Salesforce's Outlook Rises -- WSJ

March 01 2017 - 3:05AM

Dow Jones News

Revenue forecasts and metrics rise at the technology firm, but

quarterly loss widens

By Rachael King and Jay Greene

Salesforce.com Inc. posted a 29% jump in deferred revenue for

its fiscal fourth quarter, a sign the business-software company

continues to rack up customers moving computing operations to the

cloud.

Because Salesforce relies on subscriptions of its web-based,

on-demand software, deferred revenue provides a strong picture of

the company's prospects.

The measure, which consists primarily of billings received in

advance for subscription services, rose to $5.54 billion. Nomura

Securities Co. analyst Frederick Grieb had forecast

deferred-revenue growth of 22%.

In an interview, Salesforce operating chief Keith Block said the

company continues to take away market share from the competition.

"That's outstanding execution," he said.

Despite the strong quarter, Salesforce shares fell 1.9% in

after-hours trading. Analysts said the results were tempered by the

company's guidance for deferred-revenue growth of 22% to 23% for

the current quarter, which they translated into lower growth in

billings.

Salesforce attributed that to seasonality, saying its fourth

quarter is generally its strongest. "Fundamentally, our demand

environment is very strong and as a result we raised our guidance

for the whole year," finance chief Mark Hawkins said on the

company's earnings call.

Revenue from Sales Cloud, the company's flagship sales-force

automation business, rose 14% to $804.9 million. That was the

highest growth since the quarter ended April 2016.

Salesforce benefited from marketing its products to specific

industries such as financial services and retail, Mr. Block

said.

Other businesses continued to grow, but at a slower rate.

Service Cloud, which helps companies run customer-service

operations, grew 24%, down from 40% in the quarter that ended in

July 2015.

Salesforce's acquisition of Demandware Inc. last July drove

revenue growth of 62% in the company's Marketing Cloud, used for

email and advertising campaigns.

For the quarter ended Jan. 31, Salesforce's loss widened to

$51.4 million, or 7 cents a share, from $25.5 million, or 4 cents a

share, in the comparable period a year ago.

Excluding the impact of items such as amortization and

stock-based compensation, adjusted per-share earnings rose to 28

cents from 19 cents a year earlier.

Analysts surveyed by Thomson Reuters had forecast adjusted

earnings of 25 cents a share.

Revenue rose 27% to $2.29 billion for the quarter, compared with

analysts forecasts of $2.28 billion.Annual revenue rose 26% to

$8.39 billion. Salesforce said it expects fiscal 2018 revenue of

between $10.15 billion and $10.20 billion, reaching a longstanding

goal of $10 billion in full-year revenue.

For the fiscal first quarter, Salesforce expects revenue of

between $2.34 billion and $2.35 billion and a loss of 2 cents to 3

cents a share, with adjusted per-share profit of 25 cents to 26

cents a share.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

March 01, 2017 02:50 ET (07:50 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

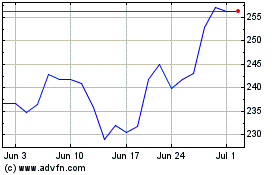

Salesforce (NYSE:CRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

From Apr 2023 to Apr 2024