Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

February 22 2017 - 4:28PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433 of the Securities Act of 1933

Issuer Free Writing Prospectus dated February 22, 2017

Relating to Preliminary Prospectus Supplement dated February 22, 2017

Registration No. 333-209249

Final Pricing Term Sheet

February 22, 2017

|

|

|

|

|

Issuer:

|

|

Chimera Investment Corporation

|

|

|

|

|

Securities Offered:

|

|

8.00% Series B Fixed-to-Floating Rate Cumulative

Redeemable Preferred Stock

|

|

|

|

|

Shares Offered:

|

|

12,000,000 shares

|

|

|

|

|

Over-Allotment Option:

|

|

1,800,000 shares

|

|

|

|

|

Trade Date:

|

|

February 22, 2017

|

|

|

|

|

Settlement and Delivery Date:

|

|

February 27, 2017 (T + 3)

|

|

|

|

|

Public Offering Price:

|

|

$25.00 liquidation preference per share; $300,000,000 in aggregate liquidation preference (assuming the over-allotment option is not exercised)

|

|

|

|

|

Underwriting Discount:

|

|

$0.7875 per share; $9,450,000 total (assuming the over-allotment option is not exercised)

|

|

|

|

|

Net Proceeds to the Issuer,

Before Expenses:

|

|

$24.2125 per share; $290,550,000 total (assuming the over-allotment option is not exercised)

|

|

|

|

|

Dividend Rate:

|

|

From and including the original issue date to, but excluding, March 30, 2024, at a fixed rate equal to 8.00% per annum of the $25.00 liquidation preference ($2.00 per annum per share), and from and including March 30, 2024, at a

floating rate equal to three-month LIBOR plus a spread of 5.791% per annum

|

|

|

|

|

Dividend Payment Date:

|

|

Quarterly cumulative dividends, in arrears, on March 30, June 30, September 30 and December 30 (provided that if any dividend payment date is not a business day, then the dividend which would otherwise have been payable on

that dividend payment date may be paid on the next succeeding business day). The first dividend will be payable on June 30, 2017 (long first dividend period) in the amount of $0.68333 per share and will be paid to the persons who are the

holders of record of the Series B Preferred Stock on the corresponding dividend record date fixed by the board of directors.

|

|

|

|

|

Dividend Record Date:

|

|

The date no fewer than ten days and no more than 35 days prior to the applicable dividend payment date, as shall be fixed by the board of directors

|

|

|

|

|

|

|

|

|

Liquidation Preference:

|

|

$25.00 per share

|

|

|

|

|

Optional Redemption Date:

|

|

March 30, 2024

|

|

|

|

|

Conversion Rights:

|

|

Share Cap

: 2.65111

Exchange Cap

: Subject to certain adjustments, the Exchange Cap will not exceed 31,813,320 shares of the Issuer’s common stock (or equivalent

Alternative Conversion Consideration, as applicable), subject to proportionate increase to the extent the underwriters’ over-allotment option to purchase additional shares of Series B Preferred Stock is exercised, not to exceed 36,585,318

shares of the Issuer’s common stock in total (or equivalent Alternative Conversion Consideration, as applicable).

|

|

|

|

|

|

|

If the Common Stock Price is less than $9.43 (which is 50% of the per share closing price of our common stock reported on the NYSE on February 21, 2017), subject to adjustment in certain circumstances, the holders of the Series B

Preferred Stock will receive a maximum of 2.65111 shares of our common stock per share of Series B Preferred Stock.

|

|

|

|

|

Proposed New York Stock

Exchange Listing Symbol:

|

|

CIM PRB

|

|

|

|

|

CUSIP:

|

|

16934Q 406

|

|

|

|

|

ISIN:

|

|

US16934Q4064

|

|

|

|

|

Joint Book-Running Managers:

|

|

Morgan Stanley & Co. LLC

UBS Securities

LLC

RBC Capital Markets, LLC

Keefe, Bruyette & Woods,

Inc.

|

The issuer has filed a registration statement (including a base prospectus dated February 1, 2016) and

a preliminary prospectus supplement, dated February 22, 2017 with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and the preliminary prospectus

supplement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, the

issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and related preliminary prospectus supplement if you request them from Morgan Stanley & Co. LLC by calling toll-free

(800) 584-6837 or by email at prospectus@morganstanley.com, UBS Securities LLC by calling toll-free (888) 827-7275, RBC Capital Markets, LLC by calling (866) 375-6829 or by email to rbcnyfixedincomeprospectus@rbccm.com, or Keefe,

Bruyette & Woods, Inc. by calling toll-free (800) 966-1559.

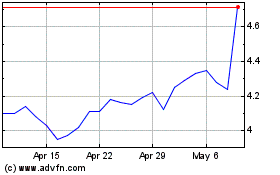

Chimera Investment (NYSE:CIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

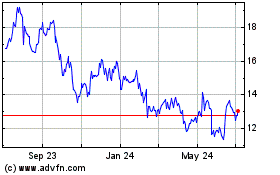

Chimera Investment (NYSE:CIM)

Historical Stock Chart

From Apr 2023 to Apr 2024