Wabash National Corporation Completes Repricing of Senior Secured Term Loan

February 27 2017 - 8:43AM

Wabash National Corporation (NYSE:WNC) has completed an

amendment to reprice its senior secured Term Loan Credit Agreement

which at current interest rates would be expected to reduce annual

cash interest costs by approximately $1.3 million. As a result of

this amendment, which became effective on February 24, 2017, the

company’s credit agreement will be priced at LIBOR plus 275 basis

points and no longer subject to a LIBOR floor. Prior to this

amendment, the term loan was priced at LIBOR plus 325 basis points,

subject to a minimum LIBOR floor of 100 basis points. The company

has approximately $189.5 million outstanding on the term loan which

matures in 2022.

Jeff Taylor, Senior Vice President and Chief Financial Officer,

commented, “Managing our capital structure to be as effective and

efficient as possible is an important component of our corporate

strategy. This term loan repricing is a great example of

further optimizing our borrowing costs by taking advantage of our

strong financial performance and favorable market conditions.”

The Amended Term Loan facility was completed with Wells Fargo

Securities, LLC acting as sole lead arranger and sole

bookrunner.

Safe Harbor StatementThis press release

contains certain forward-looking statements as defined by the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements convey the Company’s current expectations or forecasts

of future events. All statements contained in this press release

other than statements of historical fact are forward-looking

statements. The Company’s forward-looking statements are subject to

certain risks and uncertainties that could cause actual results to

differ materially from those implied by the forward-looking

statements, including factors specific to the Company and to the

credit market generally. Readers should review and consider the

various disclosures made by the Company in this press release and

in the Company’s reports to its stockholders and periodic reports

on Forms 10-K and 10-Q.

About Wabash National Corporation Wabash

National Corporation (NYSE:WNC) is a diversified industrial

manufacturer and North America’s leading producer of semi-trailers

and liquid transportation systems. Established in 1985 in

Lafayette, Indiana, the company manufactures a diverse range of

products, including: dry freight and refrigerated trailers,

platform trailers, bulk tank trailers, dry and refrigerated truck

bodies, truck-mounted tanks, intermodal equipment, aircraft

refueling equipment, structural composite panels and products,

trailer aerodynamic solutions, and specialty food grade and

pharmaceutical equipment. Its innovative products are sold under

the following brand names: Wabash National®, Beall®, Benson®,

Brenner® Tank, Bulk Tank International, DuraPlate®, Extract

Technology®, Garsite, Progress Tank, Transcraft®, Walker Engineered

Products, and Walker Transport. Learn more at

www.wabashnational.com.

Media Contact:

Dana Stelsel

Corporate Communications Manager

(765) 771-5766

dana.stelsel@wabashnational.com

Investor Relations:

Mike Pettit

Vice President – Finance and Investor Relations

(765) 771-5581

michael.pettit@wabashnational.com

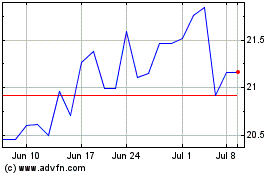

Wabash National (NYSE:WNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

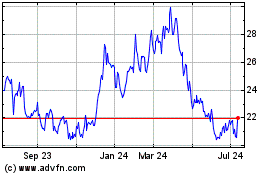

Wabash National (NYSE:WNC)

Historical Stock Chart

From Apr 2023 to Apr 2024