United Rentals Announces Pricing of Add-On Offering of $250 Million of 5.875% Senior Notes Due 2026 & $250 Million of 5.500% ...

February 22 2017 - 5:26PM

Business Wire

United Rentals, Inc. (NYSE:URI) (“United Rentals”) today

announced that its subsidiary, United Rentals (North America), Inc.

(“URNA”), has priced an offering of $250 million aggregate

principal amount of its 5.875% Senior Notes due 2026 (the

“Additional 2026 Notes”) at an issue price of 104.625% of their

aggregate principal amount plus accrued interest from September 15,

2016, for a yield of 5.253%, and an offering of $250 million

aggregate principal amount of its 5.500% Senior Notes due 2027 (the

“Additional 2027 Notes”, and together with the Additional 2026

Notes, the “Additional Notes”) at an issue price of 101.375% of

their aggregate principal amount plus accrued interest from

February 15, 2017, for a yield of 5.324%. The Additional 2026 Notes

will be part of the same series as the $750 million aggregate

principal amount of 5.875% Senior Notes due 2026 issued by URNA on

May 13, 2016. The Additional 2027 Notes will be part of the same

series as the $750 million aggregate principal amount of 5.500%

Senior Notes due 2027 issued by URNA on November 7, 2016.

The Additional Notes offered by URNA will rank:

- equally in right of payment with all of

URNA’s existing and future senior indebtedness,

- effectively junior to any of URNA’s

existing and future secured indebtedness, and

- senior in right of payment to any of

URNA’s future subordinated indebtedness.

URNA’s obligations under the Additional Notes will be guaranteed

on a senior unsecured basis by United Rentals and certain of URNA’s

domestic subsidiaries.

Aggregate net proceeds from the sale of the Additional Notes are

expected to be approximately $507 million, after underwriting

discounts and commissions and payments of estimated fees and

expenses. URNA intends to use the net proceeds from its offering of

the Additional Notes and additional borrowings of approximately

$523 million under its senior secured asset-based revolving credit

facility (the “ABL Facility”) to finance a portion of the $965

million purchase price for URNA’s previously announced pending

acquisition of NES Rentals Holdings II, Inc., a large rental

equipment company specializing in aerial equipment (the “NES

Acquisition”), and to pay related fees and expenses. Pending the

closing of the NES Acquisition, the net proceeds from the offering

will be used to repay borrowing under the ABL Facility. URNA

expects to then borrow under the ABL Facility to fund the NES

Acquisition. In the event the NES Acquisition is not consummated,

the net proceeds from the offering that were used to repay

borrowing under the ABL Facility may be reborrowed for general

corporate purposes. URNA expects the Notes offering to close on

February 27, 2017, subject to customary closing conditions.

Wells Fargo Securities, BofA Merrill Lynch, Morgan Stanley,

Barclays, Citigroup, Deutsche Bank Securities, J.P. Morgan, MUFG

and Scotiabank are the joint book-running managers for the

offering, with Wells Fargo Securities serving as lead book-running

manager.

This news release does not constitute an offer to sell or a

solicitation of an offer to buy, nor shall there be any sale of any

of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

The securities being offered have not been approved or disapproved

by any regulatory authority, nor has any such authority passed upon

the accuracy or adequacy of the prospectus supplements or the shelf

registration statement or prospectus.

United Rentals has filed a registration statement (including a

prospectus and a related preliminary prospectus supplement) with

the U.S. Securities and Exchange Commission (“SEC”) for the

offering to which this communication relates. Before you invest,

you should read the preliminary prospectus supplement and

prospectus in that registration statement and other documents

United Rentals has filed with the SEC for more complete information

about United Rentals and this offering. You may get these documents

for free by visiting EDGAR on the SEC’s website at

http://www.sec.gov. Alternatively, copies of the preliminary

prospectus supplement and accompanying prospectus for the offering

may be obtained by contacting Wells Fargo Securities, LLC,

Attention: Wells Fargo Securities Customer Service, 608 2nd Avenue,

South Minneapolis, MN 55402, (800) 645-3751 or via email at

wfscustomerservice@wellsfargo.com.

About United Rentals

United Rentals is the largest equipment rental company in the

world. The company has an integrated network of 887 rental

locations in 49 states and every Canadian province. The company’s

approximately 12,500 employees serve construction and industrial

customers, utilities, municipalities, homeowners and others. The

company offers approximately 3,200 classes of equipment for rent

with a total original cost of $8.99 billion. United Rentals is a

member of the Standard & Poor’s 500 Index, the Barron’s 400

Index and the Russell 3000 Index® and is headquartered in Stamford,

Conn. Additional information about United Rentals is available at

UnitedRentals.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and the Private Securities Litigation Reform Act of

1995, known as the PSLRA. These statements can generally be

identified by the use of forward-looking terminology such as

“believe,” “expect,” “may,” “will,” “should,” “seek,” “on-track,”

“plan,” “project,” “forecast,” “intend” or “anticipate,” or the

negative thereof or comparable terminology, or by discussions of

vision, strategy or outlook. These statements are based on current

plans, estimates and projections, and, therefore, you should not

place undue reliance on them. No forward-looking statement can be

guaranteed, and actual results may differ materially from those

projected. Factors that could cause actual results to differ

materially from those projected include, but are not limited to,

the possibility that potential debt investors will not be receptive

to the offering on the terms described above or at all; corporate

developments that could preclude, impair or delay the

above-described transactions due to restrictions under the federal

securities laws; changes in the terms or availability of our credit

facility; changes in our credit rating; changes in our cash

requirements or financial position; changes in general market,

economic, tax, regulatory or industry conditions that impact our

ability or willingness to consummate the above-described

transactions on the terms described above or at all; and our

continued access to credit markets on favorable terms. For a more

complete description of these and other possible risks and

uncertainties, please refer to our Annual Report on Form 10-K for

the year ended December 31, 2016, as well as to our subsequent

filings with the SEC. The forward-looking statements contained

herein speak only as of the date hereof, and we make no commitment

to update or publicly release any revisions to forward-looking

statements in order to reflect new information or subsequent

events, circumstances or changes in expectations.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170222006689/en/

United Rentals, Inc.Ted Grace, 203-618-7122Cell:

203-399-8951tgrace@ur.com

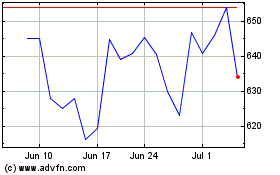

United Rentals (NYSE:URI)

Historical Stock Chart

From Mar 2024 to Apr 2024

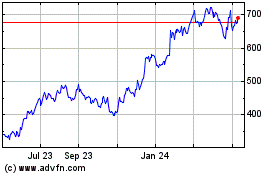

United Rentals (NYSE:URI)

Historical Stock Chart

From Apr 2023 to Apr 2024