Glencore Swung to Profit in 2016 -- WSJ

February 24 2017 - 3:02AM

Dow Jones News

Strong resource prices get mining company back on track; CEO

talks of 'big dividends'

By Scott Patterson

LONDON -- Glencore PLC rode a wave of surging commodity prices

in 2016 to return to a profit of $1.4 billion, marking a

head-snapping turnaround for a miner that faced an investor revolt

just 18 months ago.

With cash hordes now burgeoning at the world's No. 4 mining

company by market value, Chief Executive Ivan Glasenberg now faces

a tough decision: start splurging on new mergers or acquisitions,

or return the rewards to shareholders in the form of dividends.

Mr. Glasenberg -- known as one of the mining industry's most

voracious deal-makers -- appears to be leaning in a surprising

direction: dividends.

"I don't think there's big stuff around to look at, but we'll

see what opportunities come," the CEO said about potential deals on

a conference call with reporters Thursday. "If we don't find big

opportunities, we'll kick out big dividends."

Mr. Glasenberg said Glencore could eventually contemplate

returning a special dividend to shareholders as high as $20

billion, a move that would benefit the CEO who, along with other

senior management, is a major shareholder. The company earlier said

it plans to pay out $1 billion in dividends in 2017.

Shares in the company were up more than 4% in early-afternoon

trading in London.

It is a big change for the swashbuckling executive known for

pulling off some of the biggest deals in the industry, including

the $29.5 billion deal to merge with Xstrata in 2013. Two years

ago, the talk of the industry was a potential merger between

Glencore and Anglo-Australian behemoth Rio Tinto PLC, a deal that

would likely have created the biggest mining company in the

world.

The more conservative approach could raise questions about

whether Glencore's days of meteoric growth are behind it.

Since its IPO in 2011, Glencore had been distinct from other

mining giants like BHP Billiton Ltd., which were attractive to

investors for steady dividends. By contrast, Mr. Glasenberg offered

a narrative of deals and earnings buoyed by the company's powerful

trading unit.

Mr. Glasenberg's emphasis on dividends is "a shift in focus for

Glencore, " said John Meyer, an analyst for SP Angel in London.

"Glencore has traditionally been highly acquisitive." Now, a

tighter balance sheet is causing Glencore's strategy to shift "to

one of cash generation, debt reduction and cash returns to

shareholders," he said.

It is the latest sign of how much Glencore has changed in the

past year and a half. Back in the summer of 2015, its share price

took a dip, including a 29% drop in one day, as investors punished

the company for high debt levels amid what was then a brutal

downturn in commodity prices.

Since then, Glencore pared back debt, cut spending and sold off

$4.7 billion in assets in an effort to mend its debt-laden balance

sheet. A sharp rise in commodity prices last year also helped boost

the firm's cash flow, with metallurgical coal almost tripling and

copper 27% higher.

On Thursday, Glencore reported net income of $1.4 billion for

2016, compared with a $4.9 billion net loss the previous year. Net

debt fell to $15.5 billion by year-end from $25.9 billion at the

end of 2015, below the lower end of the range of its guidance of

$16.5 billion to $17.5 billion.

Glencore's earnings are the latest positive sign from the mining

sector. BHP Billiton and Anglo American PLC earlier this week also

returned to profit. On Thursday, Vale, the Brazilian mining giant,

said it returned to a net profit of $525 million in the fourth

quarter of 2016.

Mr. Glasenberg said reduced supplies in key commodities such as

copper, coal and zinc were a big reason why commodities soared in

2016. The CEO has long criticized his competitors for ramping up

supplies in the face of falling prices. Glencore in the past few

years has cut back production in its zinc, copper and coal

operations, moves Mr. Glasenberg said provided support for the

prices of those commodities.

"There wasn't this massive new increase in supply" last year,

Mr. Glasenberg said. "You saw voluntary cutbacks, ourselves, we

were one of the leaders."

Glencore said its trading business posted earnings before

interest and taxes of $2.8 billion last year, a 14% gain from 2015,

amid stronger demand, particularly from China, and drops in

inventory levels.

It expects its trading group to report adjusted earnings in the

range of $2.2 billion and $2.5 billion in 2017. That is lower than

previous years' guidance of as much as $3.2 billion, due to its

sale of half of its agriculture division last year.

Write to Scott Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

February 24, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

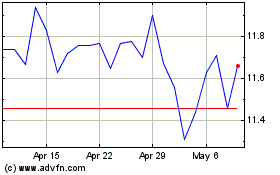

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

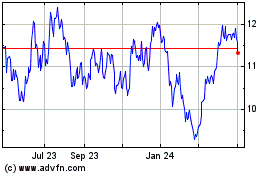

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Apr 2023 to Apr 2024