AIG Directors to Discuss Whether to Penalize or Oust CEO Over Fourth-Quarter Results -- Update

February 27 2017 - 2:00PM

Dow Jones News

By Joann S. Lublin, Leslie Scism and David Benoit

Directors of American International Group Inc. are trying to

determine whether to blame -- and possibly replace -- Chief

Executive Peter Hancock following a major setback in the insurance

giant's turnaround plan, people familiar with the matter said.

Mr. Hancock's 15 fellow directors are expected to debate at an

early March board meeting various potential actions, including

cutting his bonus or removing him, some people said. Some cautioned

it is premature to predict any particular outcome at this point,

and that the board will look broadly at management's role.

The discussion marks a sign of lessened board support for the

58-year-old Mr. Hancock, who has run the giant insurer for more

than two years. It is fallout from a $3.04 billion fourth-quarter

loss, one of AIG's worst results since the U.S. government bailed

it out during the financial crisis.

The stock fell 9% on the Feb. 14 earnings announcement and

additional bad news the next day: lowered targets for improving two

closely watched profit measures.

Directors want to know "how did this happen, and who, if anyone,

should be held accountable for this?" one person said.

In response to a request for comment from Mr. Hancock and the

board's chairman, Douglas Steenland, AIG said that "AIG's Board of

Directors and management team" are focused on their "clearly

defined transformation plan for the company to deliver high

quality, sustainable earnings."

The statement added, "At this point every year, we actively

review our past and future expected performance against our plan,

and this year is no exception."

Mr. Hancock faces a defined timetable for improving AIG's

profitability. Amid calls in late 2015 by billionaire investors

John Paulson and Carl Icahn for a breakup of the company, he and

the board laid out steps in January 2016 to bridge the company's

big gap in performance with peers. They set a deadline of December

2017. Mr. Icahn also called for Mr. Hancock's firing.

Those pledges were key in the activists' decision to pass on a

board fight last year, and last spring AIG added Mr. Paulson and a

representative of Mr. Icahn to the board.

AIG's board is large, and views are expected to vary, the people

said. Of the 16 board members, Mr. Hancock is the only member of

management, and the others are all classified as independent

directors.

The board in March also may discuss whether one of the directors

would replace Mr. Hancock as interim CEO, one person said. Some

members have insurance-industry experience.

The steep slide in AIG's shares on Feb. 15 represented the

stock's biggest one-day percentage decline since 2011. AIG was the

day's biggest loser in the S&P 500. The stock has regained some

ground, but at Friday's close remained 4.9% below the Feb. 14

closing price.

AIG's fourth-quarter loss was driven by a larger-than-expected

$5.6 billion boost to claims reserves for its core business of

selling property-casualty policies to businesses world-wide. The

company said the charge involved an array of liability policies

such as medical malpractice coverage. Some were issued more than a

decade ago, but a full $3 billion of the boost covers policies from

2011 to 2015. Mr. Hancock, a former bank chief financial and risk

officer, ran the property-casualty unit from 2011 to 2014, before

his promotion to CEO.

The reserve boost followed a $3.6 billion increase for reserves

in 2015's fourth quarter, when some investors thought AIG had

brought them to an appropriate, conservative level.

The huge additional reserve bolstering raises questions "that

AIG simply didn't adequately understand its book of business,"

Keefe, Bruyette & Woods analyst Meyer Shields said.

AIG has said that most of the claims costs reflected in the

fourth-quarter reserve charge will be covered by a reinsurance

agreement that the insurer announced in January with Warren

Buffett's Berkshire Hathaway Inc.

AIG averted a possible bankruptcy brought on by other problems

in 2008 thanks to its nearly $185 billion federal bailout. AIG's

current challenges with money-losing policies appear to stem at

least partly from its comeback attempt after its near collapse.

Then, some rivals complained that AIG was undercutting them on

price as a way to keep customers from fleeing. AIG fully repaid

taxpayers by late 2012, then focused on trying to close its

profitability gap with rivals.

Over the past year, Mr. Hancock's team has sold operations and

assets deemed noncore, cut expenses and exited some problematic

insurance lines while scaling back others, shedding billions of

dollars of liability-insurance business that was unprofitable or

not profitable enough. At the same time, Mr. Hancock has spent

heavily to upgrade the company's information-technology

systems.

AIG also promised investors last year that it would to return

$25 billion to shareholders by this year's end, through

stock-buyback programs and dividends. Between January 2016 through

early this month, it had returned $14.3 billion.

Write to Joann S. Lublin at joann.lublin@wsj.com, Leslie Scism

at leslie.scism@wsj.com and David Benoit at

david.benoit@wsj.com

(END) Dow Jones Newswires

February 27, 2017 13:45 ET (18:45 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

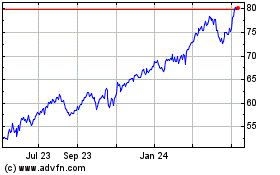

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

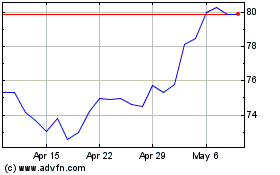

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024