Current Report Filing (8-k)

February 24 2017 - 5:22PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported):

February 24, 2017 (February 17, 2017)

MGT

Capital Investments, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-32698

|

|

13-4148725

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

512

S. Mangum Street, Suite 408

Durham,

NC 27701

(Address

of principal executive offices, including zip code)

(914)

630-7431

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item

1.01 Entry into a Material Definitive Agreement.

On February 17, 2017, MGT

Capital Investments, Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Purchase Agreement”)

with an accredited investor (the “Investor”) relating to the issuance and sale of 1,000,000 shares of the Company’s

common stock, par value $0.001 per share (the “Shares”) at a purchase price of $0.40 per Share. In addition, for every

Share purchased, the Investor shall receive detachable warrants, as follows (i) one Series A Warrant; (ii) one Series B Warrant;

and (iii) one Series C Warrant (collectively the “Warrants”).

Each Series A Warrant

is exercisable for one (1) Share, for a period of three (3) years at a price of $0.50 per Share. Each Series B Warrant

is exercisable for one (1) Share, for a period of three (3) years at a price of $0.75 per Share, and each Series C Warrant

is exercisable is exercisable for one (1) Share, for a period of three (3) years at a price of $1.00 per Share.

The

gross proceeds from the Purchase Agreement are $400,000, and the Company received proceeds of $200,000 on February 17, 2017. The

Company expects to receive the remaining $200,000 on or before March 15, 2017.

The

Purchase Agreement also contains other customary representations, warranties and agreements by the Company and the Investor. The

representations, warranties and covenants contained in the Purchase Agreement were made only for purposes of such agreement and

as of specific dates, were solely for the benefit of the parties to such agreement and may be subject to limitations agreed upon

by the contracting parties.

The foregoing descriptions

of the Purchase Agreement and the Warrants are not complete and are qualified in their entirety by reference to the full text

of the Form of Purchase Agreement filed as Exhibit 10.1, the Form of Series A Warrant filed as Exhibit 10.2, the Form of Series

B Warrant filed as Exhibit 10.3, and the Form of Series C Warrant filed as Exhibit 10.4 to this report and are incorporated by

reference herein.

Item

3.02 Unregistered Sales of Equity Securities

On

February 17, 2017, the Company issued the Shares and the Warrants, in exchange for aggregate gross proceeds of $400,000. The details

of this transaction are described in Item 1.01, which is incorporated by reference, in its entirety, into this Item 3.02.

The

issuance and sale of the Shares and the Warrants was made pursuant to an exemption from registration under Section 4(a)(2) of

the Securities Act of 1933, as amended.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

|

|

10.1

|

Form

of Securities Purchase Agreement

|

|

|

|

|

|

|

10.2

|

Form of Series A Warrant

|

|

|

|

|

|

|

10.3

|

Form of Series B Warrant

|

|

|

|

|

|

|

10.4

|

Form of Series C Warrant

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

MGT

CAPITAL INVESTMENTS, INC.

|

|

|

|

|

|

Date:

February 24, 2017

|

By:

|

/s/

Robert B. Ladd

|

|

|

Name:

|

Robert

B. Ladd

|

|

|

Title:

|

President

|

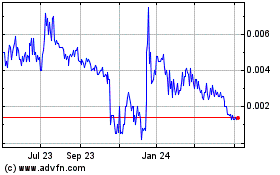

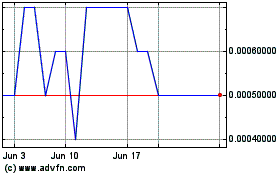

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Apr 2023 to Apr 2024