated

by reference to Exhibit 4.25 from the Company’s Annual Report on Form 20-F (File No. 001-35729) filed with the Securities

and Exchange Commission on April 21, 2015.

|

ITEM 13. INFORMATION REQUIRED BY SCHEDULE

13E-3.

Not applicable.

SIGNATURE

After due inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

YY INC.

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Eric He

|

|

|

|

Name:

|

Eric He

|

|

|

|

Title:

|

Chief Financial Officer

|

|

Dated: March 1, 2017

EXHIBIT

INDEX

|

Exhibit No.

|

|

Description

|

|

(a)(1)

|

|

Repurchase Right Notice to Holders of 2.25% Convertible Senior Notes due 2019 Issued by YY Inc., dated March 1, 2017.

|

|

(a)(5)

|

|

Press release issued by the Company, dated March 1, 2017.

|

|

(d)

|

|

Indenture, dated as of March 24, 2014, between the Company and Deutsche Bank Trust Company Americas, as trustee, incorporated by reference to Exhibit 4.25 from the Company’s Annual Report on Form 20-F (File No. 001-35729) filed with the Securities and Exchange Commission on April 21, 2015.

|

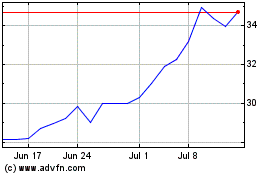

JOYY (NASDAQ:YY)

Historical Stock Chart

From Mar 2024 to Apr 2024

JOYY (NASDAQ:YY)

Historical Stock Chart

From Apr 2023 to Apr 2024