UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 12b-25

SEC File Number

001-36353

CUSIP Number

G97822103

NOTIFICATION OF LATE FILING

(

Check One

): [ X ] Form 10-K [ ] Form 20-F [ ] Form 11-K [ ] Form 10-Q [ ] Form 10-D

[ ] Form N-SAR [ ] Form N-CSR

For Period Ended:

December 31, 2016

[ ] Transition Report on Form 10-K

[ ] Transition Report on Form 20-F

[ ] Transition Report on Form 11-K

[ ] Transition Report on Form 10-Q

[ ] Transition Report on Form N-SAR

For the Transition Period Ended: _____________________________________________________________

If the notification relates to a portion of the filing checked above, identify the item(s) to which the notification relates:

PART I - REGISTRANT INFORMATION

|

|

|

|

|

|

|

|

|

Perrigo Company plc

|

|

Full Name of Registrant

|

|

|

|

|

|

|

|

Former Name if Applicable

|

|

|

|

|

|

|

|

Treasury Building, Lower Grand Canal Street

|

|

Address of Principal Executive Office (

Street and Number

)

|

|

|

|

|

|

|

|

Dublin 2, Ireland

|

|

City, State and Zip Code

|

PART II - RULE 12b-25 (b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. [ ] (Check box if appropriate.)

(a) The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

|

[X]

|

(b) The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

(c) The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

PART III - NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

Perrigo Company plc (the “Company”) has determined that is unable to file its Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (the “Form 10-K”) by March 1, 2017, the original due date for such filing. On February 27, 2017, the Company signed a definitive agreement to divest its rights to the royalty from the global nets sales of the multiple sclerosis drug, Tysabri

®

. Announcement date or signing date? Given the timing of this development, the Company has not completed its calculation of the implied fair value of the Tysabri

®

asset. In connection with the review for the sale, the Company’s independent auditors also are evaluating the historical revenue recognition practices associated with Tysabri

®

. In addition, the Company is in the process of identifying certain deferred tax assets and other related effects at Omega Pharma Invest N.V. As a result of these matters, the Company cannot, without unreasonable effort or expense, file its Form 10-K by the due date of March 1, 2017.

PART IV - OTHER INFORMATION

(1) Name and telephone number of person to contact in regard to this notification

Ronald L. Winowiecki

(269)

673-8451

(Name) (Area Code) (Telephone Number)

|

|

|

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s).

|

Yes [X] No

|

|

|

|

(3)

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

|

Yes [X] No

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

Until the completion of the review and evaluation of the matters discussed above in Part III, the Company is unable to provide a reasonable estimate of its detailed results of operations for the fiscal year ended December 31, 2016. In the press release, furnished as an exhibit to the Company’s Current Report on Form 8-K filed on February 27, 2017, the Company disclosed expected unaudited calendar year 2016 preliminary net sales of $5.6 billion, unaudited calendar year 2016 preliminary loss per diluted share in a range of $(28.85) - $(29.00), unaudited preliminary calendar year 2016 operating loss of $(4.65) billion - $(4.68), and full year 2016 cash flow from operations of $1.01 billion.

Forward-Looking Statements

Certain statements in this filing are “forward-looking statements.” These statements relate to future events or the Company’s future financial performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results, levels of activity, performance or achievements of the Company or its industry to be materially different from those expressed or implied by any forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential” or the negative of those terms or other comparable terminology. The Company has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While the Company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond the Company’s control, including future impairment charges, the ability to achieve its guidance, the ability to execute and achieve the desired benefits of announced initiatives and the timing, amount and cost of share repurchases. In addition, there can be no assurance that the Company will be able to file its 2016 Form 10-K within the fifteen calendar day extension provided by Rule 12b-25, or that the Company may not identify one or more material weaknesses in its internal control over financial reporting, need to restate its financial statements or conclude that investors should no longer rely upon previously issued financial statements. These and other important factors, including those discussed under “Risk Factors” in the Company’s Form 10-KT for the six-month period ended December 31, 2015, as well as the Company’s subsequent filings with the United States Securities and Exchange Commission, may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements in this filing are made only as of the date hereof, and unless otherwise required by applicable securities laws, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

|

|

|

|

|

|

|

|

|

|

|

|

Perrigo Company plc

|

|

|

|

|

(Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

has caused this notification to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Ronald L. Winowiecki

|

|

Dated:

|

February 27, 2017

|

|

|

Ronald L. Winowiecki

|

|

|

|

|

|

Chief Financial Officer

|

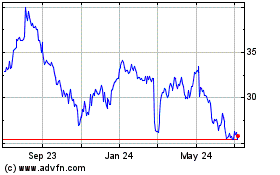

Perrigo Company Plc Irel... (NYSE:PRGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Perrigo Company Plc Irel... (NYSE:PRGO)

Historical Stock Chart

From Apr 2023 to Apr 2024