Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

February 27 2017 - 5:28PM

Edgar (US Regulatory)

Free Writing Prospectus

Filed Pursuant to Rule 433

Relating to the Preliminary Prospectus Supplement

dated February 27, 2016

To the Prospectus dated February 23, 2017

Registration Statement No. 333- 216211

Moody’s Corporation

Pricing Term Sheet

February 27, 2017

|

|

|

|

|

Issuer:

|

|

Moody’s Corporation

|

|

Trade

Date:

|

|

February 27, 2017

|

|

Settlement Date:

|

|

T+3; March 2, 2017

|

|

Rating:*

|

|

BBB+ by Fitch Ratings

BBB+ by Standard & Poor’s Rating Services

|

2.75% Senior Notes due 2021

|

|

|

|

|

Principal Amount:

|

|

$500,000,000

|

|

Maturity

Date:

|

|

December 15, 2021

|

|

Coupon:

|

|

2.75%

|

|

Benchmark

Treasury:

|

|

1.875% due February 28, 2022

|

|

Benchmark

Treasury Price and Yield:

|

|

100-00

3

⁄

4

/ 1.870%

|

|

Spread to

Benchmark Treasury:

|

|

+ 95 basis points

|

|

Yield to

Maturity:

|

|

2.820%

|

|

Public

Offering Price:

|

|

99.691%

|

|

Interest

Payment Dates:

|

|

June 15 and December 15, commencing June 15, 2017

|

|

Make-whole Call:

|

|

Callable at any time at the greater of par and the make-whole redemption price (Treasury plus 15 basis points)

|

|

Par

Call:

|

|

Callable on or after the date that is one month prior to the Maturity Date, at a redemption price equal to 100% of the principal amount of

the notes being redeemed

|

|

Concurrent Debt Offering:

|

|

$300,000,000 principal amount of Floating Rate Senior Notes due September 4, 2018

|

|

CUSIP/ISIN:

|

|

615369 AG0 / US615369AG02

|

|

Joint Book-Running Managers:

|

|

Barclays Capital Inc.

J.P. Morgan Securities LLC

Merrill Lynch, Pierce, Fenner &

Smith

Incorporated

Citigroup Global Markets Inc.

|

|

Lead

Managers:

|

|

Lloyds Securities Inc.

MUFG Securities Americas Inc.

TD Securities (USA)

LLC

|

|

Co-Managers:

|

|

Citizens Capital Markets, Inc.

Fifth Third Securities, Inc.

PNC Capital Markets LLC

Scotia Capital (USA) Inc.

U.S. Bancorp Investments, Inc.

The Williams Capital Group, L.P.

Mischler Financial Group,

Inc.

|

Floating Rate Senior Notes due 2018

|

|

|

|

|

Principal Amount:

|

|

$300,000,000

|

|

Maturity:

|

|

September 4, 2018

|

|

Coupon:

|

|

Three-month LIBOR + 35 basis points

|

|

Spread to

LIBOR:

|

|

+ 35 basis points

|

|

Public

Offering Price:

|

|

100.000%

|

|

Interest

Payment Dates:

|

|

June 4, 2017, September 4, 2017, December 4, 2017, March 4, 2018, June 4, 2018 and on the maturity date

|

|

Interest

Reset Dates:

|

|

June 4, 2017, September 4, 2017, December 4, 2017, March 4, 2018 and June 4, 2018

|

|

Interest

Determination Dates:

|

|

Two London business days prior to the Interest Reset Dates

|

|

Day Count

Convention:

|

|

Actual/360

|

|

Make-whole Call:

|

|

The Floating Rate Notes due September 4, 2018 are not callable

|

|

Redemption:

|

|

The Floating Rate Notes due September 4, 2018 are not redeemable

|

|

CUSIP/ISIN:

|

|

615369 AH8 / US615369AH84

|

|

Joint

Book-Running Managers:

|

|

Barclays Capital Inc.

J.P. Morgan Securities LLC

Merrill Lynch, Pierce, Fenner &

Smith

Incorporated

Citigroup Global Markets Inc.

|

|

Lead

Managers:

|

|

Lloyds Securities Inc.

MUFG Securities Americas Inc.

TD Securities (USA)

LLC

|

|

Co-Managers:

|

|

Citizens Capital Markets, Inc.

Fifth Third Securities, Inc.

PNC Capital Markets LLC

Scotia Capital (USA) Inc.

U.S. Bancorp Investments, Inc.

The Williams Capital Group, L.P.

Mischler Financial Group,

Inc.

|

Description of Floating Rate Senior Notes

The Floating Rate Notes will mature on September 4, 2018. Interest on the Floating Rate Notes will accrue from March 2, 2017, or from the most recent

interest payment date to which interest has been paid or provided for. Moody’s Corporation will pay interest on the Floating Rate Notes quarterly in arrears on June 4, 2017, September 4, 2017, December 4,

2017, March 4, 2018, June 4, 2018, and on the maturity date, to the record holders at the close of business on the business day preceding the interest payment date.

The interest rate on the Floating Rate Notes will be calculated by Wells Fargo Bank, National Association, as a calculation agent. The Floating Rate Notes

will bear interest for each interest period at a rate calculated by the calculation agent (or its successor). The interest rate on the Floating Rate Notes for a particular interest period will be equal to three-month LIBOR (as defined below) as

determined on the interest determination date plus 0.35%. The interest determination date for an interest period will be the second London business day preceding the

2

first day of such interest period. Interest will be computed on the basis of a 360-day year and the actual number of days that have elapsed in the applicable interest period.

A London business day is a day on which dealings in deposits in U.S. dollars are transacted in the London interbank market.

“LIBOR” will be determined by the calculation agent in accordance with the following provisions:

|

|

(a)

|

On any interest determination date, LIBOR will be equal to the offered rate for deposits in U.S. dollars having an index maturity of three months, in amounts of at least $1,000,000, as such rate appears on the Reuters

screen “LIBOR01” at approximately 11:00 a.m., London time, on such interest determination date. If on an interest determination date, such rate does not appear on the Reuters screen “LIBOR01” as of 11:00 a.m., London time, or if

the Reuters screen “LIBOR01” is not available on such date, the calculation agent will obtain such rate from Bloomberg L.P.’s page “BBAM.”

|

|

|

(b)

|

With respect to an interest determination date on which no rate appears on Reuters screen “LIBOR01” or Bloomberg L.P.’s page “BBAM”, as specified in (a) above, the calculation agent will

request the principal London offices of each of four major reference banks in the London interbank market, as selected by Moody’s Corporation (after consultation with the calculation agent), to provide the calculation agent with its offered

quotation for deposits in U.S. dollars for the period of three months commencing on the applicable interest reset date to prime banks in the London interbank market at approximately 11:00 a.m., London time, on that interest determination date and in

a principal amount of not less than $1,000,000 for a single transaction in U.S. dollars in such market at such time. If at least two quotations are provided, then the three-month LIBOR on such interest determination date will be the arithmetic mean

of such quotations. If fewer than two such quotations are provided, then the three-month LIBOR on such interest determination date will be the arithmetic mean of the rates quoted at approximately 11:00 a.m., New York City time, on such interest

determination date by three major reference banks in New York City selected by Moody’s Corporation (after consultation with the calculation agent) for loans in U.S. dollars to leading European banks, having an index maturity of three months and

in a principal amount of not less than $1,000,000 for a single transaction in U.S. dollars in such market at such time; provided, however, that if the banks selected by Moody’s Corporation (after consultation with the calculation agent) are not

providing quotations in the manner described by this sentence, the three-month LIBOR determined as of such interest determination date will be the three-month LIBOR in effect prior to such interest determination date.

|

All percentages resulting from any calculation of any interest rate for the Floating Rate Notes will be rounded, if necessary, to the nearest one hundred

thousandth of a percentage point, with five one-millionths of a percentage point rounded upward (e.g., 3.876545% (or .03876545) would be rounded to 3.87655% (or .0387655)), and all U.S. dollar amounts used in or resulting from such calculations will

be rounded to the nearest cent, with one-half cent being rounded upward. Each calculation of the interest rate on the Floating Rate Notes by the calculation agent will (in the absence of manifest error) be final and binding on the holders of the

Floating Rate Notes and Moody’s Corporation.

Upon written request from any holder of Floating Rate Notes, the calculation agent will provide the

interest rate in effect on such Floating Rate Notes for the current interest period and, if it has been determined, the interest rate to be in effect for the next interest period.

3

The coupon on the Floating Rate Notes will in no event be higher than the maximum rate permitted by applicable

law. Additionally, the coupon on the Floating Rate Notes will in no event be lower than zero.

In addition to the risk factors set forth in the

preliminary prospectus supplement, the following risk factor relates to the Floating Rate Notes:

The amount of interest payable on the Floating

Rate Notes is set only once per period based on three-month LIBOR on the interest determination date, which rate may fluctuate substantially.

In the

past, the level of three-month LIBOR has experienced significant fluctuations. You should note that historical levels, fluctuations and trends of three-month LIBOR are not necessarily indicative of future levels. Any historical upward or downward

trend in three-month LIBOR is not an indication that three-month LIBOR is more or less likely to increase or decrease at any time during an interest rate period for the Floating Rate Notes, and you should not take the historical levels of

three-month LIBOR as an indication of its future performance. You should further note that although the actual three-month LIBOR on an interest payment date or at other times during an interest period may be higher than three-month LIBOR on the

applicable interest determination date, an investor in the Floating Rate Notes will not benefit from three-month LIBOR at any time other than on the interest determination date for such interest period. As a result, changes in three-month LIBOR may

not result in a comparable change in the market value of the Floating Rate Notes.

*******************************************

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on

the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Barclays Capital Inc. (1-888-603-5847)

,

J.P. Morgan

Securities LLC (1-212-834-4533) or Merrill Lynch, Pierce, Fenner & Smith Incorporated (1-800-294-1322).

4

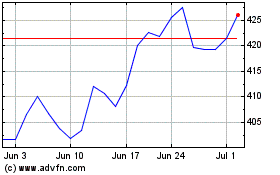

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024