Filed Pursuant to Rule 424(b)(3) and Rule 424(c)

Registration No. 333-215856

PROSPECTUS SUPPLEMENT NO. 1

(to Prospectus dated

February 27, 2017)

10,000,000 Shares

Common Stock

This Prospectus Supplement No. 1 supplements the

prospectus dated February 27, 2017 or the prospectus that forms a part of our Registration Statement on Form S-1 (Registration Statement No. 333-215856). This prospectus supplement is being filed to update, amend and supplement the

information included or incorporated by reference in the prospectus with the information contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission on February 28, 2017 (the “Current Report”).

Accordingly, we have attached the Current Report to this prospectus supplement.

The prospectus and this prospectus supplement relate to the disposition

from time to time by the selling stockholders identified in the prospectus, or their permitted transferees or other successors-in-interest, of an aggregate of 10,000,000 shares of our common stock. We are not selling any common stock under the

prospectus and this prospectus supplement, and will not receive any of the proceeds from the sale of shares by the selling stockholders.

This prospectus

supplement should be read in conjunction with the prospectus, which is to be delivered with this prospectus supplement. This prospectus supplement updates, amends and supplements the information included or incorporated by reference in the

prospectus. If there is any inconsistency between the information in the prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our common stock is traded on the NASDAQ Capital Market under the symbol “CAPN.” The last reported sale price of our common stock on The NASDAQ

Capital Market on February 28, 2017 was $0.65 per share.

Investing in our common stock involves a high degree of risk. You should review

carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 8 of the prospectus, and under similar headings in any amendments or supplements to the prospectus, and “Part II —

Item 1A — Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2016.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement

is March 1, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 28, 2017

CAPNIA, INC.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-36593

|

|

77-0523891

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File No.)

|

|

(IRS Employer

Identification Number)

|

1235 Radio Road, Suite 110

Redwood City, CA 94065

(Address of principal executive offices)

(650) 213-8444

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☒

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01. Other Events.

Capnia, Inc. (“Capnia”) is making the following supplemental disclosures to the definitive proxy statement on Schedule 14A (the “Definitive

Proxy Statement”), filed by Capnia with the United States Securities and Exchange Commission (the “SEC”) on February 10, 2017. The following supplemental disclosures should be read in conjunction with the Definitive Proxy

Statement, which should be read in its entirety. To the extent that information herein differs from or updates information contained in the Definitive Proxy Statement, the information contained herein supersedes the information contained in the

Definitive Proxy Statement. Defined terms used but not defined herein have the meanings set forth in the Definitive Proxy Statement.

As previously

announced, on December 22, 2016, Capnia, Essentialis, Inc., Company E Merger Sub, Inc., a wholly-owned subsidiary of Capnia (“Merger Sub”), and Neil Cowen, in his capacity as stockholders’ representative, entered into

an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which, if the transactions contemplated by the Merger Agreement are consummated, Merger Sub will merge with and into Essentialis, with Essentialis surviving the

Merger as a wholly owned subsidiary of Capnia (the “Merger”).

On February 16, 2017, a purported stockholder class action lawsuit captioned

Garfield v. Capnia, Inc., et al.

, Case No. C17-00284 was filed in Superior Court of the State of California, County of Contra Costa against Capnia and certain of its officers and directors (the “Lawsuit”). The

Lawsuit alleges, generally, that Capnia’s directors breached their fiduciary duties to Capnia stockholders by seeking to sell control of Capnia through an allegedly defective process, and on unfair terms. The Lawsuit also alleges

that defendants have failed to disclose all material facts concerning the proposed Merger to stockholders. The Lawsuit seeks, among other things, equitable relief that would enjoin the consummation of the proposed Merger, compensatory and/or

rescissory damages, and attorneys’ fees and costs. Capnia denies the allegations of the Lawsuit, believes that the Definitive Proxy Statement disclosed all material information, and denies that any supplemental disclosure is necessary.

As previously disclosed in the Definitive Proxy Statement, a special meeting is being held on March 6, 2017, at 8:30 a.m., Pacific Time, at Capnia’s

principal executive offices located at 1235 Radio Road, Suite 110, Redwood City, California 94065, for the purpose of considering and voting upon, among other matters, the Merger Agreement. The Capnia Board unanimously determined that the Merger

Agreement, the Merger and the transactions contemplated by the Merger Agreement, including the Merger, are advisable, fair to and in the best interests of Capnia and its stockholders and recommends that the stockholders of Capnia vote

“FOR” the proposal to approve the Merger Agreement and the Merger.

Although Capnia denies that any supplemental disclosures are necessary, in

connection with the pending dismissal of plaintiff’s claims in the Lawsuit, Capnia is making the following supplemental disclosures below.

SUPPLEMENT TO DEFINITIVE PROXY STATEMENT

The Summary Term Sheet section of the Definitive Proxy Statement is hereby amended by

:

adding a new second sentence under the heading “Interests of the Directors and of the Executive Officers of Capnia” on page 4 as follows:

“It is anticipated that following the conversion of certain bridge loans as of immediately before the closing of the merger, Vivo affiliated funds will

own 13,488,974 shares of preferred stock and warrants exercisable for shares of Essentialis, which will represent on an as-converted basis approximately 28.75% of Essentialis’ fully-diluted capitalization.”

adding a new fifth sentence under the heading “Interests of the Directors and of the Executive Officers of Capnia” on page 4 as follows:

“Additionally, Vivo is purchasing 1,398,636 shares of Capnia common stock in the Concurrent Financing at $0.96 per share. As of the date immediately

preceding this supplement, Capnia’s common stock trading closed at $0.73. To the extent that Capnia’s stock price is below $0.96 as of the date of the Concurrent Financing, Vivo will be purchasing the stock at an above-market price. To the

extent that our stock price is above $0.96 as of the date of the Concurrent Financing, Vivo will receive an immediate monetary benefit from purchasing the stock at a discount to market price.”

The Risk Factors section of the Definitive Proxy Statement is hereby amended by

:

adding a new fourth sentence under the heading “We have and will continue to incur substantial transaction-related costs in connection with

the transactions” on page 21 as follows:

“As of February 28, 2017, we have incurred transaction-related costs of approximately

$325,000 consisting of legal fees, external audit fees, external accounting fees, and financial printing fees. We expect to incur additional transaction-related costs of approximately $100,000 prior to closing.”

The Background of the Transactions section of the Definitive Proxy Statement is hereby amended by

:

Replacing the third substantive paragraph under the heading “Background of the Transactions” on page 37 in its entirety with the following:

“In connection with management’s regular review of Capnia’s business strategy, members of Capnia management periodically have

discussions concerning the exploration of potential opportunities with strategic partners. In connection with this ongoing exploration of potential opportunities, in October 2015, Anish Bhatnagar, Capnia’s Chief Executive Officer was introduced

to Neil Cowen, Essentialis’s President and Chief Scientific Officer, by Mahendra Shah, an affiliate of Vivo Ventures Fund V. Capnia’s management was aware at that time that Vivo was a significant stockholder of Essentialis and may have

interests that are different from, or in addition to, Capnia’s stockholders. Messrs. Cowen and Bhatnagar had preliminary discussions regarding a potential partnership or strategic transaction between Essentialis and Capnia in the latter half of

October 2015. On October 23, 2015, in furtherance of these preliminary discussions, Capnia and Essentialis entered into a standard non-disclosure agreement.”

Replacing the second to last full paragraph on page 38 in its entirety as follows:

“On September 15, 2016, Capnia’s board of directors held a regularly scheduled meeting at its corporate offices in Redwood Shores, California.

Regular business was first reviewed and discussed. Dr. Bhatnagar presented an overview of additional strategic opportunities that Capnia was reviewing. Potential strategic opportunities discussed included potential partnerships or other forms

of business combination with companies focused in the therapeutic space. A discussion followed, including with regard to a draft term sheet for the proposed transaction that had been provided to the board members in advance of the meeting.

Dr. Engleman then left the meeting, leaving the special committee (as previously authorized by the board of directors) to review the proposed transaction with Essentialis. Dr. Bhatnagar presented a detailed overview of the proposed

transaction. A detailed discussion followed. Mr. O’Toole presented a financial analysis of the proposed transaction, including a discussion of the opportunities for revenue that the acquisition of DCCR could present, the market

opportunities for the combined company, and the structure of the proposed transaction. A detailed discussion followed. The special committee discussed the proposed transaction, including pros, cons, risks, and related matters. The pros, cons, risks

and related matters discussed by the special committee are summarized below under the heading ‘Capnia’s Reasons for the Merger; Recommendation of the Special Committee.’ As part of their deliberations, the special committee considered

the potential benefits to Vivo as a result of its ownership in Essentialis and Capnia (and therefore in the combined company). It was determined to proceed with the negotiations of the proposed transaction, on the basis presented to and discussed by

the special committee at the meeting.”

Adding a new second and third sentence to the fifth paragraph on page 39 as follows:

“In particular, Capnia’s management considered whether the proposed board representatives from Essentialis could be considered independent due to

Essentialis’ ownership in the combined company. This topic was also subsequently discussed by the Nominating and Corporate Governance Committee at its next meeting.”

Adding a new fourth sentence to the last paragraph on page 40 as follows:

“The assumptions underlying Mr. Bhatnagar’s and Mr. O’Toole’s analysis included an analysis of the sources and likelihood of

securing the $8 million required to complete the Concurrent Financing, the proposed budget to complete the Phase II/III trial for DCCR, Capnia’s limited cash position and the limited ability for meaningful revenue growth for CoSense.”

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CAPNIA, INC.

|

|

Date: February 28, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ David D. O’Toole

|

|

|

|

|

|

David D. O’Toole

|

|

|

|

|

|

Chief Financial Officer

|

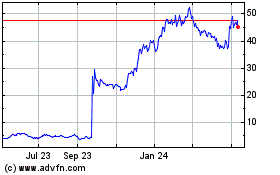

Soleno Therapeutics (NASDAQ:SLNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

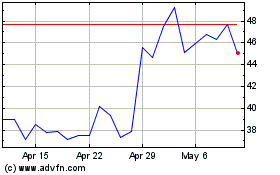

Soleno Therapeutics (NASDAQ:SLNO)

Historical Stock Chart

From Apr 2023 to Apr 2024