Clear Channel Outdoor Holdings, Inc. (NYSE: CCO) today reported

financial results for the fourth quarter and year ended

December 31, 2016.

“We continue to invest in transforming our Americas and

International outdoor businesses to more effectively compete in an

increasingly digital world,” said Bob Pittman, Executive Chairman

and Chief Executive Officer of Clear Channel Outdoor Holdings, Inc.

“Both Americas outdoor and International outdoor made great

progress in building out their industry-leading data-rich,

analytics capabilities and programmatic ad-buying solutions to do

business in the same way that the advertising industry does today

while expanding their digital networks and winning new

contracts.”

“We are pleased with the successful execution of our strategic

initiatives this year,” said Rich Bressler, Chief Financial Officer

of Clear Channel Outdoor Holdings, Inc. “In the fourth quarter and

full year 2016, consolidated revenue declined and operating income

increased. However, excluding the impact of the 2016 sales of

certain U.S. markets and International businesses as well as

foreign exchange, Americas outdoor and International outdoor

revenues, operating income and OIBDAN all increased. Throughout

2016, we continued to invest in innovative products at both

businesses for the benefit of our audiences and partners while

maintaining tight operating and financial discipline.”

Key Financial Highlights

The Company’s key financial highlights for the fourth quarter of

2016 include:

- Consolidated revenue decreased 5.9%.

Consolidated revenue increased 4.7%, after adjusting for a $19.8

million impact from movements in foreign exchange rates and the

$58.9 million impact of markets and businesses sold in 2016.

- Americas revenues decreased $17.2

million, or 4.7%. Revenues increased $10.5 million, or 3.1%, after

adjusting for a $0.1 million impact from movements in foreign

exchange rates and a $27.9 million impact from the sale of

non-strategic markets in the first quarter of 2016.

- International revenues decreased $28.4

million, or 7.0%. Revenues increased $22.5 million, or 6.2%, after

adjusting for a $19.9 million impact from movements in foreign

exchange rates and a $31.0 million impact from the sale of our

businesses in Turkey in the second quarter of 2016 and Australia in

the fourth quarter of 2016.

- Operating income increased 115.7% to

$250.9 million.

- OIBDAN decreased 3.8%. OIBDAN increased

9.6%, excluding the impact from movements in foreign exchange rates

and the impact of the non-strategic markets sold in 2016.

The Company’s key financial highlights for 2016 include:

- Consolidated revenue decreased 3.7%.

Consolidated revenue increased 2.7%, after adjusting for a $47.6

million impact from movements in foreign exchange rates and the

$125.4 million impact of the markets and businesses sold in 2016.

- Americas outdoor revenues decreased

$70.6 million, or 5.2%. Revenues increased $39.9 million, or 3.2%,

after adjusting for a $7.7 million impact from movements in foreign

exchange rates and a $102.7 million impact from the non-strategic

markets sold in the first quarter of 2016.

- International outdoor revenues

decreased $33.2 million, or 2.3%. Revenues increased $29.3 million,

or 2.2%, after adjusting for a $39.9 million impact from movements

in foreign exchange rates and a $22.7 million impact from the sale

of our businesses in Turkey in the second quarter of 2016 and

Australia in the fourth quarter of 2016.

- Operating income increased $376.5

million, or 144.3%.

- OIBDAN decreased 4.1% and increased

4.9%, excluding the impact from movements in foreign exchange rates

and the impact of the markets and businesses sold in 2016.

Key Non-Financial

Highlights

The Company’s recent key non-financial highlights include:

- Installed 31 new digital billboards in

the fourth quarter and 82 over the full year for an end of year

total of 1,113 across North America, and installed 1,077 digital

displays in the fourth quarter and almost 3,600 over the full year

in the International markets for an end-of-year total of more than

9,600.

- Launched first nationwide programmatic

private marketplace (PMP) solution in the U.S. for out-of-home

ad-buying. This will enable advertisers and brands to purchase

almost 1,000 of Americas outdoor's high impact digital inventory

billboards at scale, seamlessly, within a PMP.

- Being named to AdWeek's Top Mobile

Innovators of 2016 for the launch of RADAR - the industry's first

suite of third-party research, data and mobile analytics tools for

planning, attribution, measurement and retargeting - as well as the

integration of RADAR into the first-to-market programmatic

out-of-home buying solution via private marketplaces.

- Introduced the first out-of-home

programmatic buying tool in Europe - this automated solution is

live in Belgium with plans to continue the roll-out across Europe

including the UK in March. Customers can now access and buy

audience-based packages on an Automated Guaranteed basis across

Clear Channel's digital out-of-home network in the city of

Brussels.

- Awarded 10-year contract extension to

provide Nashville International Airport with an entirely new

digital advertising network that will include technologically

sophisticated, state-of-the-art media.

- Won five-year partnership extension to

bolster the digital media program for Austin-Bergstrom

International airport.

- Renewed the city of Lyon transit

contract for seven years to operate out-of-home advertising across

its buses, bus shelters, Tramway and Metro. Lyon's metro system is

the second largest in France after Paris.

GAAP Measures by Segment

(In thousands) Three Months EndedDecember 31,

%Change Year EndedDecember 31,

%

Change

2016 2015 2016 2015 Revenue Americas $

347,355 $ 364,536 (4.7 )% $ 1,278,413 $ 1,349,021 (5.2 )%

International 379,116 407,529 (7.0 )% 1,423,982

1,457,183 (2.3 )%

Consolidated revenue

$ 726,471 $ 772,065

(5.9 )% $ 2,702,395 $

2,806,204 (3.7 )% Direct Operating and

SG&A expenses1 Americas $ 207,026 $ 213,096 (2.8 )% $ 795,725 $

830,636 (4.2 )% International 279,372 313,070

(10.8 )% 1,155,046 1,195,770 (3.4 )%

Consolidated Direct Operating

and SG&A expenses1

$ 486,398 $

526,166 (7.6 )% $

1,950,771 $ 2,026,406

(3.7 )% Operating income Americas $ 95,558 $ 98,500

(3.0 )% $ 297,034 $ 313,871 (5.4 )% International 60,061 53,360

12.6 % 116,178 95,353 21.8 % Corporate2 (32,955 ) (30,510 ) 8.0 %

(123,095 ) (121,768 ) 1.1 % Impairment charges — —

nm

(7,274 ) (21,631 ) (66.4 )% Other operating income (loss), net

128,203 (5,068 ) (2,629.7 )% 354,688 (4,824 )

(7,452.6 )%

Consolidated Operating income $

250,867 $ 116,282 115.7

% $ 637,531 $ 261,001

144.3 % 1

Direct Operating and SG&A Expenses as

included throughout this earnings release refers to the sum of

Direct operating expenses (excludes depreciation and amortization)

and Selling, general and administrative expenses (excludes

depreciation and amortization).

2 Includes Corporate depreciation and amortization of $1.5

million and $1.4 million for the three months ended December 31,

2016 and 2015, respectively, and $5.7 million and $5.4 million for

the years ended December 31, 2016 and 2015, respectively.

Non-GAAP Measures1 (see preceding table for

comparable GAAP measures)

(In thousands) Three Months EndedDecember 31,

Year EndedDecember 31, %

Change

2016 2015 2016 2015 Revenue

excluding movements in foreign exchange Americas $ 347,214 $

364,536 (4.8 )% $ 1,286,134 $ 1,349,021 (4.7 )% International

399,029 407,529 (2.1 )% 1,463,876 1,457,183

0.5 %

Consolidated revenue excluding

movements in foreign exchange

$ 746,243 $ 772,065

(3.3 )% $ 2,750,010 $

2,806,204 (2.0 )% Direct Operating and

SG&A expenses1 excluding movements in foreign exchange Americas

$ 206,766 $ 213,096 (3.0 )% $ 801,449 $ 830,636 (3.5 )%

International 293,383 313,070 (6.3 )% 1,188,284

1,195,770 (0.6 )%

Consolidated Direct Operating and

SG&A expenses excluding movements in foreign

exchange

$ 500,149 $ 526,166

(4.9 )% $ 1,989,733 $

2,026,406 (1.8 )% OIBDAN Americas $

140,329 $ 151,440 (7.3 )% $ 482,688 $ 518,385 (6.9 )% International

99,744 94,459 5.6 % 268,936 261,413 2.9 % Corporate (29,336 )

(26,812 ) 9.4 % (107,145 ) (108,021 ) (0.8 )%

Consolidated

OIBDAN $ 210,737 $ 219,087

(3.8 )% $ 644,479

$ 671,777 (4.1 )% OIBDAN

excluding movements in foreign exchange Americas $ 140,448 $

151,440 (7.3 )% $ 484,685 $ 518,385 (6.5 )% International 105,646

94,459 11.8 % 275,592 261,413 5.4 % Corporate (31,092 ) (26,812 )

16.0 % (111,274 ) (108,021 ) 3.0 %

Consolidated OIBDAN

excluding movements in foreign exchange

$ 215,002 $ 219,087

(1.9 )% $ 649,003 $

671,777 (3.4 )% Revenue excluding

effects of foreign exchange and revenue from markets and businesses

sold Americas $ 347,214 $ 336,653 3.1 % $ 1,283,664 $ 1,243,847 3.2

% International $ 388,422 $ 365,902 6.2 % $ 1,342,836 $ 1,313,491

2.2 %

Consolidated revenue, excluding

effects of foreign exchange and revenue from markets

and businesses sold

$ 735,636 $ 702,555 4.7 %

$ 2,626,500 $ 2,557,338 2.7

% OIBDAN excluding effects of foreign exchange and revenue

from markets and businesses sold Americas $ 140,448 $ 138,200 1.6 %

$ 483,985 $ 470,771 2.8 % International $ 102,445 $ 81,803 25.2 % $

250,543 $ 231,175 8.4 %

Consolidated OIBDAN, excluding

effects of foreign exchange and revenue from markets

and businesses sold

$ 211,801 $ 193,191 9.6 %

$ 623,254 $ 593,925 4.9 %

Certain prior period amounts have been reclassified to conform

to the 2016 presentation of financial information throughout the

press release.

1 1 See the end of this press release for reconciliations of (i)

OIBDAN excluding effects of foreign exchange rates and OIBDAN for

each segment to segment and consolidated operating income (loss);

(ii) revenues excluding effects of foreign exchange rates to

revenues; (iii) direct operating and SG&A expenses excluding

effects of foreign exchange rates to direct operating and SG&A

expenses; (iv) corporate expenses excluding non-cash compensation

expenses and effects of foreign exchange rates to corporate

expenses; (v) Consolidated and segment revenues excluding the

effects of foreign exchange rates and results from markets and

businesses sold to Consolidated and segment revenues; (vi)

Consolidated and segment direct operating and SG&A expenses

excluding the effects of foreign exchange rates and results from

markets and businesses sold to Consolidated and segment direct

operating and SG&A expenses; and (vii) Consolidated and segment

OIBDAN excluding the effects of foreign exchange rates and results

from markets and businesses sold to Consolidated and segment

operating income. See also the definition of OIBDAN under the

Supplemental Disclosure section in this release.

Full Year 2016 Results

Consolidated

Consolidated revenue decreased $103.8 million, or 3.7%, during

2016 as compared to 2015. Consolidated revenue increased $69.2

million, or 2.7%, after adjusting for a $47.6 million impact from

movements in foreign exchange rates and the $125.4 million impact

of markets and businesses sold in 2016.

Consolidated direct operating and SG&A expenses decreased

$75.6 million, or 3.7%, during 2016 as compared to 2015.

Consolidated direct operating and SG&A expenses increased $36.6

million, or 2.0%, during 2016 as compared to 2015, after adjusting

for a $39.0 million impact of movements in foreign exchange rates

and the $73.2 million impact of the sale of the markets and

businesses.

Consolidated operating income increased $376.5 million, or

144.3%, during 2016 as compared to 2015, primarily due to the net

gain of $278.3 million on sale of nine non-strategic outdoor

markets in the first quarter of 2016 and the net gain of $127.6

million on sale on our Australia business in the fourth quarter of

2016, partially offset by the $56.6 million loss, which includes

$32.2 million in cumulative translation adjustments, on the sale of

our Turkey business in the second quarter of 2016.

The Company's OIBDAN decreased 4.1% to $644.5 million during

2016 as compared to 2015. After adjusting for the movements in

foreign exchange rates and the impact of the sale of markets and

businesses, the Company’s OIBDAN increased 4.9% in 2016 compared to

2015.

Included in the 2016 operating income and OIBDAN were $10.5

million of direct operating and SG&A expenses and $2.5 million

of corporate expenses associated with the Company’s strategic

revenue and efficiency initiatives, compared to $13.5 million and

$6.8 million of such expenses in 2015, respectively.

Americas Outdoor

Americas outdoor revenues decreased $70.6 million, or 5.2%,

during 2016 as compared to 2015. Revenues increased $39.9 million,

or 3.2%, after adjusting for a $7.7 million impact from movements

in foreign exchange rates and a $102.7 million impact from

non-strategic markets sold in the first quarter of 2016. The

increase was primarily due to increased revenues from digital

billboards as a result of new deployments and higher occupancy on

existing digital billboards, as well as new airport contracts, and

higher revenues in Latin America.

Direct operating and SG&A expenses decreased $34.9 million,

or 4.2%, during 2016 as compared to 2015. Direct operating and

SG&A expenses increased $26.6 million, or 3.4%, after adjusting

for a $5.7 million impact from movements in foreign exchange rates

and the $55.8 million impact from the sale of non-strategic markets

during the first quarter 2016, due primarily to higher operating

expenses related to new contracts and higher variable compensation

expense related to higher revenues.

Operating income decreased 5.4% to $297.0 million during 2016 as

compared to 2015, resulting primarily from the sale of the

non-strategic outdoor markets in 2016. OIBDAN decreased $35.7

million, or 6.9%. OIBDAN increased 2.8% during 2016 as compared to

2015, after adjusting for a $2.0 million impact from movements in

foreign exchange rates and the $46.9 million impact from the sale

of the non-strategic markets.

International Outdoor

International outdoor revenues decreased $33.2 million, or 2.3%,

during 2016 as compared to 2015. Revenues increased $29.3 million,

or 2.2%, after adjusting for a $39.9 million impact from movements

in foreign exchange rates and the $22.7 million impact from the

sale of our businesses in Turkey and Australia in the second and

fourth quarters of 2016, respectively. Higher revenue primarily

from new digital assets and new contracts in China, Italy, Spain,

Sweden, France and Belgium was partially offset by lower revenue

due to the sale of our businesses in Turkey and Australia, as well

as lower revenue in the United Kingdom due to the London bus

shelter contract not being renewed.

Direct operating and SG&A expenses decreased $40.8 million,

or 3.4%, during 2016 as compared to 2015. Direct operating and

SG&A expenses increased $10.0 million, or 0.9%, after adjusting

for a $33.3 million impact from movements in foreign exchange rates

and the $17.4 million impact from the sale of our businesses in

Turkey and Australia in the second and fourth quarters of 2016,

respectively. Direct operating and SG&A expenses increased

primarily due to higher site lease and production expenses related

to higher revenues. This was partially offset by lower site lease

expense due to lower revenue in the United Kingdom, as well as

operating expenses of $11.4 million recorded in the fourth quarter

of 2015 to correct for accounting errors included in the results

for our Netherlands subsidiary reported in prior years.

Operating income increased 21.8% to $116.2 million during 2016

as compared to 2015. OIBDAN increased $7.5 million, or 2.9%. OIBDAN

increased $19.3 million, or 8.4%, during 2016 as compared to 2015,

after adjusting for a $6.6 million impact from movements in foreign

exchange rates and the $5.3 million impact from the sale of our

businesses in Turkey and Australia in the second and fourth

quarters of 2016, respectively. Operating income and OIBDAN in

2016 each include $7.4 million in expenses related to investments

in strategic revenue and efficiency initiatives compared to $11.1

million in 2015.

Clear Channel International B.V. (“CCIBV”)

CCIBV’s consolidated revenues decreased $53.7 million to

$1,168.7 million in 2016 compared to 2015. This decrease includes a

$35.3 million impact from movements in foreign exchange rates.

CCIBV’s operating income was $100.7 million in 2016 compared to

operating income of $23.8 million in 2015. This increase includes a

$5.8 million impact from movements in foreign exchange rates. The

increase was primarily due to the net gain of $127.6 million on

sale on our business in Australia in the fourth quarter of 2016,

partially offset by the $56.6 million loss, which includes $32.2

million in cumulative translation adjustments, on the sale of our

business in Turkey in the second quarter of 2016.

Liquidity and Financial

Position

As of December 31, 2016, we had $542.0 million of cash on

our balance sheet, including $180.1 million of cash held outside

the U.S. by our subsidiaries. For the year ended December 31,

2016, cash flow provided by operating activities was $310.3

million, cash flow provided by investing activities was $551.5

million, cash flow used for financing activities was $726.5

million, and there was $(6.0) million impact from movements in

foreign exchange rates on cash. The net increase in cash from

December 31, 2015 was $129.3 million.

Capital expenditures for the year ended December 31, 2016

were $229.8 million compared to $218.3 million for the same period

in 2015.

In the first quarter of 2016, we sold nine non-strategic U.S.

markets for net proceeds, including cash and certain advertising

assets in Florida, totaling $592.3 million. These markets

contributed $2.5 million and $105.2 million in revenue during the

years ended December 31, 2016 and 2015, respectively.

We sold our business in Turkey in the second quarter of 2016. We

sold our business in Australia in the fourth quarter of 2016 for

net cash proceeds of $195.7 million. These businesses contributed

$121.0 million and $143.7 million in revenue during the years ended

December 31, 2016 and 2015, respectively.

On January 7, 2016, CCOH paid a special dividend of $217.8

million using the proceeds of the issuance of $225.0 million in

aggregate principal amount of 8.75% Senior Notes due 2020 by Clear

Channel International B.V., an indirect wholly-owned subsidiary of

CCOH, in December 2015.

On February 4, 2016, CCOH paid a special cash dividend of $540.0

million to our stockholders using proceeds relating to a $300

million demand on the intercompany note owed by

iHeartCommunications to the Company and a portion of the proceeds

from the sale of non-strategic U.S. markets.

On February 9, 2017, CCOH declared a special dividend of $282.5

million to our stockholders using a portion of the proceeds from

the sales of certain non-strategic U.S. markets and of our

Australia business. The dividend was paid on February 23, 2017 to

shareholders of record as of February 20, 2017.

Conference Call

The Company, along with its parent company, iHeartMedia, Inc.,

will host a conference call to discuss results on February 23,

2017 at 8:30 a.m. Eastern Time. The conference call number is (800)

230-1092 (U.S. callers) and (612) 288-0329 (International callers)

and the passcode for both is 417884. A live audio webcast of the

conference call will also be available on the investor section of

www.iheartmedia.com and www.clearchanneloutdoor.com. After the live

conference call, a replay will be available for a period of thirty

days. The replay numbers are (800) 475-6701 (U.S. callers) and

(320) 365-3844 (International callers) and the passcode for both is

417884. An archive of the webcast will be available beginning 24

hours after the call for a period of thirty days.

TABLE 1 - Financial Highlights of Clear

Channel Outdoor Holdings, Inc. and Subsidiaries

(In thousands) Three Months EndedDecember 31,

Year EndedDecember 31, 2016 2015 2016

2015 Revenue $ 726,471 $ 772,065 $ 2,702,395

2,806,204 Operating expenses:

Direct operating expenses

(excludesdepreciation and amortization)

359,728 386,873 1,435,569 1,494,902

Selling, general and administrative

expenses(excludes depreciation and amortization)

126,670 139,293 515,202 531,504

Corporate expenses (excludes depreciation

andamortization)

31,434 29,126 117,383 116,380 Depreciation and amortization 85,975

95,423 344,124 375,962 Impairment charges — — 7,274 21,631 Other

operating income, net 128,203 (5,068 ) 354,688 (4,824

)

Operating income 250,867 116,282

637,531 261,001 Interest expense 93,056 89,609

374,892 355,669

Interest income on Due

fromiHeartCommunications

13,876 15,507 50,309 61,439 Equity in loss of nonconsolidated

affiliates (315 ) 352 (1,689 ) (289 ) Other income (expense), net

(23,953 ) (5,085 ) (70,151 ) 12,387 Income (loss) before

income taxes 147,419 37,447 241,108 (21,131 ) Income tax benefit

(expense) (39,078 ) (69,886 ) (76,675 ) (50,177 ) Consolidated net

income (loss) 108,341 (32,439 ) 164,433 (71,308 )

Less: Amount attributable to

noncontrollinginterest

6,840 8,944 23,002 24,764

Net income (loss) attributable to

the Company

$ 101,501 $ (41,383 )

$ 141,431 $ (96,072 )

For the three months ended December 31, 2016, foreign

exchange rate movements decreased the Company’s revenues by $19.8

million and decreased direct operating expenses by $10.5 million,

SG&A expenses by $3.2 million and Corporate expenses by $1.8

million. For the year ended December 31, 2016, foreign

exchange rate movements decreased the Company’s revenues by $47.6

million and decreased direct operating expenses by $29.0 million,

SG&A expenses by $9.9 million and Corporate expenses by $4.1

million.

TABLE 2 - Selected Balance Sheet

Information

Selected balance sheet information for December 31, 2016

and December 31, 2015:

(In millions) December 31, 2016

2015 Cash and cash equivalents $ 542.0 $ 412.7 Total current assets

1,341.4 1,567.7 Net property, plant and equipment 1,412.8 1,628.0

Due from iHeartCommunications 885.7 930.8 Total assets 5,718.8

6,306.8 Current liabilities (excluding current portion of long-term

debt) 634.7 916.3 Long-term debt (including current portion of

long-term debt) 5,117.0 5,110.8 Shareholders’ deficit (932.8 )

(569.7 )

TABLE 3 - Total Debt

At December 31, 2016 and December 31, 2015, Clear

Channel Outdoor Holdings had a total net debt of:

(In millions) December 31, 2016

2015 Clear Channel Worldwide Senior Notes: 6.5% Series A Senior

Notes Due 2022 $ 735.8 $ 735.8 6.5% Series B Senior Notes Due 2022

1,989.2 1,989.2 Clear Channel Worldwide Holdings Senior

Subordinated Notes: 7.625% Series A Senior Subordinated Notes Due

2020 275.0 275.0 7.625% Series B Senior Subordinated Notes Due 2020

1,925.0 1,925.0 Clear Channel International B.V. Senior Notes due

2020 225.0 225.0 Other debt 14.8 19.0 Original issue discount (6.7

) (7.8 ) Long-term debt fees (41.1 ) (50.4 ) Total debt 5,117.0

5,110.8 Cash 542.0 412.7 Net Debt $ 4,575.0 $

4,698.1

The current portion of long-term debt was $7.0 million and $4.3

million as of December 31, 2016 and December 31, 2015,

respectively.

Supplemental Disclosure Regarding

Non-GAAP Financial Information

The following tables set forth the Company’s OIBDAN for the

three months and year ended December 31, 2016 and 2015. The

Company defines OIBDAN as consolidated operating income adjusted to

exclude non-cash compensation expenses, included within corporate

expenses, as well as the following line items presented in its

Statement of Operations: Depreciation and amortization; Impairment

charges; and Other operating income, net.

The Company uses OIBDAN, among other measures, to evaluate the

Company's operating performance. This measure is among the primary

measures used by management for the planning and forecasting of

future periods, as well as for measuring performance for

compensation of executives and other members of management. We

believe this measure is an important indicator of the Company's

operational strength and performance of its business because it

provides a link between operational performance and operating

income. It is also a primary measure used by management in

evaluating companies as potential acquisition targets.

The Company believes the presentation of this measure is

relevant and useful for investors because it allows investors to

view performance in a manner similar to the method used by the

Company's management. The Company believes it helps improve

investors' ability to understand the Company's operating

performance and makes it easier to compare the Company's results

with other companies that have different capital structures or tax

rates. In addition, the Company believes this measure is also among

the primary measures used externally by the Company's investors,

analysts and peers in its industry for purposes of valuation and

comparing the operating performance of the Company to other

companies in its industry.

Since OIBDAN is not a measure calculated in accordance with

GAAP, it should not be considered in isolation of, or as a

substitute for, operating income as an indicator of operating

performance and may not be comparable to similarly titled measures

employed by other companies. OIBDAN is not necessarily a measure of

the Company's ability to fund its cash needs. As it excludes

certain financial information compared with operating income, the

most directly comparable GAAP financial measure, users of this

financial information should consider the types of events and

transactions which are excluded.

The other non-GAAP financial measures presented in the tables

below are: (i) revenues, direct operating and SG&A expenses and

OIBDAN, each excluding the effects of foreign exchange rates; (ii)

revenues, direct operating and SG&A expenses and OIBDAN, each

excluding the effects of foreign exchange rates and the results

from markets and businesses sold and (iii) corporate expenses,

excluding non-cash compensation expenses and the effects of foreign

exchange rates.

The Company presents revenues, direct operating and SG&A

expenses and OIBDAN, each excluding the effects of foreign exchange

rates, because management believes that viewing certain financial

results without the impact of fluctuations in foreign currency

rates facilitates period to period comparisons of business

performance and provides useful information to investors. A

significant portion of the Company's advertising operations are

conducted in foreign markets, principally Europe, the U.K. and

China, and management reviews the results from its foreign

operations on a constant dollar basis. Revenues, direct operating

and SG&A expenses and OIBDAN, each excluding the effects of

foreign exchange rates, are calculated by converting the current

period's amounts in local currency to U.S. dollars using average

foreign exchange rates for the prior period.

In the first quarter of 2016, the Company sold nine

non-strategic Americas markets. The Company sold its businesses in

Turkey and Australia in the second and fourth quarters of 2016,

respectively. The Company presents revenues, direct operating and

SG&A expenses and OIBDAN, each excluding the effects of foreign

exchange rates and the results from markets and businesses sold,

for the consolidated Company and the Company's segments, in order

to facilitate investors' understanding of operational trends

without the impact of fluctuations in foreign currency rates and

without the results from the markets and businesses that were sold,

as these results will not be included in the Company's results in

current and future periods.

Corporate expenses excluding the effects of non-cash

compensation expenses is presented as OIBDAN excludes non-cash

compensation expenses.

Since these non-GAAP financial measures are not calculated in

accordance with GAAP, they should not be considered in isolation

of, or as a substitute for, the most directly comparable GAAP

financial measures as an indicator of operating performance.

As required by the SEC rules, the Company provides

reconciliations below to the most directly comparable amounts

reported under GAAP, including (i) OIBDAN excluding effects of

foreign exchange rates and OIBDAN for each segment to consolidated

and segment operating income (loss); (ii) Revenues excluding the

effects of foreign exchange rates to revenues; (iii) Direct

operating and SG&A expenses excluding the effects of foreign

exchange rates to direct operating and SG&A expenses; (iv)

Corporate expenses excluding non-cash compensation expenses and

effects of foreign exchange rates to Corporate expenses; (v)

Consolidated and segment revenues excluding the effects of foreign

exchange rates and results from markets and businesses sold to

Consolidated and segment revenues; (vi) Consolidated and segment

direct operating and SG&A expenses excluding the effects of

foreign exchange rates and results from markets and businesses sold

to Consolidated and segment direct operating and SG&A expenses;

(vii) Consolidated and segment OIBDAN excluding the effects of

foreign exchange rates and results from markets and businesses sold

to Consolidated and segment Operating income.

Reconciliation of OIBDAN, excluding effects of foreign

exchange rates and OIBDAN for each segment to, Consolidated and

Segment Operating Income (Loss)

(In thousands)

OIBDANexcludingeffects

offoreignexchange

Foreignexchangeeffects

OIBDAN

(subtotal)

Non-cash

compensation

expenses

Depreciation

and

amortization

Impairmentcharges

Other

operating

(income)

expense, net

Operating

income (loss)

Three Months Ended December 31, 2016 Americas $ 140,448

$ (119 )

$ 140,329 $ — $

44,771 $ — $ — $ 95,558 International 105,646 (5,902

)

99,744 — 39,683 — — 60,061 Corporate (31,092 ) 1,756

(29,336 ) 2,098 1,521 — — (32,955 ) Impairment

charges — —

— — — — — — Other operating income, net —

—

— — —

— (128,203 ) 128,203

Consolidated $ 215,002

$ (4,265 ) $

210,737 $ 2,098 $

85,975 $ —

$ (128,203 ) $ 250,867

Three Months Ended December 31, 2015 Americas $ 151,440 $ —

$ 151,440 $ — $ 52,940 $ — $ — $ 98,500 International

94,459 —

94,459 — 41,099 — — 53,360 Corporate (26,812 ) —

(26,812 ) 2,314 1,384 — — (30,510 ) Impairment

charges — —

— — — — — — Other operating expense, net —

—

— —

— — 5,068 (5,068 )

Consolidated $ 219,087

$ — $ 219,087

$ 2,314 $ 95,423

$ — $ 5,068

$ 116,282 Year Ended December 31, 2016

Americas $ 484,685 $ (1,997 )

$ 482,688 $ — $ 185,654

$ — $ — $ 297,034 International 275,592 (6,656 )

268,936 —

152,758 — — 116,178 Corporate (111,274 ) 4,129

(107,145

) 10,238 5,712 — — (123,095 ) Impairment charges — —

— — — 7,274 — (7,274 ) Other operating income, net —

—

— — —

— (354,688 ) 354,688

Consolidated $ 649,003

$ (4,524 ) $

644,479 $ 10,238 $

344,124 $ 7,274

$ (354,688 ) $ 637,531

Year Ended December 31, 2015 Americas $ 518,385 $ —

$

518,385 $ — $ 204,514 $ — $ — $ 313,871 International

261,413 —

261,413 — 166,060 — — 95,353 Corporate (108,021 )

—

(108,021 ) 8,359 5,388 — — (121,768 ) Impairment

charges — —

— — — 21,631 — (21,631 ) Other operating

expense, net — —

—

— — — 4,824 (4,824

)

Consolidated $ 671,777

$ — $ 671,777

$ 8,359 $ 375,962

$ 21,631 $ 4,824

$ 261,001

Reconciliation of Revenues, excluding effects of foreign

exchange rates, to Revenues

(In thousands) Three Months EndedDecember 31,

%Change Year EndedDecember 31,

%

Change

2016 2015 2016 2015 Consolidated

revenue $ 726,471 $ 772,065 (5.9 )% $ 2,702,395 2,806,204 (3.7 )%

Excluding: Foreign exchangedecrease

19,772 — 47,615 —

Consolidated revenue excludingeffects of

foreign exchange

$ 746,243 $ 772,065 (3.3

)%

$ 2,750,010 $ 2,806,204

(2.0 )% Americas revenue $ 347,355 $ 364,536 (4.7 )%

$ 1,278,413 $ 1,349,021 (5.2 )%

Excluding: Foreign exchange(increase)

decrease

(141 ) — 7,721 —

Americas revenue excluding effectsof

foreign exchange

$ 347,214 $ 364,536 (4.8

)%

$ 1,286,134 $ 1,349,021

(4.7 )% International revenue $ 379,116 $ 407,529

(7.0 )% $ 1,423,982 $ 1,457,183 (2.3 )%

Excluding: Foreign exchangedecrease

19,913 — 39,894 —

International revenue excludingeffects of

foreign exchange

$ 399,029 $ 407,529 (2.1

)%

$ 1,463,876 $ 1,457,183

0.5 %

Reconciliation of Direct operating and SG&A expenses,

excluding effects of foreign exchange rates, to Direct operating

and SG&A expenses

(In thousands) Three Months EndedDecember 31,

%Change Year EndedDecember 31,

%

Change

2016 2015 2016 2015

Consolidated direct operating andSG&A

expenses

$ 486,398 $ 526,166 (7.6 )% $ 1,950,771 $ 2,026,406 (3.7 )%

Excluding: Foreign exchangedecrease

13,751 — 38,962 —

Consolidated direct operating andSG&A

expenses excludingeffects of foreign exchange

$ 500,149 $ 526,166 (4.9

)%

$ 1,989,733 $ 2,026,406

(1.8 )%

Americas direct operatingand SG&A

expenses

$ 207,026 $ 213,096 (2.8 )% $ 795,725 $ 830,636 (4.2 )%

Excluding: Foreign exchange(increase)

decrease

(260 ) — 5,724 —

Americas direct operating andSG&A

expenses excludingeffects of foreign exchange

$ 206,766 $ 213,096 (3.0

)%

$ 801,449 $ 830,636

(3.5 )%

International direct operating andSG&A

expenses

$ 279,372 $ 313,070 (10.8 )% $ 1,155,046 $ 1,195,770 (3.4 )%

Excluding: Foreign exchangedecrease

14,011 — 33,238 —

International direct operating andSG&A

expenses excludingeffects of foreign exchange

$ 293,383 $ 313,070 (6.3

)%

$ 1,188,284 $ 1,195,770

(0.6 )%

Reconciliation of Corporate expenses, excluding non-cash

compensation expenses and effects of foreign exchange rates, to

Corporate Expenses

(In thousands) Three Months EndedDecember 31,

%Change Year EndedDecember 31,

%

Change

2016 2015 2016 2015 Corporate Expense $

31,434 $ 29,126 7.9 % $ 117,383 $ 116,380 0.9 %

Excluding: Non-cashcompensation

expense

(2,098 ) (2,314 ) (10,238 ) (8,359 )

Corporate Expense excluding non-cash

compensation expense

$ 29,336 $ 26,812 9.4 %

$

107,145 $ 108,021 (0.8 )%

Excluding: Foreign exchangedecrease

$ 1,756 $ — $ 4,129 $ —

Corporate Expense excluding non-cash

compensation expense andeffects of foreign exchange

$ 31,092 $ 26,812 16.0 %

$ 111,274 $ 108,021 3.0 %

Reconciliation of Consolidated and Segment Revenues,

excluding effects of foreign exchange rates and results from

markets and businesses sold, to Consolidated and Segment

Revenues

(In thousands) Three Months EndedDecember 31,

%

Change

Year EndedDecember 31, %

Change

2016 2015 2016 2015 Consolidated

revenue $ 726,471 $ 772,065 (5.9 )% $ 2,702,395 $ 2,806,204 (3.7 )%

Excluding: Revenue from markets and

businessessold

(10,607 ) (69,510 ) (123,510 ) (248,866 ) Excluding: Foreign

exchange decrease 19,772 — 47,615 —

Consolidated revenue, excluding effects of

foreignexchange and revenue from markets andbusinesses sold

$ 735,636 $ 702,555 4.7 %

$ 2,626,500 $ 2,557,338

2.7 % Americas revenue $ 347,355 $ 364,536 (4.7 )% $ 1,278,413 $

1,349,021 (5.2 )% Excluding: Revenue from non-strategic markets

sold — (27,883 ) (2,470 ) (105,174 ) Excluding: Foreign exchange

(increase) decrease (141 ) — 7,721 —

Americas revenue, excluding effects of

foreignexchange and revenue from non-strategic marketssold

$ 347,214 $ 336,653 3.1 %

$ 1,283,664 $ 1,243,847

3.2 % International revenue $ 379,116 $ 407,529 (7.0 )% $ 1,423,982

$ 1,457,183 (2.3 )% Excluding: Revenue from businesses sold (10,607

) (41,627 ) (121,040 ) (143,692 ) Excluding: Foreign exchange

decrease 19,913 — 39,894 —

International revenue, excluding effects

of foreignexchange and revenue from businesses sold

$ 388,422 $ 365,902 6.2 %

$ 1,342,836 $ 1,313,491

2.2 %

Reconciliation of Consolidated and Segment Direct operating

and SG&A expenses, excluding effects of foreign exchange rates

and results from markets and businesses sold, to Consolidated and

Segment Direct operating and SG&A expenses

(In thousands) Three Months EndedDecember 31,

%

Change

Year EndedDecember 31, %

Change

2016 2015 2016 2015 Consolidated direct

operating and SG&A expenses $ 486,398 $ 526,166 (7.6 )% $

1,950,771 $ 2,026,406 (3.7 )%

Excluding: Operating expenses from markets

andbusinesses sold

(7,406 ) (43,614 ) (97,761 ) (171,014 )

Excluding: Foreign exchange decrease

13,751 — 38,962 —

Consolidated direct operating and SG&A

expenses,excluding effects of foreign exchange andoperating

expenses from markets and businessessold

$ 492,743 $ 482,552 2.1 %

$ 1,891,972 $ 1,855,392

2.0 % Americas direct operating and SG&A expenses $ 207,026 $

213,096 (2.8 )% $ 795,725 $ 830,636 (4.2 )%

Excluding: Operating expenses from

non-strategicmarkets sold

— (14,643 ) (1,770 ) (57,560 ) Excluding: Foreign exchange

(increase) decrease (260 ) — 5,724 —

Americas direct operating and SG&A

expenses,excluding effects of foreign exchange andoperating

expenses from non-strategic marketssold

$ 206,766 $ 198,453 4.2 %

$ 799,679 $ 773,076 3.4 %

International direct operating and SG&A expenses $ 279,372 $

313,070 (10.8 )% $ 1,155,046 $ 1,195,770 (3.4 )% Excluding:

Operating expenses from businesses sold (7,406 ) (28,971 ) (95,991

) (113,454 ) Excluding: Foreign exchange decrease 14,011 —

33,238 —

International direct operating and

SG&Aexpenses, excluding effects of foreign exchangeand

operating expenses from businesses sold

$ 285,977 $ 284,099 0.7 %

$ 1,092,293 $ 1,082,316

0.9 %

Reconciliation of Consolidated and Segment OIBDAN, excluding

effects of foreign exchange rates and results from markets and

businesses sold to, Consolidated and Segment Operating

income

(In thousands) Three Months EndedDecember 31,

%

Change

Year EndedDecember 31, %

Change

2016 2015 2016 2015 Consolidated

operating income $ 250,867 $ 116,282 115.7 % $ 637,531 $ 261,001

144.3 %

Excluding: Revenue, direct operating and

SG&Aexpenses from markets and businesses sold

(3,201 ) (25,896 ) (25,749 ) (77,852 ) Excluding: Foreign exchange

(increase) decrease 4,265 — 4,524 — Excluding: Non-cash

compensation expense 2,098 2,314 10,238 8,359 Excluding:

Depreciation and amortization 85,975 95,423 344,124 375,962

Excluding: Impairment charges — — 7,274 21,631 Excluding: Other

operating (income) expense, net (128,203 ) 5,068 (354,688 )

4,824

Consolidated OIBDAN, excluding effects of

foreignexchange and OIBDAN from markets andbusinesses sold

$ 211,801 $ 193,191 9.6 %

$ 623,254 $ 593,925 4.9 %

Americas Outdoor operating income $ 95,558 $ 98,500 (3.0 )% $

297,034 $ 313,871 (5.4 )%

Excluding: Revenue, direct operating and

SG&Aexpenses from non-strategic markets sold

— (13,240 ) (700 ) (47,614 ) Excluding: Foreign exchange decrease

119 — 1,997 — Excluding: Depreciation and amortization 44,771

52,940 185,654 204,514

Americas Outdoor OIBDAN, excluding effects

offoreign exchange and OIBDAN from non-strategic markets sold

$ 140,448 $ 138,200 1.6 %

$ 483,985 $ 470,771 2.8 %

International Outdoor operating income $ 60,061 $ 53,360 12.6 % $

116,178 $ 95,353 21.8 %

Excluding: Revenue, direct operating and

SG&Aexpenses of businesses sold

(3,201 ) (12,656 ) (25,049 ) (30,238 ) Excluding: Foreign exchange

decrease 5,902 — 6,656 — Excluding: Depreciation and amortization

39,683 41,099 152,758 166,060

International Outdoor OIBDAN, excluding

effectsof foreign exchange and OIBDAN frombusinesses sold

$ 102,445 $ 81,803 25.2 %

$ 250,543 $ 231,175 8.4 %

About Clear Channel Outdoor Holdings, Inc.

Clear Channel Outdoor Holdings, Inc., (NYSE: CCO) is one of the

world’s largest outdoor advertising companies, with over 590,000

displays in 35 countries across five continents, including 43 of

the 50 largest markets in the United States. Clear Channel Outdoor

Holdings offers many types of displays across its global platform

to meet the advertising needs of its customers. This includes a

growing digital platform that now offers more than 1,000 digital

billboards across 27 markets in the United States. Clear Channel

Outdoor Holdings’ International segment operates in 19 countries

across Asia and Europe in a wide variety of formats. More

information is available at www.clearchanneloutdoor.com and www.clearchannelinternational.com.

Certain statements in this press release constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of Clear Channel Outdoor Holdings, Inc. and its

subsidiary Clear Channel International B.V. to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. The words

or phrases “guidance,” “believe,” “expect,” “anticipate,”

“estimates,” “forecast” and similar words or expressions are

intended to identify such forward-looking statements. In addition,

any statements that refer to expectations or other

characterizations of future events or circumstances, such as

statements about our business plans, strategies and initiatives and

our expectations about certain markets, are forward-looking

statements. These statements are not guarantees of future

performance and are subject to certain risks, uncertainties and

other factors, some of which are beyond our control and are

difficult to predict. Various risks that could cause future

results to differ from those expressed by the forward-looking

statements included in this press release include, but are not

limited to: weak or uncertain global economic conditions; changes

in general economic and political conditions in the United States

and in other countries in which the Company currently does

business; industry conditions, including competition; the level of

expenditures on advertising; legislative or regulatory

requirements; fluctuations in operating costs; technological

changes and innovations; changes in labor conditions; capital

expenditure requirements; risks of doing business in foreign

countries; fluctuations in exchange rates and currency values; the

outcome of pending and future litigation; taxes and tax disputes;

changes in interest rates; shifts in population and other

demographics; access to capital markets and borrowed indebtedness;

the Company’s ability to implement its business strategies; risks

relating to the successful integration of the operations of

acquired businesses; risks that the anticipated cost savings from

the Company's strategic revenue and efficiency initiatives may not

persist; the impact of the Company’s substantial indebtedness,

including the effect of the Company’s leverage on its financial

position and earnings; the Company’s ability to generate sufficient

cash from operations or liquidity-generating transactions to make

payments on its indebtedness; the Company’s relationship with

iHeartCommunications, including its ability to elect all of the

members of the Company’s Board of Directors and its ability, as

controlling stockholder, to determine the outcome of matters

submitted to the stockholders and certain additional matters

governed by intercompany agreements between the Company and

iHeartCommunications; and the impact of these and additional

factors on iHeartCommunications, the Company’s primary direct or

indirect external source of capital, which could have a significant

need for capital in the future. Other unknown or unpredictable

factors also could have material adverse effects on the Company’s

future results, performance or achievements. In light of these

risks, uncertainties, assumptions and factors, the forward-looking

events discussed in this press release may not occur. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date stated, or if no date

is stated, as of the date of this press release. Other key risks

are described in the Company’s reports filed with the U.S.

Securities and Exchange Commission, including the section entitled

“Item 1A. Risk Factors” of Clear Channel Outdoor Holdings, Inc.’s

Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

Except as otherwise stated in this press release, the Company does

not undertake any obligation to publicly update or revise any

forward-looking statements because of new information, future

events or otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170223005467/en/

MediaWendy Goldberg,

212-377-1105Executive Vice President – CommunicationsorInvestorsEileen McLaughlin, 212-377-1116Vice

President – Investor Relations

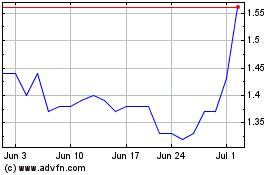

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

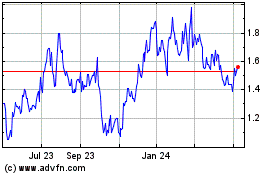

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Apr 2023 to Apr 2024