UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Consent Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Consent Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to § 240.14a-12

|

VCA Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Consent Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11.

|

|

|

|

|

|

|

|

1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

1)

|

|

Amount Previously Paid:

|

|

|

|

2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

4)

|

|

Date Filed:

|

The following is a transcript of a video message from Robert L. Antin, the Chief Executive Officer of VCA Inc., a

Delaware corporation (the “Company”), that will be made available to employees of the Company on or after March 1, 2017:

Hi, I’m Bob

Antin. I’m one of the three founders of VCA, along with my brother Art and Neil Tauber.

I sent a letter out on January 9th marking an

incredible opportunity for us to merge our company with the Mars family, and I promised in the letter that I would provide periodic updates on what is taking place. So, using a few props, I wanted to tell you that so far, everything has gone

according to what we hoped. We’re in the process right now of putting information together for our shareholders, which it has to go to a shareholder vote, and then we’ll go through some other processes.

I wanted to answer some of the questions I received from you, and I really appreciate it, on the website where we offered to take questions. So far, for me,

I’m ecstatic. I think the Mars folks have been absolutely incredible. I still have ultimate confidence that VCA, which they love, they love the brand, they love the hospitals, ANTECH, Sound, and Camp Bow Wow is going to stay a separate and

discrete company. I think they appreciate it, and I have confidence they are going to do it. I have every intention of staying, I see that as a great opportunity for me personally, and I continue to see VCA go into the future.

Some of the questions that you’ve asked – our relationship with Banfield. I believe Banfield is a great company, but VCA is going to operate

separately from them. We’re still going to support our own culture, and I have 100% confidence in that.

So far, the other questions I got, which are

kind of funny, are candy. Are we going to get discounts in Mars candy? I sure hope so, and if the Mars people are listening, I want them to know that everybody in our company supports Mars in every way, and we’re hoping that we get candy from

the Mars folks.

In terms of questions that you get from clients, VCA is going to be a stronger company because Mars is one of the largest family-owned

businesses in the world, and they have lots of capital that they are deploying on a long-term benefit. You know and I know between Royal Canin, Whiskas, Iams and the money they’ve invested in nutrition, they would like for us to try to learn

something through their nutrition and our diagnostics so that we can further our ambitions in pet care.

So far in the questions, in terms of are we going

to continue to practice medicine? The answer is yes. Mars has absolutely promised me, and I’ve seen it in their other companies, our doctors are even going to make their own choice of which diets to use. Currently, in our hospitals, we have

Hills and we have Royal Canin, and those are decisions that doctors make, and they will continue to be the ones that doctors make.

So, I wanted to give

you an update. I’m incredibly appreciative of the Mars folks. They’ve been spectacular. For all of us who have engaged in them, I’m excited. If you have any other questions, I would encourage you to write to

vca.vcamarsquestions@vca.com, so that’s vca.vcamarsquestions@vca.com. I didn’t make that URL up, that’s the one I was given. So if you do have questions, please feel free, and again I say it with a smile on my face and a smile on my

heart: I think it’s a great thing for VCA in the long term, because it’s a family that has a tremendous commitment to the profession.

So this

is my update, it’s not very long, but I really want to thank you for being part of VCA. You’ve made us an amazing company. I love your brand that you’ve created, and I think we’re all proud of VCA. Thank you.

Forward Looking Statements

This document contains forward-looking statements within the meaning of the securities laws with respect to the proposed transaction between the Company, Mars,

Incorporated (“Mars”) and certain subsidiaries of Mars. We have included herein statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We generally identify

forward-looking statements in this document using words like “believe,” “intend,” “expect,” “estimate,” “may,” “plan,” “should,” “could,” “forecast,”

“looking ahead,” “possible,” “will,” “project,” “contemplate,” “anticipate,” “predict,” “potential,” “continue,” or similar expressions. You may find some of

these statements below and elsewhere in this document. These forward-looking statements are not historical facts and are inherently uncertain and outside of our control. Any or all of our forward-looking statements in this document may turn out to

be incorrect. They can be affected by inaccurate assumptions we might make, or by known or unknown risks and uncertainties. Many factors mentioned in our discussion in this document will be important in determining future results. Consequently, no

forward-looking statement can be guaranteed. Actual future results may vary materially. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to:

(i) the risk that the proposed transaction may not be completed in a timely manner or at all, which may adversely affect the Company’s business and the price of the common stock of the Company; (ii) the failure to satisfy or obtain

waivers of the conditions to the consummation of the proposed transaction, including the adoption of the merger agreement by the stockholders of the Company and the receipt of certain governmental and regulatory approvals; (iii) the occurrence

of any event, change or other circumstances that could give rise to the termination of the merger agreement; (iv) the effect of the announcement or pendency of the proposed transaction on the Company’s business relationships, operating

results and business generally; (v) risks that the proposed transaction disrupts current plans and operations of the Company, including the risk of adverse reactions or changes to business relationships with customers, suppliers and other

business partners of the Company; (vi) potential difficulties in the hiring or retention of employees of the Company as a result of the proposed transaction; (vii) risks related to diverting management’s attention from the

Company’s ongoing business operations; (viii) potential litigation relating to the merger agreement or the proposed transaction; (ix) unexpected costs, charges or expenses resulting from the proposed transaction; (x) competitive

responses to the proposed transaction; and (xi) legislative, regulatory and economic developments. The foregoing list of factors is not exclusive. Additional risks and uncertainties that could affect the Company’s financial and operating

results are included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in the Company’s most recent Annual Report on Form 10-K

for the year ended December 31, 2016, filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2017, and the Company’s more recent reports filed with the SEC. The Company can give no assurance that the

conditions to the proposed transaction will be satisfied, or that it will close within the anticipated time period. Investors and security holders are cautioned not to place undue reliance on these forward-looking statements, which speak only as of

the date on which statements were made. Except as required by applicable law, the Company undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new

information, future events or otherwise.

Additional Information and Where to Find It

This document is being made in respect of the proposed transaction between the Company, Mars and certain subsidiaries of Mars. In connection with the proposed

transaction, on February 15, 2017, the Company filed with the SEC and mailed (or otherwise provided) to each stockholder entitled to vote at the special meeting relating to the proposed transaction a definitive proxy statement on Schedule 14A

and a form of proxy. INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO CAREFULLY READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) IN THEIR ENTIRETY AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE PROPOSED

TRANSACTION THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE PROPOSED TRANSACTION. The definitive proxy statement, the preliminary proxy statement and any

other materials or documents filed by the Company with the SEC, may be obtained free of charge at the SEC’s website (http://www.sec.gov) or through the investor relations section of the Company’s website (http://investor.vca.com).

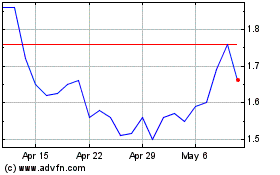

Petco Health and Wellness (NASDAQ:WOOF)

Historical Stock Chart

From Mar 2024 to Apr 2024

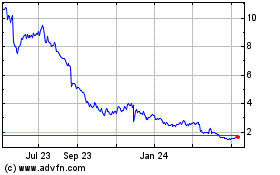

Petco Health and Wellness (NASDAQ:WOOF)

Historical Stock Chart

From Apr 2023 to Apr 2024