Envestnet (NYSE:ENV), the leading provider of intelligent

systems for wealth management and financial wellness, today

announced that it will report its results for the fourth quarter

and year ended December 31, 2016, upon the finalization of its

financial statements.

Envestnet is currently finalizing certain accounting matters,

primarily related to potential state and local non-income tax

obligations. In addition, the Company may conclude that certain

control deficiencies exist in internal controls over financial

reporting and may represent a material weakness over financial

reporting as of December 31, 2016. The resolution of these matters

may impact the timing of the filing of Envestnet’s Form 10-K for

the year ended December 31, 2016.

Envestnet is working diligently to complete its financial

statements and anticipates releasing its fourth quarter results and

holding a conference call to discuss its fourth quarter 2016

results and 2017 outlook as soon as practicable.

The Company also updated its financial outlook for the fourth

quarter ended December 31, 2016 as summarized below:

In Millions Except Adjusted EPS

Previous Updated

GAAP:

AUM/A revenue $ 92.5 - 93.5 $ 93.4 - 93.5

Subscription and licensing revenue

55.0 - 56.0 55.7 - 55.8 Professional services and other revenue 5.5

- 6.0 6.0 - 6.1 Revenues $ 153.0 - 155.5 $ 155.1 - 155.5

Cost of revenues $ 48.5 - 49.5 $ 48.2 - 48.3 Net Income - -

Diluted shares outstanding 45.0 44.8 Net Income per Diluted Share -

-

Non-GAAP:

Adjusted Revenues(1) $ 153.0 - 155.5 $ 155.6 - 156.0 Adjusted

EBITDA(1) 29.0 - 30.0 30.1 - 30.5 Adjusted Net Income per Diluted

Share(1) $0.30 $0.32

Included in the Company’s adjusted revenues is approximately

$0.5 million in acquired deferred revenue not recognizable under

GAAP. The Company does not forecast net income and net income per

share due to the unpredictable nature of various items adjusted for

non-GAAP disclosure purposes, including the periodic GAAP income

tax provision.

Included at the end of this press release are various operating

metrics for the quarter and year ended December 31, 2016.

Neither the items included in the Company’s financial outlook

above nor the operating metrics included below will be

affected by any exposure to the potential state and local

non-income tax obligations referred to above.

About Envestnet

Envestnet, Inc. (NYSE: ENV) is the leading provider of

intelligent systems for wealth management and financial wellness.

Envestnet’s unified technology enhances advisor productivity and

strengthens the wealth management process. Envestnet empowers

enterprises and advisors to more fully understand their clients and

deliver better outcomes.

Envestnet enables financial advisors to better manage client

outcomes and strengthen their practices. Institutional-quality

research and advanced portfolio solutions are provided through

Envestnet | PMC, our Portfolio Management Consultants group.

Envestnet | Yodlee is a leading data aggregation and data analytics

platform powering dynamic, cloud-based innovation for digital

financial services. Envestnet | Tamarac provides leading

rebalancing, reporting, and practice management software for

advisors. Envestnet | Retirement Solutions provides retirement

advisors with an integrated platform that combines leading practice

management technology, research and due diligence, data

aggregation, compliance tools, fiduciary solutions and intelligent

managed account solutions.

More than 52,000 advisors and 2,500 companies including: 16 of

the 20 largest U.S. banks, 38 of the 50 largest wealth management

and brokerage firms, over 500 of the largest Registered Investment

Advisers, and hundreds of Internet services companies, leverage

Envestnet technology and services. Envestnet solutions enhance

knowledge of the client, accelerate client on-boarding, improve

client digital experiences, and help drive better outcomes for

enterprises, advisors, and their clients.

For more information on Envestnet, please visit

www.envestnet.com and follow @ENVintel.

(1) Non-GAAP Financial Measures

“Adjusted revenues” exclude the effect of purchase accounting on

the fair value of acquired deferred revenue. Under United States

generally accepted accounting principles (GAAP), we record at fair

value the acquired deferred revenue for contracts in effect at the

time the entities were acquired. Consequently, revenue related to

acquired entities for periods subsequent to the acquisition does

not reflect the full amount of revenue that would have been

recorded by these entities had they remained stand-alone

entities.

“Adjusted EBITDA” represents net income before deferred revenue

fair value adjustment, interest income, interest expense, accretion

on contingent consideration, income tax provision (benefit),

depreciation and amortization, non-cash compensation expense,

restructuring charges and transaction costs, severance, fair market

value adjustment on contingent consideration, litigation related

expense, foreign currency and related hedging activity, non-income

tax adjustment, other (income) expense, impairment of equity method

investment, loss allocation from equity method investment and loss

attributable to non-controlling interest.

“Adjusted net income” represents net income before deferred

revenue fair value adjustment, non-cash interest expense, non-cash

compensation expense, accretion on contingent consideration,

restructuring charges and transaction costs, severance, fair market

value adjustment on contingent consideration, amortization of

acquired intangibles, litigation related expense, foreign currency

and related hedging activity, non-income tax adjustment, other

(income) expense, impairment of equity method investment, loss

allocation from equity method investment and loss attributable to

non-controlling interest. Reconciling items are presented gross of

tax, and a normalized tax rate is applied to the total of all

reconciling items to arrive at adjusted net income. The reconciling

items, and resulting adjusted net income, are presented on a

different basis than historically shown to eliminate the impact of

quarterly volatility of the GAAP tax provision (benefit) on the

Company’s adjusted earnings figures.

“Adjusted net income per share” represents adjusted net income

divided by the diluted number of weighted-average shares

outstanding.

Reconciliations are not provided for guidance on adjusted

EBITDA, adjusted net income and adjusted net income per share, as

the Company is unable to predict the amounts to be adjusted, such

as the GAAP tax provision. The Company’s Non-GAAP Financial

Measures should not be viewed as a substitute for revenues, net

income or net income per share determined in accordance with

GAAP.

Cautionary Statement Regarding Forward-Looking

Statements

The forward-looking statements made in this press release

concerning, among other things, Envestnet, Inc.’s (the

“Company”) expected financial performance for the fourth quarter

and full year of 2016, are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

These statements involve risks and uncertainties and the Company’s

actual results could differ materially from the results expressed

or implied by such forward-looking statements. Furthermore,

reported results should not be considered as an indication of

future performance. The potential risks, uncertainties and other

factors that could cause actual results to differ from those

expressed by the forward-looking statements in this press release

include, but are not limited to, potential exposure to state and

local non-income tax obligations; the impact of any inability to

timely complete the Company’s audit of its financial statements and

file its Form 10-K; the Company’s ability to remediate any material

weaknesses in internal controls over financial reporting which may

have contributed to any delay in completion of the Company’s

financial statements and filing of its Form 10-K; difficulty in

sustaining rapid revenue growth, which may place significant

demands on the Company’s administrative, operational and financial

resources, the concentration of nearly all of the Company’s

revenues from the delivery of investment solutions and services to

clients in the financial services industry, the impact of market

and economic conditions on revenues, the Company’s reliance on a

limited number of clients for a material portion of its revenue,

the renegotiation of fee percentages or termination of the

Company’s services by its clients, the Company’s ability to

identify potential acquisition candidates, complete acquisitions

and successfully integrate acquired companies, the impact of market

and economic conditions on revenue, the Company’s inability to

successfully execute the conversion of its clients’ assets from

their technology platform to the Company’s technology platform in a

timely and accurate manner, the Company’s ability to expand its

relationships with existing customers, grow the number of customers

and derive revenue from new offerings such as its data analytic

solutions and market research services and premium FinApps,

compliance failures, adverse judicial or regulatory proceedings

against the Company, liabilities associated with potential,

perceived or actual breaches of fiduciary duties and/or conflicts

of interest, changes in laws and regulations, general economic

conditions, political and regulatory conditions, the impact of

fluctuations in market conditions and interest rates on the demand

for the Company’s products and services and the value of assets

under management or administration, the impact of market conditions

on the Company’s ability to issue debt and equity, the impact of

fluctuations in interest rates on the Company’s cost of borrowing,

the Company’s financial performance, the results of the Company’s

investments in research and development, our data center and other

infrastructure, the Company’s ability to maintain the security and

integrity of its systems and facilities and to maintain the privacy

of personal information, failure of the Company’s systems to work

properly, the Company’s ability to realize operating efficiencies,

the advantages of the Company’s solutions as compared to those of

others, the failure to protect the Company’s intellectual property

rights, the Company’s ability to establish and maintain

intellectual property rights, the Company’s ability to retain and

hire necessary employees and appropriately staff its, and

management’s response to these factors. More information regarding

these and other risks, uncertainties and factors is contained in

the Company’s filings with the Securities and Exchange Commission

(“SEC”) which are available on the SEC’s website at www.sec.gov or

the Company’s Investor Relations website at

http://ir.envestnet.com/. You are cautioned not to unduly rely on

these forward-looking statements, which speak only as of the date

of this press release. All information in this press release is as

of February 22, 2017 and, unless required by law, the Company

undertakes no obligation to publicly revise any forward-looking

statement to reflect circumstances or events after the date of this

press release or to report the occurrence of unanticipated

events.

Envestnet, Inc. Historical Assets, Accounts and

Advisors (in millions, except accounts and advisors)

(unaudited) As

of

December 31,2015

March 31,2016

June 30,2016

September 30, 2016

December 31, 2016

Platform Assets Assets Under Management (AUM) $

92,559 $ 95,489 $ 96,700 $ 101,924 $ 105,178 Assets Under

Administration (AUA) 197,177 207,537

220,690 231,831 241,682 Subtotal

AUM/A 289,736 303,026 317,390 333,755 346,860 Licensing

561,699 576,988 685,952

721,690 748,125

Total Platform Assets $

851,435 $ 880,014 $ 1,003,342 $ 1,055,445

$ 1,094,985

Platform Accounts AUM 490,471

498,449 503,147 519,717 545,130 AUA 807,708

904,373 935,870 961,590

994,583 Subtotal AUM/A 1,298,179 1,402,822 1,439,017 1,481,307

1,539,713 Licensing 2,176,068 2,237,427

4,304,645 4,394,670 4,558,883

Total Platform Accounts 3,474,247

3,640,249 5,743,662 5,875,977

6,098,596

Advisors AUM/A 33,775 35,718 35,067

35,861 36,483 Licensing 13,553 13,675

16,081 16,191 17,852

Total

Advisors 47,328 49,393

51,148 52,052 54,335

The following tables summarize the changes in AUM and AUA for

the three months ended December 31, 2016:

In Millions

Except Accounts 9/30/2016

GrossSales

Redemp-tions

NetFlows

MarketImpact

12/31/2016 Assets under Management (AUM) $

101,924 $ 9,916 $ (6,635 ) $ 3,281 $ (27 ) $ 105,178

Assets

under Administration (AUA) 231,831 23,400

(15,890 ) 7,510 2,341

241,682

Total AUM/A $ 333,755 $

33,316 $ (22,525 )

$ 10,791 $ 2,314 $

346,860 Fee-Based Accounts 1,481,307 58,406 1,539,713

The above AUM/A gross sales figures include $5.3 billion in new

client conversions. The Company onboarded an additional $19.0

billion in licensing conversions during the fourth quarter,

bringing total conversions for the quarter to $24.3 billion.

The following tables summarize the changes in AUM and AUA for

the year ended December 31, 2016:

In Millions

Except Accounts 12/31/2015

GrossSales

Redemp-tions

Net Flows

MarketImpact

12/31/2016 Assets under Management (AUM) $

92,559 $ 34,504 $ (26,698 ) $ 7,806 $ 4,813 $ 105,178

Assets

under Administration (AUA) 197,177 84,253

(54,942 ) 29,311 15,194 241,682

Total AUM/A $ 289,736 $ 118,757

$ (81,640 ) $

37,117 $ 20,007 $ 346,860

Fee-Based Accounts 1,298,179 241,534 1,539,713

The above AUM/A gross sales figures include $17.1 billion in new

client conversions. The Company onboarded an additional $137.4

billion in licensing conversions during 2016, bringing total

conversions for the year to $154.5 billion.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170222005871/en/

Envestnet, Inc.Investor

Relations312-827-3940investor.relations@envestnet.comorMedia

Relationsmediarelations@envestnet.com

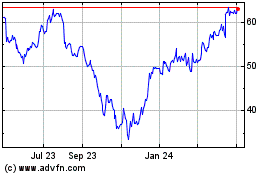

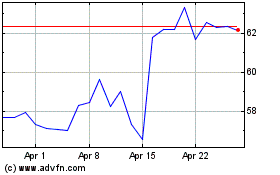

Envestnet (NYSE:ENV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Envestnet (NYSE:ENV)

Historical Stock Chart

From Apr 2023 to Apr 2024