The information in this pricing supplement is

not complete and may be changed. This pricing supplement is not an offer to sell nor does it seek an offer to buy these notes in

any jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-211718

Subject

to Completion, Dated February 22, 2017.

|

The Toronto-Dominion

Bank

$

Leveraged

Capped Buffered S&P 500® Index-Linked Notes due |

| |

|

| |

|

| |

|

|

The notes do not bear interest. The amount that you will be paid on your notes on the maturity

date (expected to be the third business day after the valuation date) is based on the performance of the S&P 500®

Index as measured from the pricing date to and including the valuation date (expected to be between 24 and 27 months after the

pricing date). If the final level on the valuation date is greater than the initial level (equal to the closing level of the index

on the pricing date), the return on your notes will be positive, subject to the maximum payment amount (expected to be between

$1,171.30 and $1,201.45 for each $1,000 principal amount of your notes). If the final level declines by up to 10.00% from the initial

level, you will receive the principal amount of your notes. If the final level declines by more than 10.00% from the initial

level, the return on your notes will be negative and, despite the inclusion of the buffer level, due to the downside multiplier

you may lose your entire principal amount.

To determine your payment at

maturity, we will calculate the percentage change of the S&P 500® Index, which is the percentage increase or

decrease in the final level from the initial level. At maturity, for each $1,000 principal amount of your notes, you will receive

an amount in cash equal to:

| ● | if the percentage change is positive (the final level is greater than the initial level), the sum

of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) 150.00% times (c) the percentage change, subject

to the maximum payment amount; |

| ● | if the percentage change is zero or negative but not below -10.00% (the final level is equal to

the initial level or is less than the initial level, but not by more than 10.00%), $1,000; or |

| ● | if the percentage change is negative and is below -10.00% (the final level is less than the initial

level by more than 10.00%), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) approximately

111.11% times (c) the sum of the percentage change plus 10.00%. |

The notes

do not guarantee the return of principal at maturity.

The notes are unsecured and

are not savings accounts or insured deposits of a bank. The notes are not insured or guaranteed by the Canada Deposit Insurance

Corporation, the U.S. Federal Deposit Insurance Corporation or any other governmental agency or instrumentality. Any payments on

the notes are subject to our credit risk. The notes will not be listed on any exchange.

You should read the disclosure

herein to better understand the terms and risks of your investment. See “Additional Risk Factors” on page P-7 of this

pricing supplement.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined that this pricing

supplement, the product prospectus supplement or the prospectus is truthful or complete. Any representation to the contrary is

a criminal offense.

The estimated value of your notes

at the time the terms of your notes are set on the pricing date is expected to be between $955.00 and $985.00 per $1,000 principal

amount. For a discussion of the estimated value and the price at which Goldman, Sachs & Co. would initially buy or sell your

notes, if it makes a market in the notes (which it is not obligated to do), see “Additional Information Regarding Estimated

Value of the Notes” on page P-2 of this pricing supplement.

| |

Public Offering Price |

Underwriting Discount |

Proceeds to TD |

| Per Note |

$1,000.00 |

$17.50 |

$982.50 |

| Total |

$ |

$ |

$ |

| TD Securities (USA) LLC |

Goldman, Sachs & Co. |

| |

Agent |

The public offering price, underwriting

discount and proceeds to TD listed above relate to the notes we issue initially. We may decide to sell additional notes after the

date of the final pricing supplement, at public offering prices and with underwriting discounts and proceeds to TD that differ

from the amounts set forth above. The return (whether positive or negative) on your investment in the notes will depend in part

on the public offering price you pay for such notes.

We or Goldman, Sachs & Co. (“GS&Co.”),

or any of our or their respective affiliates, may use this pricing supplement in the initial sale of the notes. In addition, we

or GS&Co. or any of our or their respective affiliates may use this pricing supplement in a market-making transaction in a

note after its initial sale. Unless we or GS&Co., or any of our or their respective affiliates, informs the purchaser otherwise

in the confirmation of sale, this pricing supplement will be used in a market-making transaction.

Additional

Information Regarding Estimated Value of the Notes

The estimated value of your notes

at the time the terms of your notes are set on the Pricing Date is expected to be between $955.00 and $985.00 per $1,000 principal

amount, which is less than the public offering price of your notes. The pricing models used to determine the estimated value

consider certain variables, including principally our credit spreads, interest rates (forecasted, current and historical rates),

volatility, price-sensitivity analysis and the time to maturity of the notes. The difference between the estimated value of your

notes and the public offering price is a result of certain factors, including principally the underwriting discount and commissions,

the expenses incurred in creating, documenting and marketing the notes, and an estimate of the difference between the amounts

we pay to GS&Co. or an affiliate and the amounts GS&Co. or an affiliate pays to us in connection

with your notes, as described further under “Supplemental Plan of Distribution (Conflicts of Interest)” on page P-23.

We pay to GS&Co. or an affiliate amounts based on what we would pay to holders of a non-structured note with a similar

maturity. In return for such payment, GS&Co. or an affiliate pays to us the amounts we owe under your notes.

The

price at which GS&Co. will make a market in the notes (if it makes a market, which it is not obligated to do), and the value

of your notes shown on your account statement, will be based on pricing models and variables similar to those used in determining

the estimated value on the Pricing Date. The value of your notes at any time will reflect many factors and cannot be predicted;

however, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would initially buy or

sell notes (if it makes a market, which it is not obligated to do) and the value that GS&Co. will initially use for account

statements and otherwise is equal to approximately the estimated value of your notes on the pricing date, plus an additional amount

(initially equal to $ per $1,000 principal amount). Prior to , the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co.

would buy or sell your notes (if it makes a market, which it is not obligated to do) will equal approximately the sum of (a) the

then-current estimated value of your notes (as determined by reference to GS&Co.’s pricing models) plus (b) any remaining

additional amount (the additional amount will decline to zero on a straight-line basis from the time of pricing through approximately

3 months after the Pricing Date). On and after , the price (not including GS&Co.’s

customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market) will equal approximately

the then-current estimated value of your notes determined by reference to such pricing models.

We urge you to read the “Additional

Risk Factors” beginning on page P-7 of this pricing supplement.

Summary

The information in this “Summary”

section is qualified by the more detailed information set forth in this pricing supplement, the product prospectus supplement and

the prospectus.

| Issuer: |

The Toronto-Dominion Bank (“TD”) |

| Issue: |

Senior Debt Securities |

| Type of Note: |

Leveraged Capped Buffered Notes (the “Notes”) |

| Term: |

Expected to be between 24 and 27 months |

| Reference Asset: |

S&P 500® Index (Bloomberg Ticker: SPX) |

| CUSIP / ISIN: |

89114QZL5 / US89114QZL57 |

| Agents: |

TD Securities (USA) LLC (“TDS”) and Goldman, Sachs & Co. (“GS&Co.”) |

| Currency: |

U.S. Dollars |

| Minimum Investment: |

$1,000 and minimum denominations of $1,000 in excess thereof |

| Principal Amount: |

$1,000 per Note; $ in the aggregate for all the offered Notes; the aggregate principal amount of the offered Notes may be increased if the Issuer, at its sole option, decides to sell an additional amount of the offered Notes on a date subsequent to the date of the final pricing supplement. |

| Pricing Date: |

[ ] |

| Issue Date: |

Expected to be five Business Days following the Pricing Date. |

| Valuation Date: |

Expected to be between 24 and 27 months after the Pricing Date, subject to postponement for market and other disruptions, as described under “General Terms of the Notes—Valuation Date” on page PS-18 in the product prospectus supplement. |

| Maturity Date: |

Expected to be three Business Days following the Valuation Date, subject to postponement for market and other disruptions, as described under “General Terms of the Notes—Maturity Date” on page PS-18 in the product prospectus supplement. |

| Payment at Maturity: |

For each $1,000 principal amount of the

Notes, we will pay you on the Maturity Date an amount in cash equal to:

●

if the Final Level is greater than or equal to the Cap Level, the Maximum Payment Amount;

●

if the Final Level is greater than the Initial Level but less than the Cap Level, the sum of (i) $1,000

plus (ii) the product of (a) $1,000 times (b) the Leverage Factor times (c) the Percentage Change;

●

if the Final Level is equal to or less than the Initial Level but greater than or equal to the Buffer Level, $1,000; or

●

if the Final Level is less than the Buffer Level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the

Downside Multiplier times (c) the sum of the Percentage Change plus the Buffer Percentage

If the Final Level is less than the

Buffer Level, the investor will receive less than the principal amount of the Notes at maturity and may lose their entire principal

amount. |

| Leverage Factor: |

150.00% |

| Cap Level: |

Expected to be between 111.42% and 113.43% of the Initial Level (to be determined on the Pricing Date) |

| Buffer Percentage: |

10.00% |

| Buffer Level: |

90.00% of the Initial Level |

| Downside Multiplier: |

The quotient of the Initial Level divided by the Buffer Level, which equals approximately 111.11% |

| Maximum Payment Amount: |

Between $1,171.30 and $1,201.45 per $1,000 principal amount of the Notes (117.130% to 120.145% of the principal amount of the Notes). As a result of the Maximum Payment Amount, the maximum return at maturity of the Notes will be between 17.130% and 20.145% of the principal amount of the Notes. The actual Maximum Payment Amount will be determined on the Pricing Date. |

| Percentage Change: |

The quotient of (1) the Final Level minus the Initial Level divided by (2) the Initial Level, expressed as a percentage. |

| Initial Level: |

The Closing Level of the Reference Asset on the Pricing Date |

| Final Level: |

The Closing Level of the Reference Asset on the Valuation Date, except in the limited circumstances described under “General Terms of the Notes—Market Disruption Events” on page PS-18 of the product prospectus supplement and subject to adjustment as provided under “General Terms of the Notes—Unavailability of the Level of the Reference Asset” on page PS-18 of the product prospectus supplement. |

| Closing Level: |

The Closing Level of the Reference Asset will be the official closing level of the Reference Asset or any successor index (as defined in the product prospectus supplement) on any Trading Day for the Reference Asset, as displayed on Bloomberg Professional® service (“Bloomberg”) page “SPX <INDEX>” or any successor page on Bloomberg or any successor service, as applicable. |

| Business Day: |

Any day that is a Monday, Tuesday, Wednesday, Thursday or Friday that is neither a legal holiday nor a day on which banking institutions are authorized or required by law to close in New York City or Toronto. |

| U.S. Tax Treatment: |

By purchasing a Note, each holder agrees, in the absence of a statutory, regulatory, administrative or judicial ruling to the contrary, to characterize the Notes, for U.S. federal income tax purposes, as pre-paid derivative contracts with respect to the Reference Asset. Based on certain factual representations received from us, in the opinion of our special U.S. tax counsel, Cadwalader, Wickersham & Taft LLP, it is reasonable to treat the Notes in the manner described above. However, because there is no authority that specifically addresses the tax treatment of the Notes, it is possible that your Notes could alternatively be treated for tax purposes as a single contingent payment debt instrument, or pursuant to some other characterization, such that the timing and character of your income from the Notes could differ materially from the treatment described above. Please see the discussion below under “Supplemental Discussion of U.S. Federal Income Tax Consequences”. |

| Canadian Tax Treatment: |

Please see the discussion in the product prospectus supplement under “Supplemental Discussion of Canadian Tax Consequences,” which applies to the Notes. |

| Calculation Agent: |

TD |

| Listing: |

The Notes will not be listed on any securities exchange. |

| Clearance and Settlement: |

DTC global (including through its indirect participants Euroclear and Clearstream, Luxembourg as described under “Forms of the Debt Securities” and “Book-Entry Procedures and Settlement” in the prospectus). |

The Pricing Date, the Issue Date, the

Valuation Date and the Maturity Date are subject to change. These dates will be set forth in the final pricing supplement that

will be made available in connection with sales of the Notes.

Additional

Terms of Your Notes

You should read this pricing supplement

together with the prospectus, as supplemented by the product prospectus supplement, relating to our Senior Debt Securities, of

which these Notes are a part. Capitalized terms used but not defined in this pricing supplement will have the meanings given to

them in the product prospectus supplement. In the event of any conflict the following hierarchy will govern: first, this pricing

supplement; second, the product prospectus supplement; and last, the prospectus. The Notes vary from the terms described

in the product prospectus supplement in several important ways. You should read this pricing supplement carefully.

This pricing supplement, together with

the documents listed below, contains the terms of the Notes and supersedes all prior or contemporaneous oral statements as well

as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation,

sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters

set forth in “Additional Risk Factors” beginning on page P-7 of this pricing supplement, “Additional Risk Factors

Specific to the Notes” beginning on page PS-5 of the product prospectus supplement and “Risk Factors” on page

1 of the prospectus, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment,

legal, tax, accounting and other advisors before you invest in the Notes. You may access these documents on the Securities and

Exchange Commission (the “SEC”) website at www.sec.gov as follows (or if that address has changed, by reviewing our

filings for the relevant date on the SEC website):

| § | Prospectus dated June 30, 2016: |

| § | Product Prospectus Supplement MLN-EI-1 dated June 30, 2016: |

https://www.sec.gov/Archives/edgar/data/947263/000089109216015847/e70323_424b2.htm

Our Central Index Key, or CIK, on the

SEC website is 0000947263. As used in this pricing supplement, the “Bank,” “we,” “us,” or “our”

refers to The Toronto-Dominion Bank and its subsidiaries. Alternatively, The Toronto-Dominion Bank, any agent or any dealer participating

in this offering will arrange to send you the product prospectus supplement and the prospectus if you so request by calling 1-855-303-3234.

Additional

Risk Factors

The Notes involve risks not associated

with an investment in conventional debt securities. This section describes the most significant risks relating to the terms of

the Notes. For additional information as to these risks, please see “Additional Risk Factors Specific to the Notes”

in the product prospectus supplement and “Risk Factors” in the prospectus.

You should carefully consider whether

the Notes are suited to your particular circumstances before you decide to purchase them. Accordingly, prospective investors should

consult their investment, legal, tax, accounting and other advisors as to the risks entailed by an investment in the Notes and

the suitability of the Notes in light of their particular circumstances.

Principal at Risk.

Investors in the Notes

could lose their entire principal amount if there is a decline in the level of the Reference Asset by more than the Buffer Percentage.

If the Final Level is less than the Initial Level by more than 10.00%, you will lose a portion of each $1,000 principal amount

in an amount equal to the Downside Multiplier multiplied by the sum of the negative Percentage Change plus the Buffer Percentage

times $1,000. Specifically, you will lose approximately 1.1111% of the principal amount of each of your Notes for every 1% that

the Final Level is less than the Initial Level in excess of the Buffer Percentage and you may lose your entire principal amount.

The Notes Do Not Pay Interest and Your

Return on the Notes May Be Less Than the Return on Conventional Debt Securities of Comparable Maturity.

There will be no periodic interest payments

on the Notes as there would be on a conventional fixed-rate or floating-rate debt security having the same term. The return that

you will receive on the Notes, which could be negative, may be less than the return you could earn on other investments. Even if

your return is positive, your return may be less than the return you would earn if you bought a conventional senior interest bearing

debt security of TD.

Your Potential Return on the Notes

Is Limited by the Maximum Payment Amount and May Be Less Than the Return on a Direct Investment In the Reference Asset.

The opportunity to participate in the

possible increases in the level of the Reference Asset through an investment in the Notes will be limited because the Payment at

Maturity will not exceed the Maximum Payment Amount. Furthermore, the effect of the Leverage Factor will not be taken into account

for any Final Level exceeding the Cap Level no matter how much the level of the Reference Asset may rise above the Cap Level. Accordingly,

your return on the Notes may be less than your return would be if you made an investment in a security directly linked to the performance

of the Reference Asset.

Investors Are Subject to TD’s

Credit Risk, and TD’s Credit Ratings and Credit Spreads May Adversely Affect the Market Value of the Notes.

Although the return on the Notes will

be based on the performance of the Reference Asset, the payment of any amount due on the Notes is subject to TD’s credit

risk. The Notes are TD’s unsecured debt obligations. Investors are dependent on TD’s ability to pay all amounts due

on the Notes on the Maturity Date, and, therefore, investors are subject to the credit risk of TD and to changes in the market’s

view of TD’s creditworthiness. Any decrease in TD’s credit ratings or increase in the credit spreads charged by the

market for taking TD’s credit risk is likely to adversely affect the market value of the Notes.

The Agent Discount, Offering Expenses

and Certain Hedging Costs Are Likely to Adversely Affect Secondary Market Prices.

Assuming no changes in market conditions

or any other relevant factors, the price, if any, at which you may be able to sell the Notes will likely be lower than the public

offering price. The public offering price includes, and any price quoted to you is likely to exclude, the underwriting discount

paid in connection with the initial distribution, offering expenses as well as the cost of hedging our obligations under the Notes.

In addition, any such price is also likely to reflect dealer discounts, mark-ups and other transaction costs, such as a discount

to account for costs associated with establishing or unwinding any related hedge transaction. In addition, if the dealer from which

you purchase Notes, or one of its affiliates, is to conduct hedging activities for us in connection with the Notes, that dealer,

or one of its affiliates, may profit in connection with such hedging activities and such profit, if any, will be in addition to

the compensation that the dealer receives for the sale of the Notes to you. You should be aware that the potential for the dealer

or one of its affiliates to earn fees in connection with hedging activities may create a further incentive for the dealer to sell

the Notes to you in addition to the compensation they would receive for the sale of the Notes.

There May Not Be an Active Trading

Market for the Notes — Sales in the Secondary Market May Result in Significant Losses.

There may be little or no secondary market

for the Notes. The Notes will not be listed on any securities exchange. TDS, GS&Co. and our or their respective affiliates

may make a market for the Notes; however, they are not required to do so.

TDS, GS&Co. and our or their respective affiliates

may stop any market-making activities at any time. Even if a secondary market for the Notes develops, it may not provide significant

liquidity or trade at prices advantageous to you. We expect that transaction costs in any secondary market would be high. As a

result, the difference between bid and ask prices for your Notes in any secondary market could be substantial.

If you sell your Notes before the Maturity

Date, you may have to do so at a substantial discount from the public offering price irrespective of the level of the Reference

Asset and, as a result, you may suffer substantial losses.

If the Level of the Reference Asset

Changes, the Market Value of Your Notes May Not Change in the Same Manner.

Your Notes may trade quite differently

from the performance of the Reference Asset. Changes in the level of the Reference Asset may not result in a comparable change

in the market value of your Notes. Even if the level of the Reference Asset increases above the Initial Level during the life of

the Notes, the market value of your Notes may not increase by the same amount and could decline.

The Payment at Maturity Is Not Linked

to the Level of the Reference Asset at Any Time Other than the Valuation Date.

The Final Level will be the Closing Level

of the Reference Asset on the Valuation Date (subject to adjustment as described elsewhere in this pricing supplement). Therefore,

if the Closing Level of the Reference Asset dropped precipitously on the Valuation Date, the Payment at Maturity for your Notes

may be significantly less than it would have been had the Payment at Maturity been linked to the Closing Level of the Reference

Asset prior to such drop in the level of the Reference Asset. Although the actual level of the Reference Asset on the Maturity

Date or at other times during the life of your Notes may be higher than the Final Level, you will only benefit from the Closing

Level of the Reference Asset on the Valuation Date.

We May Sell an Additional Aggregate

Principal Amount of the Notes at a Different Public Offering Price.

At our sole option, we may decide to sell

an additional aggregate principal amount of the Notes subsequent to the date of the final pricing supplement. The public offering

price of the Notes in the subsequent sale may differ substantially (higher or lower) from the original public offering price you

paid as provided on the cover of the final pricing supplement.

If You Purchase Your Notes at a Premium

to Principal Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at Principal Amount and the

Impact of Certain Key Terms of the Notes Will be Negatively Affected.

The Payment at Maturity will not be adjusted

based on the public offering price you pay for the Notes. If you purchase Notes at a price that differs from the principal amount

of the Notes, then the return on your investment in such Notes held to the Maturity Date will differ from, and may be substantially

less than, the return on Notes purchased at principal amount. If you purchase your Notes at a premium to principal amount and hold

them to the Maturity Date, the return on your investment in the Notes will be lower than it would have been had you purchased the

Notes at principal amount or a discount to principal amount. In addition, the impact of the Buffer Level and the Cap Level on the

return on your investment will depend upon the price you pay for your Notes relative to principal amount. For example, if you purchase

your Notes at a premium to principal amount, the Cap Level will only permit a lower positive return on your investment in the Notes

than would have been the case for Notes purchased at principal amount or a discount to principal amount. Similarly, the Buffer

Level, while still providing some protection for the return on the Notes, will allow a greater percentage decrease in your investment

in the Notes than would have been the case for Notes purchased at principal amount or a discount to principal amount.

You Will Not Have Any Rights to the

Securities Included in the Reference Asset.

As a holder of the Notes,

you will not have voting rights or rights to receive cash dividends or other distributions or other rights that holders of securities

included in the Reference Asset (“Reference Asset Constituents”) would have. The Final Level will not reflect any dividends

paid on any Reference Asset Constituents.

We Have No Affiliation with the Index

Sponsor and Will Not Be Responsible for Any Actions Taken by the Index Sponsor.

S&P Dow Jones Indices

LLC, a division of The McGraw-Hill Companies, Inc. (the “Index Sponsor”) is not an affiliate of ours and will not be

involved in any offerings of the Notes in any way. Consequently, we have no control of any actions of the Index Sponsor, including

any actions of the type that would require the Calculation Agent to adjust the Payment at Maturity. The Index Sponsor does not

have any obligation of any sort with respect to the Notes. Thus, the Index Sponsor has no obligation to take your interests into

consideration for any reason, including in taking any actions that might affect the value of the Notes. None of our proceeds from

any issuance of the Notes will be delivered to the Index Sponsor, except to the extent that we are required to pay the Index Sponsor

licensing fees with respect to the Reference Asset.

The Business Activities of the Issuer

or its Affiliates or GS&Co. or its Affiliates May Create Conflicts of Interest.

We, GS&Co. and our

or their respective affiliates expect to engage in trading activities related to the Reference Asset or any Reference Asset Constituents

that are not for the account of holders of the Notes or on their behalf. These trading activities may present a conflict between

the holders’ interests in the Notes and the interests we, GS&Co., and our or their respective affiliates will have in

their proprietary accounts, in facilitating transactions, including options and other derivatives transactions, for their customers

and in accounts under their management. These trading activities, if they influence the level of the Reference Asset, could be

adverse to the interests of the holders of the Notes. We, GS&Co. and one or more of our or their respective affiliates

may, at present or in the future, engage in business with the Reference Asset Constituent Issuers, including making loans to or

providing advisory services. These services could include investment banking and merger and acquisition advisory services. These

activities may present a conflict between our or one or more of our or their affiliates’ obligations and your interests as

a holder of the Notes. Moreover, we, GS&Co. and our or their respective affiliates may have published, and in the future expect

to publish, research reports with respect to the Reference Asset or any Reference Asset Constituents. This research is modified

from time to time without notice and may express opinions or provide recommendations that are inconsistent with purchasing or holding

the Notes. Any of these activities by us, GS&Co., or one or more of our or their respective affiliates may affect the level

of the Reference Asset, and, therefore, the market value of the Notes.

Trading Activities by TD, the Agents

and Their Respective Affiliates May Adversely Affect the Market Value of the Notes.

TD, GS&Co. and our or their respective

affiliates may hedge our obligations under the Notes by purchasing securities, futures, options or other derivative instruments

with returns linked or related to changes in the level of the Reference Asset or prices of the Reference Asset Constituents, and

we or they may adjust these hedges by, among other things, purchasing or selling securities, futures, options or other derivative

instruments at any time. It is possible that we, GS&Co. or one or more of our or their respective affiliates could receive

substantial returns from these hedging activities while the market value of the Notes declines. We, GS&Co. or one or more of

our or their respective affiliates may also issue or underwrite other securities or financial or derivative instruments with returns

linked or related to changes in the performance of the Reference Asset or Reference Asset Constituents.

These trading activities may present a

conflict between the holders’ interest in the Notes and the interests we, GS&Co. and our or their respective affiliates

will have in our or their proprietary accounts, in facilitating transactions, including options and other derivatives transactions,

for our or their customers’ accounts and in accounts under our or their management. These trading activities could be adverse

to the interests of the holders of the Notes.

The Estimated Value of Your Notes at

the Time the Terms of Your Notes Are Set on the Pricing Date Will Be Less Than the Public Offering Price of Your Notes.

The public offering price for your Notes

will exceed the estimated value of your Notes at the time the terms of your Notes are set on the Pricing Date. This estimated value

is set forth under “Additional Information Regarding Estimated Value of the Notes” on page P-2 of this pricing supplement.

As discussed in such section, the pricing models that are used to determine the estimated value of your Notes consider our credit

spreads. After the Pricing Date, the estimated value will be affected by changes in market conditions, our creditworthiness and

other relevant factors as further described under “Additional Information Regarding Estimated Value of the Notes” on

page P-2 of this pricing supplement.

The Value of the Notes Shown in Your

GS&Co. Account Statements and the Price at Which GS&Co. Would Buy or Sell Your Notes (if GS&Co. Makes a Market, Which

It is Not Obligated to Do) Will Be Based on the Estimated Value of Your Notes.

The price at which GS&Co.

would initially buy or sell your Notes (if GS&Co. makes a market, which it is not obligated to do), and the value

that GS&Co. will initially use for account statements and otherwise, exceeds the estimated value of your Notes as

determined by reference to GS&Co.’s pricing models and taking into account TD’s credit spreads. As agreed by

GS&Co., this excess (i.e., the additional amount described under “Additional Information Regarding Estimated Value

of the Notes”) will decline to zero on a straight line basis over the period from the date hereof through the

applicable date set forth above under “Additional Information Regarding Estimated Value of the Notes” on page P-2

of this pricing supplement. Thereafter, if GS&Co. buys or sells your Notes, it will do so at prices that reflect the

estimated value at that time determined by reference to pricing models and taking into account variables similar to those

used in determining the estimated value on the Pricing Date. The price at which GS&Co. will buy or sell your Notes at any

time also will reflect its then current bid and ask spread for similar sized trades of structured notes.

In estimating the value of your Notes

at the time the terms of your Notes are set on the Pricing Date, as disclosed under “Additional Information Regarding Estimated

Value of the Notes” on page P-2 of this pricing supplement, the pricing models consider certain variables, including principally

TD’s credit spreads, interest rates (forecasted, current and historical rates), volatility, price-sensitivity analysis and

the time to maturity of the Notes. These pricing models rely in part on certain assumptions about future events, which may prove

to be incorrect. As a result, the actual value you would

receive if you sold your Notes in the secondary market, if any, to others

may differ, perhaps materially, from the estimated value of your Notes determined by reference to GS&Co.’s models due

to, among other things, any differences in pricing models or assumptions used by others.

In addition to the factors discussed above,

the value and quoted price of your Notes at any time will reflect many factors and cannot be predicted. If GS&Co. makes a market

in the Notes, the price quoted by GS&Co. would reflect any changes in market conditions and other relevant factors, including

any deterioration in TD’s creditworthiness or perceived creditworthiness. These changes may adversely affect the value of

your Notes, including the price you may receive for your Notes in any market making transaction. To the extent that GS&Co.

makes a market in the Notes, the quoted price will reflect the estimated value determined at that time using pricing models and

variables similar to those used in determining the estimated value on the Pricing Date,

plus or minus its then current bid and ask spread for similar sized trades of structured notes (and subject to the declining excess

amount described above).

Furthermore, if you sell your Notes, you

will likely be charged a commission for secondary market transactions, or the price will likely reflect a dealer discount. This

commission or discount will further reduce the proceeds you would receive for your Notes in a secondary market sale.

There is no assurance that GS&Co.

or any other party will be willing to purchase your Notes at any price and, in this regard, GS&Co. is not obligated to make

a market in the Notes. See “—There May Not Be an Active Trading Market for the Notes—Sales in the Secondary Market

May Result in Significant Losses” above.

The Temporary Price

at Which GS&Co. May Initially Buy the Notes in the Secondary Market May Not Be Indicative of Future Prices of Your Notes.

Assuming that all relevant

factors remain constant after the Pricing Date, the price at which GS&Co. may initially buy or sell the Notes in the secondary

market (if GS&Co. makes a market in the Notes, which it is not obligated to do) may exceed the estimated value of the Notes

on the Pricing Date, as well as the secondary market value of the Notes, for a temporary period after the Issue Date of the Notes.

The price at which GS&Co. may initially buy or sell the Notes in the secondary market may not be indicative of future prices

of your Notes.

There Are Potential Conflicts of Interest

Between You and the Calculation Agent.

The Calculation Agent

will, among other things, determine the amount of your payment on the Notes. We will serve as the Calculation Agent and may appoint

a different Calculation Agent after the Issue Date without notice to you. The Calculation Agent will exercise its judgment when

performing its functions and may take into consideration our ability to unwind any related hedges. Since this discretion by the

Calculation Agent may affect payments on the Notes, the Calculation Agent may have a conflict of interest if it needs to make any

such decision. For example, the Calculation Agent may have to determine whether a market disruption event affecting the Reference

Asset has occurred. This determination may, in turn, depend on the Calculation Agent’s judgment whether the event has materially

interfered with our ability or the ability of one of our affiliates to unwind our hedge positions. Since this determination by

the Calculation Agent will affect the payment on the Notes, the Calculation Agent may have a conflict of interest if it needs to

make a determination of this kind. For additional information as to the Calculation Agent’s role, see “General Terms

of the Notes—Role of Calculation Agent” in the product prospectus supplement.

Market Disruption Events and Adjustments.

The Valuation Date, and therefore the

Maturity Date, are subject to postponement as described in the product prospectus supplement due to the occurrence of one or more

market disruption events. For a description of what constitutes a market disruption event as well as the consequences of that market

disruption event, see “General Terms of the Notes—Market Disruption Events” in the product prospectus supplement.

Significant Aspects of the Tax Treatment

of the Notes Are Uncertain.

Significant aspects of the U.S. tax treatment

of the Notes are uncertain. You should consult your tax advisor about your own tax situation and should read carefully the section

entitled “Supplemental Discussion of U.S. Federal Income Tax Consequences” below.

For a more complete discussion of the

Canadian federal income tax consequences of investing in the Notes, please see the discussion in the product prospectus supplement

under “Supplemental Discussion of Canadian Tax Consequences.”

If you are not a Non-resident Holder (as

that term is defined in the prospectus) for Canadian federal income tax purposes or if you acquire the Notes in the secondary market,

you should consult your tax advisors as to the consequences of acquiring, holding and disposing of the Notes and receiving the

payments that might be due under the Notes.

Hypothetical

Returns

The examples and graph set out below are

included for illustration purposes only. They should not be taken as an indication or prediction of future investment results and

merely are intended to illustrate the impact that the various hypothetical levels of the Reference Asset on the Valuation Date

could have on the Payment at Maturity assuming all other variables remain constant. The actual terms of the Notes will be set on

the Trade Date.

The examples below are based on a range

of Final Levels that are entirely hypothetical; the levels of the Reference Asset on any day throughout the life of the Notes,

including the Final Level on the Valuation Date, cannot be predicted. The Reference Asset has been highly volatile in the past—meaning

that the level of the Reference Asset has changed considerably in relatively short periods—and its performance cannot be

predicted for any future period.

The information in the following examples

reflects hypothetical rates of return on the offered Notes assuming that they are purchased on the Issue Date at the principal

amount and held to the Maturity Date. If you sell your Notes in a secondary market prior to the Maturity Date, your return will

depend upon the market value of your Notes at the time of sale, which may be affected by a number of factors that are not reflected

in the examples below, such as interest rates, the volatility of the Reference Asset and our creditworthiness. In addition, the

estimated value of your Notes at the time the terms of your Notes are set on the Pricing Date is less than the original public

offering price of your Notes. For more information on the estimated value of your Notes, see “Additional Risk Factors—The

Estimated Value of Your Notes at the Time the Terms of Your Notes Are Set on the Pricing Date Will Be Less Than the Public Offering

Price of Your Notes” on page P-9 of this pricing supplement. The information in the examples also reflect the key terms and

assumptions in the box below.

| Key Terms and Assumptions |

| Principal Amount |

$1,000 |

| Leverage Factor |

150.00% |

| Hypothetical Cap Level |

111.42% of the Initial Level |

| Hypothetical Maximum Payment Amount |

$1,171.30 |

| Buffer Level |

90.00% of the Initial Level |

| Downside Multiplier |

Approximately 111.11% |

| Buffer Percentage |

10.00% |

| Neither a market disruption event nor a non-Trading Day occurs on the originally scheduled Valuation Date |

| No change in or affecting any of the Reference Asset Constituents or the method by which the Index Sponsor calculates the Reference Asset |

| Notes purchased on the Issue Date at the principal amount and held to the Maturity Date |

Moreover, we have not yet set the Initial

Level, which will serve as the baseline for determining the Percentage Change, the Cap Level or the Maximum Payment Amount, each

of which will affect the amount that we will pay on your Notes, if any, at maturity. We will not do so until the Pricing Date.

As a result, the actual Initial Level may differ substantially from the level of the Reference Asset prior to the Pricing Date.

For these reasons, the actual performance

of the Reference Asset over the life of your Notes, as well as the Payment at Maturity, if any, may bear little relation to the

hypothetical examples shown below or to the historical levels of the Reference Asset shown elsewhere in this pricing supplement.

For information about the historical levels of the Reference Asset during recent periods, see “Information Regarding the

Reference Asset—Historical Information” below. Before investing in the offered Notes, you should consult publicly available

information to determine the levels of the Reference Asset between the date of this pricing supplement and the date of your purchase

of the offered Notes.

Also, the hypothetical examples shown

below do not take into account the effects of applicable taxes. Because of the U.S. tax treatment applicable to your Notes, tax

liabilities could affect the after-tax rate of return on your Notes to a comparatively greater extent than the after-tax return

on the Reference Asset Constituents.

The levels in the left column of the table

below represent hypothetical Final Levels and are expressed as percentages of the Initial Level. The amounts in the right column

represent the hypothetical Payment at Maturity, based on the corresponding hypothetical Final Level, and are expressed as percentages

of the principal amount of a Note (rounded to the nearest one-thousandth of a percent). Thus, a hypothetical Payment at Maturity

of 100.000% means that the value of the cash payment that we would deliver for each $1,000 of the outstanding principal amount

of the offered Notes on the Maturity Date would equal 100.000% of the principal amount of a Note, based on the corresponding hypothetical

Final Level and the assumptions noted above.

|

Hypothetical Final Level

(as Percentage of Initial Level) |

Hypothetical Payment at Maturity

(as Percentage of Principal Amount) |

| 150.000% |

117.130% |

| 140.000% |

117.130% |

| 130.000% |

117.130% |

| 120.000% |

117.130% |

| 111.420% |

117.130% |

| 108.000% |

112.000% |

| 104.000% |

106.000% |

| 102.000% |

103.000% |

| 100.000% |

100.000% |

| 98.000% |

100.000% |

| 96.000% |

100.000% |

| 94.000% |

100.000% |

| 90.000% |

100.000% |

| 75.000% |

83.333% |

| 50.000% |

55.556% |

| 25.000% |

27.778% |

| 0.000% |

0.000% |

If, for example, the Final Level were determined

to be 25.000% of the Initial Level, the Payment at Maturity that we would deliver on your Notes at maturity would be approximately

27.778% of the principal amount of your Notes, as shown in the table above. As a result, if you purchased your Notes on the Issue

Date at the principal amount and held them to the Maturity Date, you would lose approximately 72.222% of your investment (if you

purchased your Notes at a premium to principal amount you would lose a correspondingly higher percentage of your investment).

If the Final Level were determined to be 0.000% of the Initial Level, you would lose 100.000% of your investment in the Notes.

In addition, if the Final Level were determined to be 150.000% of the Initial Level, the Payment at Maturity that we would

deliver on your Notes at maturity would be capped at the Maximum Payment Amount, or 117.130%

of each $1,000 principal amount of your Notes, as shown in the table above. As a result, if you held your Notes to the Maturity

Date, you would not benefit from any increase in the Final Level of greater than 111.420% of the Initial Level.

The following examples illustrate the hypothetical

Payment at Maturity for each Note based on

hypothetical Final Levels of the Reference Asset, calculated based on the key

terms and assumptions above. The values below have been rounded for ease of analysis.

|

Example 1— |

Calculation

of the Payment at Maturity where the Percentage Change is positive (and the Final Level is below the Cap Level). |

| |

|

| |

Percentage

Change: |

5.00% |

| |

|

|

| |

Payment

at Maturity: |

$1,000

+ ($1,000 x 5.00% x 150.00%) = $1,000 + $75.00 = $1,075.00 |

| |

|

|

| |

On

a $1,000 investment, a 5.00% Percentage Change results in a Payment at Maturity of $1,075.00, a 7.50% return on the Notes.

|

|

Example 2— |

Calculation

of the Payment at Maturity where the Percentage Change is positive (and the Final Level is above or equal to the Cap Level). |

| |

|

| |

Percentage

Change: |

20.00% |

| |

|

|

| |

Payment

at Maturity: |

$1,000

+ ($1,000 x 20.00% x 150.00%) = $1,000 + $300.00 = $1,300.00. However, the Maximum Payment Amount is $1,171.30 and therefore

the Payment at Maturity would be $1,171.30. |

| |

|

|

| |

On

a $1,000 investment, a 20.00% Percentage Change results in a Payment at Maturity of $1,171.30, a 17.13% return on the

Notes.

In

addition to limiting your return on the Notes, the Maximum Payment Amount limits the positive effect of the Leverage Factor.

If the Final Level is greater than the Initial Level, you will participate in the performance of the Reference Asset at

a rate of 150.00% up to a certain point. However, the effect of the Leverage Factor will be progressively reduced for

Final Levels that are greater than 111.42% of the Initial Level (based on the Maximum Payment Amount of 117.13% or $1,171.30

per $1,000 principal amount of the Notes) since your return on the Notes for any Final Level greater than 111.42% of the

Initial Level will be limited by the Maximum Payment Amount.

|

|

Example 3— |

Calculation

of the Payment at Maturity where the Percentage Change is negative (but the Final Level is above or equal to the Buffer Level). |

| |

|

| |

Percentage

Change: |

-5.00% |

| |

|

|

| |

Payment

at Maturity: |

At

maturity, if the Percentage Change is negative BUT not by more than the Buffer Percentage, then the Payment at Maturity will

equal the principal amount. |

| |

|

|

| |

On a $1,000

investment, a -5.00% Percentage Change results in a Payment at Maturity of $1,000.00, a 0.00% return on the Notes.

|

|

Example 4— |

Calculation

of the Payment at Maturity where the Percentage Change is negative (and the Final Level is below the Buffer Level). |

| |

|

| |

Percentage

Change: |

-35.00% |

| |

|

|

| |

Payment

at Maturity: |

$1,000

+ [$1,000 x 111.11% x (-35.00% + 10.00%)] = $1,000 – $277.78 = $722.22 |

| |

|

|

| |

On

a $1,000 investment, a -35.00% Percentage Change results in a Payment at Maturity of $722.22, a -27.78% return on the Notes. |

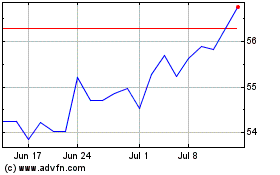

The following chart shows a graphical

illustration of the hypothetical Payment at Maturity that we would pay on your Notes on the Maturity Date if the Final Level were

any of the hypothetical levels shown on the horizontal axis. The hypothetical Payments at Maturity in the chart are expressed as

percentages of the principal amount of your Notes and the hypothetical Final Levels are expressed as percentages of the Initial

Level. The chart shows that any hypothetical Final Level of less than 90.00% (the section left of the 90.00% marker on the horizontal

axis) would result in a hypothetical Payment at Maturity of less than 100.00% of the principal amount of your Notes (the section

below the 100.00% marker on the vertical axis) and, accordingly, in a loss of principal to the holder of the Notes. The chart also

shows that any hypothetical Final Level of greater than or equal to 111.42% (the section right of the 111.42% marker on the horizontal

axis) would result in a capped return on your investment.

The Payments at Maturity shown above

are entirely hypothetical; they are based on a hypothetical Cap Level and Maximum Payment Amount, levels of the Reference Asset

that may not be achieved on the Valuation Date and assumptions that may prove to be erroneous. The actual market value of your

Notes on the Maturity Date or at any other time, including any time you may wish to sell your Notes, may bear little relation to

the hypothetical Payment at Maturity shown above, and these amounts should not be viewed as an indication of the financial return

on an investment in the offered Notes. The hypothetical Payment at Maturity on the Notes in the examples above assume you purchased

your Notes at their principal amount and have not been adjusted to reflect the actual public offering price you pay for your Notes.

The return on your investment (whether positive or negative) in your Notes will be affected by the amount you pay for your Notes.

If you purchase your Notes for a price other than the principal amount, the return on your investment will differ from, and may

be significantly lower than, the hypothetical returns suggested by the above examples. Please read “Additional Risk Factors

Specific to the Notes—The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” beginning on

page PS-6 of the product prospectus supplement.

Payments

on the Notes are economically equivalent to the amounts that would be paid on a combination of other instruments. For example,

payments on the Notes are economically equivalent to a combination of a non-interest-bearing bond bought by the holder and one

or more options entered into between the holder and us (with one or more implicit option premiums paid over time). The discussion

in this paragraph does not modify or affect the terms of the Notes or the U.S. federal income tax treatment of the Notes, as described

elsewhere in this pricing supplement.

We cannot predict the actual Final Level or what the market value of your Notes will be on any particular Trading Day, nor can we predict the relationship between the level of the Reference Asset and the market value of your Notes at any time prior to the Maturity Date. The actual amount that you will receive, if any, at maturity and the rate of return on the offered Notes will depend on the actual Initial Level, the Cap Level and the Maximum Payment Amount, which we will set on the Pricing Date, and the actual Final Level to be determined by the Calculation Agent as described above. Moreover, the assumptions on which the hypothetical returns are based may turn out to be inaccurate. Consequently, the amount of cash to be paid in respect of your Notes, if any, on the Maturity Date may be very different from the information reflected in the examples above.

Information

Regarding the Reference Asset

S&P 500® Index

All

disclosures contained in this pricing supplement regarding the Reference Asset, including, without limitation, its make-up, method

of calculation, and changes in its components, have been derived from publicly available sources. The information reflects the

policies of, and is subject to change by, S&P Dow Jones Indices LLC, a division of The McGraw-Hill Companies, Inc. (“S&P”).

S&P, which owns the copyright and all other rights to the Reference Asset, has no obligation to continue to publish, and may

discontinue publication of, the Reference Asset. The consequences of S&P discontinuing publication of the Reference Asset are

discussed in the section of the product prospectus supplement entitled “General Terms of the Notes—Unavailability of

the Level of the Reference Asset.” Additional information regarding the Reference Asset is available on the following website:

http://us.spindices.com/indices/equity/sp-500. We are not incorporating

by reference the website or any other material it includes in this pricing supplement.

The Reference Asset is intended to provide

an indication of the pattern of common stock price movement. The calculation of the level of the Reference Asset is based on the

relative value of the aggregate market value of the common stocks of 500 companies as of a particular time compared to the aggregate

average market value of the common stocks of 500 similar companies during the base period of the years 1941 through 1943.

S&P chooses companies for inclusion

in the Reference Asset with the aim of achieving a distribution by broad industry groupings that approximates the distribution

of these groupings in the common stock population of its Stock Guide Database of over 10,000 companies, which S&P uses as an

assumed model for the composition of the total market. Relevant criteria employed by S&P include the viability of the particular

company, the extent to which that company represents the industry group to which it is assigned, the extent to which the market

price of that company’s common stock generally is responsive to changes in the affairs of the respective industry, and the

market value and trading activity of the common stock of that company. Certain types of securities are always excluded, such as

business development companies (BDCs), limited partnerships, master limited partnerships, OTC bulletin board issues, closed-end

funds, exchange traded funds (“ETFs”), ETNs, royalty trusts, etc. Companies that experience a trading halt may be retained

or deleted in S&P’s discretion. S&P from time to time, in its sole discretion, may add companies to, or delete companies

from, the Reference Asset to achieve the objectives stated above.

S&P calculates the Reference Asset

by reference to the prices of the constituent stocks of the Reference Asset without taking account of the value of dividends paid

on those stocks. As a result, the return on the Notes will not reflect the return you would realize if you actually owned the Reference

Asset constituent stocks and received the dividends paid on those stocks.

Effective with the September 2015 rebalance,

consolidated share class lines are no longer included in the Reference Asset. Each share class line is subject to public float

and liquidity criteria individually, but a company’s total market capitalization is used to evaluate each share class line.

This may result in one listed share class line of a company being included in the Reference Asset while a second listed share class

line of the same company is excluded.

As of January 31, 2017, the 500 companies

included in the Reference Asset were divided into eleven Global Industry Classification Sectors. The Global Industry Classification

Sectors include (with the approximate percentage currently included in such sectors indicated in parentheses): Information Technology

(21.3%), Financials (14.6%), Health Care (13.7%), Consumer Discretionary (12.3%), Industrials (10.2%), Consumer Staples (9.3%)

, Energy (7.2%), Utilities (3.2%), Materials (2.9%), Real Estate (2.8%) and Telecommunication Services (2.5%). Sector designations

are determined by the S&P using criteria it has selected or developed. Different index sponsors may use very different standards

for determining sector designations. In addition, many companies operate in a number of sectors, but are listed in only one sector

and the basis on which that sector is selected may also differ. As a result, sector comparisons between indices with different

index sponsors may reflect differences in methodology as well as actual differences in the sector composition of the indices.

Computation of the Reference Asset

While S&P currently employs the following

methodology to calculate the Reference Asset, no assurance can be given that S&P will not modify or change this methodology

in a manner that may affect the Payment at Maturity.

Historically, the market value of any

component stock of the Reference Asset was calculated as the product of the market price per share and the number of then outstanding

shares of such component stock. In March 2005, S&P began shifting the Reference Asset halfway from a market capitalization

weighted formula to a float-adjusted formula, before moving the Reference Asset to full float adjustment on September 16, 2005.

S&P’s criteria for selecting stocks for the Reference Asset did not change with the shift to float adjustment. However,

the adjustment affects each company’s weight in the Reference Asset.

Under float adjustment, the share counts

used in calculating the Reference Asset reflect only those shares that are available to investors, not all of a company’s

outstanding shares. Float adjustment excludes shares that are closely held by control groups, other publicly traded companies or

government agencies.

In September 2012, all shareholdings representing

more than 5% of a stock’s outstanding shares, other than holdings by “block owners,” were removed from the float

for purposes of calculating the Reference Asset. Generally, these “control holders” will include officers and directors,

private equity, venture capital and special equity firms, other publicly traded companies that hold shares for control, strategic

partners, holders of restricted shares, ESOPs, employee and family trusts, foundations associated with the company, holders of

unlisted share classes of stock, government entities at all levels (other than government retirement/pension funds) and any individual

person who controls a 5% or greater stake in a company as reported in regulatory filings. However, holdings by block owners, such

as depositary banks, pension funds, mutual funds and ETF providers, 401(k) plans of the company, government retirement/pension

funds, investment funds of insurance companies, asset managers and investment funds, independent foundations and savings and investment

plans, will ordinarily be considered part of the float.

Treasury stock, stock options, restricted

shares, equity participation units, warrants, preferred stock, convertible stock, and rights are not part of the float. Shares

held in a trust to allow investors in countries outside the country of domicile, such as depositary shares and Canadian exchangeable

shares are normally part of the float unless those shares form a control block. If a company has multiple classes of stock outstanding,

shares in an unlisted or non-traded class are treated as a control block.

For each stock, an investable weight factor

(“IWF”) is calculated by dividing the available float shares by the total shares outstanding. As of September 21, 2012,

available float shares are defined as the total shares outstanding less shares held by control holders. This calculation is subject

to a 5% minimum threshold for control blocks. For example, if a company’s officers and directors hold 3% of the company’s

shares, and no other control group holds 5% of the company’s shares, S&P would assign that company an IWF of 1.00, as

no control group meets the 5% threshold. However, if a company’s officers and directors hold 3% of the company’s shares

and another control group holds 20% of the company’s shares, S&P would assign an IWF of 0.77, reflecting the fact that

23% of the company’s outstanding shares are considered to be held for control. For companies with multiple classes of stock,

S&P calculates the weighted average IWF for each stock using the proportion of the total company market capitalization of each

share class as weights.

The Reference Asset is calculated using

a base-weighted aggregate methodology. The level of the Reference Asset reflects the total market value of all 500 component stocks

relative to the base period of the years 1941 through 1943. An indexed number is used to represent the results of this calculation

in order to make the level easier to use and track over time. The actual total market value of the component stocks during the

base period of the years 1941 through 1943 has been set to an indexed level of 10. This is often indicated by the notation 1941-43

= 10. In practice, the daily calculation of the Reference Asset is computed by dividing the total market value of the component

stocks by the “index divisor.” By itself, the index divisor is an arbitrary number. However, in the context of the

calculation of the Reference Asset, it serves as a link to the original base period level of the Reference Asset. The index divisor

keeps the Reference Asset comparable over time and is the manipulation point for all adjustments to the Reference Asset, which

is index maintenance.

Index Maintenance

In order to keep the Reference Asset comparable

over time, S&P engages in an index maintenance process. The index maintenance process involves changing the constituents as

discussed above, and also involves maintaining quality assurance processes and procedures, adjusting the number of shares used

to calculate the Reference Asset, monitoring and completing the adjustments for company additions and deletions, adjusting for

stock splits and stock dividends and adjusting for other corporate actions. In addition to its daily governance of indices and

maintenance of the index methodology, at least once within any 12 month period, the S&P Index Committee reviews the index methodology

to ensure the Reference Asset continues to achieve the stated objective, and that the data and methodology remain effective. The

S&P Index Committee may at times consult with investors, market participants, security issuers included in or potentially included

in the Reference Asset, or investment and financial experts.

To prevent the level of the Reference Asset

from changing due to corporate actions, all corporate actions which affect the total market value of the Reference Asset require

an index divisor adjustment. By adjusting the index divisor for the change in total market value, the level of the Reference Asset

remains constant. This helps maintain the level of the Reference Asset as an accurate barometer of stock market performance and

ensures that the movement of the Reference Asset does not reflect the corporate actions of individual companies in the Reference

Asset. All index divisor adjustments are made after the close of trading and after the calculation of the closing level of the

Reference Asset. Some corporate actions, such as stock splits and stock dividends, require simple changes in the common shares

outstanding and the stock prices of the companies in the Reference Asset and do not require index divisor adjustments.

The table below summarizes the types of

index maintenance adjustments and indicates whether or not an index divisor adjustment is required:

| Type of Corporate Action |

|

Adjustment Factor |

|

Divisor Adjustment

Required |

|

Stock Split

(i.e., 2-for-1) |

|

Shares outstanding multiplied by 2; Stock price divided by 2 |

|

No |

| |

|

|

|

Share Issuance

(i.e., change ≥ 5%) |

|

Shares outstanding plus newly issued shares |

|

Yes |

| |

|

|

|

Share Repurchase

(i.e., change ≥ 5%) |

|

Shares outstanding minus repurchased shares |

|

Yes |

| |

|

|

| Special Cash Dividends |

|

Share price minus special dividend |

|

Yes |

| |

|

|

| Company Change |

|

Add new company market value minus old company market value |

|

Yes |

| |

|

|

| Rights Offering |

|

Price of parent company minus

price of rights offering

rights ratio |

|

Yes |

| |

|

|

|

|

| Spin-Off |

|

Price of parent company minus

price of spin-off co.

share exchange ratio |

|

Yes |

Stock splits and stock dividends do not

affect the index divisor of the Reference Asset, because following a split or dividend both the stock price and number of shares

outstanding are adjusted by S&P so that there is no change in the market value of the component stocks. All stock split and

dividend adjustments are made after the close of trading on the day before the ex-date.

Each of the corporate events exemplified

in the table requiring an adjustment to the index divisor has the effect of altering the market value of the component stocks and

consequently of altering the aggregate market value of the component stocks, which we refer to as the post-event aggregate market

value. In order that the level of the Reference Asset, which we refer to as the pre-event index value, not be affected by the altered

market value (whether increase or decrease) of the affected component stocks, a new index divisor, which we refer to as the new

index divisor, is derived as follows:

| post-event aggregate market value |

|

= |

|

pre-event index value |

| new index divisor |

|

|

|

|

| |

|

|

| new index divisor |

|

= |

|

post-event market value |

| |

|

|

|

pre-event index value |

Changes in a company’s shares outstanding

of 5.00% or more due to mergers, acquisitions, public offerings, tender offers, Dutch auctions, or exchange offers are made as

soon as reasonably possible. All other changes of 5.00% or more (due to, for example, company stock repurchases, private placements,

redemptions, exercise of options, warrants, conversion of preferred stock, notes, debt, equity participation units, at the market

offerings, or other recapitalizations) are made weekly and are announced on Fridays for implementation after the close of trading

on the following Friday. Changes of less than 5.00% due to a company’s acquisition of another company in the Reference Asset

are made as soon as reasonably possible. All other changes of less than 5.00% are accumulated and made quarterly on the third Friday

of March, June, September, and December, and are usually announced two to five days prior.

Changes in IWFs of more than five percentage

points caused by corporate actions (such as merger and acquisition activity, restructurings, or spinoffs) will be made as soon

as reasonably possible. Other changes in IWFs will be made annually when IWFs are reviewed.

Recalculation Policy

S&P reserves the right to recalculate

and republish the Reference Asset under certain limited circumstances. S&P may recalculate and republish the Reference Asset

if it determines that the Reference Asset incorrect or inconsistent within two trading days of the publication of the index level

because of an incorrect or revised closing price, missed corporate event, late announcement of a corporate event, incorrect application

of corporate action or index methodology or for such

other extraordinary circumstances that the S&P Index Committee determines

is necessary to reduce or avoid a possible market impact or disruption.

Calculations and Pricing Disruptions

Closing levels for the Reference Asset

are calculated by S&P based on the closing price of the individual constituents of the index as set by their primary exchange.

Closing prices are received by S&P from one of its third party vendors and verified by comparing them with prices from an alternative

vendor. The vendors receive the closing price from the primary exchanges. Real-time intraday prices are calculated similarly without

a second verification. If there is a failure or interruption on one or more exchanges, real time calculations switch to the “Composite

Tape” for all securities listed on the affected exchange and an announcement is published on the S&P Dow Jones Indices

Web site at www.spdji.com. If the interruption is not resolved before the market close and the exchange(s) in question publishes

a list of closing prices, those prices are used. If no list is published, the last trade as of 4 p.m. Eastern Time on the “Composite

Tape” is used (or the previous close adjusted for corporate actions if no intraday trades were reported). A notice is published

on the S&P Web site at www.spdji.com indicating any changes to the prices used in Reference Asset calculations. In extreme

circumstances, S&P may decide to delay index adjustments or not publish the Reference Asset. Real-time indices are not restated.

Unscheduled Market Closures

In situations where an exchange is forced

to close early due to unforeseen events, such as computer or electric power failures, weather conditions or other events, S&P

will calculate the closing price of the Reference Asset based on (1) the closing prices published by the exchange, or (2) if no

closing price is available, the last regular trade reported for each stock before the exchange closed. If the exchange fails to

open due to unforeseen circumstances, S&P treats this closure as a standard market holiday. The Reference Asset will use the

prior day’s closing prices and shifts any corporate actions to the following business day. If all exchanges fail to open

or in other extreme circumstances, S&P may determine not to publish the Reference Asset for that day.

License Agreement

S&P® is a registered

trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow

Jones Trademark Holdings LLC (“Dow Jones”). These trademarks have been licensed for use by S&P. “Standard

& Poor’s®,” “S&P 500®” and “S&P®”

are trademarks of Standard & Poor’s Financial Services LLC. These trademarks have been sublicensed for certain purposes

by us. The Reference Asset is a product of S&P and/or its affiliates and has been licensed for use by us.

The Notes are not sponsored, endorsed,

sold or promoted by S&P, Standard & Poor’s Financial Services LLC or any of their respective affiliates (collectively,

“S&P Dow Jones Indices”). S&P Dow Jones Indices make no representation or warranty, express or implied, to

the holders of the Notes or any member of the public regarding the advisability of investing in securities generally or in the

Notes particularly or the ability of the Reference Asset to track general market performance. S&P Dow Jones Indices’

only relationship to us with respect to the Reference Asset is the licensing of the Reference Asset and certain trademarks, service

marks and/or trade names of S&P Dow Jones Indices and/or its third party licensors. The Reference Asset is determined, composed

and calculated by S&P Dow Jones Indices without regard to us or the Notes. S&P Dow Jones Indices have no obligation to

take our needs or the needs of holders of the Notes into consideration in determining, composing or calculating the Reference Asset.

S&P Dow Jones Indices are not responsible for and have not participated in the determination of the prices, and amount of the

Notes or the timing of the issuance or sale of the Notes or in the determination or calculation of the equation by which the Notes

are to be converted into cash. S&P Dow Jones Indices have no obligation or liability in connection with the administration,

marketing or trading of the Notes. There is no assurance that investment products based on the Reference Asset will accurately

track index performance or provide positive investment returns. S&P and its subsidiaries are not investment advisors. Inclusion

of a security or futures contract within an index is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold such

security or futures contract, nor is it considered to be investment advice. Notwithstanding the foregoing, CME Group Inc. and its

affiliates may independently issue and/or sponsor financial products unrelated to the Notes currently being issued by us, but which

may be similar to and competitive with the Notes. In addition, CME Group Inc. and its affiliates may trade financial products which

are linked to the performance of the Reference Asset. It is possible that this trading activity will affect the value of the Notes.

S&P DOW JONES INDICES DO NOT GUARANTEE

THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE REFERENCE ASSET OR ANY DATA RELATED THERETO OR ANY COMMUNICATION,

INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P

DOW JONES INDICES SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES

INDICES MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR

PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY US, HOLDERS OF THE NOTES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE REFERENCE

ASSET OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P

DOW JONES INDICES BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED

TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES,

WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS

BETWEEN S&P DOW JONES INDICES AND US, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

Historical Information