Carl Icahn Takes Stake in Bristol-Myers Squibb -- Update

February 21 2017 - 4:33PM

Dow Jones News

By David Benoit

Carl Icahn has taken a stake in Bristol-Myers Squibb Co., making

him the second big activist to pressure the company following

disappointment in its cancer-treatment efforts.

Mr. Icahn owns a large stake and believes the New York drug

giant has a good pipeline that would help make it an attractive

takeover target, people familiar with the matter said. It isn't

clear how big the stake is.

On Tuesday, Bristol-Myers announced it would add three directors

to its board and buy back $2 billion in stock in a pact with

another activist, Jana Partners LLC.

Jana took a stake last year and began pushing for board changes

after Bristol-Myers announced in January that a lung-cancer

treatment wouldn't get approval as fast as hoped, according to a

person familiar with the matter. That warning increased investor

fears Bristol-Myers would lose out to rivals in a crucial treatment

sphere and contributed to a roughly 30% decline in the stock since

July. The shares had fallen by nearly 2% Tuesday afternoon to

$53.55 following news of the settlement with Jana. The drug

company's market value now stands at about $90 billion.

Mr. Icahn has a history of successfully pushing for deals among

pharmaceutical companies, and his presence on Bristol-Myers'

shareholder register will likely add to recent speculation that a

bidder could swoop in following the stock decline. Such a

possibility has helped boost Bristol-Myers shares somewhat since

January.

The famed investor, who just turned 81, has a history with

Bristol-Myers. In 2008, he was a large shareholder in ImClone

Systems Inc. and helped rebuff Bristol-Myers' attempt to buy the

company, its partner on an important cancer drug, for $4.7 billion.

Instead, Mr. Icahn supported Eli Lilly & Co. when it swooped in

to buy ImClone for $6.5 billion.

In 2012, Mr. Icahn took a stake in Amylin Pharmaceuticals Inc.

and called on the company to explore a sale after it had rebuffed a

bid from Bristol-Myers. After the diabetes-treatment maker ran a

sales process, it agreed to a higher bid, valued at $5.3 billion,

from Bristol-Myers.

Bristol-Myers pioneered cancer immunotherapy, which aims to

fight the disease using the body's immune system, but its recent

missteps had critics wondering if it would be surpassed by

competitors like Merck & Co. Management has sought to reassure

investors that its immunotherapy treatments have a bright

future.

On Tuesday, Bristol-Myers said it recruited former senior

executives from Bausch & Lomb Inc. and Vertex Pharmaceuticals

Inc. -- Robert Bertolini and Matthew Emmens, respectively -- to its

board, effective immediately, along with Theodore Samuels, who

currently sits on the boards Perrigo Company PLC and

Stamps.com.

The Bristol-Myers board will be temporarily expanded to 14

seats, but only 11 directors will stand for election at the

company's annual meeting in May. Current Chairman Lamberto

Andreotti will retire, as previously announced.

--Imani Moise contributed to this article.

Write to David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

February 21, 2017 16:18 ET (21:18 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

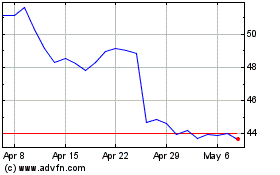

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

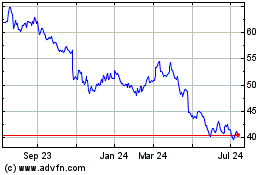

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024