As filed with the Securities and Exchange Commission on February 28, 2017.

Registration

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Exxon Mobil Corporation

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

New Jersey

|

|

13-5409005

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification Number)

|

5959 Las Colinas Boulevard

Irving, Texas, 75039-2298

(972)

444-1000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Robert N. Schleckser

Vice

President and Treasurer

Exxon Mobil Corporation

5959 Las Colinas Boulevard

Irving, Texas 75039-2298

(972)

444-1000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copy to:

Michael Kaplan

Byron B. Rooney

Davis

Polk & Wardwell LLP

450 Lexington Avenue

New York, New York 10017

(212)

450-4000

Approximate

date of commencement of proposed sale to the public

: From time to time after the effective date of this registration statement.

If the

only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post- effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post- effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box. ☒

If this Form is a post- effective amendment to a registration statement filed pursuant to General Instruction I.D.

filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-

accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule

12b-2

of the

Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☒

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered(1)

|

|

Proposed

Maximum

Offering

Price

Per Share(2)

|

|

Proposed

Maximum

Aggregate

Offering Price(2)

|

|

Amount of

Registration Fee

|

|

Common Stock, without par value(3)

|

|

68,191,228

|

|

$81.285

|

|

$5,542,923,967.98

|

|

$642,424.89

|

|

|

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act, this Registration Statement also covers such additional number of our shares as may be issuable from time to time as a result of stock splits, stock dividends,

capitalizations or similar events.

|

|

(2)

|

Estimated solely for the purposes of calculating the registration fee. Pursuant to Rule 457(c) under the Securities Act, the registration fee has been calculated based upon the average of the high and low prices, as

reported by the New York Stock Exchange, for our shares on February 22, 2017.

|

|

(3)

|

All the shares being registered hereby are offered for the account of certain selling stockholders who acquired such shares in a private transaction.

|

PROSPECTUS

Exxon Mobil Corporation

68,191,228 Shares of Common Stock

This prospectus

relates to the proposed resale or other disposition of up to 68,191,228 shares of Exxon Mobil Corporation common stock, without par value, by the selling stockholders named in this prospectus. We are not offering any shares of common stock under

this prospectus and will not receive any proceeds from the sale of shares offered by the selling stockholders. The selling stockholders acquired the shares pursuant to a Purchase and Sale Agreement entered into with an affiliate of Exxon Mobil

Corporation dated January 16, 2017. We are registering the offer and sale of the shares to satisfy registration rights we have granted to the selling stockholders.

The selling stockholders may offer and sell or otherwise dispose of the shares of common stock described in this prospectus from time to time

through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The selling stockholders will bear all underwriting fees, commissions and discounts, if any,

attributable to the sales of shares and any transfer taxes. We will bear all other costs, expenses and fees in connection with the registration of the shares. See “Plan of Distribution” for more information about how the selling

stockholders may sell or dispose of their shares of common stock.

Our common stock is traded on the New York Stock Exchange under the

symbol “XOM”. On February 15, 2017, the last reported sale price for our common stock on the New York Stock Exchange was $83.16 per share.

We urge you to

carefully read this prospectus and the accompanying prospectus supplement, together with the documents we incorporate by reference, before you make your investment decision.

Investing in our common stock involves certain risks. See “Risk Factors” in our most recent annual report on Form

10-K,

which is incorporated by reference herein, as well as in any other recently filed quarterly or current reports and, if any, in the relevant prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of

this prospectus is February 28, 2017

Neither we nor the selling stockholders have authorized anyone to provide any information other

than that contained or incorporated by reference in this prospectus or in any related prospectus supplement. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The

shares are not being offered in any jurisdiction where the offer is not permitted. You should not assume that the information contained in or incorporated by reference in this prospectus is accurate as of any date other than the respective dates of

such document. Our business, financial condition, results of operations and prospects may have changed since those dates.

The terms

“ExxonMobil,” “the Company,” “we,” “us” and “our” refer to Exxon Mobil Corporation and its subsidiaries, unless otherwise stated or the context otherwise requires.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission utilizing a

“shelf” registration process. Under this shelf process, certain selling stockholders may from time to time sell the shares of common stock described in this prospectus in one or more offerings.

This prospectus may be supplemented from time to time by one or more prospectus supplements. The prospectus supplement may add, update or

change information contained in this prospectus. You should carefully read both this prospectus and any applicable prospectus supplement together with additional information described under the heading “Where You Can Find More Information”

before deciding to invest in any shares being offered.

We have filed or incorporated by reference exhibits to the registration statement

of which this prospectus forms a part. You should read the exhibits carefully for provisions that may be important to you.

EXXON MOBIL CORPORATION

ExxonMobil was incorporated in the State of New Jersey in 1882. Our divisions and affiliated companies

operate or market products in the United States and most other countries of the world. Our principal business is energy, involving exploration for, and production of, crude oil and natural gas, manufacture of petroleum products and transportation

and sale of crude oil, natural gas and petroleum products. We are a major manufacturer and marketer of commodity petrochemicals, including olefins, aromatics, polyethylene and polypropylene plastics and a wide variety of specialty products. Our

affiliates conduct extensive research programs in support of these businesses.

Our principal offices are located at 5959 Las Colinas

Boulevard, Irving, Texas, 75039-2298, and our telephone number is (972)

444-1000.

We maintain a website at exxonmobil.com where general information about us is available. We are not incorporating the contents

of the website into this prospectus.

1

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of shares of our common stock in this offering. The selling stockholders will receive

all of the proceeds from this offering.

2

PRICE RANGE OF COMMON STOCK

Our common stock is listed on the NYSE under the symbol “XOM”. The following table sets forth the high and low closing sales prices

of our common stock as reported by the NYSE for the fiscal quarters indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

High

|

|

|

Low

|

|

|

|

|

(Dollars per share)

|

|

|

Fiscal Year 2015

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

93.45

|

|

|

|

82.68

|

|

|

Second Quarter

|

|

|

90.09

|

|

|

|

82.80

|

|

|

Third Quarter

|

|

|

83.53

|

|

|

|

66.55

|

|

|

Fourth Quarter

|

|

|

87.44

|

|

|

|

73.03

|

|

|

|

|

|

|

Fiscal Year 2016

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

85.10

|

|

|

|

71.55

|

|

|

Second Quarter

|

|

|

93.83

|

|

|

|

81.99

|

|

|

Third Quarter

|

|

|

95.55

|

|

|

|

82.29

|

|

|

Fourth Quarter

|

|

|

93.22

|

|

|

|

82.76

|

|

|

|

|

|

|

Fiscal Year 2017

|

|

|

|

|

|

|

|

|

|

First Quarter (through February 15, 2017)

|

|

|

91.34

|

|

|

|

81.17

|

|

On February 15, 2017, the last reported sale price for our common stock on the NYSE was $83.16 per share.

As of February 15, 2017, we had 402,006 registered holders of record of our common stock.

3

DIVIDEND POLICY

Dividends paid to common stockholders totaled $12.5 billion ($2.98 per common share) in fiscal year 2016 and $12.1 billion ($2.88

per common share) in fiscal year 2015.

The payment of future dividends is subject to the discretion of our Board of Directors.

4

DESCRIPTION OF COMMON STOCK

This section describes the general terms of our common stock. The following description is a summary only and is qualified by reference to

the relevant provisions of New Jersey law and our restated certificate of incorporation and

by-laws,

copies of which are incorporated by reference in this prospectus.

We are authorized to issue up to 9,000,000,000 shares of common stock, without par value. As of February 15, 2017, there were

4,144,579,740 shares of our common stock issued and outstanding. The outstanding shares of our common stock are duly authorized, validly issued, fully paid and nonassessable.

Each holder of our common stock is entitled to one vote for each share of our common stock held of record on the applicable record date on all

matters submitted to a vote of shareholders.

Holders of our common stock are entitled to receive such dividends as may be declared from

time to time by our board of directors out of funds legally available therefor, subject to any preferential dividend rights granted to the holders of any of our outstanding preferred stock.

Holders of our common stock are entitled to share pro rata, upon any liquidation, dissolution or winding up of ExxonMobil, in all remaining

assets available for distribution to shareholders after payment of or provision for our liabilities and the liquidation preference of any of our outstanding preferred stock.

Holders of our common stock have no preemptive rights to purchase, subscribe for or otherwise acquire any unissued or treasury shares or other

securities.

Transfer Agent and Registrar

Computershare Trust Company, N.A. is the transfer agent and registrar for our common stock.

Stock Exchange Listing

Our common stock

is traded on the New York Stock Exchange under the symbol “XOM”.

5

SELLING STOCKHOLDERS

We have prepared this prospectus to allow the selling stockholders to offer and sell from time to time up to 68,191,228 shares of our common

stock for their own account. On January 16, 2017, an affiliate of Exxon Mobil Corporation entered into a Purchase and Sale Agreement with the selling stockholders, pursuant to which we sold in a private placement transaction an aggregate

of 68,191,228 shares of our common stock. We are registering the offer and sale of the shares of common stock to satisfy certain registration obligations that we agreed to in connection with the Purchase and Sale Agreement. Pursuant to a

registration rights agreement we entered into in connection with such transaction, we have agreed to use our commercially reasonable efforts to keep the registration statement, of which this prospectus forms a part, effective until the shares

offered by this prospectus (i) have been disposed of by the selling stockholders in accordance with this prospectus, (ii) have been disposed of by the selling stockholders under circumstances in which all of the applicable conditions of

Rule 144 (or any similar provisions then in force) under the Securities Act are met, (iii) have been transferred or assigned in a private transaction the result of which we have delivered a new certificate or other evidence of ownership for

such shares not bearing a legend and such shares may be resold without subsequent registration under the Securities Act or (iv) may be sold pursuant to Rule 144 without the requirement that such sales be in compliance with

manner-of-sale

restrictions or volume limitations. As used in this prospectus, the term “selling stockholders” includes the selling stockholders listed in the table

below and their donees, pledgees, assignees, transferees, distributees and

successors-in-interest

that receive shares in any

non-sale

transfer after the date of this prospectus.

The following table sets forth the name of

each selling stockholder, the number of shares owned by each of the respective selling stockholders, the number of shares that may be offered under this prospectus and the number of shares of our common stock owned by the selling stockholders

assuming all of the shares covered hereby are sold. The selling stockholders may sell some, all or none of their shares. We do not know how long the selling stockholders will hold the shares before selling them, and we currently have no agreements,

arrangements or understandings with the selling stockholders regarding the sale or other disposition of any of the shares. The shares covered hereby may be offered from time to time by the selling stockholders. Other than with respect to the

Purchase and Sale Agreement pursuant to which the selling stockholders acquired their respective shares of common stock, no selling stockholder, nor any person controlling a selling stockholder, has had any position, office or other material

relationship with us or any of our predecessors or affiliates within the last three years.

The information set forth below is based upon

information obtained from the selling stockholders and upon information in our possession regarding the issuance of shares of common stock to the selling stockholders in connection with the private placement transaction. Beneficial ownership of

the selling stockholders is determined in accordance with Rule

13d-3(d)

of the Exchange Act. The percentage of shares beneficially owned prior to and after the offering is based on 4,144,579,740 shares of our

common stock outstanding as of February 15, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beneficial Ownership Prior to this Offering

|

|

|

|

|

|

Beneficial Ownership After Offering(1)

|

|

|

Name of Selling Stockholder

|

|

Number of Shares

|

|

|

% of Outstanding

Common Stock

|

|

|

Number of Shares

Being Offered

|

|

|

Number of Shares

|

|

|

% of Outstanding

Common Stock

|

|

|

RBBMI Holdings, L.P.(2)

|

|

|

5,619,970

|

|

|

|

0.1

|

%

|

|

|

5,619,970

|

|

|

|

—

|

|

|

|

—

|

|

|

FW Avalon Holdings, L.P.(3)

|

|

|

11,603,529

|

|

|

|

0.3

|

%

|

|

|

11,603,529

|

|

|

|

—

|

|

|

|

—

|

|

|

CBSM, L.P.(4)

|

|

|

7,236,283

|

|

|

|

0.2

|

%

|

|

|

7,236,283

|

|

|

|

—

|

|

|

|

—

|

|

|

GCBSM, L.P.(5)

|

|

|

20,143,313

|

|

|

|

0.5

|

%

|

|

|

20,143,313

|

|

|

|

—

|

|

|

|

—

|

|

|

NBLSM, L.P.(6)

|

|

|

11,578,718

|

|

|

|

0.3

|

%

|

|

|

11,578,718

|

|

|

|

—

|

|

|

|

—

|

|

|

OBSM, L.P.(7)

|

|

|

11,948,530

|

|

|

|

0.3

|

%

|

|

|

11,948,530

|

|

|

|

—

|

|

|

|

—

|

|

|

SBCA Holdings, L.P.(8)

|

|

|

60,885

|

|

|

|

0.0

|

%

|

|

|

60,885

|

|

|

|

—

|

|

|

|

—

|

|

6

|

(1)

|

Assumes that all shares being registered in this prospectus are resold to third parties and that with respect to a particular selling stockholder, such selling stockholder sells all shares of common stock registered

under this prospectus held by such selling stockholder.

|

|

(2)

|

RBH Genpar, LLC is the general partner of RBBMI Holdings, L.P. BEPCO, L.P. is the sole member of RBH Genpar, LLC. BEPCO Genpar, L.L.C. is the general partner of BEPCO, L.P. Sid R. Bass is the sole member of the

executive committee of the board of directors of BEPCO Genpar, L.L.C. Sid R. Bass is deemed to have beneficial ownership and voting and investment power over the common stock held by RBBMI Holdings, L.P. The address of RBBMI Holdings, L.P. is 201

Main Street, Suite 2700, Fort Worth, TX 76102.

|

|

(3)

|

FW Avalon Holdings Genpar, LLC is the general partner of FW Avalon Holdings, L.P. Robert M. Bass is the sole manager of FW Avalon Holdings Genpar, LLC. Robert M. Bass is deemed to have beneficial ownership and voting

and investment power over the common stock held by FW Avalon Holdings, L.P. The address of FW Avalon Holdings, L.P. is 201 Main Street, Suite 2700, Fort Worth, TX 76102.

|

|

(4)

|

CBSM Genpar, LLC is the general partner of CBSM, L.P. Sid R. Bass is the sole manager of CBSM Genpar, LLC. Sid R. Bass is deemed to have beneficial ownership and voting and investment power over the common stock held by

CBSM, L.P. The address of CBSM, L.P. is 201 Main Street, Suite 2700, Fort Worth, TX 76102.

|

|

(5)

|

GCBSM Genpar, LLC is the general partner of GCBSM, L.P. Sid R. Bass is the sole manager of GCBSM Genpar, LLC. Sid R. Bass is deemed to have beneficial ownership and voting and investment power over the common stock held

by GCBSM, L.P. The address of GCBSM, L.P. is 201 Main Street, Suite 2700, Fort Worth, TX 76102.

|

|

(6)

|

NBLSM Genpar, LLC is the general partner of NBLSM, L.P. Edward P. Bass is the sole manager of NBLSM Genpar, LLC. Edward P. Bass is deemed to have beneficial ownership and voting and investment power over the common

stock held by NBLSM, L.P. The address of NBLSM, L.P. is 201 Main Street, Suite 2700, Fort Worth, TX 76102.

|

|

(7)

|

OBSM Genpar, LLC is the general partner of OBSM, L.P. Lee M. Bass is the sole manager of OBSM Genpar, LLC. Lee M. Bass is deemed to have beneficial ownership and voting and investment power over the common stock held by

OBSM, L.P. The address of OBSM, L.P. is 201 Main Street, Suite 2700, Fort Worth, TX 76102.

|

|

(8)

|

SBCAH Genpar, LLC is the general partner of SBCA Holdings, L.P. GCSM, LLC is the sole member of SBCAH Genpar, LLC. SRBI BP O&G, L.L.C. is the manager of GCSM, LLC. Sid R. Bass is the sole member of the board of

directors of SRBI BP O&G, L.L.C. Sid R. Bass is deemed to have beneficial ownership and voting and investment power over the common stock held by SBCA Holdings, L.P. The address of SBCA Holdings, L.P. is 201 Main Street, Suite 2600, Fort Worth,

TX 76102.

|

7

PLAN OF DISTRIBUTION

We have prepared this prospectus to allow the selling stockholders to offer and sell from time to time after the date of this prospectus up to

68,191,228 shares of our common stock for their own account. We are not offering any shares of common stock under this prospectus and will not receive any proceeds from the sale of shares offered by the selling stockholders.

The selling stockholders may sell the shares directly to purchasers or to or through broker-dealers or agents in one or more transactions at

any time at fixed prices, at market prices prevailing at the time of sale, at varying prices determined at the time of sale, or at negotiated prices. Such sales may be effected in transactions on any national securities exchange or quotation service

on which the shares may be listed or quoted at the time of sale, in the

over-the-counter

market or in transactions other than on such exchanges or services or in the

over-the-counter

market. The selling stockholders may use any one or more of the following methods when selling shares:

|

|

•

|

|

a block trade in which the broker-dealer so engaged will attempt to sell the shares of common stock as agent, but may position or resell a portion of the block, as principal, in order to facilitate the transaction;

|

|

|

•

|

|

purchases by a broker-dealer, as principal, and resale by such broker-dealer for its account;

|

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker solicits purchasers; or

|

|

|

•

|

|

in privately negotiated transactions.

|

The selling stockholders may enter into hedging

transactions from time to time in which a selling stockholder may:

|

|

•

|

|

enter into transactions with a broker-dealer or any other person in connection with which such broker-dealer or other person will engage in short sales of the shares, in which case such broker-dealer or other person may

use the shares received from the selling stockholders to close out its short positions;

|

|

|

•

|

|

sell shares of common stock short and

re-deliver

shares offered by this prospectus to close out its short positions;

|

|

|

•

|

|

enter into options or other types of transactions that require the selling stockholder to deliver the shares to a broker-dealer, affiliate or third party, who will then resell or transfer the shares under this

prospectus; or

|

|

|

•

|

|

loan or pledge the shares to a broker-dealer or any other person, who may sell the loaned shares or, in an event of default in the case of a pledge, sell the pledged shares under this prospectus.

|

The selling stockholders may also sell shares under Rule 144 of the Securities Act, if available, rather than under this prospectus.

The selling stockholders and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting

commissions or discounts under the Securities Act. Any selling stockholder who is an “underwriter” within the meaning of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act and the provisions of

the Exchange Act and the rules thereunder relating to stock manipulation. In order to comply with certain states’ securities laws, if applicable, the shares sold in those jurisdictions may only be sold through registered or licensed brokers or

dealers.

The selling stockholders have informed us that none of them has any agreement or understanding, directly or indirectly, with any

person to distribute the shares offered by this prospectus. If any selling stockholder

8

notifies us that a material arrangement has been entered into with a broker-dealer for the sale of shares through a block trade, special offering or secondary distribution or a purchase by a

broker or dealer, we may be required to file a supplement to this prospectus pursuant to the applicable rules promulgated under the Securities Act.

There can be no assurance that any selling stockholder will sell any or all of the shares of common stock covered by this prospectus.

We are required to pay all fees and expenses incident to the registration of the shares. The selling stockholders will bear the fees,

discounts, concessions and commissions incurred by the selling stockholders in connection with resales of the shares. We have agreed to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities

under the Securities Act and the Exchange Act, or the selling stockholders may be entitled to contribution. The selling stockholders have agreed to indemnify us against certain losses, claims, damages, and liabilities, including liabilities under

the Securities Act that may arise from written information furnished to us by the selling stockholders specifically for use in this prospectus.

In certain circumstances, we may restrict or suspend offers and sales or other dispositions of the shares under the registration statement of

which this prospectus forms a part after the date of this prospectus. In the event of such restriction or suspension, the selling stockholders will not be able to offer or sell or otherwise dispose of the shares of common stock under the

registration statement of which this prospectus forms a part.

The selling stockholders and any other person participating in the sale of

the common stock will be subject to the rules of the Exchange Act. The Exchange Act rules include, without limitation, Regulation M, which may limit the timing of purchases and sales of the common stock by the selling stockholders and any other such

person. In addition, Regulation M may restrict the ability of any person engaged in the distribution of the common stock to engage in market-making activities with respect to the particular common stock being distributed. This may affect the

marketability of the common stock and the ability of any person or entity to engage in market-making activities with respect to the common stock.

Once sold under the registration statement of which this prospectus forms a part, the shares of common stock will be freely tradable in the

hands of persons other than our affiliates.

9

WHERE YOU CAN FIND MORE INFORMATION

ExxonMobil files annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission

under the Exchange Act. You may read and copy this information at the following location of the Securities and Exchange Commission:

Public

Reference Room

100 F Street, N.E.

Washington, D.C. 20549

You may

also obtain copies of this information by mail from the Public Reference Section of the Securities and Exchange Commission, 100 F Street, N.E., Room 1580, Washington, D.C. 20549, at prescribed rates. You may obtain information on the operation of

the Securities and Exchange Commission’s Public Reference Room by calling the Securities and Exchange Commission at

1-800-SEC-0330.

The Securities and Exchange Commission also maintains an Internet worldwide web site that contains reports, proxy

statements and other information about issuers like ExxonMobil who file electronically with the Securities and Exchange Commission. The address of the site is

http://www.sec.gov

.

The Securities and Exchange Commission allows ExxonMobil to “incorporate by reference” information into this document. This means

that ExxonMobil can disclose important information to you by referring you to another document filed separately with the Securities and Exchange Commission. The information incorporated by reference is considered to be a part of this document,

except for any information superseded by information that is included directly in this document or incorporated by reference subsequent to the date of this document.

This prospectus incorporates by reference the documents listed below and any future filings that ExxonMobil makes with the Securities and

Exchange Commission under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than information in the documents or filings that is deemed to have been furnished and not filed), prior to the termination of the offering of shares of common

stock under this prospectus.

|

|

|

|

|

Exxon Mobil Corporation Securities and Exchange

Commission

Filings

|

|

Period or date filed

|

|

Annual Report on Form

10-K

|

|

Fiscal year ended December 31, 2016

|

|

|

|

|

Current Reports on Form

8-K

|

|

January 3, 2017, January 17, 2017 and January 26, 2017

|

|

|

|

|

The description of the Registrant’s capital stock contained in the Registrant’s Registration Statement on Form

S-4

(File

No. 333-75659),

and any document filed which updated that description.

|

|

April 5, 1999

|

Documents incorporated by reference are available from the Securities and Exchange Commission as described

above or from ExxonMobil without charge, excluding any exhibits to those documents unless the exhibit is specifically incorporated by reference as an exhibit in this document. You can obtain documents incorporated by reference in this document by

requesting them in writing or by telephone at the following address:

ExxonMobil Shareholder Services

c/o Computershare Trust Company, N.A.

P.O. Box 43078

Providence, Rhode

Island 02940-3078

Telephone: (800)

252-1800

(within the U.S. and Canada)

Telephone: (781)

575-2058

(outside the U.S. and Canada)

10

INFORMATION CONCERNING FORWARD-LOOKING STATEMENTS

Statements relating to future plans, projections, events or conditions are forward-looking statements. Future results, including project

plans, costs, timing, and capacities; capital and exploration expenditures; asset carrying values; resource recoveries; and share purchase levels, could differ materially due to factors including: changes in oil, gas, or petrochemical prices or

other market or economic conditions affecting the oil, gas, or petrochemical industries, including the scope and duration of economic recessions; the outcome of exploration and development efforts; changes in law or government regulation, including

tax and environmental requirements; the impact of fiscal and commercial terms and outcome of commercial negotiations; changes in technical or operating conditions; actions of competitors; and other factors discussed under the heading “Factors

Affecting Future Results” in the “Investors” section of ExxonMobil’s website and in Item 1A of ExxonMobil’s Annual Report on Form

10-K

for the fiscal year ended December 31, 2016.

The forward-looking statements are and will be based on management’s then current views and assumptions regarding future events and

speak only as of their dates. ExxonMobil undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by the securities laws.

VALIDITY OF THE SECURITIES

The validity of the shares of common stock in respect of which this prospectus is being delivered will be passed on for us by James E.

Parsons, Esq., ExxonMobil’s Coordinator – Corporate Securities and Finance Law.

EXPERTS

The consolidated financial statements of ExxonMobil and ExxonMobil management’s assessment of the effectiveness of internal control over

financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting) incorporated in this prospectus by reference to ExxonMobil’s Annual Report on Form

10-K

for

the year ended December 31, 2016, have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

11

Part II

Information not required in prospectus

|

Item 14.

|

Other expenses of issuance and distribution

|

The following table sets forth the costs

and expenses to be borne by the Registrant in connection with the offerings described in this Registration Statement.

|

|

|

|

|

|

|

Registration fee

|

|

$

|

642,424.89

|

|

|

Accounting fees and expenses

|

|

$

|

50,000

|

|

|

Legal fees and expenses

|

|

$

|

50,000

|

|

|

Miscellaneous

|

|

$

|

5,000

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

747,424.89

|

|

|

Item 15.

|

Indemnification of directors and officers

|

The Registrant’s restated certificate of

incorporation does not contain any provision relating to the indemnification of its directors or officers. Article X of the Registrant’s

by-laws

provides that the Registrant shall indemnify to the full

extent permitted by law any current or former director or officer made or threatened to be made a party to any legal action by reason of the fact that such person is or was a director, officer, employee or other corporate agent of the Registrant or

any of its subsidiaries or serves or served any other enterprise at the request of the Registrant against expenses (including attorneys’ fees), judgments, fines, penalties, excise taxes and amounts paid in settlement, actually and reasonably

incurred by such person in connection with such legal action. No indemnification is required under the Registrant’s

by-laws

with respect to any settlement or other nonadjudicated disposition of any legal

action unless the Registrant has previously consented to such settlement or other disposition.

The Registrant is organized under the laws

of the State of New Jersey.

Section 14A:3-5(2)

of the New Jersey Business Corporation Act provides that a New Jersey corporation has the power to indemnify a corporate agent (generally defined as any

person who is or was a director, officer, employee or agent of the corporation or of any constituent corporation absorbed by the corporation in a consolidation or merger and any person who is or was a director, officer, trustee, employee or agent of

any other enterprise, serving as such at the request of the corporation or the legal representative of any such director, officer, trustee, employee or agent) against his or her expenses and liabilities in connection with any proceeding involving

such corporate agent by reason of his or her being or having been a corporate agent, other than derivative proceedings, if (i) he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best

interests of the corporation and (ii), with respect to any criminal proceeding, such person had no reasonable cause to believe his or her conduct was unlawful. Under

Section 14A:3-5(3)

of the New Jersey

Business Corporation Act, a New Jersey corporation may indemnify a corporate agent against his or her expenses in connection with any derivative proceedings. A standard of care similar to Section

14A:3-5(2)

of

the New Jersey Business Corporation Act is applicable, except no indemnification may be provided in respect of any claim, issue or matter as to which the corporate agent is adjudged to be liable to the corporation, unless (and only to the extent

that) the Superior Court of the State of New Jersey (or the court in which the proceeding was brought) determines upon application that the corporate agent is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

Section 14A:3-5(4)

of the New Jersey Business Corporation Act requires a New Jersey

corporation to indemnify a corporate agent for his or her expenses to the extent that such corporate agent has been successful on the merits or otherwise in any proceeding referred to above, or in defense of any claim, issue or matter therein.

Except as required by the previous sentence, under

Section 14A:3-5(11)

of the New Jersey Business Corporation Act, no indemnification may be made or expenses advanced, and none may be ordered by a court,

if such indemnification or advancement would be inconsistent with (i) a provision of the corporation’s certificate of incorporation, (ii) its

by-laws,

(iii) a resolution of the board of

directors or of the corporation’s shareholders,

II-1

(iv) an agreement to which the corporation is a party or (v) other proper corporate action (in effect at the time of the accrual of the alleged cause of action asserted in the

proceeding) that prohibits, limits or otherwise conditions the exercise of indemnification powers by the corporation or the rights of indemnification to which a corporate agent may be entitled.

Under

Section 14A:3-5(6)

of the New Jersey Business Corporation Act, expenses incurred by a

director, officer, employee or other agent in connection with a proceeding may, except as described in the immediately preceding paragraph, be paid by the corporation before the final disposition of the proceeding as authorized by the board of

directors upon receiving an undertaking by or on behalf of the corporate agent to repay such amount if it shall ultimately be determined that he or she is not entitled to be indemnified. Article X of the Registrant’s

by-laws

provides that the Registrant shall pay the expenses (including attorneys’ fees) incurred by a current or former officer or director of the Registrant in defending any legal action in advance of its

final disposition promptly upon receipt of such an undertaking.

Under

Section 14A:3-5(8)

of

the New Jersey Business Corporation Act, the power to indemnify and advance expenses under the New Jersey Business Corporation Act does not exclude other rights, including the right to be indemnified against liabilities and expenses incurred in

derivative proceedings, to which a corporate agent may be entitled to under a certificate of incorporation, bylaw, agreement, vote of shareholders or otherwise. However, no indemnification may be made to or on behalf of such person if a judgment or

other final adjudication adverse to such person establishes that his or her acts or omissions were in breach of his or her duty of loyalty to the corporation or its shareholders, were not in good faith or involved a knowing violation of the law, or

resulted in the receipt by such person of an improper personal benefit.

Section 14A:3-5(9)

of the New Jersey Business Corporation Act further provides that a New Jersey corporation has the power to purchase and maintain insurance on behalf of any corporate agent against any expenses incurred in any proceeding and any liabilities asserted

against him or her by reason of his or her being or having been a corporate agent, whether or not the corporation would have the power to indemnify him or her against such expenses and liabilities under the New Jersey Business Corporation Act. The

Registrant maintains directors’ and officers’ liability insurance on behalf of its directors and officers.

The following is a list of all exhibits filed as a part of this registration

statement on Form

S-3,

including those incorporated herein by reference.

|

|

|

|

|

Exhibit

No.

|

|

Document

|

|

|

|

|

3.1

|

|

Restated Certificate of Incorporation, as restated November 30, 1999, and as further amended effective June 20, 2001 (incorporated by reference to Exhibit 3(i) to Exxon Mobil Corporation’s Annual Report on Form

10-K

for the fiscal year ended December 31, 2015)

|

|

|

|

|

3.2

|

|

By-Laws,

as revised to November 1, 2016 (incorporated by reference to Exhibit 3(ii) to Exxon Mobil Corporation’s Current Report on Form

8-K

filed on November 1, 2016)

|

|

|

|

|

4.1

|

|

Registration Rights Agreement by and among Exxon Mobil Corporation and the holders signatory thereto, dated February 28, 2017

|

|

|

|

|

4.2

|

|

Specimen certificate representing the Registrant’s Common Stock

|

|

|

|

|

5.1

|

|

Opinion of James E. Parsons, Esq., Coordinator – Corporate Securities and Finance Law of Exxon Mobil Corporation

|

|

|

|

|

23.1

|

|

Consent of PricewaterhouseCoopers LLP, Independent Registered Public Accounting Firm

|

II-2

|

|

|

|

|

Exhibit

No.

|

|

Document

|

|

|

|

|

23.2

|

|

Consent of James E. Parsons, Esq. (included in Exhibit 5.1)

|

|

|

|

|

24.1

|

|

Powers of Attorney (included on the signature page of the registration statement)

|

|

(a)

|

The undersigned Registrant hereby undertakes:

|

|

|

(1)

|

To file, during any period in which offers or sales are being made of securities registered hereby, a post-effective amendment to this registration statement:

|

|

|

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a

fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was

registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in

volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

provided

,

however

, that paragraphs (i), (ii) and (iii) above do not apply if the information required to

be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Securities and Exchange Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities

Exchange Act of 1934 that are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

|

|

(2)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered herein, and

the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

(4)

|

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

|

|

|

(A)

|

Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration

statement; and

|

|

|

(B)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration

statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and

included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule

430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the

|

II-3

|

|

securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; provided,

however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of

the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement

or made in any such document immediately prior to such effective date.

|

|

|

(b)

|

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section

15(d) of the Securities Exchange Act of 1934, as amended (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the

registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

|

|

|

(c)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise,

the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director,

officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

|

II-4

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form

S-3

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Irving,

Texas, on February 28, 2017.

|

|

|

|

|

Exxon Mobil Corporation

|

|

|

|

|

By:

|

|

/s/ Darren W. Woods

|

|

Name:

|

|

Darren W. Woods

|

|

Title:

|

|

Chairman of the Board

|

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints

Richard C. Vint, Stephen A. Littleton and Jeffrey S. Lynn, and each of them, his or her true and lawful

attorneys-in-fact

and agents, with full power to act separately

and full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement and to file the

same, with all exhibits thereto, and all other documents in connection therewith, with the Securities and Exchange Commission, granting unto each said

attorney-in-fact

and agent and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming

all that said

attorneys-in-fact

and agents or either of them or his or her or their substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed below by the following

persons in the capacities and on the date set forth above.

|

|

|

|

|

Signature

|

|

Title

|

|

|

|

|

/s/ Darren W. Woods

|

|

Chairman of the Board

(Principal Executive Officer)

|

|

Darren W. Woods

|

|

|

|

|

|

/s/ Susan K. Avery

|

|

Director

|

|

Susan K. Avery

|

|

|

|

|

|

/s/ Michael J. Boskin

|

|

Director

|

|

Michael J. Boskin

|

|

|

|

|

|

/s/ Peter Brabeck-Letmathe

|

|

Director

|

|

Peter Brabeck-Letmathe

|

|

|

|

|

|

/s/ Angela F. Braly

|

|

Director

|

|

Angela F. Braly

|

|

|

|

|

|

/s/ Ursula M. Burns

|

|

Director

|

|

Ursula M. Burns

|

|

|

|

|

|

/s/ Larry R. Faulkner

|

|

Director

|

|

Larry R. Faulkner

|

|

II-5

|

|

|

|

|

Signature

|

|

Title

|

|

|

|

|

/s/ Henrietta H. Fore

|

|

Director

|

|

Henrietta H. Fore

|

|

|

|

|

|

/s/ Kenneth C. Frazier

|

|

Director

|

|

Kenneth C. Frazier

|

|

|

|

|

|

/s/ Douglas R. Oberhelman

|

|

Director

|

Douglas R. Oberhelman

|

|

|

|

|

|

/s/ Samuel J. Palmisano

|

|

Director

|

|

Samuel J. Palmisano

|

|

|

|

|

|

/s/ Steven S Reinemund

|

|

Director

|

|

Steven S Reinemund

|

|

|

|

|

|

/s/ William C. Weldon

|

|

Director

|

|

William C. Weldon

|

|

|

|

|

|

/s/ Andrew P. Swiger

|

|

Senior Vice President

(Principal Financial Officer)

|

|

Andrew P. Swiger

|

|

|

|

|

|

/s/ David S. Rosenthal

|

|

Vice President and Controller

(Principal Accounting Officer)

|

|

David S. Rosenthal

|

|

II-6

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Document

|

|

|

|

|

3.1

|

|

Restated Certificate of Incorporation, as restated November 30, 1999, and as further amended effective June 20, 2001 (incorporated by reference to Exhibit 3(i) to Exxon Mobil Corporation’s Annual Report on Form

10-K

for the fiscal year ended December 31, 2015)

|

|

|

|

|

3.2

|

|

By-Laws,

as revised to November 1, 2016 (incorporated by reference to Exhibit 3(ii) to Exxon Mobil Corporation’s Current Report on Form

8-K

filed on November 1, 2016)

|

|

|

|

|

4.1

|

|

Registration Rights Agreement by and among Exxon Mobil Corporation and the holders signatory thereto, dated February 28, 2017

|

|

|

|

|

4.2

|

|

Specimen certificate representing the Registrant’s Common Stock

|

|

|

|

|

5.1

|

|

Opinion of James E. Parsons, Esq., Coordinator – Corporate Securities and Finance Law of Exxon Mobil Corporation

|

|

|

|

|

23.1

|

|

Consent of PricewaterhouseCoopers LLP, Independent Registered Public Accounting Firm

|

|

|

|

|

23.2

|

|

Consent of James E. Parsons, Esq. (included in Exhibit 5.1)

|

|

|

|

|

24.1

|

|

Powers of Attorney (included on the signature page of the registration statement)

|

II-7

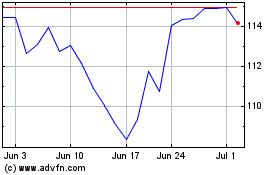

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

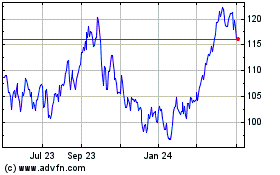

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024